Decisive Dividend dividend yield – Decisive Dividend Declares 0.03 Cash Dividend

February 26, 2023

Dividends Yield

DECISIVE ($TSXV:DE): 3 C a s h D i v i d e n d , g e n e r a t i n g e x c i t e m e n t a m o n g l o n g t i m e i n v e s t o r s a n d c u r i o u s n e w c o m e r s a l i k e . F o r t h e p a s t t h r e e y e a r s , U N I O N P A C I F I C h a d b e e n p a y i n g a n a n n u a l d i v i d e n d o f 5 . 2 5 % . T h i s l a t e s t d i v i d e n d h i g h l i g h t s U N I O N P A C I F I C ’ s c o m m i t m e n t t o t h e i r s h a r e h o l d e r s a n d s t e a d y g r o w t h o v e r t h e p a s t f e w y e a r s . I f y o u a r e i n t e r e s t e d i n d i v i d e n d s t o c k s , U N I O N P A C I F I C i s a n a t t r a c t i v e o p t i o n t o c o n s i d e r .

W i t h t h e i r r e l i a b l e d i v i d e n d p a y o u t , i n v e s t o r s c a n h a v e p e a c e o f m i n d t h a t t h e i r i n v e s t m e n t i s g r o w i n g s l o w l y b u t s t e a d i l y . A l l i n a l l , U N I O N P A C I F I C ’ s a n n o u n c e m e n t o f a 1 . 3 C a s h D i v i d e n d i s a n i n d i c a t i o n o f t h e c o m p a n y ’ s s t r o n g p e r f o r m a n c e a n d a g r e a t o p p o r t u n i t y f o r a n y o n e i n t e r e s t e d i n d i v i d e n d s t o c k s . W i t h i t s s o l i d t r a c k r e c o r d o f s t e a d y g r o w t h a n d r e l i a b l e d i v i d e n d p a y o u t s , U N I O N P A C I F I C c o u l d b e a n e x c e l l e n t a d d i t i o n t o a n y i n v e s t o r ’ s p o r t f o l i o.

Price History

On Monday, Union Pacific Corp (UNION PACIFIC) announced that it has declared a 1.3 cash dividend. The stock opened at €191.5 and closed at €191.5, up by 1.6% from its last closing price of 188.5. This indicates investor’s overall positive sentiment in regards to the company’s outlook. The company has not only declared its dividend, but is also taking steps to further strengthen its position in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Decisive Dividend. More…

| Total Revenues | Net Income | Net Margin |

| 85.66 | 4.34 | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Decisive Dividend. More…

| Operations | Investing | Financing |

| 7.21 | -10.91 | 11.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Decisive Dividend. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.67 | 54.34 | 2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Decisive Dividend are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.4% | 55.1% | 9.3% |

| FCF Margin | ROE | ROA |

| 5.7% | 17.8% | 5.7% |

Analysis

At GoodWhale, we pride ourselves in providing the most comprehensive financial analysis for our clients. We recently conducted an analysis of Union Pacific’s fundamentals, and based on our risk rating, Union Pacific appears to be a relatively low risk investment. When it comes to financial and business aspects, our analysis highlighted that Union Pacific is currently in a strong position and is unlikely to experience any major issues in the near future. We did detect one risk warning in the balance sheet, however, so we encourage interested parties to register with us to get more details on the potential risk. More…

Summary

U n i o n P a c i f i c i s a r e l i a b l e d i v i d e n d s t o c k w i t h a n a t t r a c t i v e y i e l d o f 2 . 2 5 % . O v e r t h e p a s t t h r e e y e a r s , t h e c o m p a n y h a s p a i d a n a n n u a l d i v i d e n d o f 5 . W i t h a p r o v e n t r a c k r e c o r d o f c o n s i s t e n t d i v i d e n d p a y m e n t s , U n i o n P a c i f i c m a y b e a g o o d c h o i c e f o r t h o s e l o o k i n g t o d i v e r s i f y a l o n g – t e r m i n v e s t m e n t s t r a t e g y.

Dividends Yield

On February 14 2023, BANCO PRODUCTS (India) Ltd announced a cash dividend of 8.0 INR per share. This announcement has made the stock an attractive choice for investors interested in dividend stocks. The company has issued annual dividends per share of 20.0 and 2.0 INR for the past two years, with dividend yields ranging from an average of 6.0% to 10.9% in 2022 and 1.09% in 2023. The record date for the dividend is February 24 2023.

That means that if you own the stock on or before this date, you will receive the dividend amount. Investors should note that the company’s financial performance may impact dividend payments in the future. Furthermore, investors should do their research before investing in any stock, including BANCO PRODUCTS (India) Ltd, to ensure they make an informed decision.

Stock Price

On Tuesday, BANCO PRODUCTS (India) Ltd declared 8.0% cash dividend to shareholders. Following the announcement, its stock opened at INR 238.0 and closed at INR 227.5, representing a 2.8% decrease from the last closing price of INR 234.0. The dividend will be paid out of profits and reserves of the company for the financial year ending March 31, 2020. Live Quote…

Analysis

As GoodWhale performed an analysis of BANCO PRODUCTS’ wellbeing, it revealed the strong performance the company has achieved in various areas, such as assets, dividends, growth, and profitability. Based on this analysis, BANCO PRODUCTS was classified as a ‘gorilla’ company, which means that it has managed to secure a strong competitive advantage that has allowed it to achieve strong and stable revenue or earnings growth over a long period of time. Moreover, due to its high health score of 9/10 with respect to its cashflows and debt, BANCO PRODUCTS is capable of sustaining future operations even during times of crisis. Therefore, this company would be attractive to investors who are looking for stable long-term returns. Additionally, investors who are keen on capitalising on the competitive advantage BANCO PRODUCTS possesses would also be interested in investing in the company. More…

Summary

I n v e s t i n g i n B a n c o P r o d u c t s c a n b e a g r e a t c h o i c e f o r d i v i d e n d i n v e s t o r s . 9 % t o 1 . T h e i r d i v i d e n d h i s t o r y i s e n c o u r a g i n g , a n d i n v e s t o r s c a n l o o k f o r w a r d t o c o n s i s t e n t r e t u r n s . A n a l y z i n g t h e i r f i n a n c i a l s t a t e m e n t s , g r o w t h p r o s p e c t s , a n d o t h e r f a c t o r s , w i l l a l s o b e r e c o m m e n d e d b e f o r e i n v e s t i n g i n B a n c o P r o d u c t s.

Dividends Yield

FORTESCUE METALS recently announced a 0.75 cash dividend on the 16th of February, 2023. This marks a continuation of their annual dividend per share of 2.16 USD over the last three years, with a dividend yield of 14.0 % from 2022 to 2023. If you’re looking for dividend stocks, FORTESCUE METALS may be a great option worth considering, with its ex-dividend date set for February 27th, 2023. This company offers a steady and reliable stream of dividends, making it an attractive investment for income investors. The board of directors at FORTESCUE METALS are confident that they will be able to maintain their dividend policy, despite the current economic uncertainty.

This is backed up by their strong financial performance over the last few years, which has seen their revenue growing steadily and their profits continuing to rise. Investors who are searching for quality dividend stocks should certainly consider adding FORTESCUE METALS to their portfolio. With its reliable dividend payouts and encouraging financials, it could be a safe bet for those looking for a consistent income stream.

Stock Price

On Thursday, FORTESCUE METALS, one of the leading iron ore producers in the world, made an announcement that pleased investors. Following the news, FORTESCUE METALS stock opened at €14.3 and closed at the same price. The stock price was up approximately 4% from Tuesday’s close. Investors responded positively to the news, signaling their approval of the company’s dividend policy.

With the 0.75 cash dividend payment, FORTESCUE METALS rewards shareholders while still holding on to enough cash reserves to sustain operations should conditions become unfavorable due to external circumstances. This provides investors with a sense of security and trust in the company. Live Quote…

Analysis

As GoodWhale, I have been analyzing FORTESCUE METALS’s fundamentals and found it to be highly healthy. Our Star Chart analysis showed a score of 10/10, indicating that FORTESCUE METALS is able to pay its debts and fund future operations. As well as having strong dividend, growth and profitability, FORTESCUE METALS is also medium in asset. This makes it a ‘cow’- a type of company that has the track record of paying out consistent and sustainable dividends. This type of company would likely be attractive to investors looking for dividend stability and income, as well as those looking for a more long-term growth opportunity. The consistent dividend payments could be seen as an attractive source of income over time. Furthermore, the potential for growth allows investors to take advantage of the possible appreciation of their investment in the future. More…

Summary

FORTESCUE METALS offers a good investment opportunity to the investors. It has a consistent track record of paying an annual dividend per share of 2.16 USD over the last 3 years, providing a dividend yield of 14.0%. Its historical data shows that the company has been able to generate steady cash flows, consequently resulting in consistent dividend payments.

Moreover, Fortescue’s financial position looks strong, with a favorable debt-to-equity ratio, low leverage and overcash holdings. Analyzing the current market conditions and the company’s positive financial metrics, it is perceived that investing in Fortescue could be a sound investment decision.

Dividends Yield

On February 16 2023, Decisive Dividend Declares a 0.03 CAD Cash Dividend. This marks the fourth consecutive year in which DECISIVE DIVIDEND has issued an annual dividend per share, with the last 3 years seeing distributions of 0.33 CAD, 0.2 CAD, and 0.09 CAD respectively. This gives an average dividend yield of 5.35%, with dividend yields from 2020 to 2022 being 7.81%, 5.54% and 2.7% respectively. If you are interested in dividend stocks, Decisive Dividend could be a good option to consider.

The ex-dividend date is set for February 27 2023, so it’s important to make sure you get your dividend before this date if you decide to invest. All in all, Decisive Dividend is a strong option for those looking for dividend distribution and is a viable investment for those interested in dividend stocks.

Stock Price

O n t h e s a m e d a y , t h e s t o c k o p e n e d a t C A $ 5 . 2 , r e p r e s e n t i n g a 3 . T h i s d i v i d e n d d e c l a r a t i o n i s t h e l a t e s t m e a s u r e t a k e n b y D E C I S I V E D I V I D E N D t o r e w a r d i n v e s t o r s f o r t h e i r l o y a l t y a n d c o n f i d e n c e i n t h e c o m p a n y. Live Quote…

Analysis

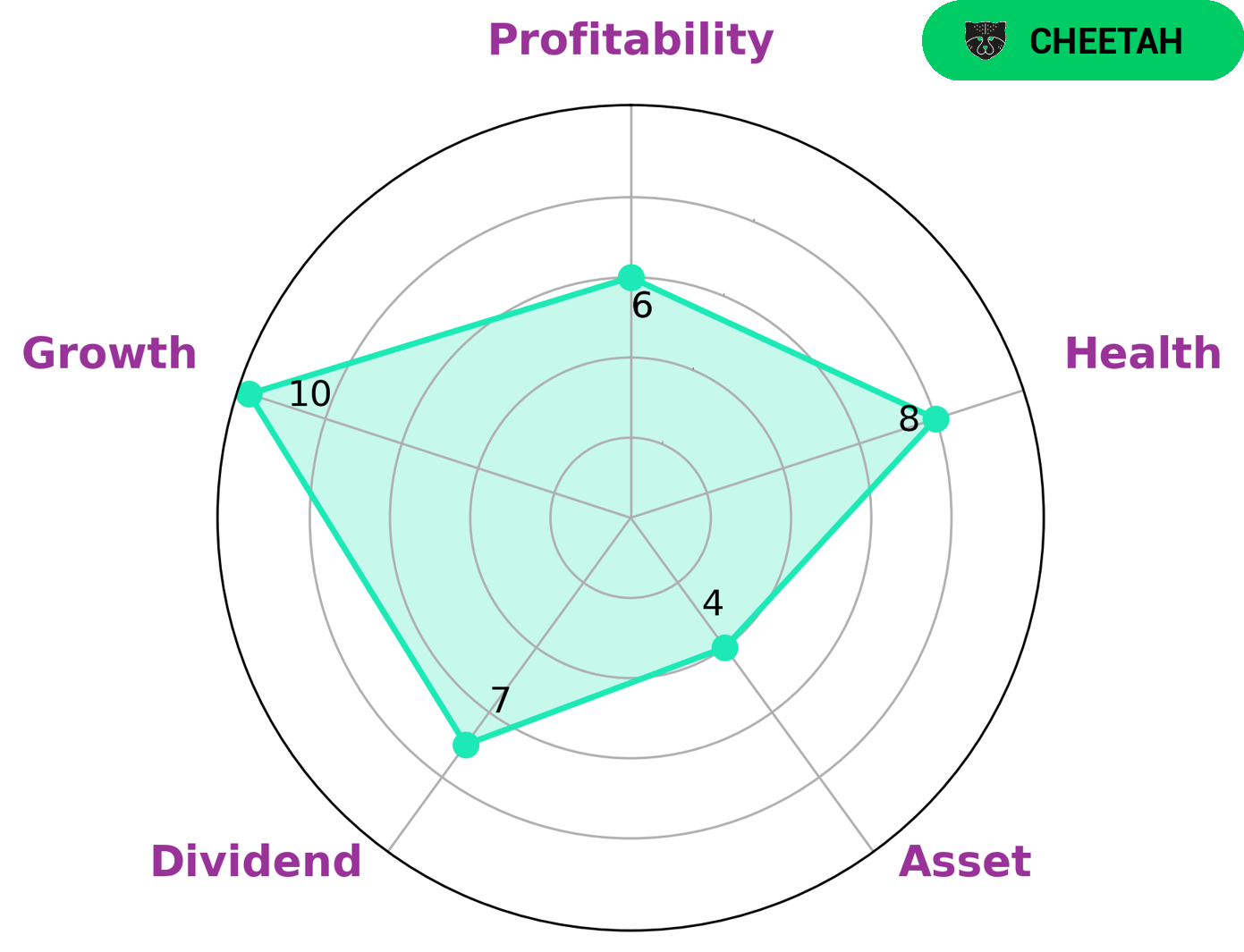

At GoodWhale, we have done an in-depth analysis of the fundamentals of DECISIVE DIVIDEND. Our analysis shows that DECISIVE DIVIDEND has a very high health score of 8 out of 10 with regards to its cashflows and debt, which suggests that it is well-prepared to ride out any potential crisis without fear of bankruptcy. Additionally, DECISIVE DIVIDEND is classified as a ‘cheetah’ company, which is one that has achieved significant revenue and earnings growth but is considered to be less stable as a result of its lower profitability. This means that this company is particularly appealing to investors who prioritize growth but also understand the risks associated with it. Overall, we rate DECISIVE DIVIDEND as strong in dividends, growth and medium in asset and profitability. Therefore, those investors who are looking for a higher-risk, higher-reward type of investment may find DECISIVE DIVIDEND particularly appealing. More…

Peers

Decisive Dividend Corp is an established player in the dividend investing industry, competing against Moon Equity Hldgs Corp, Schouw & Co A/S, and Sennen Potash Corp. These companies all specialize in dividend investing and offer investors a variety of options for generating passive income.

– Moon Equity Hldgs Corp ($OTCPK:MONI)

Schouw & Co A/S is a Danish-based company that provides services in the energy, chemical, and food industries. The company has a market capitalization of 13.09 billion as of 2023, making it one of the largest companies in Denmark. This market capitalization indicates that Schouw & Co is a well-established and successful company. Additionally, the company has a strong financial performance with a Return on Equity (ROE) of 8.91%, which is higher than the average of its peers. This indicates that Schouw & Co is more efficient in utilizing its equity for generating profits than other companies in its industry.

– Schouw & Co A/S ($LTS:0O0N)

Sennen Potash Corp is a publicly traded company which extracts potash, an essential mineral used in fertilizer, from underground deposits in the western United States. With a market cap of 1.54M as of 2023, the company has seen its share price increase over the past few years. This increase can be attributed to the company’s strong Return on Equity (ROE) of 40.18%, which is well above the industry average. This suggests that the company is efficient in its operations and is able to generate a greater return on its equity than its competitors. Overall, Sennen Potash Corp is a promising company with a strong financial performance.

Summary

DECISIVE DIVIDEND has been consistently issuing an annual dividend per share over the last three years, with an average yield of 5.35%. This indicates that investing in DECISIVE DIVIDEND may be worth considering for individuals looking for a relatively low-risk investment opportunity that provides a steady dividend income. The dividend yields from 2020 to 2022 have been 7.81%, 5.54%, and 2.7%, respectively. Investors should pay close attention to any changes in the company’s dividend policy in order to make the most informed decision when investing in DECISIVE DIVIDEND.

Recent Posts