Grove Collaborative Intrinsic Value Calculation – Grove Collaborative Announces 1-for-5 Reverse Share Split

May 26, 2023

Trending News ☀️

Grove Collaborative ($NYSE:GROV) has announced that it will be executing a 1-to-5 reverse stock split in order to give shareholders more liquidity and enhance the company’s trading flexibility. This move comes at a time when Grove Collaborative is experiencing rapid growth and surpassing expectations. Grove Collaborative is a socially conscious e-commerce company that is focused on providing home, health, and beauty essentials without compromising on quality or sustainability. The company is committed to creating an ethical, equitable, and sustainable supply chain, while offering customers non-toxic, healthy, and affordable products.

Groves also donates 5% of its profits to environmental organizations that support reforestation and the development of sustainable communities. With its mission of fostering a healthier relationship with the Earth, Grove Collaborative has become increasingly popular for both investors and customers.

Share Price

On Thursday, GROVE COLLABORATIVE announced a 1-for-5 reverse share split. The stock opened at $0.5 and closed at $0.5, up by 1.9% from the previous closing price of 0.5. This marks the fourth consecutive day of closing at the same price. This move is aimed at making the company’s shares more attractive to investors.

With the split, the price of the stock is expected to increase, as it would be trading at higher prices per share. It is also believed that this move could lead to an increase in liquidity in the market for GROVE COLLABORATIVE stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Grove Collaborative. More…

| Total Revenues | Net Income | Net Margin |

| 302.61 | -53.4 | -31.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Grove Collaborative. More…

| Operations | Investing | Financing |

| -73.5 | -3.65 | 93.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Grove Collaborative. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 165.58 | 137.88 | 0.15 |

Key Ratios Snapshot

Some of the financial key ratios for Grove Collaborative are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.3% | – | -13.9% |

| FCF Margin | ROE | ROA |

| -25.5% | -96.9% | -15.9% |

Analysis – Grove Collaborative Intrinsic Value Calculation

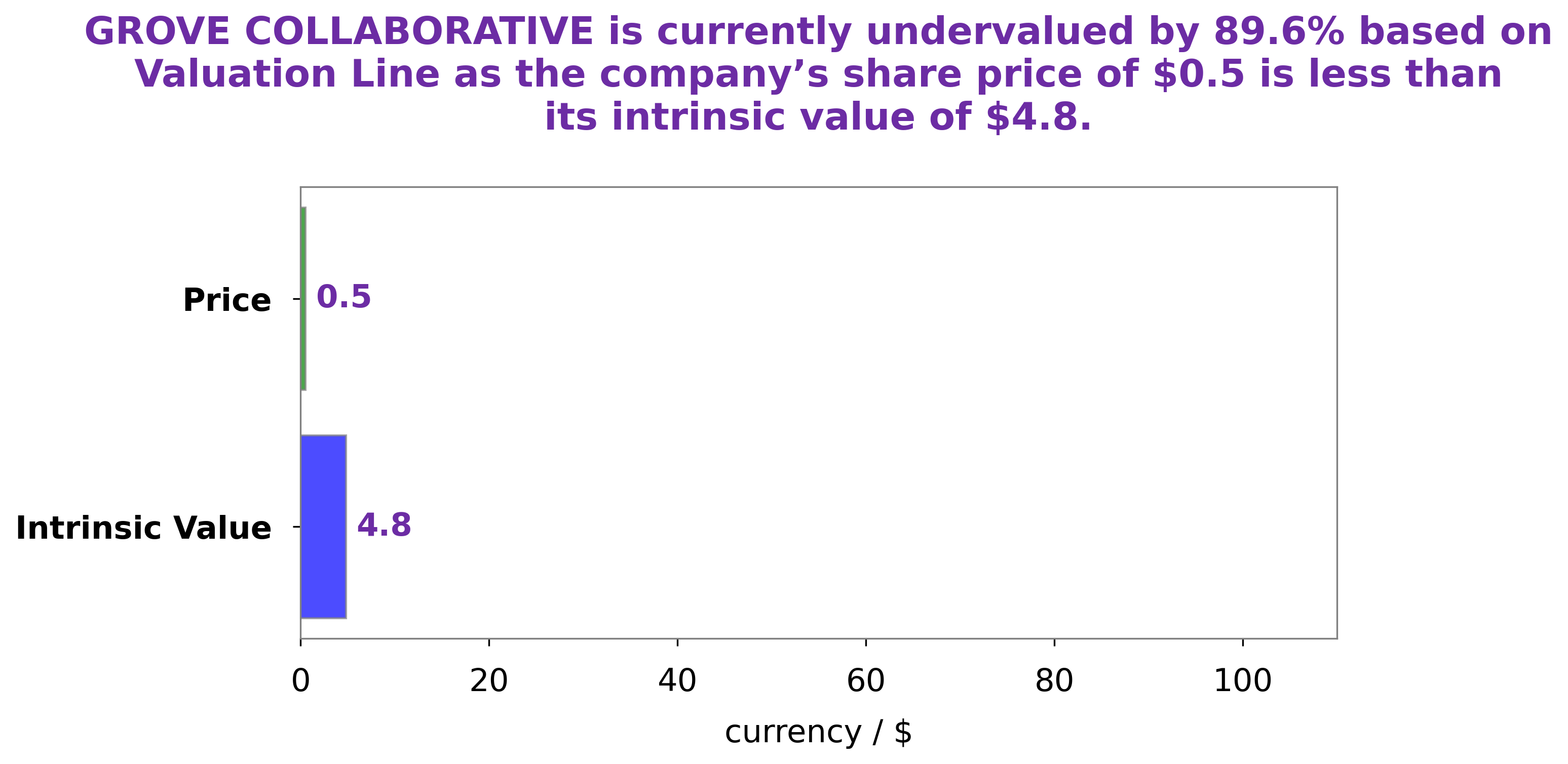

At GoodWhale, we’ve used our proprietary Valuation Line to analyze the fundamentals of GROVE COLLABORATIVE. Our analysis suggests that the intrinsic value of GROVE COLLABORATIVE’s shares is around $4.8. However, the current trading price is only $0.5, suggesting that GROVE COLLABORATIVE is being undervalued by a huge amount of 89.6%. This presents a great opportunity for savvy investors to acquire GROVE COLLABORATIVE’s stock at a discount. More…

Peers

The competition between Grove Collaborative Holdings Inc and its competitors Qingdao KingKing Applied Chemistry Co Ltd, Home Bistro Inc, and Artisan Consumer Goods Inc is fierce. All four companies are striving to be the leader in their respective industries, and each has its own unique strengths and strategies for achieving market dominance. As the competition heats up, it is clear that only the strongest will survive.

– Qingdao KingKing Applied Chemistry Co Ltd ($SZSE:002094)

Qingdao KingKing Applied Chemistry Co Ltd is a Chinese manufacturing company that specializes in the production of specialty chemicals. As of 2023, the company has a market capitalization of 2.85 billion and a Return on Equity of 1.21%. The market cap value indicates that the company is well-recognized and has a strong presence in the industry. The ROE suggests that the company is generating profits from its investments and is able to generate a good return for its shareholders.

– Home Bistro Inc ($OTCPK:HBISD)

Home Bistro Inc is a meal delivery service that provides customers with freshly prepared gourmet meals. The company has a market cap of 352.04k as of 2023, which indicates that it is relatively small in size. Home Bistro Inc’s Return on Equity is -514.38%, which indicates that the company’s shareholders have not been able to generate profits from their investments in the company. This may be due to high operating costs or poor management of resources. Despite this, Home Bistro Inc continues to strive to provide quality meals and services to its customers.

– Artisan Consumer Goods Inc ($OTCPK:ARRT)

Artisan Consumer Goods Inc is a consumer goods company that specializes in the manufacturing and distribution of quality products. Its market cap of 532.4k as of 2023 speaks to its financial strength and ability to generate profits for its shareholders. Its Return on Equity of 9.67% is indicative of the company’s ability to generate profits from its equity capital. Artisan Consumer Goods Inc has proven to be a reliable and profitable company for its shareholders and customers alike.

Summary

Grove Collaborative recently announced plans to do a 1-for-5 reverse stock split. The split will allow the company to remain listed on the Nasdaq, as it is below the $1 minimum share price for continued listing. This decision has drawn mixed reactions from investors, with some considering it a positive sign of Grove’s financial health and others expressing concern about further dilution of ownership.

Analysts believe the split may improve liquidity in the stock, allowing more investors to own shares. Ultimately, the success of Grove’s stock in the long run will depend on its ability to continue driving growth and delivering positive results for shareholders.

Recent Posts