Voxx International Stock Intrinsic Value – VOXX International Stock Price Breaks Past 200-Day Moving Average of $9.68

April 6, 2023

Trending News 🌥️

VOXX ($NASDAQ:VOXX) International Co. is a leading manufacturer of consumer electronics and automotive security products. The company’s stock has been steadily increasing over the last few months as the company has experienced significant growth in its automotive segment and its products have become increasingly popular with consumers. Furthermore, VOXX International Co. has also been working on expanding its offerings, with a focus on developing new products and improving existing ones.

Analysts believe that the company’s stock price could continue to rise as the company continues to make progress in its product development efforts and takes advantage of the current strength in the market. With continued growth and development, investors can expect to see even more positive returns from VOXX International Co. in the near future.

Price History

The stock opened at $12.0 and closed at $12.3, up by 3.3% from the last closing price of 11.9. The strong performance suggests that investors are bullish on the stock, and confidence in the company is growing. Furthermore, the increased pricing may be a sign that the company is making strides towards financial success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Voxx International. More…

| Total Revenues | Net Income | Net Margin |

| 561.37 | -6.56 | -0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Voxx International. More…

| Operations | Investing | Financing |

| -41.25 | -3.79 | 27.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Voxx International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 566.41 | 237.9 | 15.31 |

Key Ratios Snapshot

Some of the financial key ratios for Voxx International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | -27.6% | -2.0% |

| FCF Margin | ROE | ROA |

| -8.0% | -2.0% | -1.2% |

Analysis – Voxx International Stock Intrinsic Value

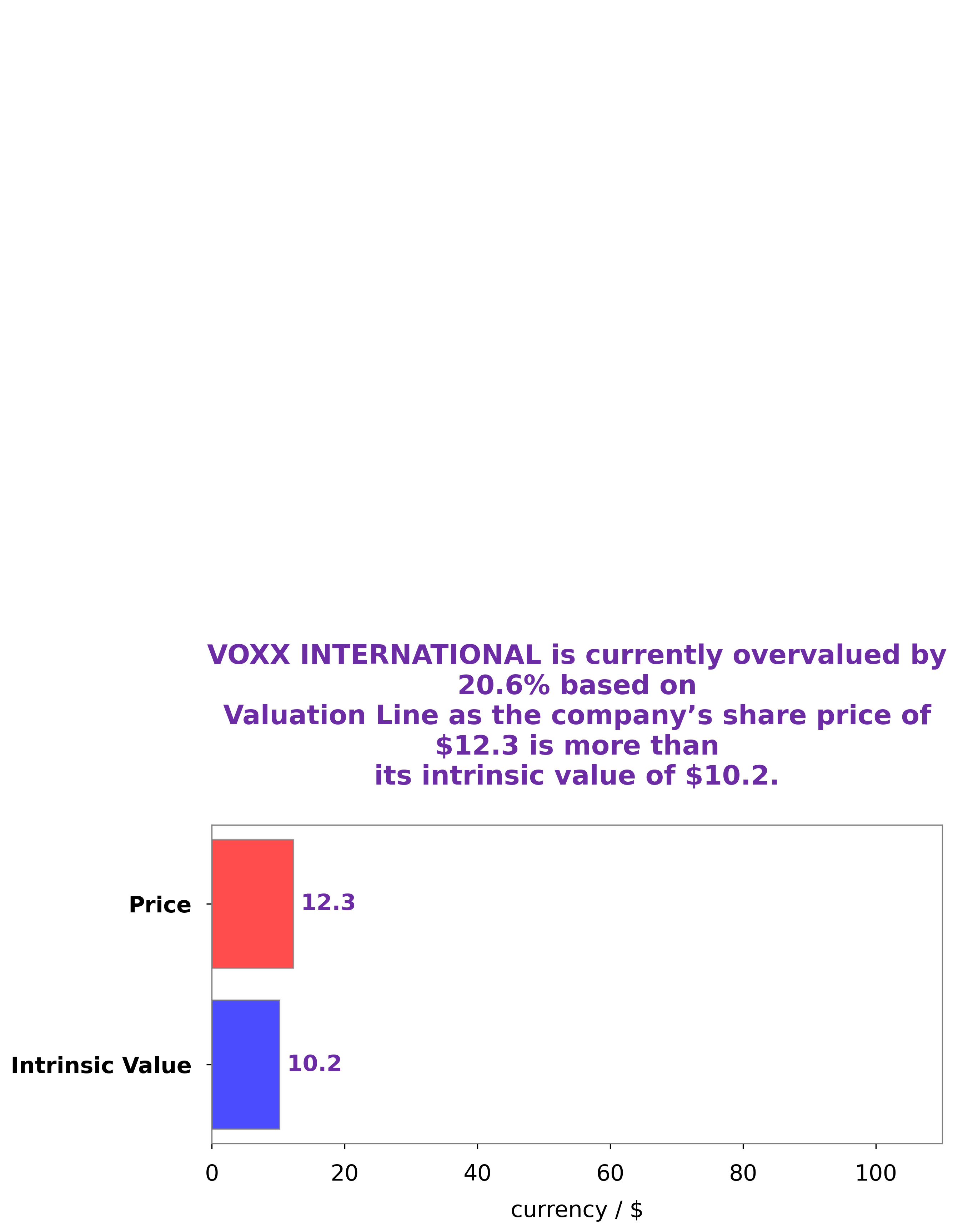

As a part of our financial analysis, GoodWhale has conducted an analysis of VOXX INTERNATIONAL‘s financials and have come up with a fair value of the company’s share at around $10.2. This calculation was done using our proprietary Valuation Line. Currently, VOXX INTERNATIONAL’s stock is traded at a price of $12.3, which is overvalued by 20.4%. More…

Peers

The competition in the market for electronic devices is fierce. One company that has been competing against some of the biggest names in the industry is VOXX International Corp. While they may not be as big as their competitors, Casio Computer Co Ltd, Emerson Radio Corp, and Cystech Electronics Corp, they have been able to hold their own in the market.

– Casio Computer Co Ltd ($TSE:6952)

Casio Computer Co Ltd is a Japanese multinational consumer electronics and commercial electronics manufacturing company headquartered in Shibuya, Tokyo, Japan. Its products include calculators, mobile phones, digital cameras, electronic musical instruments, and digital watches. The company was founded in 1946 by Tadao Kashio, an engineer and self-taught inventor.

Casio’s market cap is $321.42B as of 2022 and its ROE is 6.45%. The company is a leading manufacturer of consumer electronics and commercial electronics. Its products are sold in over 160 countries and regions. Casio has a strong research and development capability and a history of innovation. It is committed to improving the quality of life through its products and services.

– Emerson Radio Corp ($NYSEAM:MSN)

Emerson Radio Corp is a publicly traded company that designs, manufactures, and markets radio and audio products under the Emerson, Grundig, and Audiovox brands. The company has a market capitalization of 12.73 million as of 2022 and a return on equity of -9.06%.

Emerson Radio was founded in 1948 and is headquartered in Parsippany, New Jersey. The company’s products are sold worldwide through a variety of retailers, including mass merchants, electronics stores, and online retailers. Emerson Radio is a leading provider of radios and audio products for the home, office, and car. The company’s products include clock radios, portable radios, CD players, and home theater systems.

Emerson Radio has a long history of innovation and is committed to providing quality products at an affordable price. The company’s products are backed by a commitment to customer service and satisfaction. Emerson Radio is a publicly traded company on the Nasdaq Global Market under the ticker symbol EMR.

– Cystech Electronics Corp ($TPEX:6651)

Cystech Electronics Corp is a global electronics company with a market cap of 1.95B as of 2022. The company has a return on equity of 26.16% and offers a wide range of electronics products and services. Cystech Electronics Corp is a publicly traded company on the NASDAQ stock exchange.

Summary

Crossing this threshold may be a signal of market confidence, indicating that the stock may have upside potential in the future. Investors may wish to further analyze the company’s fundamentals and market activity to determine whether now is a good time to invest in VOXX International Co. stocks.

Recent Posts