Mitsui to Invest Up to NOK2 Billion in Hexagon Purus

May 26, 2023

Trending News 🌥️

Mitsui ($TSE:8031) & Co., Ltd., a diverse Japanese trading and diversified investment enterprise, has recently announced its decision to invest up to NOK2 billion to acquire shares of Hexagon Purus. This move is part of their strategy to expand their portfolio and help fuel the growth of Hexagon Purus, a Norwegian-based energy and mobility company. They are also engaged in multiple financial services, such as corporate banking, asset management, and venture capital. This investment in Hexagon Purus is a strategic move for Mitsui and an indication of their commitment to driving innovation and technological advancement in the energy and mobility sectors.

With the new investment, Hexagon Purus is set to gain access to Mitsui’s vast resources and international expertise. This will help the Norwegian-based company expand its reach and make it more competitive in the global market.

Market Price

On Thursday, Mitsui announced that it will be investing up to two billion Norwegian Krone (NOK2 billion) in Hexagon Purus, a leading global provider of modular solutions for safe and efficient transportation of fuel and other hazardous materials. Mitsui stock opened at JP¥4413.0 and closed at JP¥4427.0, down by 0.1% from the last closing price of JP¥4431.0. The investment is expected to help Hexagon Purus in its expansion into the Japanese market. This news has been welcomed by investors as a sign of continued growth and progress for Mitsui. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mitsui. More…

| Total Revenues | Net Income | Net Margin |

| 14.2M | 1.12M | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mitsui. More…

| Operations | Investing | Financing |

| 1.05M | -117.2k | -594.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mitsui. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.57M | 9.24M | 3.84k |

Key Ratios Snapshot

Some of the financial key ratios for Mitsui are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.8% | 38.3% | 10.4% |

| FCF Margin | ROE | ROA |

| 5.8% | 15.2% | 5.9% |

Analysis

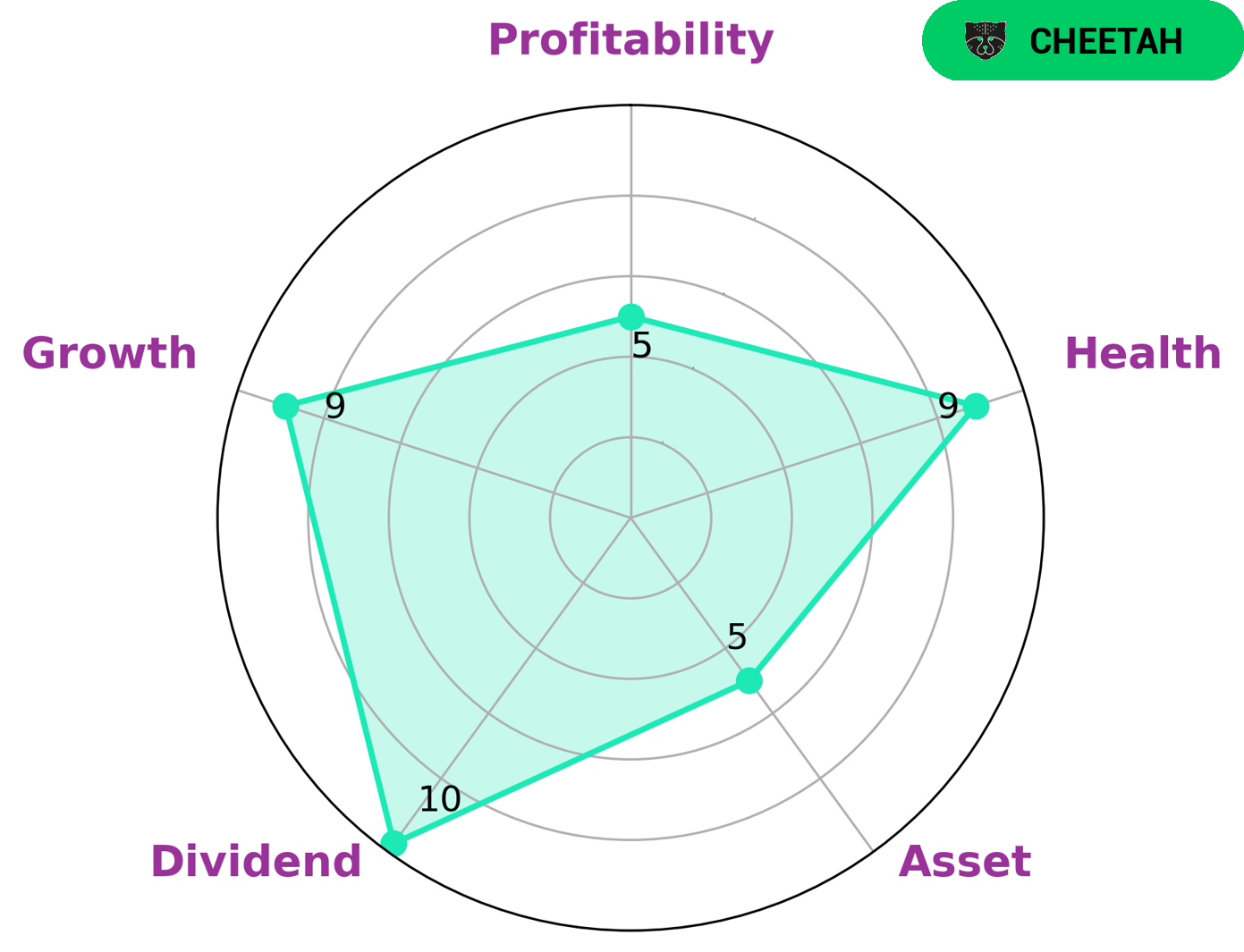

GoodWhale provides an analysis on the fundamentals of MITSUI. Our star chart classified the company as a ‘cheetah’, indicating that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. This makes MITSUI a potentially attractive investment for certain types of investors. Moreover, MITSUI has a high health score of 9/10 with regard to its cashflows and debt, making it capable to sustain future operations in times of crisis. In addition, our analysis further highlights that MITSUI is strong in dividend, growth, and medium in asset and profitability. All these factors indicate that MITSUI may be a potentially attractive investment opportunity for certain types of investors. Mitsui_to_Invest_Up_to_NOK2_Billion_in_Hexagon_Purus”>More…

Peers

Mitsui & Co Ltd is one of the largest global trading and investment companies in the world. It competes with other global conglomerates including Foreign Trade Development And Investment, Sumitomo Corp, and Intrakat Societe Anonyme Of Technical And Energy Projects. These companies are all engaged in a wide range of activities such as exploration, production, and marketing of commodities, investments in capital markets, and development of new technologies. Despite the competition, Mitsui & Co Ltd has remained a dominant player in the global market by providing innovative solutions and services to its clients.

– Foreign Trade Development And Investment ($HOSE:FDC)

Sumitomo Corporation is a global trading and investment company that operates in many areas of the world. The company has a market capitalization of 2.72 trillion as of 2023, which is the highest among its peers. Additionally, Sumitomo Corporation has an impressive Return on Equity (ROE) of 13.13%, indicating that the company is able to generate a return for its shareholders. Sumitomo Corporation is involved in a diverse range of sectors, from metals, to machinery, and chemicals, among many others. The company is able to leverage its extensive network of relationships across multiple countries and industries to generate value for its shareholders.

– Sumitomo Corp ($TSE:8053)

Intrakat Societe Anonyme Of Technical And Energy Projects is a Greek company that specializes in technical and energy projects. The company has a market cap of 122.71M as of 2023, which is an indication of the company’s market value and the size of its operations. Its Return on Equity (ROE) of -17.91% indicates that the company is not generating enough profit relative to the amount of equity invested in the business. This signals that the company may not be making the most efficient use of its resources or capital, and investors may want to consider other options.

Summary

Mitsui has agreed to invest up to NOK 2 billion in Hexagon Purus, a Norwegian-based company focused on hydrogen-related technology. The investment will be done through a share subscription to acquire a minority stake in Hexagon Purus. The investment is part of Mitsui’s strategy to strengthen its hydrogen business and expand its presence in the hydrogen-related technology sector.

This investment will help further Mitsui’s strategy to pursue investments in clean and sustainable technologies. As part of this strategy, Mitsui will continue to monitor the potential of Hexagon Purus, and assess the potential for future investment opportunities.

Recent Posts