RCM TECHNOLOGIES Reports Fourth Quarter FY2022 Earnings Results on March 15 2023

March 31, 2023

Earnings Overview

RCM TECHNOLOGIES ($NASDAQ:RCMT) reported their fourth quarter FY2022 earnings results for the period ending December 31 2022, on March 15 2023. Total revenue was USD 4.8 million, a decrease of 18.9% from the same quarter one year prior. Net income grew 8.2% to USD 70.2 million compared to the same period in the previous year.

Transcripts Simplified

All participants are in a listen-only mode until the question and answer session of the conference. At that time, if you have a question, please press the *1 key on your touchtone phone. I would now like to turn the conference over to our host, David Smith, Executive Vice President of Corporate Development and Investor Relations. Please go ahead. Thank you, operator. On today’s call, I will provide a brief overview of our financial results. Following Chris’ remarks, we will open the call for questions. Chris? Thank you, David.

Good morning and thank you all for joining us today. As David noted, we had a strong first quarter with results that exceeded our expectations. We had record bookings and solid top-line growth driven by our success in winning new business as well as renewing existing contracts. These results demonstrate our ability to capture meaningful market share in our target markets and further expand our leadership position in the industry. Before I turn the call back to David for Q&A, I want to thank our employees for their hard work and dedication to delivering exceptional service to our customers every day. Thank you again for joining us today and we look forward to your questions. Operator?

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rcm Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 284.68 | 20.89 | 7.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rcm Technologies. More…

| Operations | Investing | Financing |

| 28.44 | -4.98 | -23.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rcm Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 87.96 | 56 | 3.73 |

Key Ratios Snapshot

Some of the financial key ratios for Rcm Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.2% | 63.1% | 10.0% |

| FCF Margin | ROE | ROA |

| 10.0% | 48.5% | 20.2% |

Price History

Stock opened at $12.7 and closed at $12.5, down by 3.7% from its prior closing price of 12.9. This marked the third consecutive quarter RCM TECHNOLOGIES reported a decline in stock prices, a troubling trend that has worried many investors. Overall, the fourth quarter earnings results revealed a mixed picture for RCM TECHNOLOGIES.

Despite its decline in net income, the company was still able to post a positive EPS and maintain a relatively healthy revenue figure. Investors have been hoping for more positive news from the company as it continues to move forward in FY2023. Live Quote…

Analysis

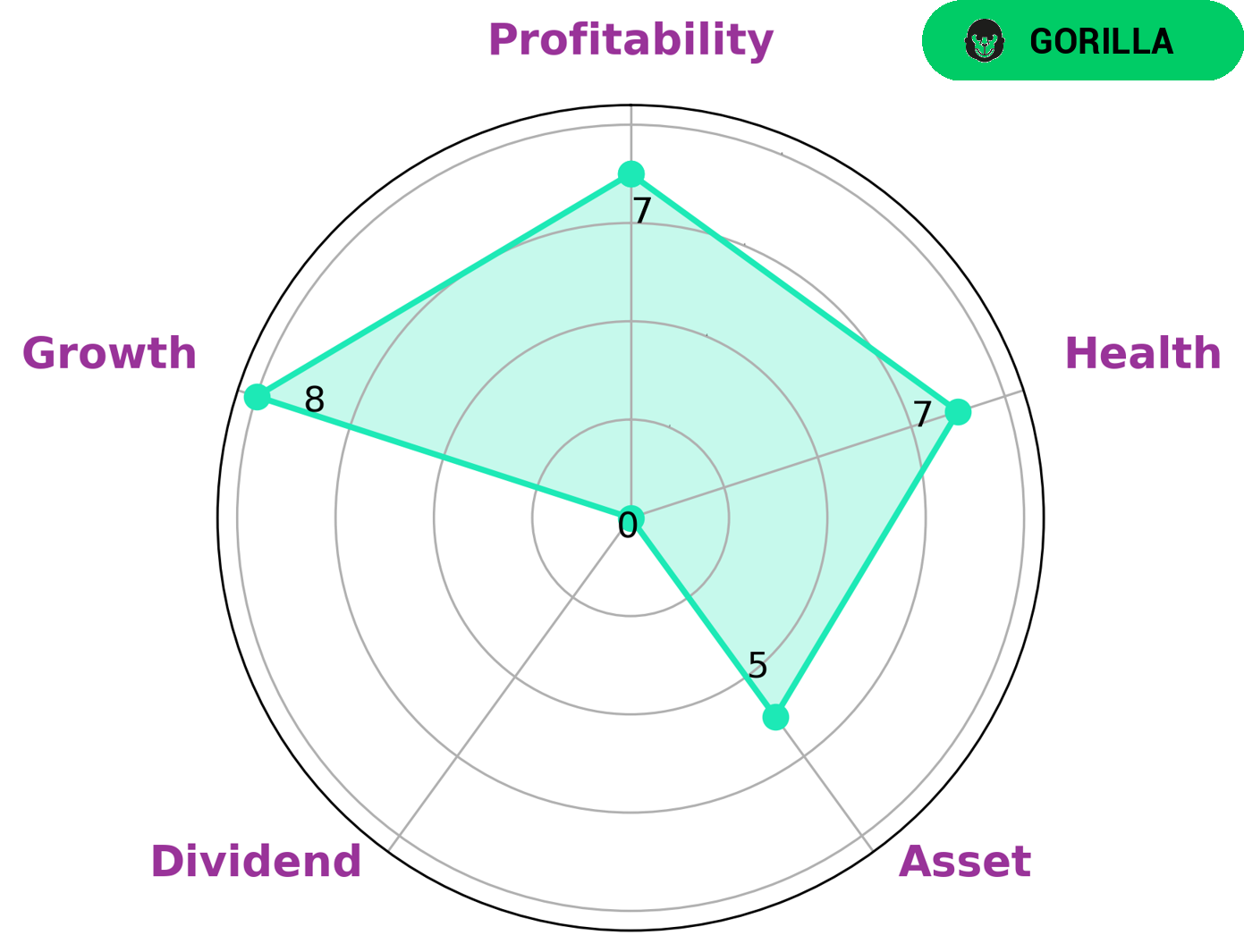

As GoodWhale, I examined RCM TECHNOLOGIES‘ financials and found that the company has a high health score of 7/10 with regard to its cashflows and debt. This indicates that RCM TECHNOLOGIES is capable to pay off debt and fund future operations. Furthermore, the company is classified as ‘gorilla’, which is a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given RCM TECHNOLOGIES’ strong performance in terms of growth, profitability and its medium asset score, investors interested in long-term investments and capital appreciation may be interested in this company. However, those investors seeking high dividends may have to look elsewhere as RCM TECHNOLOGIES score weak in this regard. More…

Peers

The company has a strong presence in North America, Europe, and Asia. RCM Technologies Inc’s competitors include Jangho Group Co Ltd, Calian Group Ltd, and Peoplein Ltd.

– Jangho Group Co Ltd ($SHSE:601886)

JHG is a leading investment company with a focus on the healthcare sector. The company has a market capitalization of 8.92 billion as of 2022 and a return on equity of -9.2%. JHG has a diversified portfolio of healthcare investments, including hospitals, clinics, and nursing homes. The company also has a significant presence in the pharmaceutical and biotechnology industries.

– Calian Group Ltd ($TSX:CGY)

Calian Group Ltd is a Canadian professional services company with over 30 years of experience in the provision of health, training, and technology solutions. The company has a market cap of 648.65M as of 2022 and a Return on Equity of 4.41%. Calian employs over 2,600 people in Canada, the United States, and the United Kingdom. The company’s health solutions include primary care, health promotion, and disease prevention services. Calian’s training solutions include online and classroom training, as well as simulation-based training. The company’s technology solutions include systems engineering, software development, and network integration services.

– Peoplein Ltd ($ASX:PPE)

As of 2022, Peoplein Ltd has a market cap of 310.55M and a Return on Equity of 13.79%. The company is a provider of human resources solutions and services.

Summary

Investors in RCM Technologies should consider the company’s fourth quarter FY2022 earnings report, released on March 15 2023. Total revenue was USD 4.8 million, a decrease of 18.9% year-over-year. Despite this, net income increased by 8.2% compared to the same period in the previous year.

This report caused the stock price to drop on the same day. Investors should keep a close eye on the company’s performance over the next few quarters to determine if an investment in RCM Technologies is right for them.

Recent Posts