Universal Electronics Stock Fair Value Calculation – “UEIC Shareholders Suffer as Stock Drops 10% This Week, Bringing Three-Year Losses to 77%”.

May 11, 2023

Trending News 🌧️

This week has been a tough one for shareholders of UNIVERSAL ELECTRONICS ($NASDAQ:UEIC) (UEIC). The company’s stock has dropped 10%, bringing their loss in market value over the last three years to an alarming 77%. This loss is being felt among investors, who are left with a significant decrease in the value of their portfolio. UEIC is a global leader in the development and manufacturing of innovative technology solutions for the connected world. UEIC has set itself apart from its competition by providing solutions that are both reliable and affordable.

Despite their success in the marketplace, UEIC’s stock has taken a nose-dive over the past three years. The causes of the stock’s rapid decline have yet to be determined. The company continues to stand by its commitment to providing quality products and service to their customers. Until the market sees an uptick in UEIC stock, however, shareholders will remain in a state of uncertainty.

Analysis – Universal Electronics Stock Fair Value Calculation

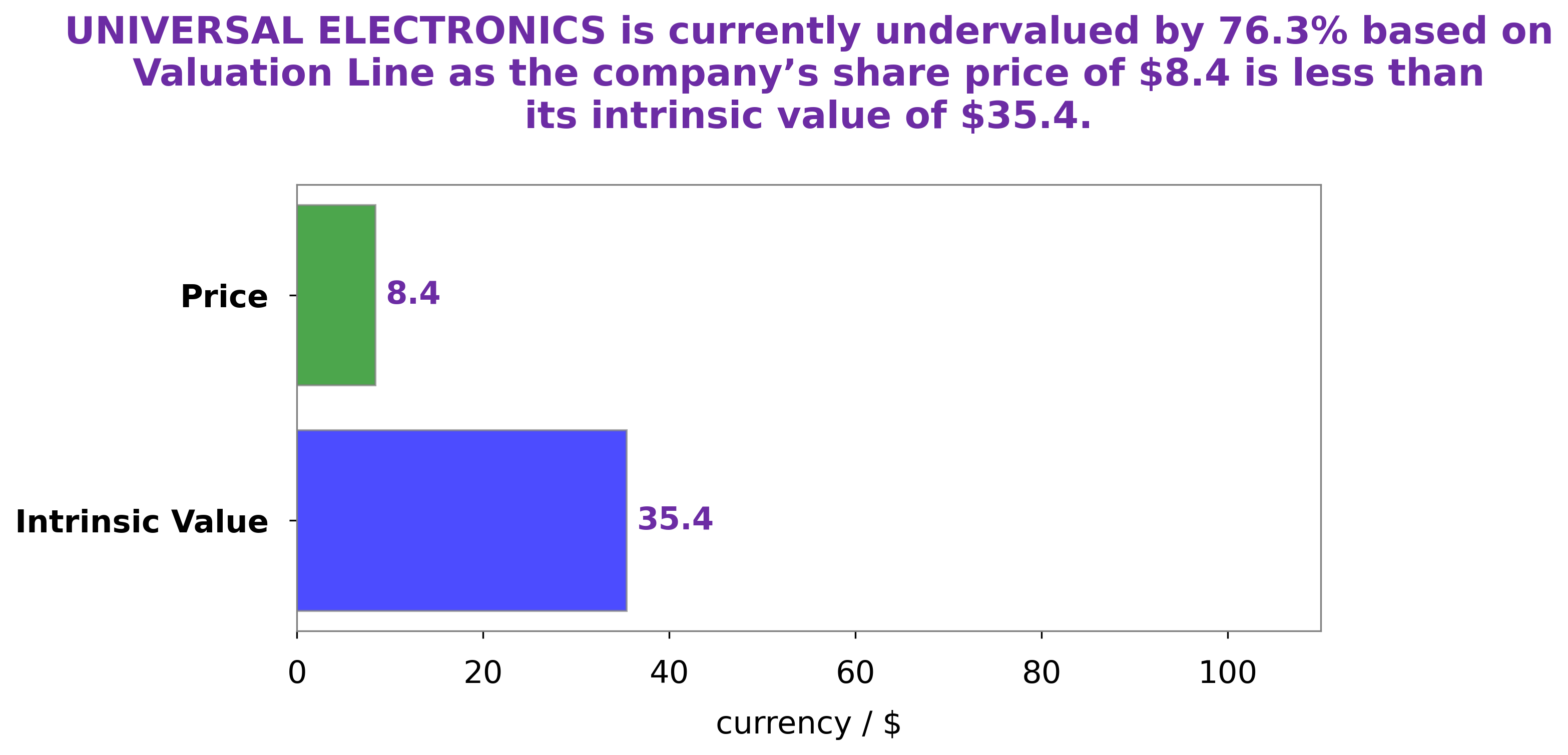

We at GoodWhale have conducted an analysis of UNIVERSAL ELECTRONICS‘s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of UNIVERSAL ELECTRONICS share to be around $35.4. However, the current market price of the stock is only $8.4, which means that UNIVERSAL ELECTRONICS is currently undervalued by 76.3%. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Universal Electronics. More…

| Total Revenues | Net Income | Net Margin |

| 518.72 | -58.05 | -5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Universal Electronics. More…

| Operations | Investing | Financing |

| 26.87 | -14.42 | -4.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Universal Electronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 416.97 | 205.93 | 16.43 |

Key Ratios Snapshot

Some of the financial key ratios for Universal Electronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.4% | -40.1% | 0.9% |

| FCF Margin | ROE | ROA |

| 0.9% | 1.2% | 0.7% |

Peers

The competition in the consumer electronics industry is heating up as companies vie for market share.

– Emerson Radio Corp ($NYSEAM:MSN)

Emerson Radio Corporation is a leading global manufacturer and marketer of household appliances and electronics. The company has a market capitalization of $12.2 million and a return on equity of -9.06%. Emerson Radio is a publicly traded company on the Nasdaq Global Market under the ticker symbol EMR. The company’s products are sold under a variety of brand names including Emerson, Durabrand, Acoustic Research, and One For All. Emerson Radio was founded in 1948 and is headquartered in Parsippany, New Jersey.

– Bonso Electronics International Inc ($NASDAQ:BNSO)

Bonso Electronics International Inc is a technology company that designs, develops, manufactures, and markets consumer electronic products and solutions worldwide. The company has a market cap of 15.64M as of 2022 and a Return on Equity of -9.13%. The company’s products include mobile phones, digital audio players, portable speakers, and car audio systems.

– Compal Broadband Networks Inc ($TWSE:6674)

Compal Broadband Networks Inc. is a global leader in the design and manufacture of broadband access equipment. The company’s products are used by service providers to deliver high-speed Internet, video, and voice services to subscribers over both copper and fiber networks. Compal Broadband Networks Inc. has a market cap of 1.46B as of 2022 and a Return on Equity of 0.31%. The company’s products are used by service providers to deliver high-speed Internet, video, and voice services to subscribers over both copper and fiber networks. Compal Broadband Networks Inc. is a global leader in the design and manufacture of broadband access equipment.

Summary

Universal Electronics (NASDAQ:UEIC) has seen a 10% decline this week, leading to a 77% three-year loss for shareholders. This drop in the stock price comes amid continued weakness in the overall market. Upon examination of the company’s recent performance, it is evident that there has been a lack of confidence in the company’s financials and outlook. This has led to investors expressing concerns about profitability and cash flow.

Additionally, analysts have raised warnings about the company’s ability to sustain its current growth rate. Due to these factors, investors may want to consider proceeding with caution when considering investing in Universal Electronics.

Recent Posts