CRA International Shares Reach Record High of $126.98!

March 6, 2023

Trending News ☀️

On Thursday, CRA ($NASDAQ:CRAI) International, Inc. achieved a major milestone in their trading history when shares rose to a record high of $126.98. The rise in CRA International‘s stock has been steady in the past weeks, but this surge on Thursday was especially remarkable. The success of CRA International has been attributed to its expertise in providing a variety of services and solutions to leading corporations across the world. Its specialized skills and expertise have given customers the assurance that they receive quality service and valuable advice. Our team of experts provide insight, advice and assistance across a range of industries and disciplines.

This versatility has seen demand for the company grow exponentially over the years. This all-time record high of $126.98 is a testament to the success of CRA International and a sign of the trust that customers have in their leadership, skills and knowledge. This marks a momentous occasion for the company and provides an exciting milestone for investors and shareholders alike.

Share Price

On Monday, CRA International shares closed at a record high of $126.98, representing a 0.5% increase from the previous closing price of 125.0. This news was met with mostly positive sentiment from the media and investors alike, who consider this to be an exciting milestone for the company. The stock opened at $125.6 and closed at $124.4, suggesting that there is still plenty of room for growth even after reaching its current high. The successful stock performance highlights the success of the company’s innovative strategies and provides a glimpse into its potential for future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cra International. More…

| Total Revenues | Net Income | Net Margin |

| 590.9 | 43.45 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cra International. More…

| Operations | Investing | Financing |

| 25.12 | -18.16 | -38.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cra International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 550.92 | 339.76 | 29.53 |

Key Ratios Snapshot

Some of the financial key ratios for Cra International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | 26.0% | 10.3% |

| FCF Margin | ROE | ROA |

| 3.6% | 18.4% | 6.9% |

Analysis

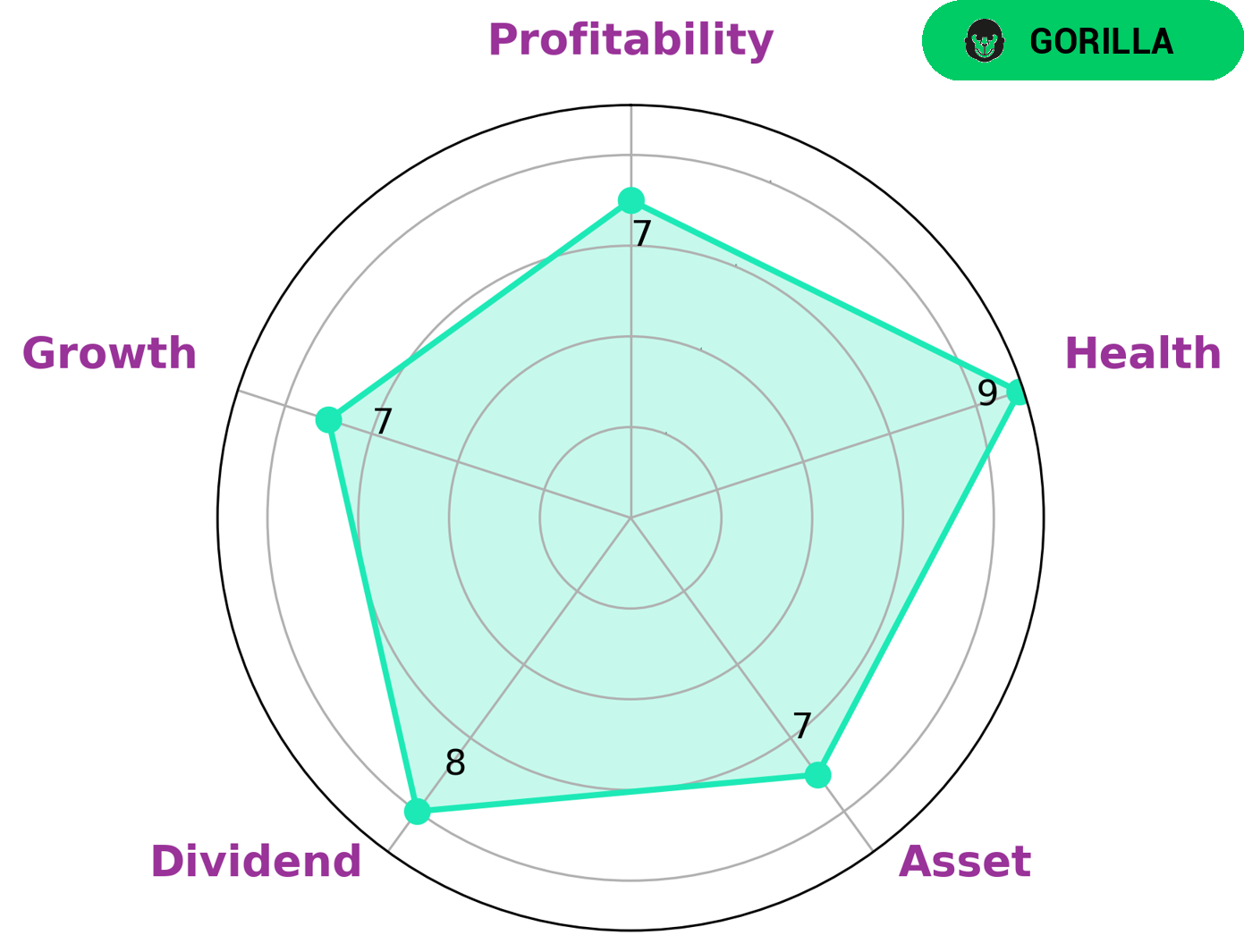

GoodWhale has conducted an analysis of CRA INTERNATIONAL‘s financials and found it to be a strong and stable player in the market. According to our Star Chart, CRA INTERNATIONAL has a high health score of 9/10, indicating its ability to safely ride out any crisis without the risk of bankruptcy. Our analysis further reveals that CRA INTERNATIONAL is strong in asset, dividend, growth, and profitability. As a result of its strong competitive advantage, CRA INTERNATIONAL is classified as a ‘gorilla’, indicating that it is able to achieve stable and high revenue or earning growth. Given its strong financial health and strong competitive advantage, CRA INTERNATIONAL is likely to attract interest from a range of investors, including large-cap investors looking for a reliable source of returns, small-cap investors searching for undervalued companies, and individual investors looking for a secure investment. More…

Peers

Its competitors are RTC Group PLC, Ince Group PLC, and Staffing 360 Solutions Inc.

– RTC Group PLC ($LSE:RTC)

RTC Group PLC is a publicly traded company that provides telecommunications and other services. As of 2022, the company had a market capitalization of 2.64 million pounds and a return on equity of -2.66%. The company offers a variety of services, including mobile phone service, fixed-line telephone service, broadband internet service, and television service. RTC Group PLC is headquartered in the United Kingdom.

– Ince Group PLC ($LSE:INCE)

Ince Group PLC is a provider of legal services. The company has a market capitalization of 14.4 million as of 2022 and a return on equity of 6.16%. Ince Group PLC provides services in the areas of corporate, commercial, dispute resolution, and shipping. The company was founded in 1782 and is headquartered in London, the United Kingdom.

– Staffing 360 Solutions Inc ($NASDAQ:STAF)

Staffing 360 Solutions Inc is a publicly traded company with a market cap of 6.18M as of 2022. The company is in the business of providing staffing and recruiting services. The company has a Return on Equity of 2.48%.

Summary

Investors are bullish on CRA International’s stock. Its shares have reached an all-time high of $126.98, reflecting the widespread positive outlook of the market. Analysts predict further growth potential for the company, attributed to its strong financials, efficient management, and wide range of services. CRA International’s specialized offerings in corporate finance, litigation consulting, and executive compensation have received strong market response.

The company’s sector focus on life sciences, technology, and energy is also seen as a big plus, given the current economic trends. Looking forward, analysts expect CRA International to continue posting impressive results and remain a top contender in the industry for the long term.

Recent Posts