Gopro Stock Fair Value Calculator – GoPro Among Top 5 Consumer Stocks Poised to Soar This Month

May 11, 2023

Trending News ☀️

GOPRO ($NASDAQ:GPRO): GoPro (NASDAQ: GPRO) is among the five consumer stocks poised to soar this month—along with 1-800-Flowers.com, Wayfair, Groupon, and Dollar Tree—according to a recent report. GoPro has become synonymous with capturing life’s most thrilling moments with its small but powerful cameras. It has developed a whole ecosystem to support its cameras, including mounts and accessories, as well as a mobile app for editing and curating photos and videos. As an innovative company that strives to create the ultimate user experience, GoPro continues to develop new products and services to meet the needs of its customers. GoPro’s stock has been fairly volatile over the last few months, but the company is now poised to rise again. The company has predicted strong revenue growth in the second quarter and several Wall Street analysts are predicting positive future performance.

In addition to this, GoPro has acquired several new companies that offer innovative products and services in order to bolster its portfolio. Analysts are optimistic that these acquisitions will result in significant growth in the coming months. GoPro is an exciting stock to watch out for this month, as it appears to be on the cusp of taking off. With its innovative products, strong financials, and promising acquisitions, GoPro has the potential to become one of the top consumer stocks on the market. For investors looking for a high-growth stock, GoPro is certainly worth considering.

Market Price

On Monday, GOPRO stock opened at $4.4 and closed at $4.3, a slight decrease of 1.4% from the prior closing price of $4.4. This decrease signals that the stock is still in a volatile position and investors are waiting for the stock to rise again. Investors are optimistic that GOPRO will show strong growth in the coming months and will be able to reach back to previous highs. With a strong brand recognition, a diverse product portfolio, and innovative technology at hand, GOPRO is well-positioned to make the most out of this current market volatility. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gopro. More…

| Total Revenues | Net Income | Net Margin |

| 1.09k | 28.85 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gopro. More…

| Operations | Investing | Financing |

| 5.75 | -8.39 | -173.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gopro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 465.37 | 3.9 |

Key Ratios Snapshot

Some of the financial key ratios for Gopro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.9% | 0.7% | 3.7% |

| FCF Margin | ROE | ROA |

| 0.2% | 4.2% | 2.4% |

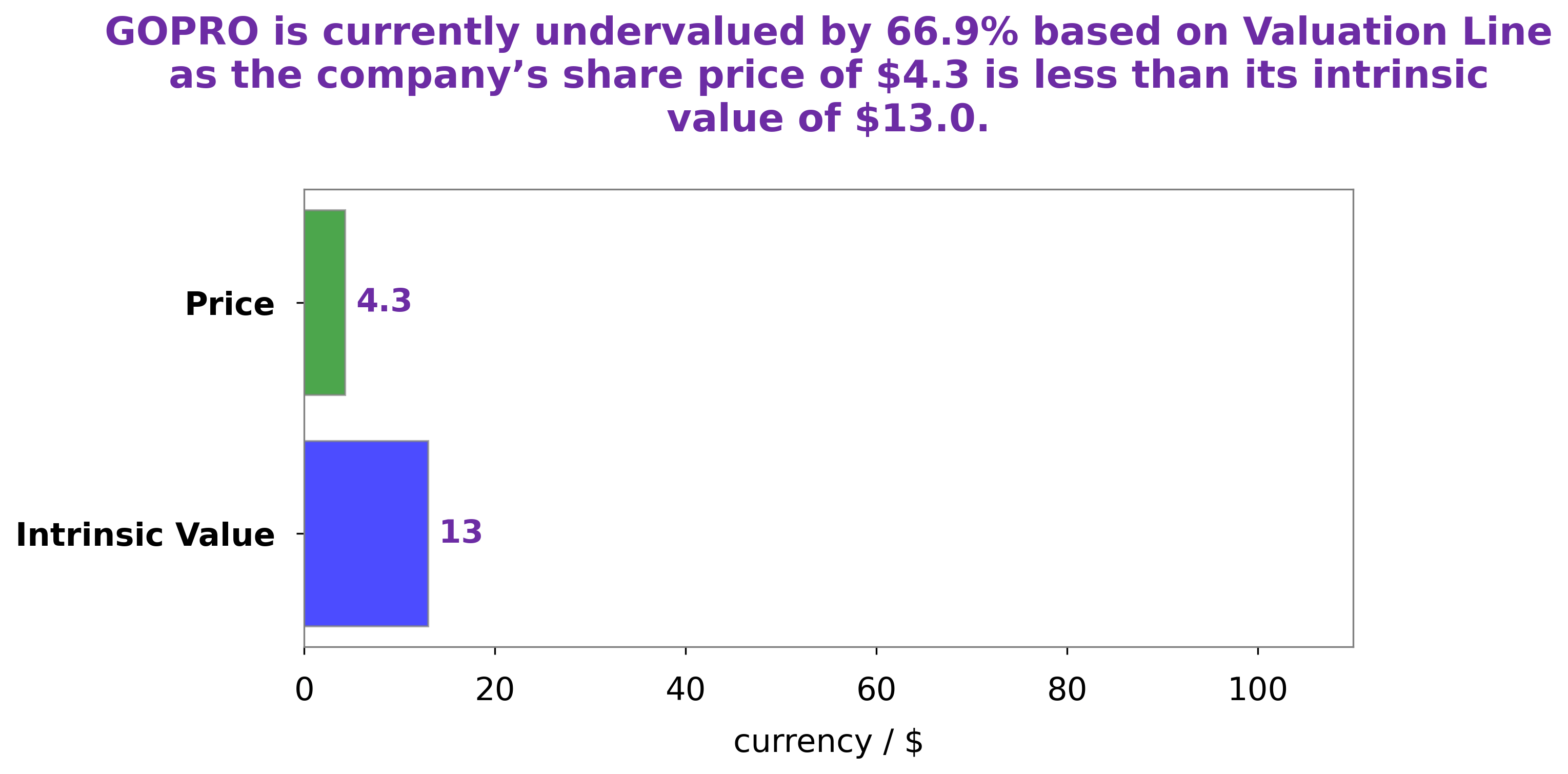

Analysis – Gopro Stock Fair Value Calculator

At GoodWhale, we recently conducted an analysis of GOPRO‘s wellbeing. After careful consideration of the company’s financials and market conditions, we determined that the fair value of GOPRO’s share was around $13.0. This calculation was made using our proprietary Valuation Line tool, which takes into account multiple factors before arriving at a fair estimate. Currently, the market price of GOPRO stock is much lower, trading at only $4.3. This represents an undervaluation of 67.0%, indicating a potential buying opportunity for savvy investors who are looking to take advantage of this significant gap between the current market price and the fair value calculated by our Valuation Line tool. More…

Peers

In recent years, GoPro Inc has faced stiff competition from Sonos Inc, B&C Speakers SpA, Bang & Olufsen A/S, and other companies in the market for portable speakers. GoPro Inc has responded by innovating its product line and expanding its market share.

– Sonos Inc ($NASDAQ:SONO)

Sonos Inc is a publicly traded company that manufactures and sells wireless speakers and home audio systems. As of 2022, the company has a market capitalization of 1.81 billion dollars and a return on equity of 11.22%. Sonos was founded in 2002 and is headquartered in Santa Barbara, California. The company sells its products through a network of retailers and distributors worldwide.

– B&C Speakers SpA ($LTS:0OM7)

B&C Speakers SpA is a leading manufacturer of professional loudspeakers, PA systems, and related products. The company has a market cap of 118.99M as of 2022 and a Return on Equity of 25.26%. B&C Speakers SpA’s products are used in a wide range of applications, including live sound, recording, broadcast, and installed sound. The company’s products are sold through a network of authorized dealers and distributors worldwide.

– Bang & Olufsen A/S ($OTCPK:BGOUF)

Bang & Olufsen A/S is a world-renowned provider of high-end audio and visual products. The company has a market capitalization of 136.77 million as of 2022 and a return on equity of -4.5%. Bang & Olufsen was founded in 1925 and is headquartered in Denmark. The company’s products are sold in more than 100 countries worldwide. Bang & Olufsen is best known for its innovative, high-quality audio and visual products. The company’s product portfolio includes televisions, radios, sound systems, and portable speakers. Bang & Olufsen is committed to providing its customers with the best possible experience. The company’s products are designed to meet the needs of its customers and to exceed their expectations.

Summary

GoPro (NASDAQ: GPRO) is a stock worth considering for potential investors this month. Analysts are optimistic that demand for GoPro’s action cameras and other products will remain strong, with the potential for further upside. The company has also been exploring new markets and expanding its product line, which should further drive sales and help increase profits. With a positive outlook and recent momentum, GoPro could provide interesting opportunities for investors this month.

Recent Posts