Klein Law Firm Investigates Fairness of Owlet’s De-SPAC Merger for Owlet Stockholders

May 27, 2023

Trending News 🌥️

The Klein Law Firm has announced an investigation into the fairness of Owlet ($NYSE:OWLT), Inc.’s de-SPAC merger for shareholders who purchased stock before May 23, 2023. Owlet, Inc. is a technology company that creates baby monitors and other products to track the health of newborns and infants. The merger in question involves Owlet’s acquisition of a private company that will result in Owlet becoming a publicly traded stock. The Klein Law Firm is looking into whether or not the merger is fair to Owlet’s stockholders, and whether or not they have been adequately compensated for their investments. The investigation is being conducted on behalf of investors who purchased Owlet stock prior to the merger announcement.

Those investors now have the option to pursue legal action against Owlet in order to ensure that their interests are adequately protected. The Klein Law Firm emphasizes their commitment to ensuring fairness for all investors, and encourages those who purchased Owlet stock before May 23, 2023 to contact them with their inquiries. Investors may have the option to join the class action lawsuit against Owlet if their interests have been affected by the merger. Those with information about the merger are also encouraged to contact the law firm with their information.

Market Price

On Tuesday, OWLET stock opened at $0.3 and closed at $0.3, down by 4.9% from the prior closing price of 0.3. The investigation aims to determine whether the merger, which was intended to bring long-term value to shareholders, was conducted properly and at a fair price. The firm is seeking to ascertain if the Owlet’s board of directors violated their fiduciary duties to the shareholders in approving the merger. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Owlet. More…

| Total Revenues | Net Income | Net Margin |

| 58.4 | -62.45 | -122.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Owlet. More…

| Operations | Investing | Financing |

| -63.36 | -0.87 | 20.26 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Owlet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 65.93 | 81.89 | -0.17 |

Key Ratios Snapshot

Some of the financial key ratios for Owlet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -100.6% |

| FCF Margin | ROE | ROA |

| -110.0% | 236.0% | -55.7% |

Analysis

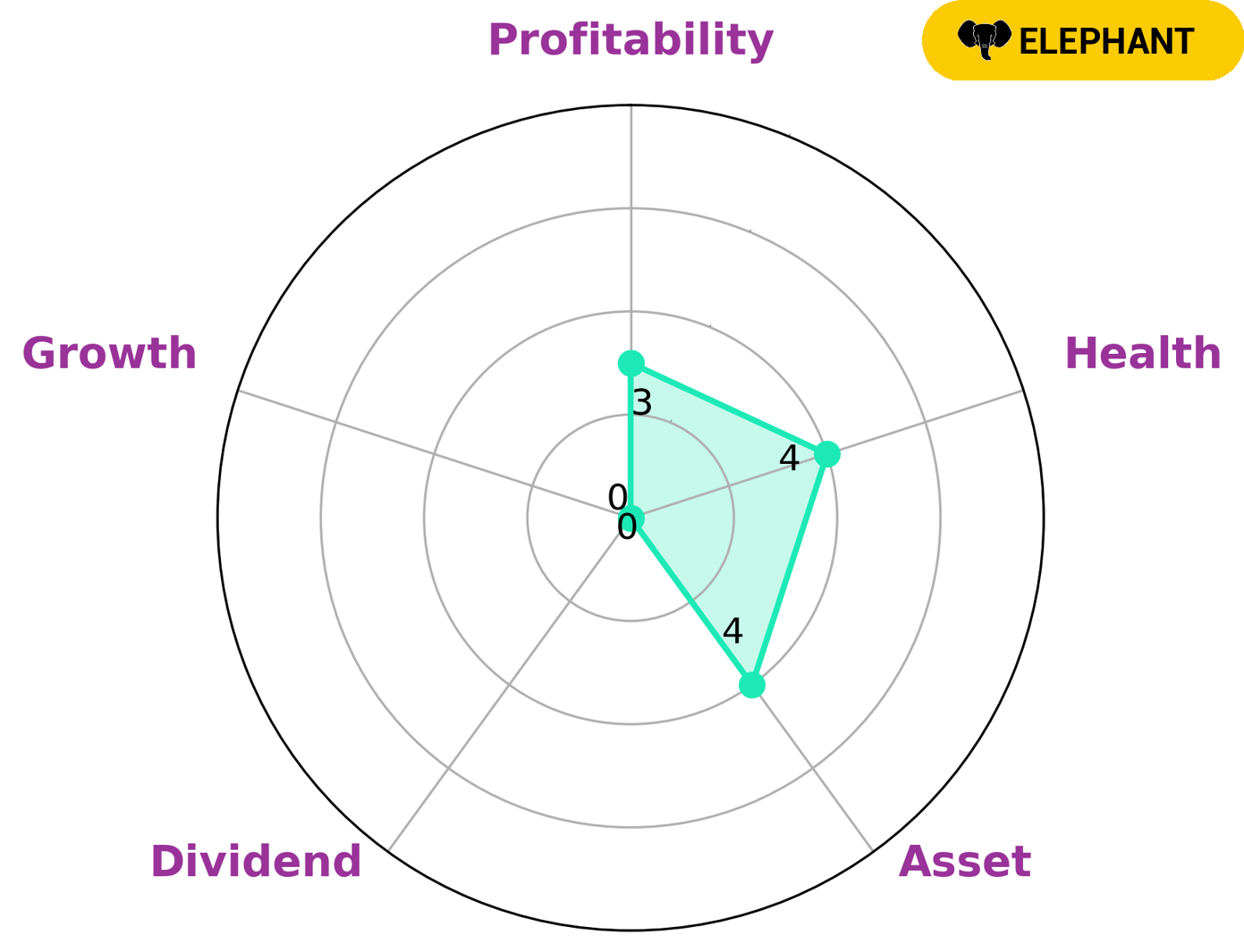

After conducting a detailed analysis of OWLET’s financials, GoodWhale has concluded that the company has an intermediate health score of 4/10 with regards to its cashflows and debt. This score indicates that OWLET can safely ride out any crisis in the future without the risk of bankruptcy. Additionally, OWLET has been classified as an ‘elephant’, which suggests that the company is asset-rich after deducting liabilities. Given these findings, there are several types of investors who may be interested in investing in OWLET. The company is strong in terms of liquidity, medium in terms of assets, and weak in terms of dividends, growth, and profitability. Consequently, investors looking for long-term stability and short-term capital gains may be drawn to this company. Furthermore, investors with an eye to the future may be enticed by OWLET’s potential for growth and profitability. Owlets_De-SPAC_Merger_for_Owlet_Stockholders”>More…

Peers

The company was founded in 2013 and is headquartered in Lehi, Utah. Owlet‘s product line includes the Owlet Smart Sock, a wearable sock that monitors an infant’s heart rate and oxygen levels; the Owlet Cam, a monitor that streams live video and audio of an infant sleeping; and the Owlet Band, a fitness tracker for kids. Owlet also offers a line of products for adults, including the Owlet Smart Sock 2, a wearable sock that monitors an adult’s heart rate and oxygen levels; the Owlet Smart Scale, a weight-loss and fitness tracker; and the Owlet Smart Sleep Monitor, a sleep tracker. Owlet’s competitors include HeraMED Ltd, Bioelectronics Corp, Suzhou Iron Technology Co Ltd, and others.

– HeraMED Ltd ($ASX:HMD)

HeraMED Ltd is a medical technology company that develops, manufactures, and markets medical devices and software. The company offers a range of products and services for the diagnosis and treatment of pregnancy and gynecological conditions. HeraMED’s products are used by obstetricians, gynecologists, and other healthcare professionals worldwide. The company has a market cap of 33.97M as of 2022 and a Return on Equity of -267.07%.

– Bioelectronics Corp ($OTCPK:BIEL)

The market cap for Bioelectronics Corp is currently at $59.35 million. The company is involved in the development and commercialization of wearable medical devices. These devices are used for the treatment of pain and other chronic conditions. The company’s products are based on its proprietary technology, which uses electrical signals to modulate the activity of specific nerves.

– Suzhou Iron Technology Co Ltd ($SHSE:688329)

Suzhou Iron Technology Co. Ltd. is a Chinese company that specializes in providing environmental protection technology and equipment. The company has a market capitalization of 3.25 billion as of 2022 and a return on equity of 9.94%. Suzhou Iron Technology Co. Ltd. was founded in 2003 and is headquartered in Suzhou, China.

Summary

Investors in OWLET, Inc. stock should be aware that The Klein Law Firm is investigating the fairness of the company’s de-SPAC merger. The announcement of this investigation caused the price of OWLET stock to immediately move down. Those who purchased OWLET stock prior to the announcement may wish to consider their legal options. Investors should research all available information and consult professional advisors before investing in OWLET.

Recent Posts