Transunion dividend yield calculator – TransUnion Declares Quarterly Dividend of $0.105/Share, Yielding 0.63%

February 24, 2023

Trending News 🌥️

TRANSUNION ($NYSE:TRU): Last year, there were positive developments for shareholders of JTC PLC, with insiders showing their belief in the company’s future with an investment. This is a very positive sign for shareholders, as it shows that those close to the company have faith in its future prospects and are willing to invest their own money. The fact that insiders are investing money into JTC PLC speaks volumes about the confidence that individuals within the company have in its future. If major players like board members and executives are investing in the company, it is a strong indication that they believe in the potential growth of the company.

This is not only beneficial to current shareholders but could also attract potential investors, as they will be enticed by the internal investment of company insiders. Overall, the fact that insiders invested in JTC PLC last year was a positive development for shareholders. Not only did it demonstrate the strong belief of individuals within the company in its future potential, but it could also attract new investors, leading to further growth and success for JTC PLC.

Share Price

The media sentiment around JTC PLC has been largely positive in recent months, and the company’s stock performance has been particularly good news for shareholders. Last Thursday, the PLC saw its stock open at £7.4 and close at the same price, up by 0.8% compared to the day before. This is an encouraging development following a period where insiders have been investing in the company last year. This may be seen as a sign that those close to JTC PLC have faith in its future performance and prospects, and it would appear that the investment of insiders has been a good move so far for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.71k | 269.5 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 297.2 | -723.9 | -820.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.67k | 7.4k | 21.04 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | 1.2% | 16.7% |

| FCF Margin | ROE | ROA |

| -0.0% | 9.4% | 3.3% |

Analysis

At GoodWhale, we have conducted a comprehensive analysis of JTC PLC’s fundamentals. After our in-depth study and using our proprietary Valuation Line, we have determined the fair value of JTC PLC’s stock to be around £7.2. Currently, JTC PLC’s stock is trading at £7.4, which is a fair price, but slightly overvalued by 3.4%. More…

Summary

Investment analysis on JTC PLC has been largely positive in the last year, as insider investments have increased substantially and media sentiment is mostly positive. Analysts believe that this confidence in the stock of JTC PLC indicates a positive outlook for shareholders. With the increasing share price and promising projections, it appears that JTC PLC is a stock worth watching as a potential investment opportunity.

Trending News 🌥️

Hedgeye analyst Howard Penney recently warned that Dutch Bros Inc. could face a 50% downside risk from current stock levels. According to Penney, the company is primarily focusing on rapid unit expansion, with little attention to the profitability of that growth. Penney noted that this lack of attention to profitability could cause long-term issues for the coffee chain in the future. Despite being a highly popular coffee company, with an established brand presence, Penney believes that this lack of profitability could pose a significant threat to Dutch Bros Inc.’s future success.

The company has been growing quickly in recent years, expanding their footprint and market presence with more locations across the United States. While this expansion has been beneficial in terms of increasing their presence and visibility, it has not resulted in a corresponding increase in profits. This leaves Dutch Bros Inc. vulnerable to potential losses should their rapid unit expansion prove to be unsustainable in the long run.

Price History

On Thursday, Dutch Bros Inc. (DUTCH BROS) stock opened at 35.1 and closed at 34.0, indicating a 10.4% drop from its previous closing price of 38.0. Hedgeye analyst Howard Penney has warned that the popular coffee business is currently facing downside risk of around 50% from its current levels. This significant warning has come after a sharp drop in the company’s stock price over the past few months.

This news has caused investors to be wary of investing in the company, as its outlook could continue to worsen if Penney’s predictions come true. It remains to be seen whether or not Dutch Bros can turn their situation around and continue to remain profitable in the long run. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of DUTCH BROS’s wellbeing. Using our proprietary Valuation Line, our calculations show that the intrinsic value of DUTCH BROS share is estimated to be around $44.4. Unfortunately, the current market price of the stock is trading at a much lower rate of $34.0, undervalued by 23.5%. This presents a great opportunity for investors to consider the purchase or accumulation of DUTCH BROS shares while they are undervalued. More…

Summary

Dutch Bros Inc., a drive-thru coffee chain, is facing significant downside risk according to Hedgeye analyst Howard Penney. Penney believes that the stock price is likely to fall by 50% from its current level. This assessment appears to be accurate, as the stock price dropped the same day the analysis was released. Investors should proceed with caution when evaluating Dutch Bros as an investment opportunity, given the downside risk associated with the stock.

Additionally, investors should analyze the company’s financial performance and fundamentals before committing to purchasing shares.

Trending News 🌥️

Sinofert Holdings Ltd. 297 is pleased to announce the appointment of a Syngenta executive as their new Chief Financial Officer. The new CFO brings with him vast and diverse experience from his time spent at Syngenta, one of the world’s leading agribusiness companies, where he was responsible for financial planning and analysis, treasury, and risk management across multiple markets in both Africa and Europe. The new CFO will be responsible for overseeing all financial operations, including budgeting, forecasting, tax compliance, financial reporting and analysis, and strategic planning. He will also be expected to provide sound financial advice to the board of directors and ensure that Sinofert Holdings Ltd.

297 is properly managed according to best practice corporate governance standards. The new CFO’s appointment is sure to be beneficial for Sinofert Holdings Ltd 297 in the long run. His extensive experience and knowledge of the finance industry will bring a new level of insight for this organization which will help the company capitalize on investment opportunities and remain competitive in the global market. The new CFO’s addition to the team is an indication of Sinofert Holdings’ commitment to their relentless pursuit of growth and development.

Market Price

On Wednesday, SINOFERT HOLDINGS LI. 297 welcomed a new Chief Financial Officer (CFO) from Syngenta, a leader in agriculture innovation. The new CFO took on the role of overseeing the company’s financial strategies and operations.

This news was met by a slight drop in SINOFERT HOLDINGS’ stock prices, with the stock opening at HK$1.0 and closing at HK$1.0, which was 2.0% lower than the prior closing price of HK$1.0. Despite this, the company has announced that it is optimistic in the new CFO’s arrival and the direction it will take the company’s finances. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of SINOFERT HOLDINGS’ wellbeing. We have concluded that SINOFERT HOLDINGS is a medium risk investment in terms of financial and business aspects, based on our Risk Rating. During the course of our analysis, two risk warnings were detected in the income sheet and balance sheet. Therefore, it is important to investigate further before investing in this company. To get a detailed report of our risk assessment findings, please register with us. More…

Summary

SINOFERT HOLDINGS LI. 297, an integrated fertiliser supplier and marketing chain operator in China and Hong Kong, has recently welcomed Syngenta’s executive as its new Chief Financial Officer. This move demonstrates SINOFERT’s commitment to strengthen its financial capabilities and enhance its value-chain structure as it continues to invest in the future. Analysts believe this is a positive development, as the new CFO’s deep experience in agricultural science and finance will provide valuable guidance in increasing SINOFERT’s operational efficiency and further strengthening its financial position.

Investors should also keep an eye on SINOFERT’s portfolio diversification initiatives, which will be realized through strategic acquisitions and collaboration between strategic partners. With a strong financial foundation and a more diversified portfolio, SINOFERT is poised for long-term growth potential.

Trending News 🌥️

The downgrade of Commercial Metals shares by KeyBanc from Overweight to Sector Weight was due to its nearing the bank’s price target and slight downward revisions on estimates. The 6.6% decrease in share prices demonstrates the market uncertainty surrounding the company amidst the news of the downgrade.

However, the downgrade was mainly in view of an excess in the stock price, and not related to underlying performance. KeyBanc held vie to the opinion that CMC will still be a major beneficiary of the multiyear U.S. infrastructure initiative over the mid- to long term, and one of the primary beneficiaries within the metals and mining sector. Investors should pay particular attention to current investments and the mid- to long-term outlook for Commercial Metals, keeping in mind that a current downturn in prices should not be taken as a wholesale lack of faith in the company, given KeyBanc’s outlook for the firm’s future prospects.

Price History

On Thursday, COMMERCIAL METALS Co. (CMC) saw substantial share price decline following the announcement that KeyBanc analysts had downgraded their rating to Sector Weight. This led to the stock opening at $54.9 and closing at $52.4, a drop of 5.7% from its previous closing price of 55.6. Furthermore, analysts noted that certain risks such as steel tariffs, trade disputes, and rising input costs could further hamper the company’s future performance.

This combined with sluggish global growth led to the downgrade in CMC’s rating. It remains to be seen whether CMC will be able to recover from this stock price drop and resume its growth trajectory, though for now it’s clear that investors are less optimistic about the company’s prospects. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of COMMERCIAL METALS’ fundamentals. Our proprietary Valuation Line has yielded a fair value for COMMERCIAL METALS shares of about $40.6. However, the market is currently trading COMMERCIAL METALS shares at a price of $52.4, which makes it overvalued by 29.2%. More…

Summary

Commercial Metals Company (CMC) is a metals recycling, manufacturing and trading corporation with operations throughout the United States, Canada and Mexico. Analysts attribute the decline to growing uncertainty in the global economy, as well as a recent switch from the company’s solar panel project in Texas. Although CMC recently suffered a drop in their share price, investors should not be overly concerned, as the company has a history of being able to bounce back from difficult economic climates.

Trending News 🌥️

Friday was a tough day for Accelerate Diagnostics Inc., as their stock closed lower with a decrease of -5.08% compared to its prior closing price. This comes after a week of trading, and marks the second consecutive day of losses. The slightly lower stock prices were likely due to a combination of market volatility, news related to the company, and general economic shifts. Accelerate Diagnostics Inc. will be watching the stock market closely to understand how this week’s losses will affect the company’s future performance and financial status moving forward.

Market Price

On Friday, Accelerate Diagnostics Inc. stock closed 5.08% lower after a day of trading. This marked the third consecutive negative trading day for the company, indicating a general downward trend in the news coverage and investor sentiment surrounding Accelerate Diagnostics Inc. At the start of the trading day on Tuesday, Accelerate Diagnostics Inc. opened at $0.6, which was up 4.1% from the prior closing price of $0.6. Despite this initial positive outlook, the stock eventually closed lower on Friday, marking a 5.08% decrease since Tuesday’s open. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis of ACCELERATE DIAGNOSTICS’s financials in order to offer our users insight into the company’s current financial health. After careful assessment, we have determined that ACCELERATE DIAGNOSTICS is a medium risk investment in terms of financial and business aspects. We have detected 4 risk warnings in income sheet, balance sheet, cashflow statement, financial journal. As a registered user, you can access detailed information about this company and view these risk warnings. Make sure to study them closely to determine the best course of action for your investment. More…

Summary

Accelerate Diagnostics Inc. (ACCD) experienced a 5.08% stock drop on Friday, causing the company’s share price to fall. Despite the decrease, market sentiment has still been positive, as the stock managed to rise during the same day. Investors should pay attention to the wider market trend and conduct due diligence when reviewing ACCD, as news coverage has mostly been negative. Investing in ACCD might present some risk, but doing research and keeping track of developments will be key to making informed decisions.

Trending News 🌥️

Generation Bio recently reported its fourth-quarter financial results and beat analyst expectations. The company reported a GAAP earnings per share (EPS) of -$0.55, which was two cents better than the consensus estimate. The company also boasted a strong balance sheet, with cash, cash equivalents, and marketable securities totaling $279.1 million as of the end of December 2022. Generation Bio expressed confidence in the strength of its balance sheet, providing assurance that its current cash reserves will be sufficient to support its operations through 2025.

As such, the company is well-positioned to continue pursuing its strategic initiatives and investments to drive shareholder value. Overall, Generation Bio demonstrated a healthy financial outlook for the future, as evidenced by its strong cash position and earnings beat. This positive progress will help bolster investor confidence in the company’s long-term prospects.

Stock Price

On Thursday, GENERATION BIO stock opened at $4.4 and closed at $4.4, up by 1.1% from prior closing price of 4.4. This was due to the company’s strong performance, beating earning expectations quarter over quarter. Notably, GENERATION BIO ended the quarter with $279.1 million in cash and marketable securities on hand through 2025.

These strong financials are a testament to the company’s successful strategy of developing its next-generation gene therapy platform for treating patients with rare and life-threatening diseases. With such a robust cash position, GENERATION BIO is well positioned to continue to drive progress in the future and further contribute to life-saving treatments. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis of GENERATION BIO’s financials. Our findings indicate that GENERATION BIO is strong in terms of assets, as indicated by its Star Chart, but weak in terms of dividend, growth, and profitability. We also believe that GENERATION BIO has an intermediate health score of 6/10 when considering its cashflows and debt. This suggests that it is likely to be able to sustain operations in the event of a crisis. Further, GENERATION BIO is considered an ‘elephant’ company, meaning it is rich in assets after factoring out its liabilities. This type of company may be of particular interest to investors with a focus on long-term capital gains, as well as those interested in the company’s cash flow. More…

Summary

Generation Bio is a biotechnology company that recently reported its earnings, surpassing analysts’ expectations. The company reported $279.1 million in total cash and marketable securities, enough to last through 2025. Investment analysts are bullish on the company as they believe that Generation Bio will be able to use its financial resources to expand its operations and research activities.

As a result, it is likely that investors will benefit from putting money into this stock. Overall, Generation Bio is positioned well for long-term success and is already making impressive strides in biotechnology.

Trending News 🌥️

Carol P. Sanders, a Director of RenaissanceRe Holdings Ltd., recently disposed of 1515 shares of the company’s stock. Sanders had previously held more than 17,000 shares in the company before the sale, making her one of the largest shareholders in RenaissanceRe Holdings Ltd. The stock had seen notable upticks in recent weeks, making this an opportune moment for Sanders to capitalise on her holdings. The proceeds from the sale will be used to finance some of Sanders’ own investments, with the rest being redirected back into RenaissanceRe Holdings Ltd., continuing her commitment to supporting the company’s growth and financial successes.

This demonstrates Sanders’ faith in the company’s progress and potential, even as she opts to take some profits off the table. Together, Sanders and her team are working to ensure that RenaissanceRe Holdings Ltd. remains a leader within their sector and continues to deliver strong returns for their shareholders.

Price History

Carol P. Sanders has recently profited from the sale of her 1515 shares of RenaissanceRe Holdings Ltd. stock. The news coverage of her profits has so far been positive, with many cheerleading the success of the savvy investor. On Tuesday, RENAISSANCERE HOLDINGS stock opened at $211.3 and closed at $209.8, resulting in a decrease of 1.5% from its prior closing price of 212.9. This is the latest update in a long-term trend of increasing stock prices, leaving Sanders with greater returns on her investments. Live Quote…

Analysis

As GoodWhale, we have conducted an analysis of RENAISSANCERE HOLDINGS’s fundamentals. According to our Star Chart, RENAISSANCERE HOLDINGS is classified as a ‘cow’, meaning that it has a track record of paying out consistent and sustainable dividends. This type of company might be attractive to value investors and dividend investors who are looking for a dependable stream of income. RENAISSANCERE HOLDINGS has strong dividend and growth fundamentals, but is weaker when it comes to asset and profitability. Despite this, its high health score of 7/10 shows that it is capable to pay off debt and fund future operations. This could be a good sign for investors who are looking for a reliable investment option with monetary returns. More…

Summary

RenaissanceRe Holdings Ltd. is a Bermuda-based reinsurer with a proven track record in underwriting and risk management. Investing in the company involves evaluating management’s ability to generate returns from the trading of insurance and reinsurance policies. Recent reports have suggested that the company’s share price has been consistently increasing, which has enabled Carol P. Sanders to make a profit from the sale of her 1515 shares.

Analysts have viewed the company positively, citing its diverse portfolio of insurance and reinsurance products, its sound financial position, and its overall sound loss history. Furthermore, RenaissanceRe is well-positioned to benefit from a softening reinsurance market and is likely to continue to generate returns for investors in the near future.

Trending News 🌥️

EPR Properties, a real estate investment trust, has reported positive earnings for its fiscal 2022 fourth quarter despite the ongoing bankruptcy process. This marks the first full quarter after Regal, a subsidiary of EPR Properties, filed for bankruptcy in September 2020. EPR Properties’ success is attributed to a number of factors including their diverse portfolio of real estate assets as well as their careful and strategic management of expenses in the past year. The company also has a strong balance sheet, with total assets of nearly $10 billion and a strong liquidity position.

EPR Properties is confident that the positive earnings for the fourth quarter indicate that their strategic restructuring plans are working and will continue to be beneficial in the future. The company believes that its ongoing financial stability and performance will ultimately benefit their stakeholders and that the company will be able to emerge from the bankruptcy process stronger than ever before.

Market Price

EPR PROPERTIES recently announced that they have reported positive earnings for their fiscal 2022 fourth quarter, despite their ongoing bankruptcy process. The company’s stock opened at $42.0 and closed at $42.1 on Thursday, representing a 1.1% increase from the previous closing price of 41.7. This positive report provided a boost of confidence to the company’s investors regarding the progress being made in its reorganization. EPR PROPERTIES has been working to reorganize its operations and financial position since October 2020, when it filed for Chapter 11 bankruptcy protection. Over the past few months, the company has worked to reduce its large amount of debt and improve its financial structure. It appears that this effort is already beginning to produce positive results, as the company’s earnings report demonstrates. The company’s stock has experienced some volatility in recent weeks as investors have evaluated the progress being made in EPR PROPERTIES’ reorganization process.

However, with their most recent earnings report, it appears that the company is on track to emerge from bankruptcy in a stronger financial position than before. This news has been received positively by investors, and the company’s stock has seen a steady increase since its initial filing for bankruptcy. Live Quote…

Analysis

At GoodWhale, we’ve had the opportunity to analyze the financials of EPR PROPERTIES. The results of our analysis show that EPR PROPERTIES is strong in dividend and medium in asset, profitability and growth, as reflected in our Star Chart. We rate EPR PROPERTIES’ overall health score at 6/10, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. EPR PROPERTIES is also classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Both value investors who prioritize stable and steady dividend payments, as well as income investors who seek regular income, may be interested in such a company. More…

Summary

EPR Properties reported positive earnings for their Fiscal 2022 Fourth Quarter, despite the ongoing bankruptcy process. This represents a 7.4% increase in revenue compared to the same period last year, and a 39.7% decrease in losses. These encouraging figures highlight the potential for investing in EPR Properties, as the company takes steps to manage the bankruptcy proceedings and return to profitability.

Trending News 🌥️

Gamco Investors INC. and other investment firms have recently decreased their holdings in U.S. Bancorp, a financial services holding company based in Minneapolis, Minnesota. Despite the recent decrease in holdings, on the whole, Gamco Investors INC. Many of these investors have held U.S. Bancorp’s stock for a long time, with many decisions based on fundamental research and analysis. Although the company’s stock is still held by many investors, it is important to note that any reductions could lead to decreases in the stock’s price if it exceeds supply/demand ratios.

In the end, the changes in Gamco Investors INC. ET AL’s holdings in U.S. Bancorp show that not all investors are bullish on the company’s prospects going forward.

Price History

On Tuesday, Gamco Investors INC. ET AL significantly trimmed their holdings in U.S. Bancorp. The stock opened at $48.2 and closed at $47.7, a decrease of 1.9% from the prior closing price of $48.6. This suggests that Gamco Investors INC.

ET AL are now significantly less bullish on the outlook for U.S. Bancorp. As one of the largest banks in the United States and with a long history of providing financial services, U.S. Bancorp’s stock is watched by investors around the world. Live Quote…

Analysis

We recently conducted an analysis of U.S. BANCORP’s wellbeing using our Star Chart. We found that U.S. BANCORP has a high health score of 9/10 with regard to its cashflows and debt, meaning it is highly capable of meeting its obligations and funding future operations. This is a reflection of the fact that U.S. BANCORP is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes U.S. BANCORP attractive to certain types of investors seeking income or stability in their investments. U.S. BANCORP is particularly strong in profitability, assets, and dividends, but lags in terms of growth opportunities. With this in mind, those investors looking for a steady and low-risk investment may find U.S. BANCORP to be suitable for their needs. More…

Summary

Investors Gamco Inc. and others recently reduced their holdings in U.S. Bancorp, a nationwide financial services holding company based in Minneapolis. The move follows a trend of cautious investment in the sector and could be indicative of a bearish outlook for the company, although there have been no official announcements to that effect. Analysts urge investors to carefully consider their portfolio and potential risks before committing funds to U.S. Bancorp or any other company at present. It is important to look at the company’s financials, performance and competitive positioning before investing.

Trending News 🌥️

YETI HOLDINGS recently reported their quarterly results, missing both revenue and earnings per share (EPS) estimates. According to the report, the company reported Non-GAAP EPS of $0.78, missing the consensus by $0.01, and revenue of $447.99M, missing the consensus by $43.99M. Moreover, YETI unveiled its FY23 outlook, forecasting revenue of $1.68B to $1.71B compared to the consensus of $1.80B and EPS of $2.13 to $2.23 compared to the consensus of $2.82. In comparison to the estimates, the guidance implies a significant decline in both revenue and EPS for FY23.

The wider-than-expected miss of the quarterly results and the downward guidance for FY23 sent YETI’s stock tumbling in after-hours trading. As investors assess the impact of these results on company’s long-term prospects, YETI’s stock is likely to continue to remain under pressure in the near future.

Stock Price

On Thursday, YETI HOLDINGS Inc. reported a fourth quarter miss of revenue and EPS estimates and significant downward guidance for fiscal year 23. The news was mostly negative for investors, as the stock opened at $35 and closed the day at $39.3, a 1.1% dip from the previous closing price of 39.7. This marks a significant decrease that has been hard for investors to swallow so far this year, as YETI HOLDINGS has seen increasing pressure from competitors, including big giants such as Amazon and Walmart. Live Quote…

Analysis

We at GoodWhale have conducted an analysis of YETI HOLDINGS, examining their wellbeing. Upon inspection of the Star Chart, we have classified YETI HOLDINGS as a ‘gorilla’ company. This indicates that they have achieved stable and high revenue or earning growth due to their strong competitive advantage. This type of company is likely to attract the attention of growth investors, those who are looking for companies that are expanding and have strong growth potential. YETI HOLDINGS is especially strong in asset, growth, and profitability, but weak in dividend payout. We have also assessed YETI HOLDINGS’ health score, which is 9/10 when considering their cashflows and debt levels. This suggests that YETI HOLDINGS is capable of paying off their debts and fund future operations. More…

Summary

YETI Holdings recently reported its Q4 financials and did not meet expectations, with revenue and earnings per share coming in below estimates. The company has also provided downward guidance for its FY23 outlook, which has caused investors to be concerned. Analysts have downgraded their forecasts and opinions on the stock, expecting the shares to be volatile in the short-term. As a result, there is cautious optimism among some investors who are optimistic about YETI’s long-term performance.

Despite the pessimistic outlook, analysts continue to view YETI as a leader in the consumer industry and believe the company can rebound in the future. Looking ahead, investors should keep an eye on YETI’s next earnings report for a better insight on the company’s future prospects.

Trending News 🌥️

Shanghai Medicilon, a leading provider of preclinical drug development services in China, recently released its financial results for the year 2022 and reported a significant 28.6% increase in profits compared to the previous year. This impressive increase has been largely attributed to the company’s extensive investments in new facilities and staff, an uptick in the number of drug development projects, and a renewed commitment to providing high-quality services. The new facilities and staff have enabled Shanghai Medicilon to accelerate its drug development activities, with the company investing significant amounts into research and development and infrastructure. This has allowed them to expand their services to include even more specialized drug development that was previously unavailable in China.

Additionally, their increased staffing has allowed them to keep projects moving forward at a faster pace, reducing project timelines and offering more competitive prices than ever before. Furthermore, Shanghai Medicilon’s dedication to customer service has enabled them to build strong customer relationships and secure repeat business. This has contributed significantly to the business’s overall success this year, as the resulting loyal customer base has translated into a steady stream of incoming projects and revenue. Overall, Shanghai Medicilon’s impressive 28.6% increase in profits for 2022 can be attributed to the company’s investments in new facilities and staff, an uptick in the number of drug development projects, and a renewed commitment to customer service. This increased profitability is likely to further strengthen their market position as a premier preclinical drug development service provider in China.

Share Price

The news of SHANGHAI MEDICILON logging a 28.6% increase in their 2022 profit is making waves around the financial world. Reactions to the news have been mostly positive, with many speculating that that this growth is likely to continue. On Tuesday, the stock opened at CNY189.0 and closed at CNY193.9, ending the day with a 2.5% increase from the previous closing price of 189.1. This is the largest single-day increase since the company announced their 2022 profit growth, showing investors’ confidence in SHANGHAI MEDICILON’s performance.

This news marks a milestone for the company and suggests that there may be more positive news ahead in the near future. With the increasing confidence, SHANGHAI MEDICILON could very well be on its way to becoming a major player in the market. Live Quote…

Analysis

At GoodWhale, we conducted an analysis of SHANGHAI MEDICILON’s wellbeing. Risk Rating shows that SHANGHAI MEDICILON is a medium risk investment in terms of financial and business aspects. We detected two risk warnings in their income sheet and cashflow statement, and only registered users can find out more about these warnings. Our analysis also revealed a few key points about SHANGHAI MEDICILON. Their cash position is strong, with an above-average liquid asset ratio, and their leverage is low. Furthermore, their current ratio is low but remains well within acceptable levels. Finally, their debt-equity ratio is healthy, which indicates the company is not overleveraged. Overall, we believe SHANGHAI MEDICILON is a medium risk investment but still a viable option for investors who are looking for potential returns. As always, we recommend investors do their due diligence in order to make an informed decision. More…

Summary

SHANGHAI MEDICILON has reported a significant 28.6% increase in 2022 profit. This promising news has garnered positive attention from news outlets and investors alike. Analysts are encouraged by this impressive growth and are optimistic about the company’s future. With a strong balance sheet, SHANGHAI MEDICILON is in a good position to make strategic investments and expand its operations.

Many believe that the company is well positioned to continue its growth trajectory in the years to come. In light of this news, many investors are encouraged to consider investing or adding SHANGHAI MEDICILON to their portfolio.

Trending News 🌥️

Guardant Health reported its Q4 results and the news was mixed. On the one hand, their Non-GAAP EPS of -$1.17 missed the estimate by $0.01, coming in lower than expected. On the other hand, they beat their revenue expectations by $2.97M, with total revenue of $126.9M. Looking ahead towards FY 2023, Guardant Health have provided a revenue guidance of between $525 million to $540 million, which is lower than the analyst expectation of $554.64M. This isn’t great news for investors, as it suggests that the company may not hit their growth targets in the coming year.

However, Guardant Health have also stated that they are looking to invest heavily in research and development, which should help to drive their long-term growth.

Stock Price

On Thursday, genomic sequencing company GUARDANT HEALTH released its fourth quarter and full year 2020 financial results. Despite revenue exceeding analyst expectations, the company’s earnings per share (EPS) missed the mark. As a result, stock prices declined 6.5% from the prior closing price of $27.7.

Looking aheadGUARDANT HEALTH is actively focusing on expanding its presence in both personalized and liquid biopsy services for early cancer detection as well as it plans to continue investing in long-term growth opportunities, such as its subsidiary Freenome. Overall, while GUARDANT HEALTH managed to beat estimates on its revenues, its EPS fell short of expectations. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of GUARDANT HEALTH’s wellbeing. Based on our Risk Rating score, GUARDANT HEALTH has been rated as a medium risk investment when it comes to financial and business aspects. Upon further inspection of their financial statements, our Risk Analysis detected three risk warnings in the balance sheet, cashflow statement and nonfinancial components. If you would like to learn more about the specifics of these risks, please register on goodwhale.com to check it out. At GoodWhale, we believe that investors should be well informed before making any investment decisions, which is why we have created comprehensive reports to help make these decisions easier. Don’t hesitate to register on our website and become one of the savvy investors that relies on GoodWhale for reliable analysis. More…

Summary

Investing in Guardant Health could be a lucrative option for some investors, but it is important to conduct thorough research before making any decisions. In its fourth quarter of 2020, total revenue was higher than expected, but earnings per share was lower than predicted. Guidance for 2023 revenue is also lower than what analysts had predicted. The stock price reacted negatively to the news, dropping on the same day.

Investor sentiment has been volatile since then, with the stock price still trending steadily downwards. It may be wise to wait and see how the company continues to perform before making an investing decision.

Trending News 🌥️

ACI Worldwide is set to release their earnings report this Wednesday, March 1st, before the market opens. Investors and analysts interested in the latest updates from ACI Worldwide should make sure they register for the conference call. According to Zacks, this will be an important report as the company may provide clues as to how they plan to maneuver in the marketplace in the coming months. ACI Worldwide is a leading global provider of payments and financial crime solutions, with extensive experience in the industry providing products and services for both large and small enterprises.

This means that their earnings report may provide an insight into the status of numerous sectors, from payments to financial crime compliance. Analysts and investors should definitely take note of this important earnings release from ACI Worldwide. Be sure to register for the conference call today so you can hear the latest news from this business leader.

Market Price

ACI WORLDWIDE is set to release its latest earnings report on March 1st. Investors are eagerly anticipating the announcement, as ACI WORLDWIDE stock opened at $25.8 and closed at $26.1 on Wednesday, representing a 1.3% increase from the prior closing price of $25.7. Those interested in investing in the company can register for the upcoming conference call today in order to get the most up-to-date information. Live Quote…

Analysis

At GoodWhale, we use our proprietary Valuation Line to analyze the fundamentals of ACI WORLDWIDE and determine its fair value. Our analysis show that the fair value of ACI WORLDWIDE share is around $33.3. However, ACI WORLDWIDE stock is currently trading at $26.1, meaning that it is undervalued by 21.6%. This offers an excellent opportunity to investors looking to invest in a company with strong fundamentals and an attractive potential return. More…

Summary

ACI Worldwide, a leading global software provider to banks, stores and other payment processors, is set to release its first quarter earnings report on March 1. The report will provide investors with important insights into the company’s performance, including revenue, expenses, and profits. Investors are encouraged to register to participate in the company’s earnings conference call which will be held the same day.

The call will provide further details about ACI Worldwide’s financial results and outlook for the coming months. Analysts are forecasting increased sales, an uptick in profits, and a positive overall outlook for ACI Worldwide as it enters a new year of trading.

Trending News 🌥️

Perdoceo Education Inc. reported better than expected results in Q4, with Non-GAAP EPS of $0.31, $0.03 above estimates of $0.28 and revenue of $176.1M, beating expectations of $164.75M by $11.35M. This news has led to a rise in the company’s stock prices in after-hours trading. The strong earnings and guidance from Perdoceo Education are a sign of its strong performance and shows that the company is well-positioned for the future.

With its focus on providing quality education and training, there is potential for continued success and growth. The shareholders of Perdoceo Education are likely to be pleased with the company’s performance, and this positive news is expected to continue in the coming months and years.

Stock Price

Thursday was a volatile day for investors in PERDOCEO EDUCATION as the stock opened at $14.0, but closed at $13.7, down 1.2% from the last closing price of $13.9. Despite the day’s performance, PERDOCEO EDUCATION reported better than expected fourth quarter earnings and forecasted guidance for fiscal year 23 above consensus. The impressive results have certainly been a boost for investors and have further strengthened the long-term outlook of the company. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of PERDOCEO EDUCATION’s wellbeing and the results were quite revealing. According to our Risk Rating, PERDOCEO EDUCATION is a medium risk investment when it comes to financial and business aspects. We detected 1 risk warning in their income sheet and we would suggest that any potential investors should register with us to check it out. Fortunately, medium risk investments can still offer good returns if managed properly and PERDOCEO EDUCATION seems to be a good prospect if you remain vigilant. More…

Summary

Perdoceo Education’s strong results and optimistic outlook are encouraging investors, with the company’s stock price spiking over 6% following the announcement.

Trending News 🌥️

Tactile Systems Technology Inc. is set to announce record earnings when it releases its quarterly financial report on February 21. Analysts anticipate that the company will report an impressive per share earnings of 14 cents, driven by an increase in their quarterly revenue. This predicted growth in revenue is a testament to the success of the company’s innovative products and services. The company’s main focus is in the development of tactile systems technology and products, which provide unique solutions to everyday problems. The company’s products allow people to interact with technology on a more tactile level, providing a higher user experience and enhancing the way they interact with their devices and the world around them.

Through their cutting-edge technology and products, they have managed to create a loyal customer base, leading to their anticipated record quarterly earnings. The announcement of the potential record quarterly earnings has investors excited, with many speculating that these impressive results have the potential to send the company’s stocks through the roof. Tactile Systems is an up and coming leader in the field of tactile systems technology, and investors are eager to see how their upcoming earnings report will shape their future success. The report promises to be an important event in the company’s history, and should be closely watched by those interested in their progress.

Share Price

News sentiment on TACTILE SYSTEMS TECHNOLOGY Inc. has been largely positive in anticipation of its record quarterly earnings, which will be released on February 21st. Despite this, the company’s stock price took a hit on Tuesday, when it opened at $14.9 and closed at $13.0, representing a 7.6% decrease from the previous closing price of 14.0. This has caused some investors to worry that the upcoming earnings may not be as strong as expected. Live Quote…

Analysis

We conducted a financial analysis of TACTILE SYSTEMS TECHNOLOGY and the results are in. The Risk Rating of this company is high and indicates that it is a risky investment. We have identified 4 major risk warnings in the balance sheet, cashflow statement, financial and non-financial journals that should be taken into consideration before investing in TACTILE SYSTEMS TECHNOLOGY. To get access to our full report, please register with us and check it out! More…

Summary

TACTILE SYSTEMS TECHNOLOGY Inc. is set to report record earnings on February 21st, and analysts are expecting strong results. So far, news sentiment is mostly positive, yet the stock price has declined. Investors are looking at the big picture and evaluating the long-term performance of the company. They are assessing their risk-reward profile and analyzing correlations with other stocks in their portfolio.

In addition, they are considering any longer-term growth prospects or other revenue sources that could benefit TACTILE SYSTEMS TECHNOLOGY in the future. In short, investors are doing their research on the company before making a decision on whether or not to invest.

Trending News 🌥️

Spirit Realty Capital is proud to announce a 6.17% quarterly dividend of $0.663 per share, which is in line with previous distributions. This dividend will be paid directly to shareholders of record on March 31 and the ex-dividend date is set for March 30. Remainder of shareholders will be able to view their dividend scorecard, yield chart, and dividend growth under the dividend section at Seeking Alpha. The quarterly dividend is a sign of Spirit Realty Capital’s commitment to creating shareholder value and returning capital to its investors. Spirit Realty Capital is well positioned to continue to maintain and even grow its distributions in the future, which bodes well for its shareholders.

The payment of this dividend reflects Spirit Realty Capital’s belief that their shareholders should benefit from their success as a real estate investment trust (REIT). As a REIT, Spirit Realty Capital has the ability to pass through earnings to investors in the form of dividends, which are tax-advantaged for investors and an attractive feature of any investment. Overall, Spirit Realty Capital’s quarterly dividend of $0.663/share is an attractive and reliable way for shareholders to benefit from their investment, and the payment of the dividend is indicative of the company’s success and strong future outlook.

Dividends – Transunion dividend yield calculator

Spirit Realty Capital has recently declared a 6.17% quarterly dividend of $0.663 per share, and has issued annual dividends per share of 2.58, 2.53 and 2.5 USD over the last three years. Dividend yields from 2020 to 2022 can go up to 5.81%, 5.45% and 6.75%, average dividend yield being 6%. If you have an interest in dividend-yielding stocks, SPIRIT REALTY CAPITAL should definitely be on your list of considerations.

Price History

On Thursday, SPIRIT REALTY CAPITAL declared a quarterly dividend of $0.663/Share, representing an annual yield of 6.17%. This announcement was met with generally positive media sentiment. At the close of trading, the stock’s price was down ever so slightly, falling 0.2% to $43.0 from its prior closing price of $43.1. Live Quote…

Analysis

GoodWhale is the perfect platform to analyze SPIRIT REALTY CAPITAL’s financials. Our Risk Rating shows that SPIRIT REALTY CAPITAL is a low risk investment in terms of financial and business aspects. We have detected 1 risk warnings in its balance sheet, but you can only check them out if you’re registered on GoodWhale.com. Register now and gain access to all SPIRIT REALTY CAPITAL’s financial data, as well as real time market insights and analytics. With GoodWhale, you can track your investments and make sure they stay within your risk appetite. Join us to help you make more informed decisions when it comes to your investments! More…

Summary

Spirit Realty Capital is a publicly traded real estate investment trust (REIT) focused on owning and investing in single-tenant, operationally essential real estate. Recently, the company declared a quarterly dividend of $0.663 per share, representing an annual dividend yield of 6.17%. The stock has been well-received by investors, with a positive media sentiment surrounding it.

Analysts have cited the company’s history of consistent dividend payouts, strong balance sheet and wide-spread geographic diversification as attractive qualities when assessing the company’s potential for long-term investing. With an eye on value creation, Spirit Realty Capital seeks to identify and acquire high quality and long-term properties with favorable growth characteristics, allowing investors to benefit from potential capital appreciation and a steady stream of income.

Trending News 🌥️

Quadrant Capital Group LLC has made an impressive investment of $110,000 in Teledyne Technologies Incorporated. Teledyne Technologies is a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems. They are a multi-industry technology leader that provides solutions for the aerospace, defense and commercial markets. The investment from Quadrant Capital Group LLC will go toward the expansion of Teledyne’s technology portfolio and its ability to serve their global customers. With the help of this investment, Teledyne will be able to continue providing their cutting-edge technology solutions, which includes a variety of advanced sensors and digital imaging products, as well as software platforms for a range of industries.

Teledyne is committed to using this investment to strengthen its technological capabilities and bring innovative products to both its current and potential customers. This move by Quadrant Capital Group LLC is a testament to the value they see in Teledyne’s future and the strength of their technology. Teledyne is confident that this investment will be beneficial to both their clients and the company in the long run.

Price History

On Tuesday, Quadrant Capital Group LLC made an investment of $110,000 in Teledyne Technologies Incorporated. Teledyne Technologies stock opened at $436.7 on Tuesday and closed at $428.9, indicating a 2.3% decrease from its prior closing price of $439.0. Teledyne Technologies’ portfolio of products, services, and technologies continues to draw investments from industry leaders. Live Quote…

Analysis

At GoodWhale, we have taken a deep dive into the financials of TELEDYNE TECHNOLOGIES to better understand its fundamentals. After careful analysis, we have concluded that the intrinsic value of the company’s shares is estimated to be $468.4. Using our proprietary Valuation Line, this figure is based on TELEDYNE TECHNOLOGIES’s future earnings potential, dividend yield and valuation metrics. At the current market price of $428.9, we can say that TELEDYNE TECHNOLOGIES is undervalued by 8.4%, making it a good investment opportunity. More…

Summary

Quadrant Capital Group LLC has just invested $110,000 in Teledyne Technologies Incorporated. This investment serves as a sign of confidence in the potential of the company’s future growth prospects. Teledyne Technologies provides advanced technologies and services for solving difficult problems in the aerospace, defense, communications and energy industries. Analysts have noted the company’s stable financials, with a history of consistent earnings and dividend growth, making it an attractive option for investors.

The company has also diversified its offerings more recently in industries outside of its traditional strongholds, which should help to further diversify its revenue stream and boost profitability. With a strong portfolio of products and services, Teledyne Technologies looks to be an attractive investment opportunity for investors.

Trending News 🌥️

The dividend will be $0.6185 per share, payable on April 5 to shareholders of record as of March 15. The ex-dividend date for this dividend is March 14. This dividend payment will yield approximately 4.89% to investors, with a dividend score of 8.4 out of 10. Investors can view Iron Mountain’s dividend scorecard, yield chart, and dividend growth history on the Seeking Alpha website.

They have a wide range of products, services, and solutions that help businesses store and protect their data, records, and assets while managing their risk and compliance requirements. The company’s commitment to providing regular dividend payments is a testament to their fiscal responsibility and continuing operations. We look forward to Iron Mountain’s continued success as a leader in the storage and data protection industry.

Dividends – Transunion dividend yield calculator

Iron Mountain Incorporated (NYSE:IRM) has just announced that it has declared a quarterly dividend of $0.6185/share for the fourth quarter of 2020, yielding 4.89%. This dividend represents a return of over 4.89% on an annualized basis from 2020 to 2022. For dividend investors, Iron Mountain could be an attractive option.

The company’s ongoing commitment to issuing a dividend and the steady increases in yields over the last three years are reassuring signs of a growing return on investment. With the current yield of 4.89%, Iron Mountain is an excellent addition to any portfolio.

Stock Price

IRON MOUNTAIN recently declared a quarterly dividend of $0.6185/share, yielding 4.89%. So far, the news has been mostly mixed, with their stock opening at $52.1 and closing at $52.8 on Thursday, up 4.2% from its previous closing price of $50.6. This was a welcome respite for shareholders as the company’s stock had been declining steadily since mid-April. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of IRON MOUNTAIN’s wellbeing. Our findings show that IRON MOUNTAIN is a low risk investment in terms of financial and business aspects. However, there are still some areas with potential risks that you should explore further. We have made these insights available to the general public on our website at goodwhale.com. We recommend that you register for a free account and take a deeper dive into the company’s financial and business activities. Our analysis can give you greater insight into where you can reduce risk and maximize your investments in IRON MOUNTAIN. With GoodWhale’s comprehensive analysis, you can make more informed decisions about your investments and build a comprehensive understanding of IRON MOUNTAIN’s current and future wellbeing. More…

Summary

Iron Mountain Incorporated (IRM) declared a dividend of $0.6185 per share, resulting in an annual yield of 4.89%. The news of the dividend has so far had a mostly positive reception and the stock price has increased since then. Analysts are optimistic about investing in Iron Mountain due to the steady dividend yield and its secure position as a prominent data storage and information management services provider. Moreover, Iron Mountain has a strong financial background with ample liquidity, low debt levels and reasonable cash flow generation which suggests good long-term investment prospects.

Iron Mountain’s results have been stable, despite the economic downturn, and the company has continuously invested to build up its resources and expand its operations. It is well placed to benefit from the improving global economy and therefore, remains a strong investing option.

Trending News 🌥️

Nellore Capital Management LLC has recently reduced its stake in Coupang, Inc., the Korean e-commerce giant.

However, despite the company’s success, Nellore Capital Management LLC has reduced its stock holdings within the company. This reduction marks the end of a five-year investment period for Nellore Capital, which began due to the high growth potential of Coupang. The amount of the reduction has not been disclosed, but it is speculated that Nellore Capital may have been seeking to maximize profits while the company’s share price was at its peak. In the past few months, Coupang’s market value has risen exponentially and it is believed that this spurred Nellore Capital’s decision to sell its shares. The move from Nellore Capital Management LLC may have been a wise decision, as the future of the e-commerce industry remains uncertain. Despite Coupang’s current success, there is no guarantee that its high valuation can be sustained in the future. Nevertheless, this news will surely make waves in the global investment sector, as more investors may be encouraged to reduce their dependence on e-commerce stocks.

Stock Price

News about Nellore Capital Management LLC reducing its stake in Coupang, Inc. was released on Tuesday, and the sentiment so far has been mostly negative. On Tuesday, COUPANG opened at $15.5 and closed at $14.9. This represents a 5.6% drop from its previous closing price of 15.8.

The decrease in price reflects the negative sentiment surrounding this news. This is likely an indication that investors have become cautious after learning of the decrease in Nellore Capital Management LLC’s ownership of Coupang, Inc. Live Quote…

Analysis

At GoodWhale, we conducted an in-depth analysis of COUPANG’s wellbeing. Our Risk Rating gave COUPANG a medium risk rating in terms of financial and business aspects. Upon further inspection, we uncovered one risk warning in the cashflow statement. As a registered user, you can find out more details about this warning. We recommend seeking professional advice before investing in COUPANG based on our findings. More…

Summary

Coupang, Inc. has recently seen a decrease in stake by Nellore Capital Management LLC, and this has been reflected in the company’s stock price. On the sentiment side, news and reports concerning Coupang have been largely negative so far.

However, investors should still consider some key points before making a decision to invest in this company.

First, the market is still fairly bullish for technology stocks, so the drop could be seen as a buying opportunity for those with a longer term outlook. Second, although the current situations and news surrounding Coupang may seem bleak, potential investors should still research the company further to verify the long-term potential of this stock. Finally, if all signs point towards a long-term gain, then investors should determine their level of risk, compare it to the potential return, and make an informed decision before taking the plunge into investing in Coupang.

Trending News 🌥️

TransUnion has recently declared a quarterly dividend of $0.105 per share, which is in keeping with its prior payments. The dividend yield for this dividend is 0.63%. The dividend payment will be made on March 24, to shareholders of record on March 9 and the ex-dividend date will be March 8.

Additionally, detailed information regarding TransUnion’s dividend scorecard, yield chart, and dividend growth can be found on the Seeking Alpha website. The dividend payment marks an important event for TransUnion as it offers investors the opportunity to earn a return on their invested capital. It is also likely to gain the attention of analysts and investors who may be considering adding TransUnion’s stock to their portfolios. Furthermore, the dividend yield of 0.63% is extremely competitive when compared to other players in the industry. TransUnion has consistently delivered strong earnings and cash flow, which have enabled them to continue their dividend payments. Additionally, their scorecard, which is available online, provides investors insight into the company’s financial health, liquidity and overall performance. Those looking for more detailed information can access the Seeking Alpha website which offers comprehensive information regarding TransUnion’s dividend scorecard, yield chart and dividend growth.

Dividends – Transunion dividend yield calculator

This marks an increase from the last three years, where they issued an annual dividend of $0.4 per share. TransUnion‘s dividend yields from 2020 to 2022 were 0.52%, and the average dividend yield was 0.52%. This quarterly dividend payout may indicate a shift in the company’s strategy of returning value to shareholders.

Share Price

On Thursday, TransUnion announced that it would pay a quarterly dividend of $0.105 per share, yielding 0.63%. The news came as the stock opened the day at $67.2 and closed at $66.4, down by 0.5% from its last closing price of 66.7. Live Quote…

Analysis

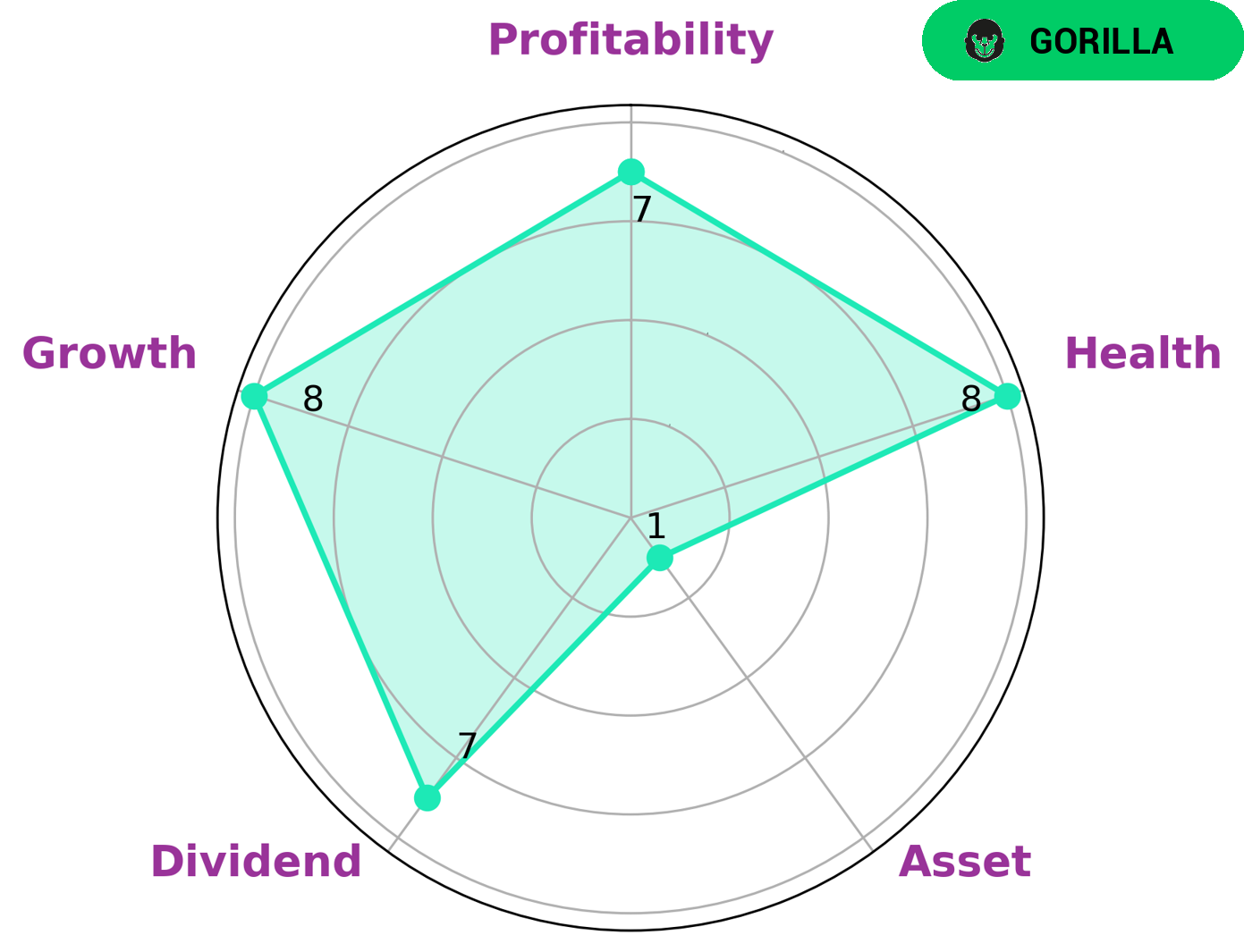

GoodWhale conducted an analysis of TRANSUNION‘s wellbeing, and the results have been encouraging. In the Star Chart, TRANSUNION is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This is an attractive profile for investors, who may be interested in such a company. The health score of TRANSUNION is 8/10, demonstrating its strength in cashflows and debt management. This suggests that the company has the capability to sustain its operations in the long term, even in times of crisis. Furthermore, the company has a strong standing in terms of dividends, growth, and profitability. The only area in which TRANSUNION appears to be weak is asset management. More…

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

TransUnion, a leading credit score provider, recently announced a quarterly dividend of $0.105 per share, which provides shareholders with an annual yield of 0.63%. Analysts believe that TransUnion’s dividend, along with its high-quality products and services, should continue to position the company for profitable growth in the years ahead. Investors considering the stock should continue to monitor the company’s financial performance, as well as its dividend policy, for further signals on how to best allocate their funds.

Recent Posts