Carolina Wealth Advisors LLC drastically reduces stake in Booz Allen Hamilton Holding Co. by 98% in Q3

October 22, 2024

☀️Trending News

Booz Allen Hamilton ($NYSE:BAH) Holding Co. is a leading provider of management consulting, technology, and engineering services to government and commercial clients. Booz Allen Hamilton is known for its deep expertise in areas such as defense, intelligence, healthcare, and energy, and has a strong reputation for delivering innovative solutions for its clients. This drastic reduction in stake is noteworthy and could potentially raise questions about the future prospects of the company. The decision of Carolina Wealth Advisors LLC to reduce its stake in Booz Allen Hamilton Holding Co. may have been influenced by various factors. One possible reason could be the overall market conditions and outlook for the company’s stock. In the third quarter of 2019, the stock market experienced a period of uncertainty, with many companies facing challenges due to trade tensions and global economic slowdown.

Additionally, the company has faced some legal issues related to alleged overbilling of government contracts, which could have also contributed to Carolina Wealth Advisors LLC’s decision to reduce its stake. This indicates that the investment advisor has not completely lost faith in the company and could potentially increase its holdings in the future. The reasons behind this move are not entirely clear, but it could be a reflection of the challenging market conditions and potential concerns about the company’s performance. It will be interesting to see how this decision plays out and if other investors follow suit.

Analysis

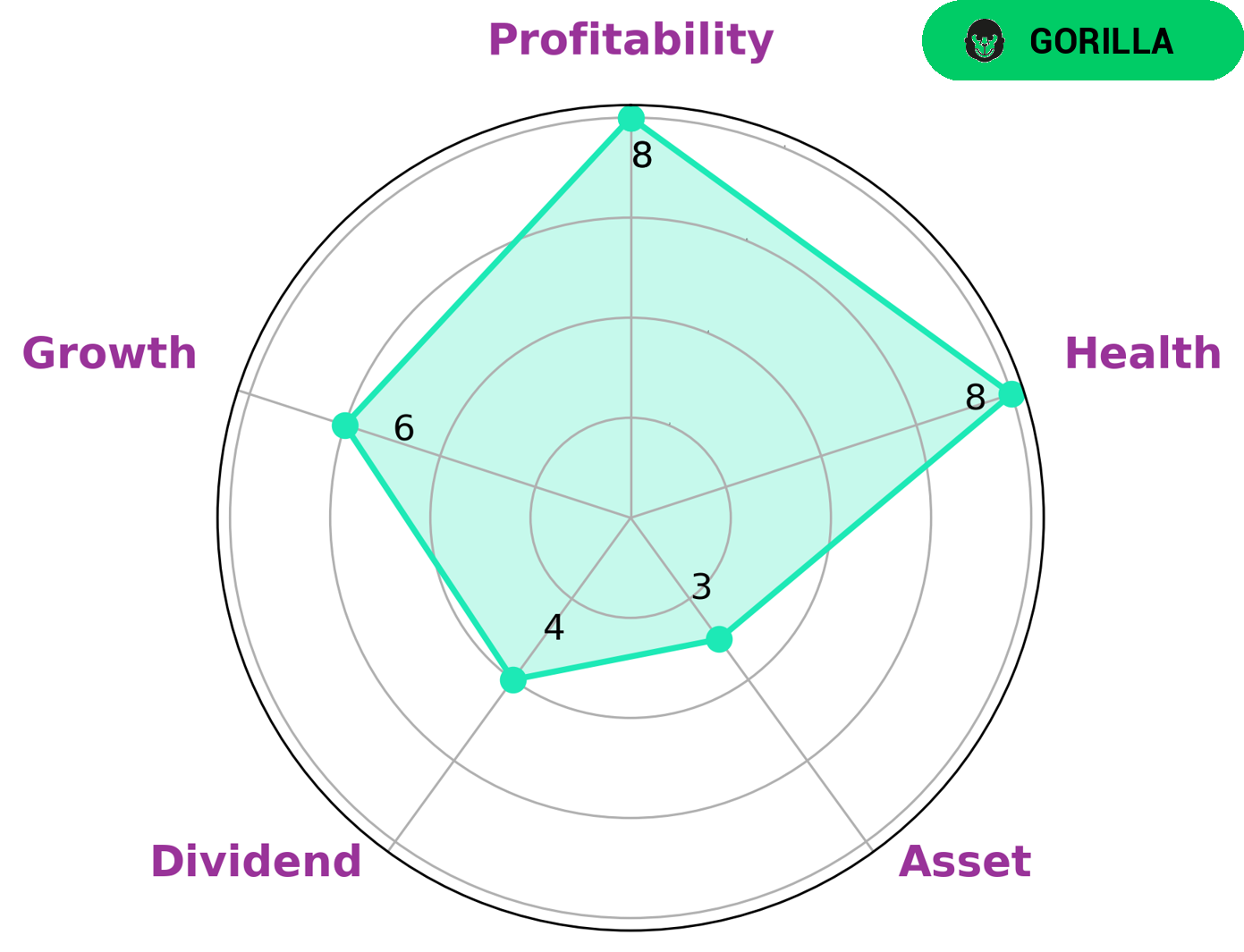

First, let’s take a look at the financials of BOOZ ALLEN HAMILTON HOLDING. This company has been classified as a ‘gorilla’ by Star Chart, indicating that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This is a positive sign for potential investors, as it suggests that the company has a solid foundation and is capable of sustained success. According to our analysis at GoodWhale, BOOZ ALLEN HAMILTON HOLDING shows strength in profitability, with a high score in this category. This means that the company is generating healthy profits, which is a key factor for investors to consider. However, it should be noted that the company’s dividend score is only medium, indicating that it may not be the most attractive option for investors seeking regular dividend payments. This suggests that while the company may not have explosive growth potential, it also doesn’t have any major red flags in this area. Additionally, the company’s asset score is on the weaker side. This could indicate that BOOZ ALLEN HAMILTON HOLDING may not have a significant amount of tangible assets, but this does not necessarily reflect poorly on the company as it may have valuable intangible assets such as intellectual property. Based on our analysis, this company may appeal to investors who are looking for a stable and established company with a strong competitive advantage and steady profitability. It may also be attractive to those who prioritize debt management and cash flow health in their investment decisions. Speaking of cash flow and debt, BOOZ ALLEN HAMILTON HOLDING has a high health score of 8/10 in this category. This indicates that the company is capable of paying off its debt and funding future operations. This is a positive sign for investors, as it suggests financial stability and potential for growth. In conclusion, BOOZ ALLEN HAMILTON HOLDING appears to be a solid investment option for those seeking a stable and profitable company with a strong competitive advantage. While it may not be the most attractive choice for dividend-seeking investors, its strong cash flow health and ability to manage debt make it a strong contender for long-term growth potential. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BAH. More…

| Total Revenues | Net Income | Net Margin |

| 10.32k | 408.04 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BAH. More…

| Operations | Investing | Financing |

| 352.22 | -96.21 | -25.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BAH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.47k | 5.39k | 8.33 |

Key Ratios Snapshot

Some of the financial key ratios for BAH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.6% | -1.2% | 7.1% |

| FCF Margin | ROE | ROA |

| 2.7% | 42.3% | 7.0% |

Peers

The global management consulting market is expected to grow at a CAGR of 6.2% from 2019 to 2026. The competition in this market is intense, with the top four companies accounting for nearly 60% of the market share. Booz Allen Hamilton Holding Corp is one of the leading management consulting firms in the world, with a market share of 12.4%. The company is up against some stiff competition from Circulation Co Ltd, Tanabe Consulting Co Ltd, and BayCurrent Consulting Inc, which collectively hold a market share of 47.6%.

– Circulation Co Ltd ($TSE:7379)

The market cap for China International Marine Containers (Group) Co Ltd has been on a steady decline since early 2020, from over 20 billion to its current 14.08 billion. However, the company’s ROE has remained relatively stable at 14.03%. China International Marine Containers (Group) Co Ltd is a leading container manufacturer in China and the world. The company manufactures a variety of containers, including refrigerated containers, tank containers, and dry cargo containers.

– Tanabe Consulting Co Ltd ($TSE:9644)

As of 2022, Tanabe Consulting Co Ltd has a market cap of 10.48B and a Return on Equity of 5.99%. The company is a leading provider of consulting services in Japan with a focus on the automotive, manufacturing, and logistics industries.

– BayCurrent Consulting Inc ($TSE:6532)

BayCurrent Consulting Inc has a market cap of 646.59B as of 2022, a Return on Equity of 34.97%. The company is a provider of consulting services. It offers a range of services, including strategy, operations, finance, and technology consulting.

Summary

Carolina Wealth Advisors LLC significantly decreased its stake in the stock of Booz Allen Hamilton Holding Co., a leading consulting firm, in the third quarter. This move reduced their investment in the company by a staggering 98.0%. While the reason behind this decision is unknown, it could be a sign of caution towards the stock’s performance in the future.

This decrease in ownership could also indicate a shift in the investment strategy of Carolina Wealth Advisors LLC. Investors should keep a close eye on further developments with this company and its stock, as it could have an impact on their own investment decisions.

Recent Posts