Despite Weak Quarterly Results, Apple Stock Rallies Above $150 As Market Cheers Premium Valuation.

February 8, 2023

Trending News ☀️

Apple Inc ($NASDAQ:AAPL). is a technology giant that is best known for its iPhones, iPads, Macs, and other innovative products. As a result, investors were not expecting much from Apple’s quarterly results that were released last week. Surprisingly, however, the stock rallied back above $150, leading some investors to cheer the premium valuation of the tech giant. The quarterly results showed a stagnant business due to weak iPhone sales, which was offset by the company’s services segment. But the stock quickly erased the losses it suffered after the announcement of the results and rose back to $150. It appears that investors are banking on Apple’s ability to pull off a major rebound and are willing to pay a premium for its potential.

However, despite the rally in share price, my investment thesis remains Bearish on Apple’s stock. The company has forecasted another weak quarter, suggesting that the current rally is likely to be short-lived. Furthermore, there are no guarantees that Apple will be able to make a major comeback. But without any concrete evidence of a turnaround, investors should be cautious when betting on Apple’s stock.

Stock Price

Despite negative news sentiment, Apple Inc (AAPL) stock rallied above the $150 mark on Monday, closing at $151.7. This was a 1.8% decrease from its closing price of $154.5 on Friday. Despite the weak quarterly results reported by the company, investors have been cheering its premium valuation. Analysts suggest that investors are confident about the company’s long-term prospects and are willing to overlook the current volatility in the stock price. They also believe that Apple’s stock is well-positioned for future growth, as the company continues to focus on innovation and customer satisfaction. The company has been increasing its focus on product and service innovation, introducing new models of iPhones, iPads, Apple Watches and other products. It has also been investing in research and development, which has enabled it to launch new products and services.

Additionally, the company is focused on expanding its presence in emerging markets such as India and China. Apple also continues to benefit from its strong brand recognition and loyal customer base. This has enabled it to gain a competitive edge over its rivals in the market. Moreover, Apple’s strong financial position has allowed it to invest in long-term projects, such as its new headquarters in Cupertino, California. Overall, despite the weak quarterly results reported by Apple, investors have continued to remain optimistic about the company’s long-term prospects. They are confident that the company’s premium valuation will help it emerge as an industry leader in the future. As such, the stock is expected to remain resilient and continue to deliver strong returns over the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apple Inc. More…

| Total Revenues | Net Income | Net Margin |

| 387.54k | 95.17k | 24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apple Inc. More…

| Operations | Investing | Financing |

| 109.19k | -7.69k | -118.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apple Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.75k | 290.02k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Apple Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 19.9% | 30.1% |

| FCF Margin | ROE | ROA |

| 25.2% | 135.9% | 21.0% |

Analysis

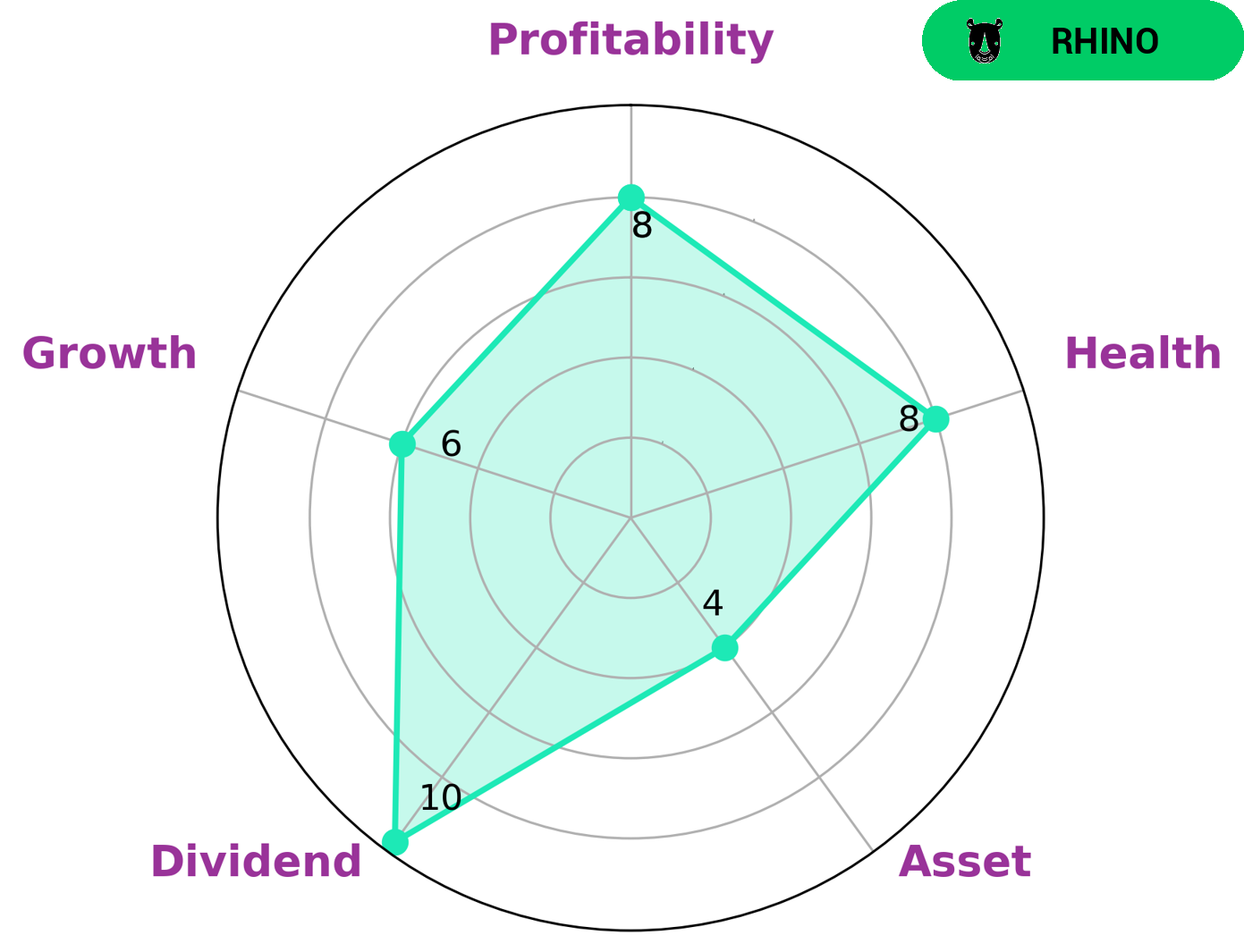

Investors who are looking for a safe, long-term investment may be interested in APPLE INC. GoodWhale’s analysis of the company’s financials shows that it is strong in dividend, profitability, and medium in asset growth. Their health score of 8 out 10 indicates that their cashflows and debt are in good condition, meaning they are capable of weathering any crisis without the risk of bankruptcy. APPLE INC is classified as a ‘rhino’, meaning they have achieved moderate revenue or earnings growth. This type of company is ideal for investors who want stability without taking on too much risk. The moderate growth also means investors can still benefit from the company’s success over time, as it accumulates wealth. The company’s financials are healthy enough to ensure that investors don’t have to worry about their money being lost. As long as the company continues to be managed well, investors can expect to make a steady return on their investment. In addition, the dividends will provide investors with the opportunity to earn some extra income from their investment. In conclusion, APPLE INC is an attractive option for investors who are looking for a safe investment with moderate returns. The company’s financials are strong, and their health score indicates that they are capable of riding out any crisis without the risk of bankruptcy. The moderate growth potential also makes it an attractive option for those who want to invest for the long-term. More…

Peers

The competition between Apple Inc and its competitors, Cisco Systems Inc, Microsoft Corp, and Sony Group Corp, has been intense over the years. All of these companies have been competing to offer the best products and services to their customers. Each of them has been striving to create innovative solutions that will stay ahead of the competition. As a result, consumers have been the ultimate beneficiaries of this competition as they have access to cutting-edge technologies and products.

– Cisco Systems Inc ($NASDAQ:CSCO)

Cisco Systems Inc is a multinational technology company that designs, manufactures and sells networking equipment. As of 2023, the company has a market capitalization of 199.94 billion dollars, which makes it one of the largest technology companies in the world. Furthermore, its Return on Equity (ROE) stands at 23.05%, which is an indication of its impressive financial performance. Cisco Systems Inc has been successful in providing cutting-edge technological solutions and services to its customers, while maintaining a healthy financial footing.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is a multinational technology company that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Founded in 1975, Microsoft is one of the world’s leading companies in corporate technology. With a market cap of 1.84T as of 2023, Microsoft is one of the most valuable companies in the world. Microsoft’s Return on Equity (ROE) of 29.64% is also one of the highest rates in the corporate sector. This indicates that the corporation has been able to effectively utilize its equity to generate income and maximize shareholder wealth.

– Sony Group Corp ($TSE:6758)

Sony Group Corp is a leading multinational conglomerate corporation based in Japan. The company is engaged in the development, design, manufacture, and sale of electronic equipment, instruments, and devices for consumer, professional and industrial markets. As of 2023, Sony Group Corp has a market cap of 14.3T, making it one of the largest companies in the world. Additionally, the company has a Return on Equity (ROE) of 10.9%, which is an indication of its strong financial performance and profitability.

Summary

Apple stock recently rallied above $150 despite weak quarterly results, indicating that the market is rewarding the company’s premium valuation. This is despite the fact that the overall sentiment surrounding the company is mostly negative. For investors considering investing in Apple, it is important to consider both the short and long-term prospects of the company, including its competitive landscape and product strategy. The company has a strong track record of producing innovative products and services, but its future success will depend on continued innovation and execution.

Additionally, investors should consider factors such as cash flow and balance sheet health, as well as potential risks such as changes in macroeconomic conditions and legal and regulatory risks. Investors should also consider the potential for market volatility or other unforeseen events that could affect the company’s performance.

Recent Posts