Sembcorp Industries Intrinsic Value Calculation – Sembcorp Industries and Becamex IDC Collaborate to Develop Sustainable Industrial Parks in 9 Vietnam Provinces by 2023.

March 29, 2023

Trending News 🌥️

Sembcorp Industries ($SGX:U96), one of the leading international energy and marine groups in Singapore, has recently announced its collaboration with Becamex IDC, a leader in industrial park development in Vietnam, to build sustainable industrial parks in nine provinces across Vietnam by 2023. The two companies are looking into developing these parks as part of their commitment to environmental sustainability and economic growth. The scope of this project includes the construction of infrastructure and utilities, such as roads, power plants, water supply systems and wastewater treatment facilities. The parks will also feature green and smart technology solutions, such as solar panels and energy efficient lighting, in order to reduce energy consumption and carbon emissions.

The industrial parks will create jobs, foster the growth of businesses, and create economic opportunities for the local communities in the nine provinces. They will promote and enhance the use of clean energy, facilitate the adoption of green manufacturing practices, and support the transition to a low-carbon future. This joint venture will harness the expertise of both companies in order to develop innovative industrial parks that will support economic growth and environmental sustainability.

Market Price

On Monday, Sembcorp Industries stock opened at SG$4.2 and closed at SG$4.3, up by 1.4% from its previous closing price of SG$4.2. This followed the news of a joint collaboration between Sembcorp Industries and Becamex IDC, a major Vietnamese developer of industrial parks and infrastructure. The parks are intended to feature advanced technologies and eco-friendly features, such as renewable energy sources, smart water management and waste management systems.

In addition, the collaboration will focus on providing quality jobs and enabling economic growth in the local communities. The joint venture marks an important step for Sembcorp Industries in its strategy to build a diverse portfolio of energy-related businesses across Asia. It is expected to be a major catalyst in helping Vietnam to meet its ambitious targets for industrial development, economic growth and environmental sustainability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sembcorp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 9.26k | 723 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sembcorp Industries. More…

| Operations | Investing | Financing |

| 1.3k | -859 | -309 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sembcorp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.82k | 12.37k | 2.36 |

Key Ratios Snapshot

Some of the financial key ratios for Sembcorp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.9% | 17.3% | 13.7% |

| FCF Margin | ROE | ROA |

| 10.7% | 19.9% | 4.7% |

Analysis – Sembcorp Industries Intrinsic Value Calculation

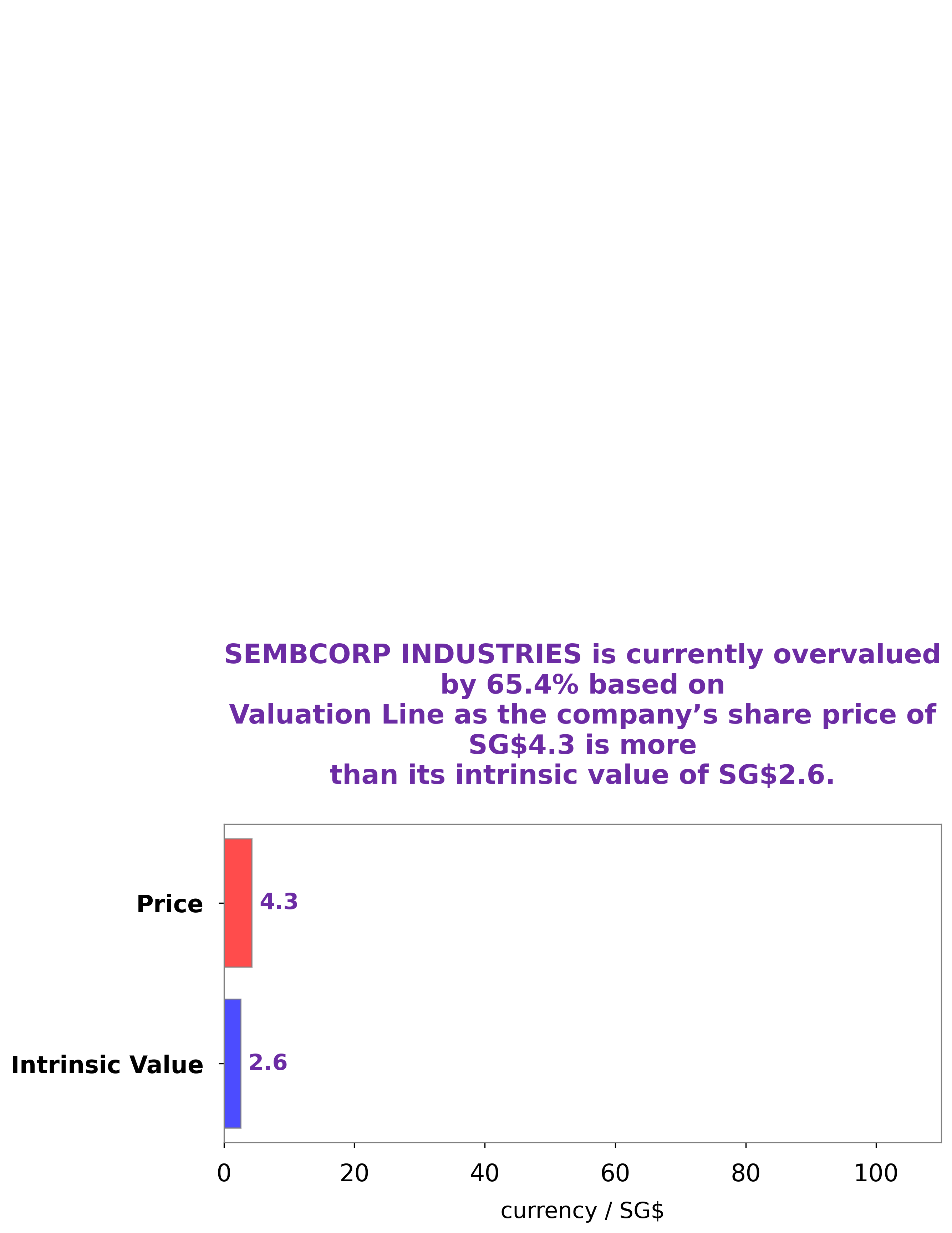

At GoodWhale, we have conducted an analysis of the wellbeing of SEMBCORP INDUSTRIES. Our proprietary Valuation Line has calculated the fair value of SEMBCORP INDUSTRIES share to be approximately SG$2.6. This means that the stock is currently being traded at SG$4.3, an overvaluation of 64.2%. This presents a potential risk for investors, and we advise them to exercise caution before investing in SEMBCORP INDUSTRIES. More…

Peers

Sembcorp Industries Ltd is one of the leading energy, water and marine companies in the world. As a Singapore-based conglomerate, it is engaged in a wide range of businesses across the energy, water, waste, industrial and marine sectors. Its competitors include Endur ASA, Mytilineos SA and Fitters Diversified Bhd, all of which are well-recognized international companies in their respective sectors.

– Endur ASA ($LTS:0JGO)

Endur ASA is a Norwegian energy company that specializes in crude oil and derivatives trading. The company has a market capitalization of 962.36M as of 2022 and a Return on Equity (ROE) of 5.71%. Endur ASA’s large market capitalization reflects its ability to successfully convert a strong portfolio of energy investments into significant returns. The company’s ROE of 5.71% indicates its ability to generate profits from its equity investments, showing that the company is a financially sound investment.

– Mytilineos SA ($OTCPK:MYTHY)

Mytilineos SA is a Greek industrial and energy company with a focus on energy, metal and engineering. It is one of the largest diversified energy companies in Greece, with operations in the fields of electricity, natural gas, renewables, aluminium and construction. With a market cap of 2.91B as of 2022, Mytilineos SA is one of the top companies in Greece. Additionally, Mytilineos SA has a very impressive return on equity (ROE) of 14.63%, which is significantly higher than the industry average. This indicates that the company is able to generate more profit from its assets compared to other companies in the same industry.

– Fitters Diversified Bhd ($KLSE:9318)

Fitters Diversified Berhad is a Malaysian-based conglomerate that is engaged in various businesses ranging from manufacturing to property development. The company has a market capitalization of 66.88 million as of 2022 and a Return on Equity of -2.15%. Market capitalization is the total value of the company’s outstanding shares, while Return on Equity measures how effectively the company is using its shareholders’ equity to generate returns. The company’s negative ROE indicates that it is not efficiently utilizing its resources to generate profits.

Summary

Singapore-based Sembcorp Industries has announced a strategic collaboration with Becamex IDC Corporation to develop sustainable industrial parks in nine provinces across Vietnam by 2023. Investment analysts anticipate that Sembcorp will benefit from increased revenue and greater access to the fast-growing Vietnamese market. The company has a strong track record of delivering successful energy and urban solutions in Vietnam, having been involved in the development of several power plants and industrial parks.

The venture is expected to lead to improved performance in Sembcorp’s business segments, most notably energy solutions, urban development, and water solutions. Analysts also note that the project provides an attractive opportunity for foreign investors interested in tapping into the Vietnamese market.

Recent Posts