SONOS Sees Potential Uplift After Rating Upgrade

December 18, 2023

🌥️Trending News

Sonos ($NASDAQ:SONO) has recently seen a glimmer of hope as the company has earned a rating upgrade from Zacks Investment Research. Recently, the company’s stock (SONO) was upgraded from ‘Hold’ to ‘Buy’ by the Zacks Investment Research. With the positive news, experts believe Sonos could see a further uplift in their stock price as they continue to show steady growth and release more products. Investors will be watching to see if the company can continue this momentum and deliver strong results in the future.

Stock Price

On Wednesday, Sonos Inc. saw an encouraging increase in its stock following a rating upgrade from analysts. Specifically, the stock opened at $16.7 and closed at $17.0, representing an uplift of 2.5%. This rise in price is viewed as a positive sign in light of the uncertain market conditions that many companies are facing due to the ongoing pandemic.

The ratings upgrade follows a period of solid financial performance by Sonos. Overall, the ratings upgrade and stock uptick serves as a positive sign for Sonos and its shareholders, suggesting that the company may have an optimistic outlook ahead despite the current climate. SONOS_Sees_Potential_Uplift_After_Rating_Upgrade”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sonos. SONOS_Sees_Potential_Uplift_After_Rating_Upgrade”>More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | -10.27 | -0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sonos. SONOS_Sees_Potential_Uplift_After_Rating_Upgrade”>More…

| Operations | Investing | Financing |

| 100.41 | -50.29 | -108.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sonos. SONOS_Sees_Potential_Uplift_After_Rating_Upgrade”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1k | 483.58 | 4.04 |

Key Ratios Snapshot

Some of the financial key ratios for Sonos are shown below. SONOS_Sees_Potential_Uplift_After_Rating_Upgrade”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.7% | 150.5% | 0.3% |

| FCF Margin | ROE | ROA |

| 3.0% | 0.6% | 0.3% |

Analysis

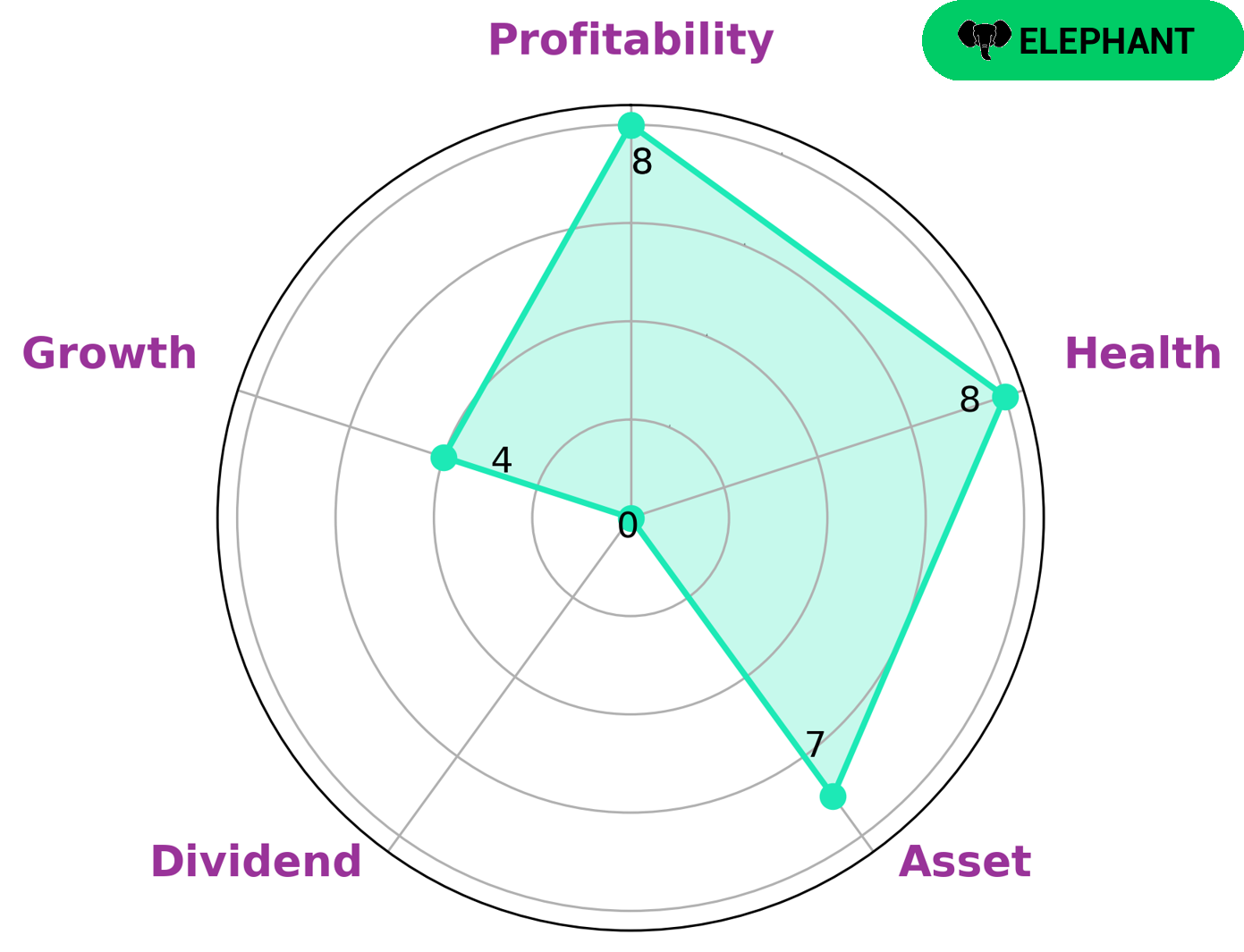

Our analysis of SONOS revealed that they are strong in asset and profitability, and have a medium growth rate. They are weak in terms of dividend. In terms of overall health, SONOS scored 8/10, indicating that they have the ability to pay off debt and fund future operations. According to the Star Chart, SONOS is classified as an ‘elephant’, a company that has a lot of assets and liquidity after liabilities have been deducted. This type of company could appeal to a wide range of investors, as it has a strong asset base and is capable of generating profits and growth. Investors with a longer-term view may be particularly interested in investing in SONOS, as the company’s high levels of asset and liquidity could provide a degree of protection in the event of any economic downturns. With its healthy cash flow and debt levels, SONOS could also be attractive to more conservative investors looking for security. More…

Peers

Sonos Inc, a California-based company that manufactures and sells wireless speakers, is locked in competition with several other companies, including Basler AG, Bang & Olufsen A/S, and GoPro Inc.

– Basler AG ($LTS:0DUI)

Basler AG is a leading international provider of high-quality imaging products. The company has a strong focus on the development and production of digital cameras for industrial and video surveillance applications, as well as medical devices. Basler AG is headquartered in Ahrensburg, Germany.

– Bang & Olufsen A/S ($OTCPK:BGOUF)

Bang & Olufsen A/S is a Danish company that designs and manufactures audio products and television sets. The company has a market capitalization of 145.79 million as of 2022 and a return on equity of -4.5%. The company was founded in 1925 by Peter Bang and Svend Olufsen, and it is headquartered in Struer, Denmark. The company’s products are available in more than 100 countries worldwide.

– GoPro Inc ($NASDAQ:GPRO)

GoPro Inc is a technology company that manufactures and sells action cameras and related accessories. The company has a market capitalization of 853.43M as of 2022 and a return on equity of 12.37%. GoPro’s products are designed for use in extreme action sports and activities, such as surfing, snowboarding, and mountain biking. The company’s flagship product, the GoPro Hero line of action cameras, is one of the best-selling cameras in the world. GoPro also offers a range of accessories, including mounts, cases, and batteries.

Summary

SONOS Inc. has recently been upgraded from a “Hold” to a “Buy” rating by analysts, signaling potential growth and a positive outlook on the company’s stock performance. This is further buoyed by strong financials and positive quarterly earnings reports. Their balance sheets are healthy, with decreasing debt levels and increasing cash flow, and their profitability metrics have been rising for several quarters. They have also been implementing several strategic plans in order to increase their market share and remain competitive.

In addition, their product offerings have been well-received by both customers and the wider market. As a result, analysts believe that the stock of SONOS is undervalued and may offer significant upside potential for investors.

Recent Posts