Gopro Intrinsic Value – GoPro Stock Falls Behind Competitors in Mixed Trading Session on Friday

September 27, 2024

🌥️Trending News

GOPRO ($NASDAQ:GPRO): GoPro Inc. is a company that specializes in manufacturing and selling action cameras and accessories. GoPro quickly gained popularity among extreme sports enthusiasts and has since expanded to cater to a wider consumer market. The stock of GoPro Inc. is listed on the NASDAQ exchange under the ticker symbol GPRO.

However, in recent years, the company has faced challenges, leading to a decline in its stock value. On Friday, GoPro’s stock fell behind its competitors in a mixed trading session in the stock market. The company’s shares dropped by 6.47% to $1.30, which was reflective of the overall performance of the Dow Jones Industrial Average. This decline can be attributed to various factors, including increased competition from other action camera brands, declining sales, and concerns over the company’s profitability. GoPro’s main competitor is Sony, which has been gaining market share in the action camera industry. Sony’s success can be attributed to its ability to offer a wider range of products at more affordable prices. This has put pressure on GoPro to lower its prices and improve its product offerings to remain competitive.

Additionally, GoPro has faced challenges with its sales and revenue growth in recent years. As a result, investors have become cautious about the company’s future growth potential, leading to a decline in its stock value. Furthermore, concerns over GoPro’s profitability have also affected its stock performance. This has raised doubts about the company’s financial stability and its ability to compete with its competitors in the long run. It remains to be seen how GoPro will address these challenges and regain its position as a leader in the action camera industry.

Price History

The company’s stock opened at $1.37 and closed at $1.30, representing a 6.47% drop from the previous closing price of $1.39. One possible reason for the drop in GOPRO’s stock price could be the overall performance of the market on Friday. Additionally, GOPRO may have been impacted by news from its competitors on Friday. Both Sony and DJI announced new products in the action camera and drone markets, respectively. This could have had investors shifting their attention and potentially funds towards these companies, causing GOPRO’s stock to fall behind. It is also worth noting that GOPRO has been facing some financial struggles in recent years. The company has had to make significant cost-cutting efforts and has faced declining sales. This could be another factor contributing to its stock’s underperformance compared to its competitors.

However, it is not all bad news for GOPRO. The company has been making efforts to turn things around, such as expanding its product line and diversifying into new markets. It also recently announced a partnership with Adobe to enhance its editing software capabilities. These efforts could help to boost GOPRO’s stock in the future. In conclusion, while GOPRO’s stock may have fallen behind its competitors in Friday’s trading session, there are still potential opportunities for the company to improve its performance in the future. Investors will likely be keeping a close eye on the company’s progress and any updates on its financials and new product developments. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gopro. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>More…

| Total Revenues | Net Income | Net Margin |

| 1.01k | -53.18 | -5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gopro. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>More…

| Operations | Investing | Financing |

| -32.86 | 121.9 | -90.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gopro. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 967.95 | 412.11 | 3.66 |

Key Ratios Snapshot

Some of the financial key ratios for Gopro are shown below. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.1% | 0.7% | -6.3% |

| FCF Margin | ROE | ROA |

| -3.4% | -7.1% | -4.1% |

Analysis – Gopro Intrinsic Value

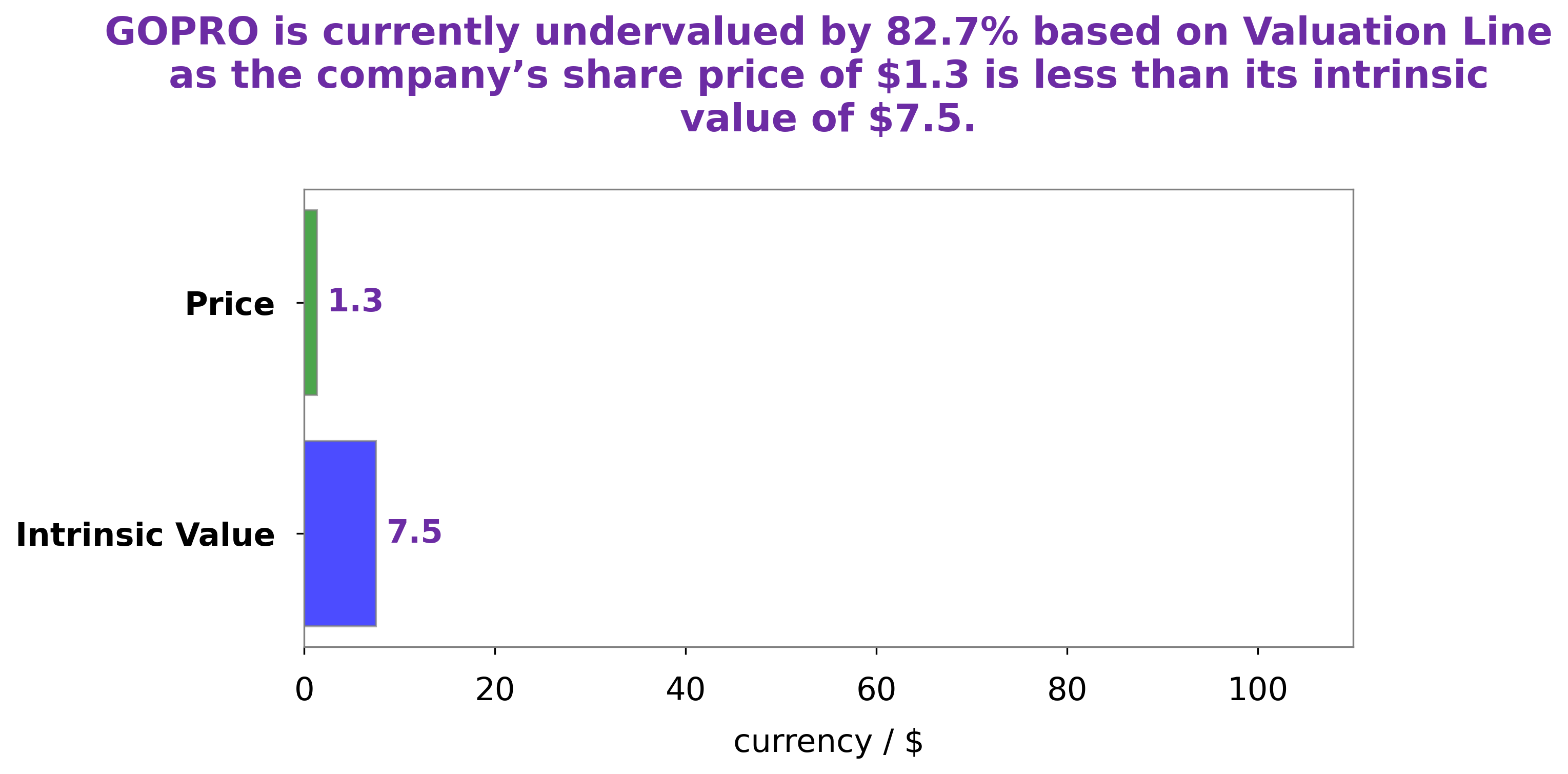

As a team at GoodWhale, we recently conducted a thorough analysis of GOPRO’s overall health. Our goal was to determine the fair value of GOPRO shares and assess whether the stock is currently undervalued or overvalued. After carefully examining various financial metrics and market trends, we have calculated the fair value of GOPRO share to be around $7.5. This value was determined using our proprietary Valuation Line, which takes into account multiple factors such as future earnings potential, industry trends, and company performance. However, we were surprised to find that GOPRO’s current stock price is only $1.3, indicating that the stock is undervalued by a whopping 82.7%. This is a significant discrepancy between our calculated fair value and the current market price, indicating that GOPRO may be a highly attractive investment opportunity. In our analysis, we found that GOPRO has a strong brand presence and a loyal customer base, which bodes well for its future growth potential. Additionally, the company has been making efforts to diversify its product offerings beyond just action cameras, which could lead to increased revenue streams and profitability. Overall, we believe that GOPRO is currently undervalued and has the potential for significant growth in the future. As always, we recommend conducting thorough research and carefully considering all factors before making any investment decisions. GoPro_Stock_Falls_Behind_Competitors_in_Mixed_Trading_Session_on_Friday”>More…

Peers

In recent years, GoPro Inc has faced stiff competition from Sonos Inc, B&C Speakers SpA, Bang & Olufsen A/S, and other companies in the market for portable speakers. GoPro Inc has responded by innovating its product line and expanding its market share.

– Sonos Inc ($NASDAQ:SONO)

Sonos Inc is a publicly traded company that manufactures and sells wireless speakers and home audio systems. As of 2022, the company has a market capitalization of 1.81 billion dollars and a return on equity of 11.22%. Sonos was founded in 2002 and is headquartered in Santa Barbara, California. The company sells its products through a network of retailers and distributors worldwide.

– B&C Speakers SpA ($LTS:0OM7)

B&C Speakers SpA is a leading manufacturer of professional loudspeakers, PA systems, and related products. The company has a market cap of 118.99M as of 2022 and a Return on Equity of 25.26%. B&C Speakers SpA’s products are used in a wide range of applications, including live sound, recording, broadcast, and installed sound. The company’s products are sold through a network of authorized dealers and distributors worldwide.

– Bang & Olufsen A/S ($OTCPK:BGOUF)

Bang & Olufsen A/S is a world-renowned provider of high-end audio and visual products. The company has a market capitalization of 136.77 million as of 2022 and a return on equity of -4.5%. Bang & Olufsen was founded in 1925 and is headquartered in Denmark. The company’s products are sold in more than 100 countries worldwide. Bang & Olufsen is best known for its innovative, high-quality audio and visual products. The company’s product portfolio includes televisions, radios, sound systems, and portable speakers. Bang & Olufsen is committed to providing its customers with the best possible experience. The company’s products are designed to meet the needs of its customers and to exceed their expectations.

Summary

On Friday, GoPro Inc. stock lagged behind its competitors, falling 6.47% to $1.30. This dip in price was part of a mixed trading session for the stock market, with the Dow Jones also experiencing a decline on the same day. This underperformance suggests that investors may be losing confidence in GoPro Inc. and are choosing to invest their money elsewhere.

As with any investment, it is important to carefully consider the company’s financial health and performance before making any decisions, especially in a volatile market. It will be interesting to see how GoPro Inc. responds and if they can regain the trust of investors.

Recent Posts