EQUIFAX INC Reports Decrease in Earnings for Fourth Quarter of FY2022

March 27, 2023

Earnings Overview

Equifax Inc ($NYSE:EFX). reported a decline in earnings for the fourth quarter of FY2022, ending December 31, 2022. Total revenue was USD 108.2 million, a decrease of 11.4% compared to the same period in the previous year. Net income also dropped to USD 1198.0 million, a decrease of 4.4% year-over-year.

Transcripts Simplified

EQUIFAX reported its fourth quarter EBITDA margins slightly lower than expected at 31%, driven by lower-than-expected margins in Workforce Solutions and International. Capital spending in the fourth quarter was $156 million, which will decline to about $150 million in 1Q 2022 and further in each quarter of 2023. Total capital spending in 2023 is expected to be about $545 million. For 2023, EQUIFAX is expecting a 30% reduction in mortgage originations in the US mortgage market compared to previous years.

This is expected to negatively impact total revenue growth by 7 percentage points. Non mortgage organic growth is expected to exceed 7% and contribute 5% of the total revenue growth. Acquisitions are expected to contribute 1% of the revenue growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Equifax Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.12k | 696.2 | 13.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Equifax Inc. More…

| Operations | Investing | Financing |

| 757.1 | -959.5 | 273.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Equifax Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.55k | 7.57k | 30.71 |

Key Ratios Snapshot

Some of the financial key ratios for Equifax Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 36.4% | 21.7% |

| FCF Margin | ROE | ROA |

| 2.6% | 18.0% | 6.0% |

Share Price

This marks a significant drop in share value for EQUIFAX INC, which had seen a steady increase through the first three quarters of the fiscal year. The company also reported a decline in its data and analytics division due to reduced demand for products and services. As a result, EQUIFAX INC’s stock price dropped despite positive performance earlier in the year. EQUIFAX INC’s CEO, Mark Begor, stated that the company is still focused on improving performance and will continue to develop new products and services to drive growth. He also noted that the company is taking steps to reduce costs and increase efficiency in order to better position itself for future success.

In addition, the company is expected to benefit from increasing demand for its data and analytics services as businesses seek more comprehensive insights into their customer base. With a strong focus on developing new products and services and reducing costs, EQUIFAX INC is well-positioned to capitalize on any potential economic growth and increase its share price in the near future. Live Quote…

Analysis

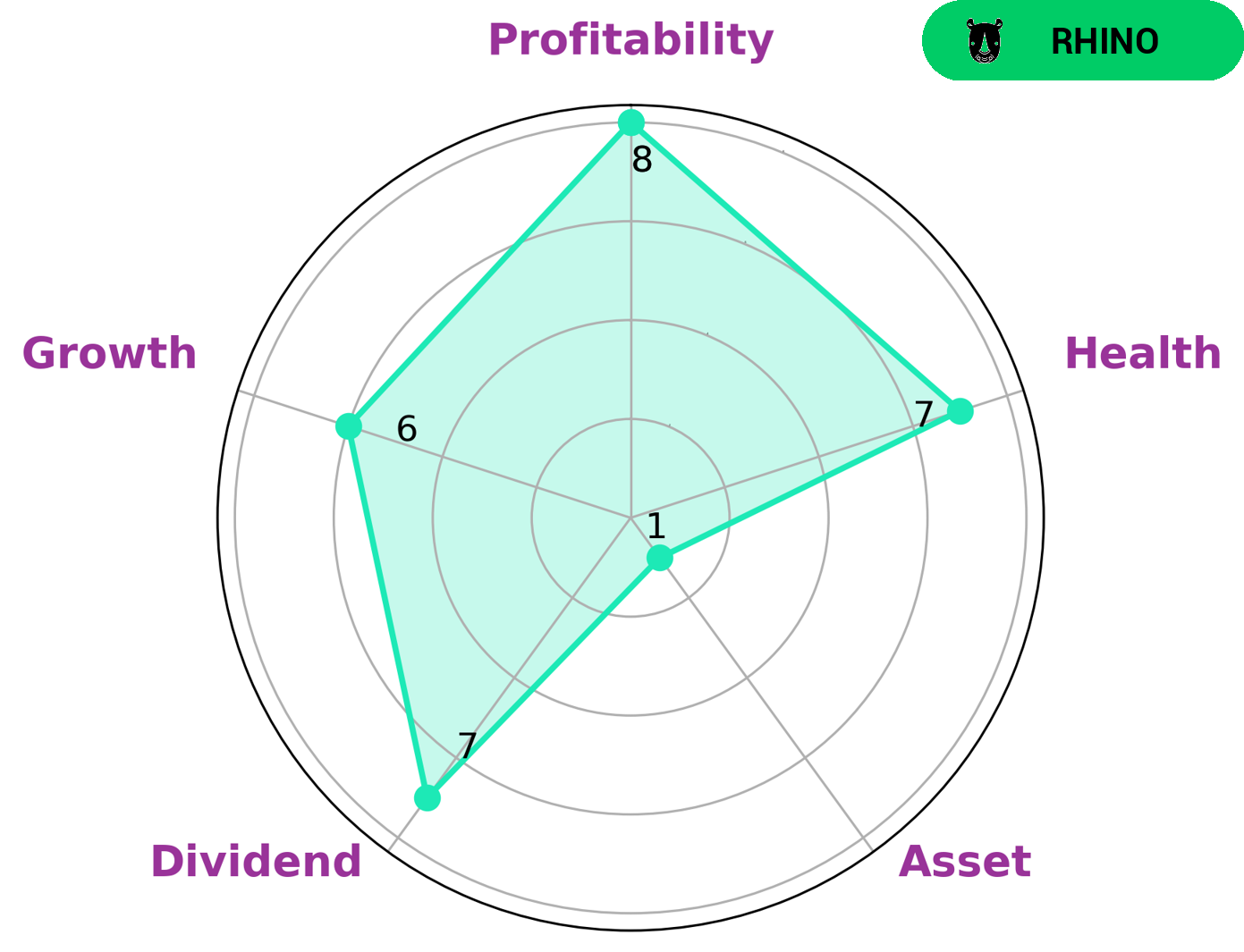

GoodWhale has performed an analysis of EQUIFAX INC‘s financials, and based on our Star Chart, we have concluded that EQUIFAX INC is strong in dividend and profitability, medium in growth, and weak in assets. Additionally, EQUIFAX INC has a high health score of 7/10 with regards to its cashflows and debt, indicating that the company is capable of paying off its debt and funding future operations. Based on these results, GoodWhale has classified EQUIFAX INC as a ‘rhino’, a type of company which has achieved moderate revenue or earnings growth. As such, this company may be attractive to investors who are looking for steady returns with some growth potential. Such investors may include value investors and those interested in investing in companies that have a proven track record of success. Additionally, due to the fact that EQUIFAX INC is strong in dividend and profitability, dividend investors may also be attracted to this company. More…

Peers

Equifax Inc. is a credit reporting agency. Its main competitors are TransUnion, Mills Music Trust, and Experian PLC. All three companies compete for credit report customers and business from creditors.

– TransUnion ($NYSE:TRU)

TransUnion is a credit reporting company. It compiles credit information on consumers and businesses, which is used by lenders to make credit decisions. The company also provides other services such as fraud detection, identity theft protection, and credit counseling. TransUnion has a market cap of 10.77B as of 2022, and a Return on Equity of 8.48%.

– Mills Music Trust ($OTCPK:MMTRS)

Mills Music Trust is a publicly traded music royalty company. The company owns the rights to a large catalog of music, which it licenses to businesses and individuals for use in their products and services. Mills Music Trust has a market cap of 10.14M as of 2022. The company generates revenue by licensing its music to businesses and individuals for use in their products and services.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.89B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to its clients. Experian helps businesses to manage credit risk, prevent fraud, target marketing offers and automate decision making.

Summary

EQUIFAX INC reported a decrease in fourth quarter FY2022 earnings, with total revenue of USD 108.2 million and net income of USD 1198.0 million. This represents a 11.4% decrease in revenue and 4.4% decrease in net income when compared to the same period the previous year. Investors may want to consider the risk associated with investing in EQUIFAX INC due to the decline in earnings. The company should be monitored closely to see if the decrease in earnings is a short-term issue or a long-term trend.

Additionally, investors should analyze the company’s operations and financial statements to determine if any changes need to be made to improve profitability.

Recent Posts