Apple Set to Unveil Foldable iPad in 2024, Analyst Predicts Positive Outlook for New Product.

February 6, 2023

Trending News ☀️

Apple Inc ($NASDAQ:AAPL). is one of the world’s leading technology companies, designing, manufacturing, and marketing consumer electronics, computer software, and online services. The company’s success has been largely propelled by its iconic devices, such as the iPhone, iPad, and Apple Watch. Now, the tech giant is set to unveil a brand new product: a foldable iPad. Analyst Ming-Chi Kuo of TF International Securities tweeted on Monday that Apple is unlikely to release any new iPad models in the upcoming nine to twelve months; however, he has a “positive” outlook for their foldable iPad, which is scheduled to be mass produced during the first quarter of 2024. Kuo believes that this innovative device could help to drive up shipments and diversify the tech giant’s tablet offerings. It will also likely come with a USB-C port and a new magnetic connector for accessories. There is no word yet on pricing or availability, but it is expected to be released in late 2024.

This news could be a major boon for Apple and its loyal customer base. After all, a foldable iPad could offer a unique form factor that could appeal to both traditional tablet users and laptop users who want the convenience of a smaller device. It could also help Apple keep up with its main competitors in the tablet market, such as Samsung and Microsoft. Overall, it looks like Apple is gearing up to release an exciting new device in 2024. With its foldable iPad, Apple could potentially revolutionize the tablet market and give its customers something truly special.

Market Price

At the time of writing, news about Apple Inc. has been mostly negative, with the stock opening at $145.0 on Monday and closing at $143.0, down by 2.0% from the prior closing price. This new product could bring a resurgence of growth and innovation to Apple Inc., furthering its standing as the world’s most valuable publicly traded company. The iPad is an incredibly useful device for both work and leisure activities, and the addition of a foldable version could further extend its capabilities. A foldable iPad could be used to create multimedia presentations with ease, or for use by students who are taking online classes.

It could also become an important addition to the Apple Inc. product lineup for those who want a larger display than what is offered on the iPhone. The foldable iPad could be a game-changer for Apple Inc., offering a new product that could attract more customers and increase sales of existing products. With its potential to revolutionize the industry, analysts believe that this new product could be the spark that leads to a resurgence of growth and innovation at Apple Inc. This could lead to even greater success for the world’s most valuable publicly traded company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apple Inc. More…

| Total Revenues | Net Income | Net Margin |

| 387.54k | 95.17k | 24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apple Inc. More…

| Operations | Investing | Financing |

| 109.19k | -7.69k | -118.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apple Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.75k | 290.02k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Apple Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 19.9% | 30.1% |

| FCF Margin | ROE | ROA |

| 25.2% | 135.9% | 21.0% |

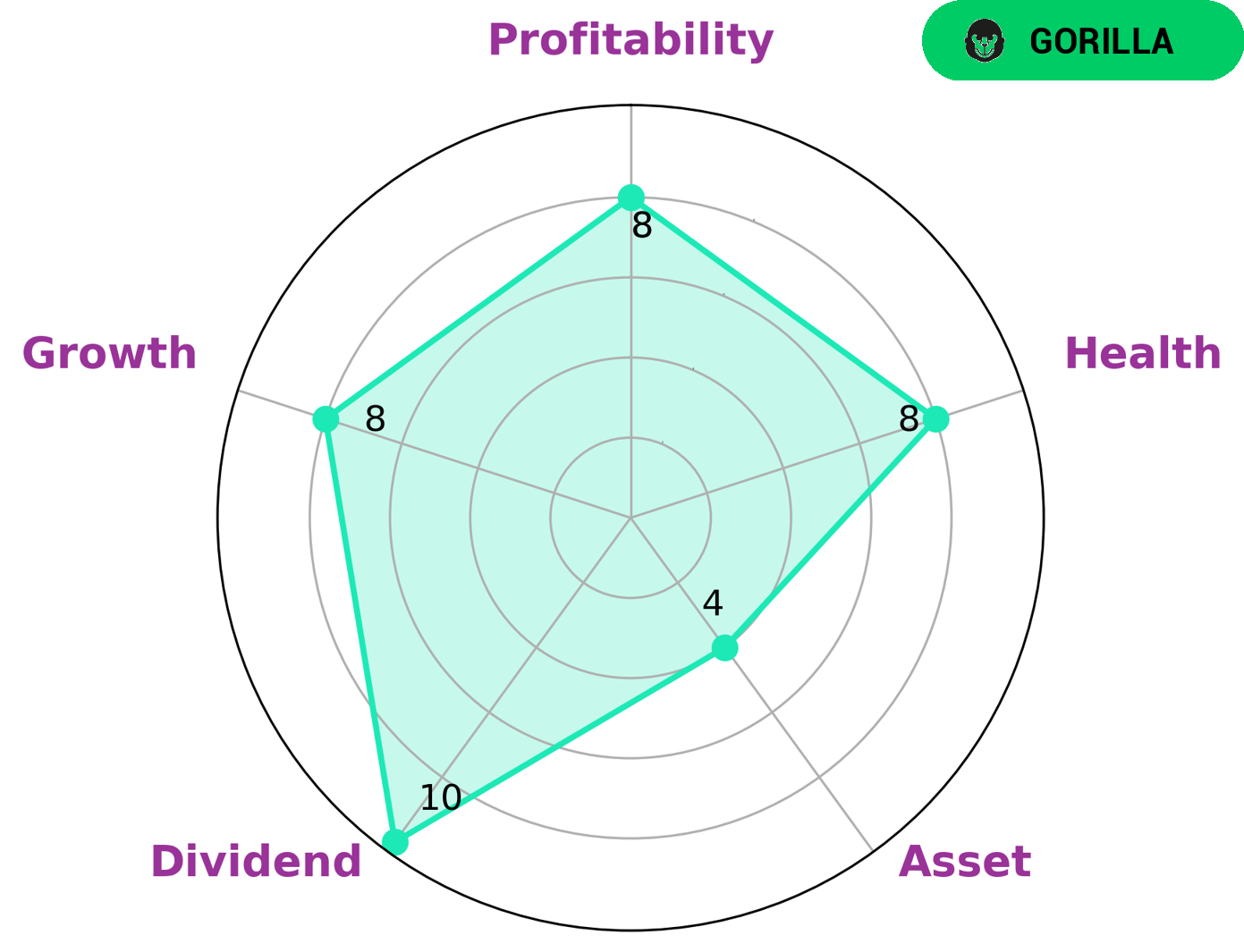

VI Analysis

The Value Insight (VI) app provides investors with an easy-to-use tool to analyze the long-term potential of a company. By analyzing the fundamentals of Apple Inc., the VI Star Chart shows that the tech giant is strong in dividend, growth, and profitability, and medium in asset. The health score of 8/10 indicates that the company is capable to pay off debt and fund future operations. Moreover, Apple Inc. is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for steady returns and growth could be interested in investing in Apple Inc. due to its strong fundamentals and potential for long-term success. Its healthy balance sheet, strong dividend payments, and solid growth prospects make it an attractive option for long-term investors who are looking for a company with a strong competitive advantage.

Additionally, the company’s cash flows and debt capacity are also attractive to potential investors. Furthermore, Apple Inc.’s status as a gorilla business could give investors a greater sense of security as they would be investing in a company with a proven track record of success. In conclusion, Apple Inc. is an attractive option for many types of investors who are looking for a safe and profitable investment. Its strong fundamentals and potential for long-term success make it an ideal investment opportunity for those who are seeking steady returns and growth. Additionally, its status as a gorilla business provides investors with a greater sense of security and confidence in their investment decision.

Peers

The competition between Apple Inc and its competitors, Cisco Systems Inc, Microsoft Corp, and Sony Group Corp, has been intense over the years. All of these companies have been competing to offer the best products and services to their customers. Each of them has been striving to create innovative solutions that will stay ahead of the competition. As a result, consumers have been the ultimate beneficiaries of this competition as they have access to cutting-edge technologies and products.

– Cisco Systems Inc ($NASDAQ:CSCO)

Cisco Systems Inc is a multinational technology company that designs, manufactures and sells networking equipment. As of 2023, the company has a market capitalization of 199.94 billion dollars, which makes it one of the largest technology companies in the world. Furthermore, its Return on Equity (ROE) stands at 23.05%, which is an indication of its impressive financial performance. Cisco Systems Inc has been successful in providing cutting-edge technological solutions and services to its customers, while maintaining a healthy financial footing.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is a multinational technology company that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Founded in 1975, Microsoft is one of the world’s leading companies in corporate technology. With a market cap of 1.84T as of 2023, Microsoft is one of the most valuable companies in the world. Microsoft’s Return on Equity (ROE) of 29.64% is also one of the highest rates in the corporate sector. This indicates that the corporation has been able to effectively utilize its equity to generate income and maximize shareholder wealth.

– Sony Group Corp ($TSE:6758)

Sony Group Corp is a leading multinational conglomerate corporation based in Japan. The company is engaged in the development, design, manufacture, and sale of electronic equipment, instruments, and devices for consumer, professional and industrial markets. As of 2023, Sony Group Corp has a market cap of 14.3T, making it one of the largest companies in the world. Additionally, the company has a Return on Equity (ROE) of 10.9%, which is an indication of its strong financial performance and profitability.

Summary

Apple Inc. is a technology giant that continues to be a top contender in the stock market. This is largely due to strong sales of Apple’s products and services, as well as the company’s commitment to innovation. As Apple works to develop new products and technologies, such as a rumored foldable iPad in 2024, investors can look forward to continued growth in the future.

Recent Posts