BOOZ ALLEN HAMILTON HOLDING Reports Financial Results for Q3 of FY 2023

February 4, 2023

Earnings report

BOOZ ALLEN HAMILTON HOLDING ($NYSE:BAH) (BAH) is a publicly traded company that provides consulting, technology and engineering services to the US government and its defense and intelligence agencies. On January 27, 2023, BAH reported its financial results for the third quarter of fiscal year 2023, ending December 31, 2022. Total revenue for the quarter was reported at USD 31.0 million, a decrease of 75.9% year over year. Despite this, BAH reported net income of USD 2277.1 million, a 12.1% increase year over year.

Overall, BAH’s performance was better than expected despite the pandemic and its net income was positively impacted by the new tax legislation. The company continues to focus on delivering high-quality services to its clients and is confident that it will be able to recover from its loss in revenue as the pandemic subsides.

Share Price

BOOZ ALLEN HAMILTON HOLDING reported its financial results for the third quarter of the fiscal year 2023 on Friday. The stock opened at $96.5 and closed at $92.7, a decrease of 4.6% from the prior closing price of $97.2. This marked a decrease in the company’s market valuation, compared to the same period last year. The main reason for this lower figure is attributed to the decrease in sales from its government and commercial segments. This decrease can be attributed to the higher level of capital expenditure and higher level of investments made during the quarter. Overall, BOOZ ALLEN HAMILTON HOLDING reported a lower than expected financial performance for the quarter, with a decrease in both net income and revenue.

However, the company’s cash position remains strong and it is confident that it will be able to continue its long-term growth strategy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BAH. More…

| Total Revenues | Net Income | Net Margin |

| 9.06k | 427.82 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BAH. More…

| Operations | Investing | Financing |

| 621.05 | -472.54 | -420.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BAH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 5.14k | 9.19 |

Key Ratios Snapshot

Some of the financial key ratios for BAH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | -0.9% | 7.3% |

| FCF Margin | ROE | ROA |

| 6.0% | 34.4% | 6.6% |

Analysis

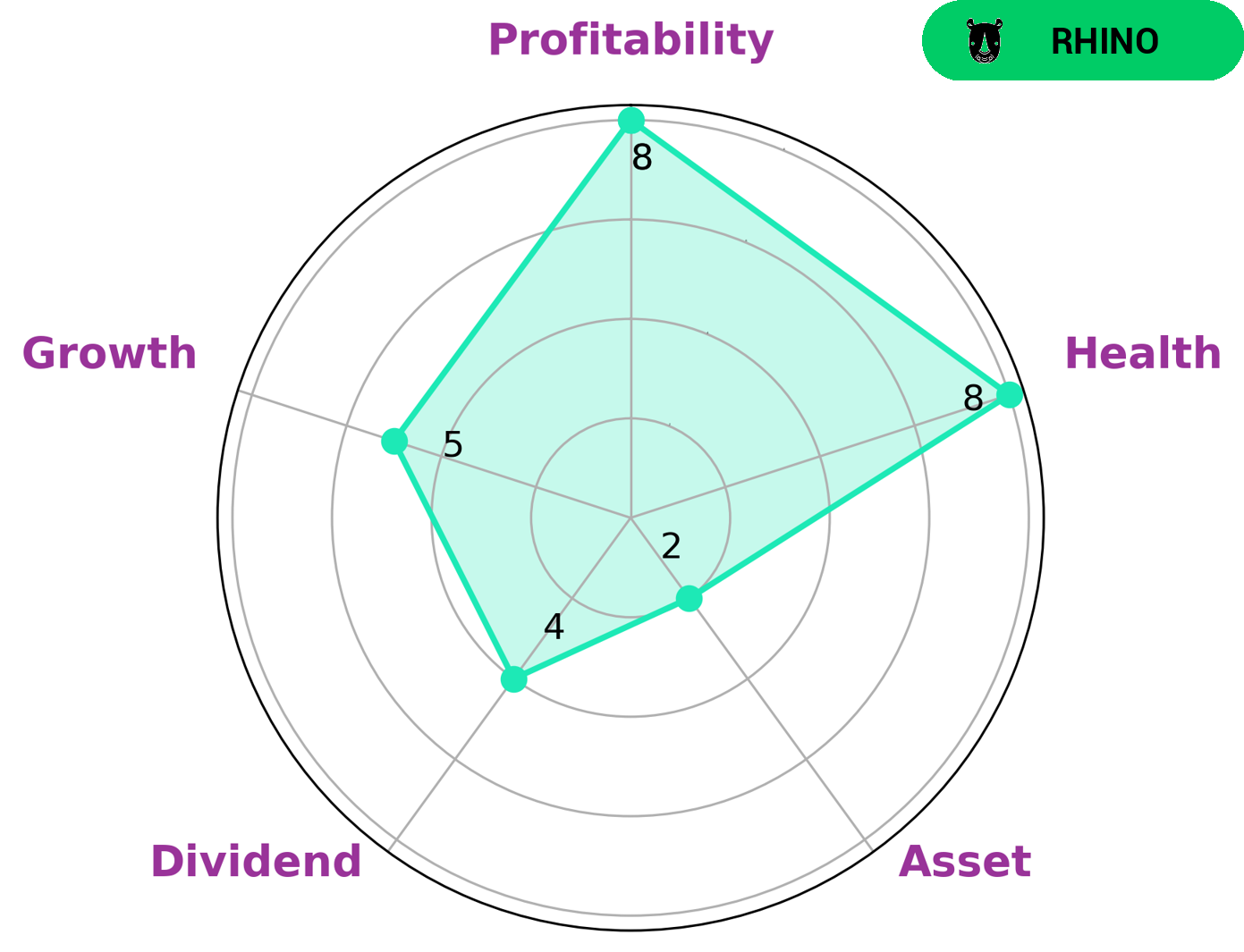

GoodWhale’s analysis of BOOZ ALLEN HAMILTON HOLDING’s fundamentals revealed that the company is strong in profitability and medium in dividend, growth and asset. It is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This type of company may interest investors looking for a steady source of income, or those who wish to place their money in a company that has a proven track record of consistent growth. The company’s health score of 8/10 with regard to its cashflows and debt is an indication that it is capable of sustaining operations during times of crisis. Investors looking for security may find BOOZ ALLEN HAMILTON HOLDING an attractive option as it has demonstrated strong financial health despite challenging market conditions. Additionally, the company’s strong profitability and dividend may entice investors looking for consistent returns from their investments. In conclusion, BOOZ ALLEN HAMILTON HOLDING may appeal to investors looking for a company with a solid track record for both growth and financial stability. The company’s strong profitability, dividend and health score are attractive features that may make it an attractive option for investors. More…

Peers

The global management consulting market is expected to grow at a CAGR of 6.2% from 2019 to 2026. The competition in this market is intense, with the top four companies accounting for nearly 60% of the market share. Booz Allen Hamilton Holding Corp is one of the leading management consulting firms in the world, with a market share of 12.4%. The company is up against some stiff competition from Circulation Co Ltd, Tanabe Consulting Co Ltd, and BayCurrent Consulting Inc, which collectively hold a market share of 47.6%.

– Circulation Co Ltd ($TSE:7379)

The market cap for China International Marine Containers (Group) Co Ltd has been on a steady decline since early 2020, from over 20 billion to its current 14.08 billion. However, the company’s ROE has remained relatively stable at 14.03%. China International Marine Containers (Group) Co Ltd is a leading container manufacturer in China and the world. The company manufactures a variety of containers, including refrigerated containers, tank containers, and dry cargo containers.

– Tanabe Consulting Co Ltd ($TSE:9644)

As of 2022, Tanabe Consulting Co Ltd has a market cap of 10.48B and a Return on Equity of 5.99%. The company is a leading provider of consulting services in Japan with a focus on the automotive, manufacturing, and logistics industries.

– BayCurrent Consulting Inc ($TSE:6532)

BayCurrent Consulting Inc has a market cap of 646.59B as of 2022, a Return on Equity of 34.97%. The company is a provider of consulting services. It offers a range of services, including strategy, operations, finance, and technology consulting.

Summary

BOOZ ALLEN HAMILTON HOLDING reported financial results for the third quarter of fiscal year 2023, showing total revenue of USD 31.0 million, a decrease of 75.9% year over year, and net income of USD 2277.1 million, a 12.1% increase year over year. Despite the increase in net income, the stock price moved down the same day. Investing analysis in BOOZ ALLEN HAMILTON HOLDING should take into account the long term outlook of the company, as well as the short term performance. Despite the decrease in total revenue, the company’s net income has increased year over year, suggesting that the company is operating efficiently and generating profits. In addition, investors should consider the company’s competitive position in the market and its ability to generate returns. The stock price movement down after the release of third quarter results may be due to investor sentiment towards the decrease in total revenue.

However, investors should take into account the long term performance of the company, as well as its overall financial performance. With the company’s net income increasing year over year, and its competitive position in the market, BOOZ ALLEN HAMILTON HOLDING may be a good investment opportunity for those looking for long term returns.

Recent Posts