Deadline for FG Merger with iCoreConnect Extended

May 25, 2023

Trending News 🌥️

The deadline for the closing of the FG ($NASDAQ:FGMC) Merger, a special purpose acquisition company (SPAC) formed by FG Acquisition Corp., has been extended. FG Acquisition Corp. is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. They seek to partner with innovative and disruptive companies in the technology, healthcare and consumer industries. iCoreConnect is a leading provider of cloud-based software and services for dental practices. With their platform, dentists are able to securely connect to their patients, insurance providers, labs, and other healthcare professionals.

Their products are designed to increase efficiency and accuracy while providing better patient care. With the combination of FG Acquisition Corp. and iCoreConnect, the two companies are well positioned to capitalize on their respective strengths and create a successful venture.

Stock Price

On Wednesday, the deadline for FG MERGER to complete a merger with iCoreConnect was extended. The news caused FG MERGER stock to open at $10.0 and close at $10.5, a rise of 5.2% from the previous closing price of $10.0. Both parties remain committed to the deal despite the delays. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fg Merger. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -0.17 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fg Merger. More…

| Operations | Investing | Financing |

| 0.94 | -1.67 | 0 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fg Merger. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 84.6 | 0.99 | 8.23 |

Key Ratios Snapshot

Some of the financial key ratios for Fg Merger are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -1.4% | -1.3% |

Analysis

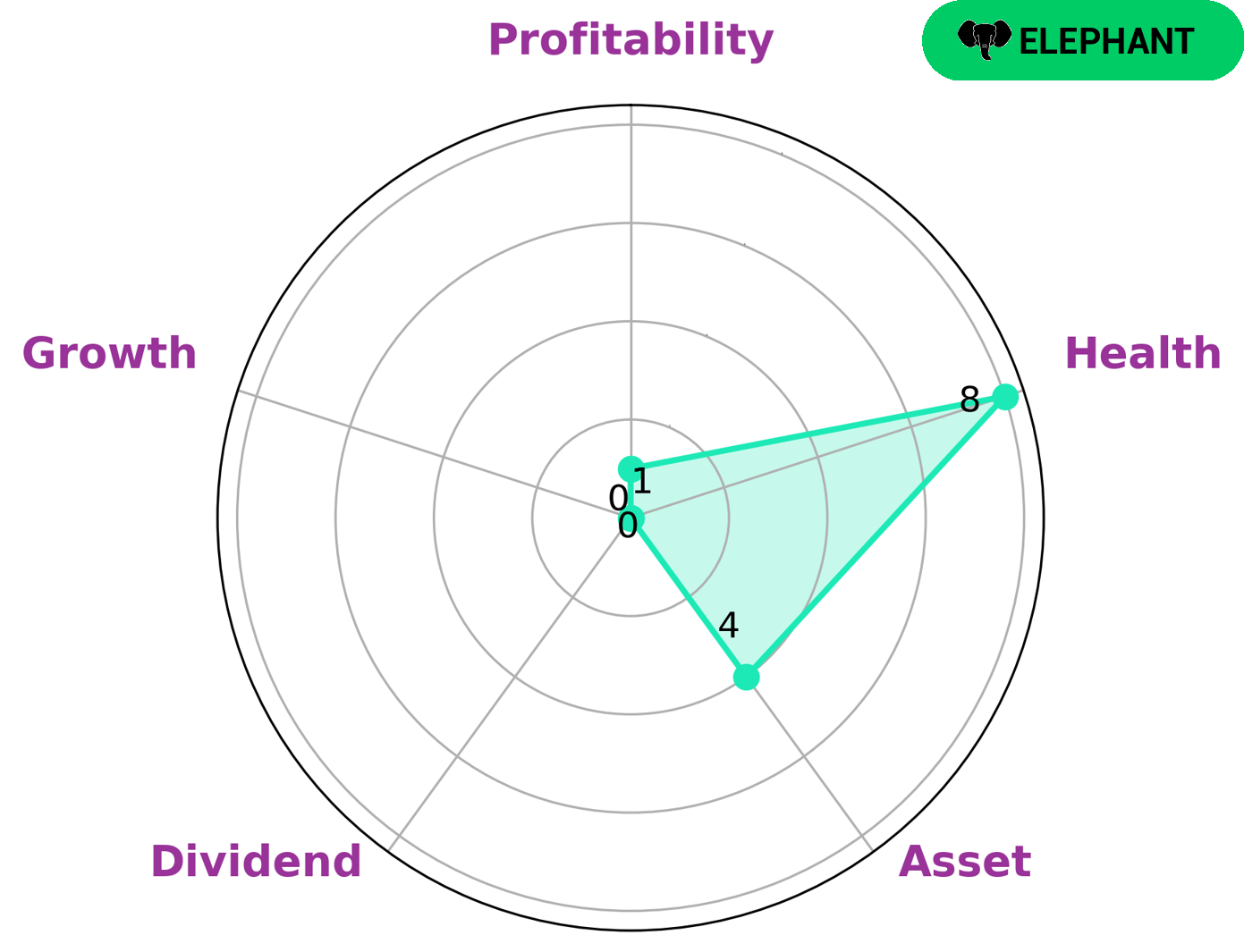

At GoodWhale, we have conducted an analysis of FG MERGER‘s wellbeing. Based on our Star Chart, we have classified FG MERGER as an ‘elephant’, meaning it has a high level of assets after liabilities have been deducted. This type of company would likely be of interest to investors looking for secure investments with the potential for long-term returns. FG MERGER has a high health score of 8/10 when it comes to cashflows and debt and is well placed to fund its future operations. We have concluded that FG MERGER is strong in terms of its cashflows and debt, medium in terms of assets and weak in dividend, growth and profitability. This means that the company may have difficulty making significant dividend payments or achieving rapid growth. However, it should be capable of meeting its liabilities and will remain an attractive investment option for those seeking steady returns over the long-term. More…

Peers

It is a well-established corporation with a strong track record of success in the market, providing valuable services to clients. It faces competition from Forum Merger IV Corp, Valuence Merger Corp I and Golden Arrow Merger Corp, who all provide similar services and strive for similar success in the industry.

– Forum Merger IV Corp ($NASDAQ:FMIV)

Forum Merger IV Corp is a publicly-traded company that engages in strategic acquisitions, mergers, and investments. It has a market cap of 161.58M as of 2023, with a Return on Equity (ROE) of -1.09%. The company’s market capitalization suggests that investors are not particularly bullish on the company, likely due to its negative ROE. This indicates that the firm is not generating enough income from its investments to cover its costs, which reduces its appeal to potential investors. It is possible that the company may be able to improve its profitability and ROE in the future, but at present it appears to be an undesirable investment.

– Valuence Merger Corp I ($NASDAQ:VMCA)

Valuence Merger Corp I is a publicly traded blank-check company formed to acquire or merge with one or more operating companies. The company has a market capitalization of 292.18 million as of 2023, and its Return on Equity (ROE) stands at -0.9%. This suggests that the company has not been able to use its assets or equity to generate a positive financial return for shareholders. Valuence Merger Corp I’s main strategy is to identify and acquire businesses with strong fundamentals and growth prospects, looking for potential trade ideas and transactions that will generate value for its investors.

– Golden Arrow Merger Corp ($NASDAQ:GAMC)

Founded in 2017, Golden Arrow Merger Corp is a special purpose acquisition company (SPAC) focused on acquiring and merging with high growth companies across the technology, media, and healthcare industries. It has a market capitalization of 96.41 million as of 2023, which is the total market value of its outstanding shares. Additionally, its return on equity (ROE) stands at a negative -0.71%, indicating that the company has not been able to generate a sufficient return on its shareholders’ investments. The company is currently looking to acquire sustainable and profitable businesses that have the potential to provide long-term value to its shareholders.

Summary

Investors have been closely monitoring FG Merger Inc.’s recent announcement to extend the deadline for the closing of its merger with iCoreConnect Inc. The stock price of FG Merger rose significantly on the same day the extension was announced, indicating investor confidence in the merger. Analysts are positive about the move, seeing it as a sign of strength and a positive indication of the strength of the merger. With the additional time to finalize the deal, FG Merger can ensure that all due diligence and agreements are in place prior to completion.

This should help ensure a smooth transition and integration of both companies, and potentially increase shareholder value in the long-term. As the closing date draws nearer, investors should keep close watch on any potential changes or developments related to the merger.

Recent Posts