Centuria Capital Group Limited Joint CEO John McBain Discusses Expansion into Healthcare Amid Rising Interest Rates in 2023.

March 28, 2023

Trending News ☀️

John McBain of Centuria Capital ($ASX:CNI) Group Limited recently discussed the rising interest rates and updated investors on the company’s plans for expansion into healthcare. He noted that the current climate of rising interest rates presents both challenges and opportunities for Centuria Capital’s portfolio. Mr. McBain reported that the organization has maintained a solid performance over the past several years, and is now well-positioned to take advantage of new opportunities in the healthcare sector. The company has seen consistent growth in its portfolios despite the higher interest rates, and Mr. McBain sees the expansion into healthcare as a way to further diversify Centuria’s portfolio. With healthcare moving toward a focus on preventative and personalized care, he believes that Centuria is in a unique position to capitalize on this trend.

Mr. McBain also noted that the organization has established strong relationships with healthcare providers, making it well-positioned to succeed in this new sector. With an experienced management team, the company is poised to take advantage of new opportunities in healthcare and maintain its successful track record in its portfolio. John McBain’s update provides insight into the company’s plans for expansion and continued success in the face of rising interest rates.

Price History

The stock opened on the same day at AU$1.6 and closed at the same price, indicating a 1.3% gain from its prior closing at AU$1.6. McBain expressed enthusiasm for the potential opportunities that the healthcare sector provides Centuria Capital Group Limited and stated that their goal is to bring in more investments in this sector and capitalize on the current market trend. He believes that the company’s investments in healthcare will help to position them as a leader in the industry and increase shareholder value. McBain also commented on the rising interest rates, noting that they have had a positive effect on Centuria Capital Group Limited as it allows them to access more capital for potential investments.

He also believes that this will enable the company to improve its current returns and potentially open up new business opportunities. His optimistic outlook has left investors interested to see the company’s future performance under his leadership. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Centuria Capital. More…

| Total Revenues | Net Income | Net Margin |

| 257.71 | -72.82 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Centuria Capital. More…

| Operations | Investing | Financing |

| 138.15 | -451.83 | 176.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Centuria Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 1.02k | 1.79 |

Key Ratios Snapshot

Some of the financial key ratios for Centuria Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 48.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

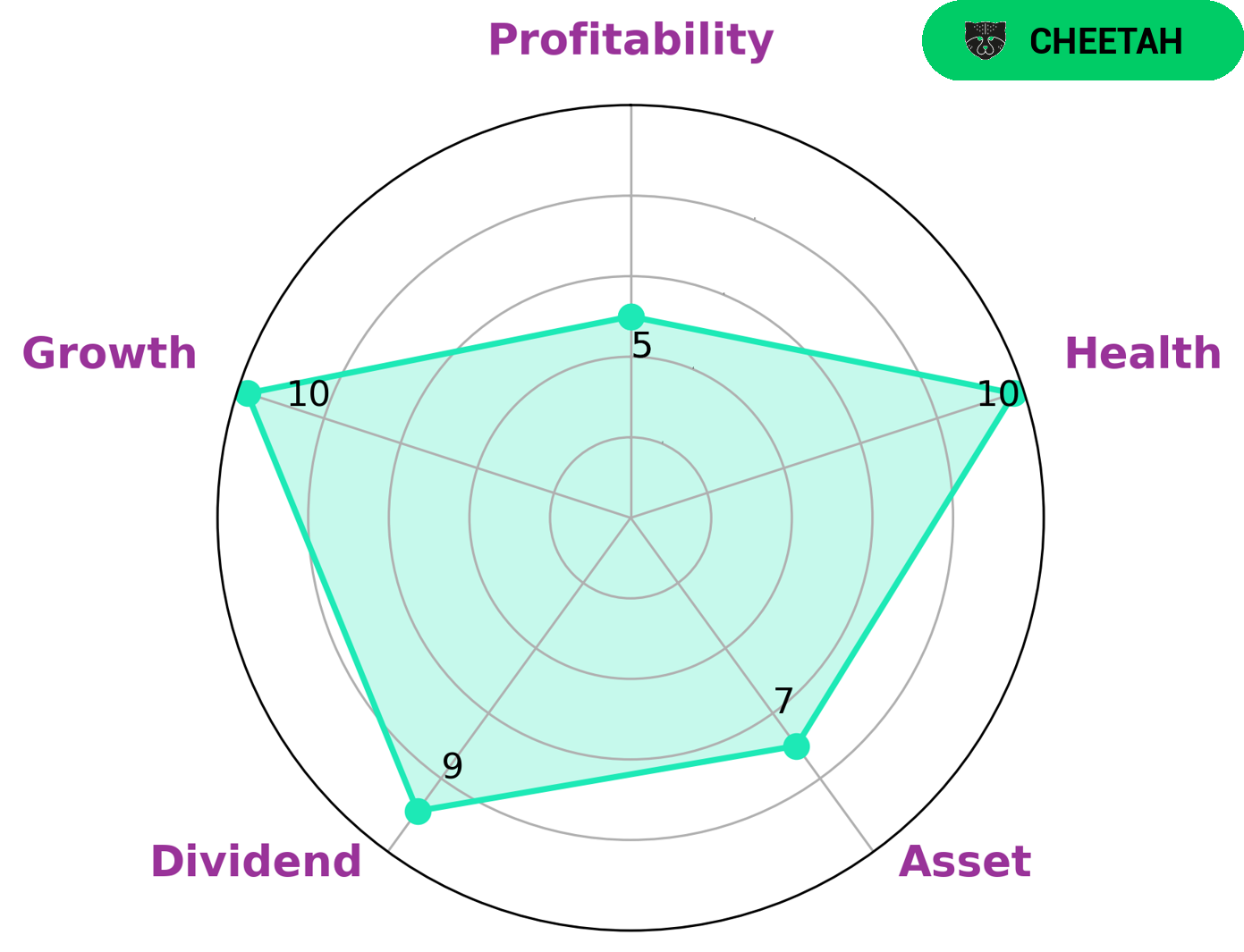

At GoodWhale, we have conducted an analysis of CENTURIA CAPITAL‘s financials. After carefully considering their cashflows and debt, we have arrived at a high score of 10/10 for their health score, indicating that the company is capable of riding out any crisis without the risk of bankruptcy. We have also classified CENTURIA CAPITAL as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. From our Star Chart, we can see that CENTURIA CAPITAL is strong in asset, dividend, and growth, and medium in profitability. Given these metrics, we recommend that investors looking for high growth potential but willing to take on some risk should consider investing in CENTURIA CAPITAL. They can also look forward to regular dividends provided that the company continues to perform well. More…

Peers

Its competitors include L E Lundbergforetagen AB, Tikehau Capital SCA, and BBX Capital Inc. All of these companies are well-established in the industry and have solid track records of delivering value to their investors.

– L E Lundbergforetagen AB ($OTCPK:LBGUF)

Lundbergforetagen AB is a Swedish-based family-owned investment company with a portfolio of businesses in various industries. Founded in 1919, Lundbergforetagen has grown to become one of the largest and most respected investment companies in the world. As of 2022, the company has a market cap of 10.58 billion and a return on equity of 7.11%. This is indicative of its strong financial health, as it has maintained consistent returns despite the volatile nature of the market. The company has a diversified portfolio that ranges from investments in real estate to financial services to industrial production. It also invests heavily in research and development, helping to create innovative solutions that can benefit society.

– Tikehau Capital SCA ($OTCPK:TKKHF)

Tikehau Capital SCA is a leading European asset and investment management firm that specializes in private debt, private equity, real estate, and infrastructure investments. The company has a market capitalization of 4.41 billion euros as of 2022 and a return on equity of 10.72%. Tikehau Capital SCA primarily serves institutional investors and companies, and also provides alternative investments to retail investors globally. The company’s goal is to deliver attractive and sustainable returns to its clients by leveraging its experience, network and resources. Tikehau Capital SCA has a solid financial base, market expertise, and a strong track record of success, which has enabled it to become a dominant player in the European asset and investment management industry.

– BBX Capital Inc ($OTCPK:BBXIA)

BBX Capital Inc is an American publicly traded company that invests in and manages real estate and other investments. The company has a market cap of 148.91M as of 2022, a Return on Equity of 9.52%. This market cap indicates BBX Capital Inc is a mid-size company and its ROE of 9.52% suggests that the firm is financially sound and able to generate profits from its investments. BBX Capital Inc also owns, operates and franchises real estate, hospitality, golf and entertainment businesses.

Summary

Centuria Capital Group Limited is an Australian-based investment manager with a focus on healthcare, real estate, and infrastructure investments. John McBain, the joint CEO of Centuria Capital, recently discussed the firm’s plans to expand into healthcare investments in 2023. McBain highlighted the potential for higher returns and increased diversification as a result of the move.

He also mentioned that the firm has taken into account the potential for rising interest rates in 2023 and has strategized accordingly to maximize returns. McBain concluded by saying that Centuria Capital is well-positioned to capitalize on the opportunities presented by these investments.

Recent Posts