Sonos Stock Fair Value Calculator – SONOS Reports Fourth Quarter Earnings Results for FY2023

November 30, 2023

🌥️Earnings Overview

On November 15 2023, SONOS ($NASDAQ:SONO) reported its earnings results for the fourth quarter of FY2023, which ended September 30 2023. The total revenue for the quarter was USD 305.1 million, representing a 3.5% decrease from the same period in the previous year. Net income for the fourth quarter was USD -31.2 million, a significant improvement of 52.1%, when compared to the net loss of -64.1 million reported in the same period in FY2022.

Stock Price

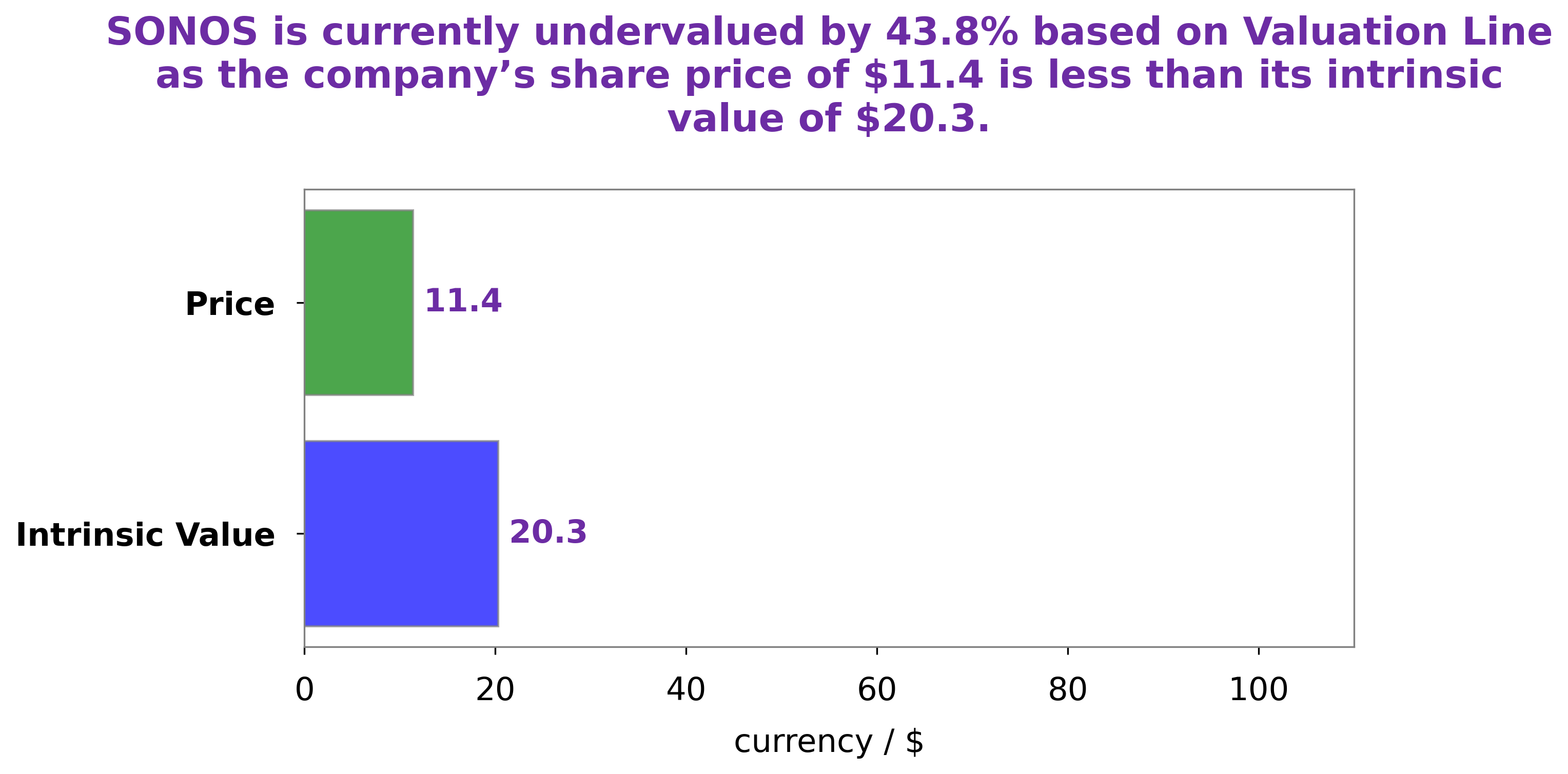

The company’s stock opened at $11.3 and closed at $11.4, representing a 0.8% increase from its prior closing price of $11.3. Overall, the results demonstrate the company’s continued growth and success in the market. Investors remain optimistic about the future of SONOS and its ability to continue to deliver strong financial performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sonos. SONOS_Reports_Fourth_Quarter_Earnings_Results_for_FY2023″>More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | -10.27 | -0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sonos. SONOS_Reports_Fourth_Quarter_Earnings_Results_for_FY2023″>More…

| Operations | Investing | Financing |

| 100.41 | -50.29 | -108.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sonos. SONOS_Reports_Fourth_Quarter_Earnings_Results_for_FY2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1k | 483.58 | 4.04 |

Key Ratios Snapshot

Some of the financial key ratios for Sonos are shown below. SONOS_Reports_Fourth_Quarter_Earnings_Results_for_FY2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.7% | 150.5% | 0.3% |

| FCF Margin | ROE | ROA |

| 3.0% | 0.6% | 0.3% |

Analysis – Sonos Stock Fair Value Calculator

At GoodWhale, we’ve been analyzing SONOS‘s fundamentals with our proprietary Valuation Line. Our calculations show that the intrinsic value of SONOS shares is around $20.3 at the time of writing. However, the stock is currently trading at $11.4, which is undervalued by 44.0%. This could make it a solid long-term buy for investors looking to capitalize on a potentially undervalued company. We believe that SONOS has potential for future growth, and this could be a great opportunity for investors to buy into a strong company at a discounted price. More…

Peers

Sonos Inc, a California-based company that manufactures and sells wireless speakers, is locked in competition with several other companies, including Basler AG, Bang & Olufsen A/S, and GoPro Inc.

– Basler AG ($LTS:0DUI)

Basler AG is a leading international provider of high-quality imaging products. The company has a strong focus on the development and production of digital cameras for industrial and video surveillance applications, as well as medical devices. Basler AG is headquartered in Ahrensburg, Germany.

– Bang & Olufsen A/S ($OTCPK:BGOUF)

Bang & Olufsen A/S is a Danish company that designs and manufactures audio products and television sets. The company has a market capitalization of 145.79 million as of 2022 and a return on equity of -4.5%. The company was founded in 1925 by Peter Bang and Svend Olufsen, and it is headquartered in Struer, Denmark. The company’s products are available in more than 100 countries worldwide.

– GoPro Inc ($NASDAQ:GPRO)

GoPro Inc is a technology company that manufactures and sells action cameras and related accessories. The company has a market capitalization of 853.43M as of 2022 and a return on equity of 12.37%. GoPro’s products are designed for use in extreme action sports and activities, such as surfing, snowboarding, and mountain biking. The company’s flagship product, the GoPro Hero line of action cameras, is one of the best-selling cameras in the world. GoPro also offers a range of accessories, including mounts, cases, and batteries.

Summary

Investors should be encouraged by Sonos‘ latest earnings report, which showed total revenue of USD 305.1 million and a net income of USD -31.2 million for the fourth quarter of FY2023. Although the 3.5% year-over-year decrease in revenue may seem troubling initially, the 52.1% improvement in net income from FY2022 demonstrates a positive trend in the company’s financial performance. Furthermore, the company’s focus on product innovation should ensure that they remain competitive in the market going into the future. With a promising outlook, Sonos appears to be a good stock to consider for potential investors.

Recent Posts