Turtle Beach Intrinsic Value Calculation – Turtle Beach Crowns Stealth Pro as the Ultimate Wireless Gaming Audio Solution

April 30, 2023

Trending News ☀️

Turtle Beach ($NASDAQ:HEAR) has long been a leader and innovator in the gaming audio space, and today the company is proud to announce the release of their latest product, the Stealth Pro. This ultra-premium wireless gaming audio solution utilizes cutting-edge technology and state-of-the-art design to bring forth an unbeatable experience that gamers will love.

Additionally, the headset is compatible with virtually any gaming platform, making it a great option for those looking to take their game to the next level. The Turtle Beach team has also taken the time to ensure that the Stealth Pro is comfortable to wear, with an ergonomic design that fits comfortably around the ears. Turtle Beach has earned its reputation as one of the world’s premier gaming audio solutions providers, and now with the Stealth Pro, they have released a truly exceptional product that will no doubt be a hit with gamers everywhere. So if you’re looking for a premium wireless gaming audio solution, look no further than the Turtle Beach Stealth Pro.

Price History

The launch of this headset is a major milestone for the company, and they have crowned it as the ‘ultimate wireless gaming audio solution’ on the market. The reaction from the market has been mixed, with the stock opening at $11.0 and closing at $10.4, down 4.6% from the prior closing price of $10.9. Despite the drop in share price, many analysts believe the product launch will have a positive effect on Turtle Beach’s sales figures in the months to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Turtle Beach. More…

| Total Revenues | Net Income | Net Margin |

| 240.17 | -59.55 | -24.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Turtle Beach. More…

| Operations | Investing | Financing |

| -41.85 | -3.55 | 19.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Turtle Beach. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 163.39 | 74.45 | 5.37 |

Key Ratios Snapshot

Some of the financial key ratios for Turtle Beach are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.8% | -27.7% | -22.2% |

| FCF Margin | ROE | ROA |

| -17.4% | -33.6% | -20.4% |

Analysis – Turtle Beach Intrinsic Value Calculation

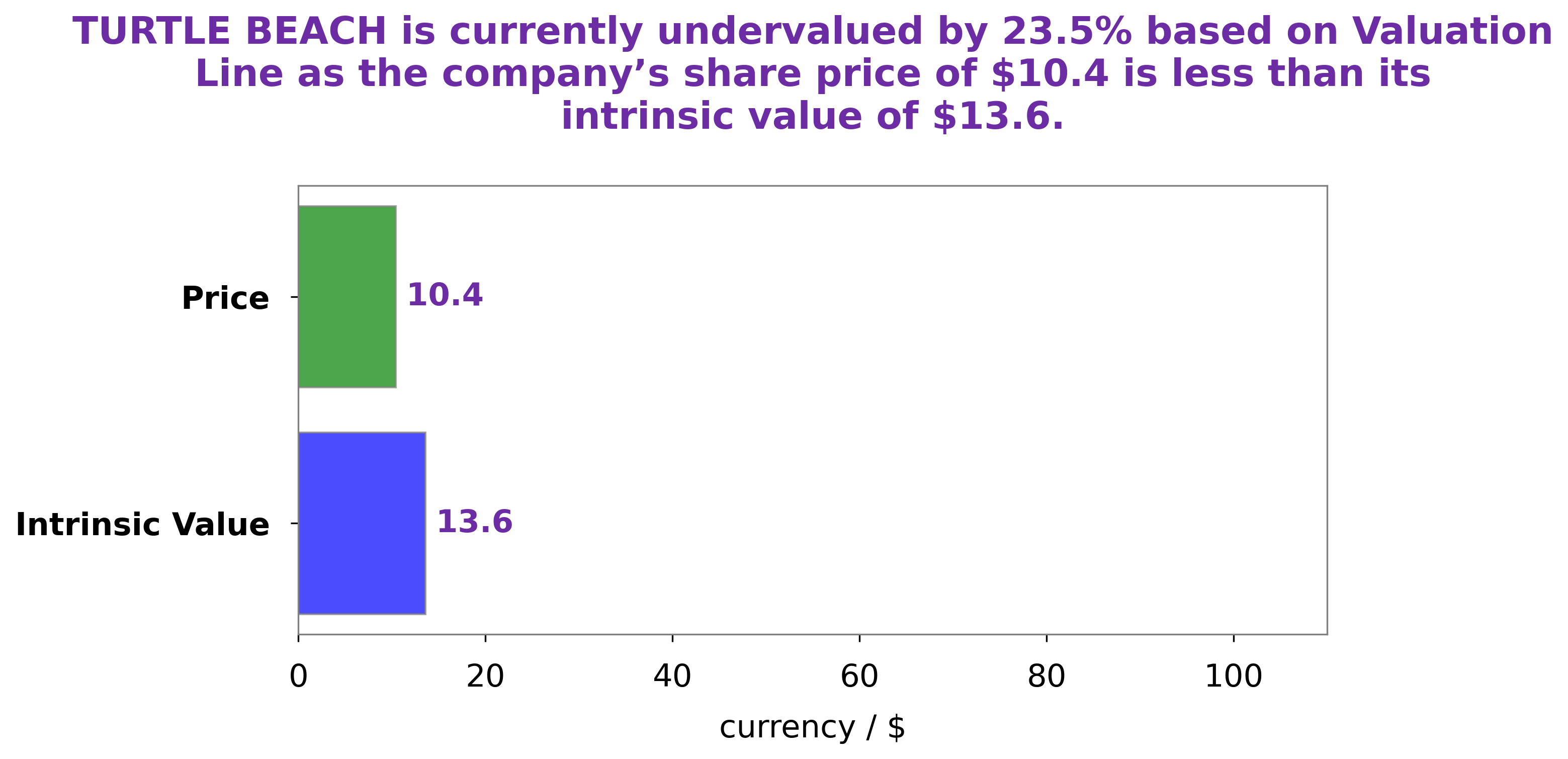

At GoodWhale, we recently conducted a financial analysis of Turtle Beach Corporation (TURTLE BEACH). After careful examination, we have determined that the company’s intrinsic value is around $13.6, which was calculated using our proprietary Valuation Line. This figure is significantly higher than the current trading price of $10.4, indicating that the stock is undervalued by 23.6%. Therefore, we believe that there is an opportunity for investors to purchase TURTLE BEACH shares at a discount. More…

Peers

In the world of video game accessories, there is stiff competition between Turtle Beach Corp and its competitors Quixant PLC, Corsair Gaming Inc, and Bigben Interactive. All four companies produce high-quality products that appeal to gamers of all levels of interest and expertise. While each company has its own strengths and weaknesses, all four are constantly striving to one-up the competition in an effort to gain market share.

– Quixant PLC ($LSE:QXT)

Quixant PLC is a designer and manufacturer of gaming platforms for the global gaming industry. The company has a market cap of 111.3M as of 2022 and a Return on Equity of 6.78%. Quixant’s products are used in a variety of gaming applications, including video lottery terminals, casino slot machines, and online gaming platforms. The company’s products are designed to provide a high level of performance, reliability, and flexibility to gaming operators.

– Corsair Gaming Inc ($NASDAQ:CRSR)

Corsair Gaming Inc is a company that manufactures and sells gaming peripherals and other gaming products. The company has a market cap of 1.21B as of 2022 and a return on equity of -2.68%. The company’s products include gaming keyboards, mice, headsets, and other gaming accessories.

– Bigben Interactive ($LTS:0O0E)

Bigben Interactive is a French company that specializes in the design and distribution of video game products. The company has a market capitalization of 141.94 million as of 2022 and a return on equity of 4.82%. Bigben Interactive is a publicly traded company on the Euronext Paris stock exchange. The company’s products are available in more than 50 countries.

Summary

Turtle Beach‘s stock price moved down the same day as the announcement of the Stealth Pro retail availability. This could be attributed to investors’ reservations about the financial performance of the ultra-premium wireless gaming audio product line. Investors should monitor the financial results of Turtle Beach over the coming quarters to gauge the success of the new product line and make an informed decision when investing in the company.

Recent Posts