Turtle Beach Q1 Earnings Exceed Expectations Despite Negative EPS

May 5, 2023

Trending News ☀️

Turtle Beach ($NASDAQ:HEAR) Corporation is a global leader in gaming audio, providing gamers with the most advanced audio technology for their gaming experience. The company designs and markets premium gaming headsets for Xbox One, PlayStation 4, PC and Nintendo Switch, as well as console and PC controllers and other gaming accessories. With its portfolio of innovative products, Turtle Beach has become an essential part of the gaming experience for both hardcore and casual gamers.

Earnings

Despite posting negative EPS and lower profits, the company’s total revenue exceeded expectations, reaching 100.9M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Turtle Beach. More…

| Total Revenues | Net Income | Net Margin |

| 240.17 | -59.55 | -24.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Turtle Beach. More…

| Operations | Investing | Financing |

| -41.85 | -3.55 | 19.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Turtle Beach. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 163.39 | 74.45 | 5.37 |

Key Ratios Snapshot

Some of the financial key ratios for Turtle Beach are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.8% | -27.7% | -22.2% |

| FCF Margin | ROE | ROA |

| -17.4% | -33.6% | -20.4% |

Market Price

The stock opened at $11.4 and closed at $11.2, down by 0.9% from the last closing price of $11.3. This slight dip in share value comes as a surprise given the strong financial performance posted by the company. The strong year-over-year growth coupled with the positive outlook for the gaming industry should have been enough to buoy investor confidence. It is likely that the quarterly loss has caused some investors to take a more cautious approach to investing in TURTLE BEACH stock. Despite this, analysts remain optimistic about the company’s prospects and believe that the growth momentum will continue in the coming quarters.

In addition, the company has announced plans to invest heavily in research and development to maintain its competitive edge. The impressive revenue growth, coupled with the positive outlook for the industry and the planned investments in R&D are likely to result in strong share prices in the near future. Live Quote…

Analysis

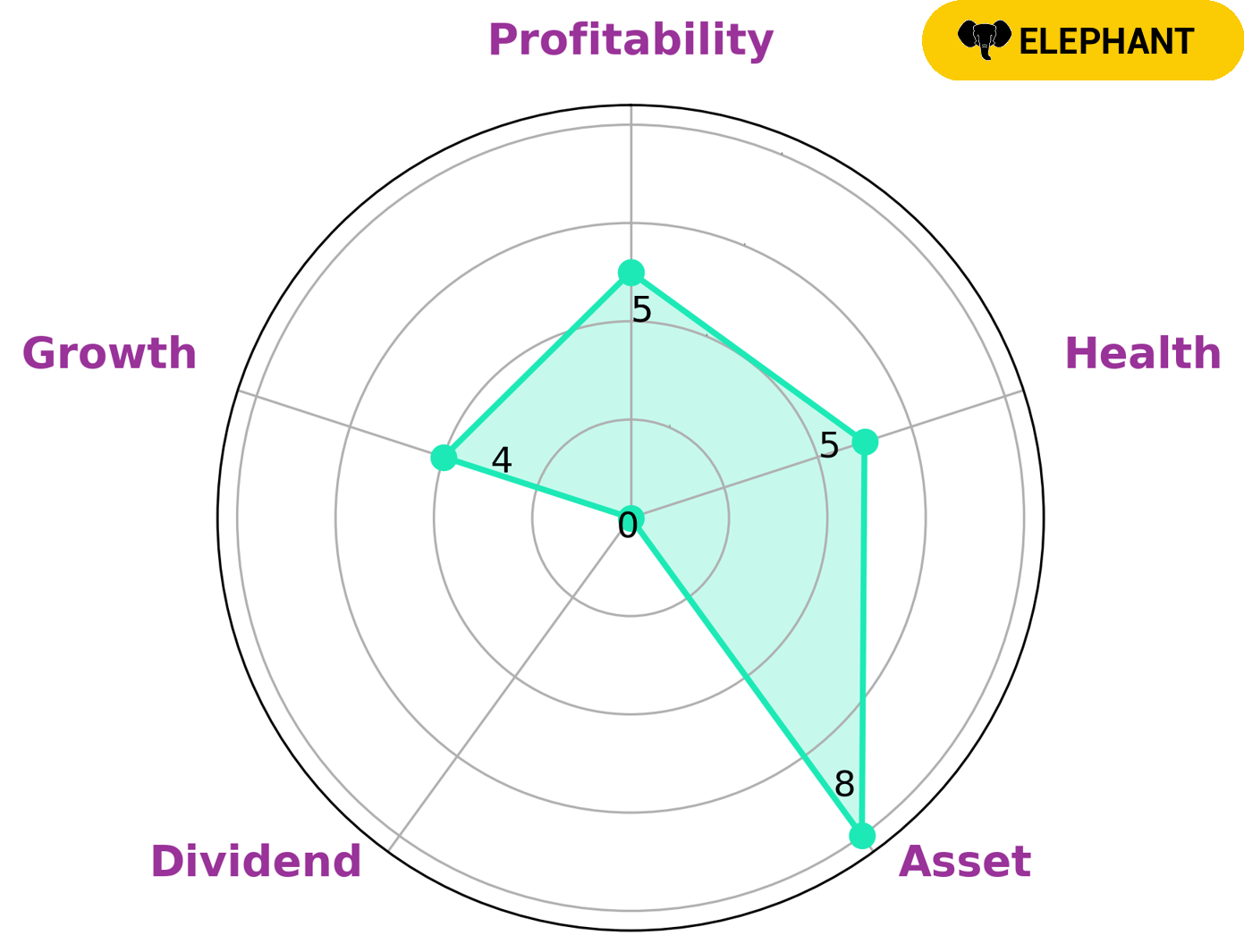

GoodWhale has conducted an analysis of TURTLE BEACH‘s finances, and we have determined that the company has an intermediate health score of 5/10 with regard to cashflows and debt. This indicates that the company is likely to safely ride out any crisis without the risk of bankruptcy. Furthermore, our analysis reveals that TURTLE BEACH is strong in asset, medium in growth, profitability and weak in dividend. After deducting off liabilities, we have classified the company as an ‘elephant’, a type of company that is rich in assets. Given these factors, investors who are seeking low-risk opportunities with reliable returns might be interested in TURTLE BEACH as a potential investment. The company’s strong asset base provides a degree of security, while the medium ratings in growth and profitability suggest that it could offer some potential upside. Additionally, its weak dividend score means that it may not be suitable for investors who rely heavily on dividend income. More…

Peers

In the world of video game accessories, there is stiff competition between Turtle Beach Corp and its competitors Quixant PLC, Corsair Gaming Inc, and Bigben Interactive. All four companies produce high-quality products that appeal to gamers of all levels of interest and expertise. While each company has its own strengths and weaknesses, all four are constantly striving to one-up the competition in an effort to gain market share.

– Quixant PLC ($LSE:QXT)

Quixant PLC is a designer and manufacturer of gaming platforms for the global gaming industry. The company has a market cap of 111.3M as of 2022 and a Return on Equity of 6.78%. Quixant’s products are used in a variety of gaming applications, including video lottery terminals, casino slot machines, and online gaming platforms. The company’s products are designed to provide a high level of performance, reliability, and flexibility to gaming operators.

– Corsair Gaming Inc ($NASDAQ:CRSR)

Corsair Gaming Inc is a company that manufactures and sells gaming peripherals and other gaming products. The company has a market cap of 1.21B as of 2022 and a return on equity of -2.68%. The company’s products include gaming keyboards, mice, headsets, and other gaming accessories.

– Bigben Interactive ($LTS:0O0E)

Bigben Interactive is a French company that specializes in the design and distribution of video game products. The company has a market capitalization of 141.94 million as of 2022 and a return on equity of 4.82%. Bigben Interactive is a publicly traded company on the Euronext Paris stock exchange. The company’s products are available in more than 50 countries.

Summary

Turtle Beach released its non-GAAP earnings report for the quarter, beating estimates by $0.14 per share. Revenue of $51.44M beat estimates by $5.39M. The company’s strong performance is due to increased demand for video game-related products, such as headsets and accessories.

In addition, cost-cutting measures implemented in the quarter has resulted in savings that improved the company’s bottom line. The stock price of Turtle Beach rose following the news and investors may want to consider adding it to their portfolios. Analysts are generally positive on the company’s prospects and its strong balance sheet should provide support. Overall, Turtle Beach is a good investment opportunity in the gaming industry.

Recent Posts