SIAM CEMENT PCL Reports 15.6% Decrease in Revenue for Quarter Ending March 31 2023.

May 29, 2023

Earnings Overview

For the quarter ending March 31 2023, SIAM CEMENT PCL ($BER:TCM1) reported total revenue of THB 128.8 billion, a decrease of 15.6% compared to the same quarter in FY2022. The net income for the period was THB 16.5 billion, an increase of 87.0% from the previous fiscal year.

Analysis

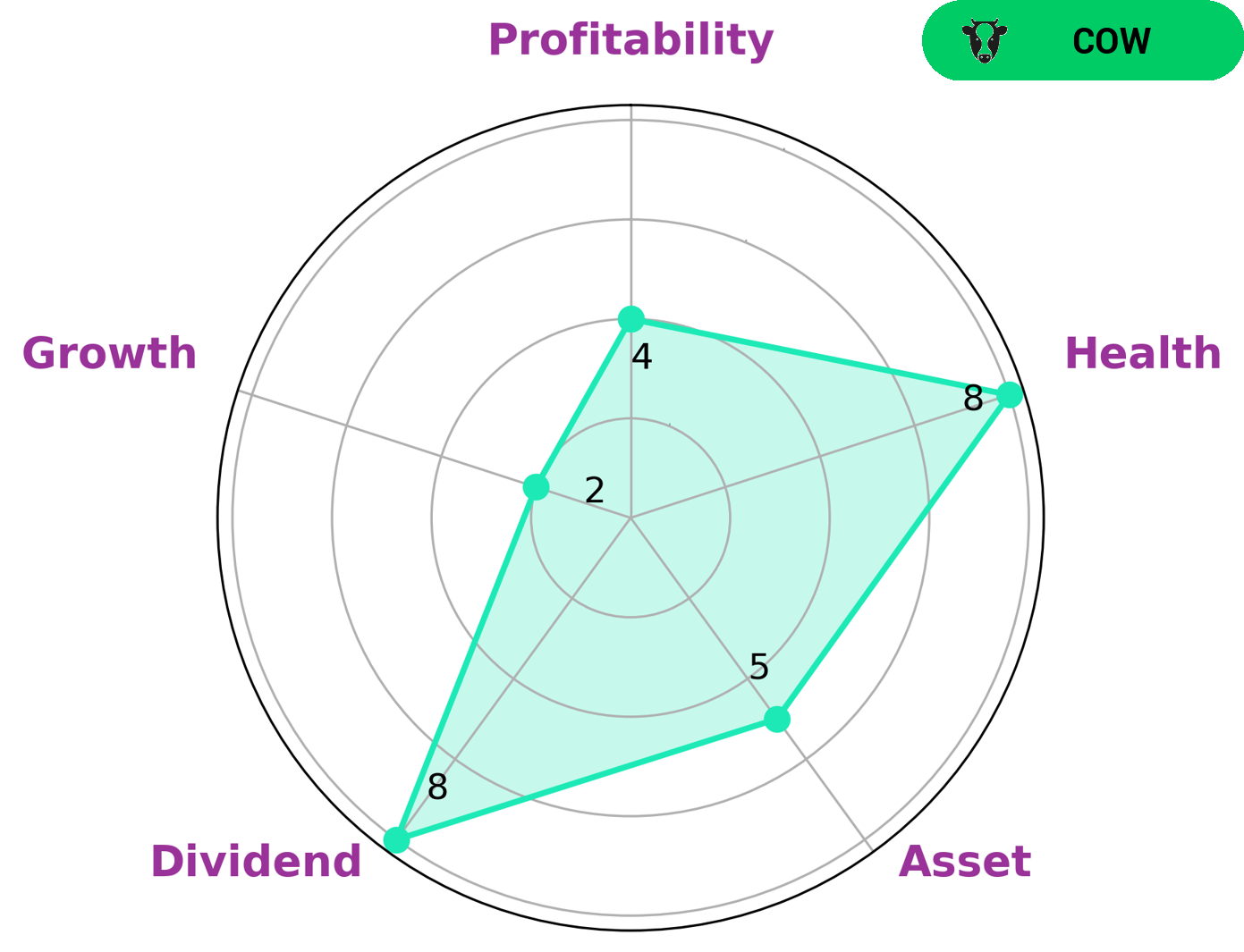

GoodWhale conducted an analysis of SIAM CEMENT PCL’s fundamentals and, according to the Star Chart, the company is strong in dividend but medium in asset, profitability and growth. It scored a high health score of 8/10, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. The analysis classifies SIAM CEMENT PCL as a ‘cow’, a type of company with the track record of paying out consistent and sustainable dividends. This makes it an attractive option for investors who are looking for a long-term dividend-paying stock. In addition, investors who are looking for companies with stable and predictable cash flows are likely to be interested in SIAM CEMENT PCL as it has demonstrated its ability to weather crises. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TCM1. More…

| Total Revenues | Net Income | Net Margin |

| 545.86k | 29.06k | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TCM1. More…

| Operations | Investing | Financing |

| 33k | -60.77k | 7.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TCM1. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 923.72k | 460k | 322.87 |

Key Ratios Snapshot

Some of the financial key ratios for TCM1 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.2% | -50.5% | 7.3% |

| FCF Margin | ROE | ROA |

| -0.9% | 6.5% | 2.7% |

Summary

Siam Cement Public Company Limited (PCL) reported a 15.6% decline in total revenue for the quarter ending March 31, 2023 compared to the same quarter in the previous year. However, net income for the period increased by 87.0%, indicating that the company was able to effectively manage operating costs and maximize profits. The strong results are encouraging for investors, as they suggest that Siam Cement PCL is well-positioned to deliver continued financial growth despite the difficult market conditions. In addition, the company is actively pursuing measures to further increase efficiency, which should help to continue to drive profitability in future quarters.

Recent Posts