Bonheur Asa dividend yield – Bonheur ASA Announces 5.0 Cash Dividend

May 26, 2023

Dividends Yield

On May 25, 2023, Bonheur ASA announced a cash dividend of 5.0 Norwegian Krone per share. If you are looking for stocks providing dividends, BONHEUR ASA ($BER:V7P) may be a strong choice. Over the last three years, they have issued annual dividends of 4.3, 4.3 and 4.0 Norwegian Krone per share respectively, resulting in an average dividend yield of 14.55%, 12.74% and 18.18% in 2021, 2022 and 2023 respectively. The ex-dividend date is set at May 26, 2023.

With this dividend payment and the current dividend yield of 18.18%, investors have the potential to receive a good return on their investment as well as grow their capital over time. Its long-standing presence in the market also gives it access to resources and opportunities that can help it remain competitive and sustain its growth for many more years to come. With its attractive dividend yield, investors have the potential to reap substantial returns from their investments in the company over the long term.

Market Price

This news caused a drop in the stock price, as the stock opened at €24.4 and closed at €24.0, representing a 1.4% decrease from the previous closing price of €24.4. This dividend is expected to offer investors with additional returns from the company’s stock position. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bonheur Asa. More…

| Total Revenues | Net Income | Net Margin |

| 11.96k | 669.41 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bonheur Asa. More…

| Operations | Investing | Financing |

| 2.97k | -1.42k | -47.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bonheur Asa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.49k | 15.8k | 149.57 |

Key Ratios Snapshot

Some of the financial key ratios for Bonheur Asa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.8% | 92.1% | 25.5% |

| FCF Margin | ROE | ROA |

| 15.4% | 31.5% | 8.1% |

Analysis

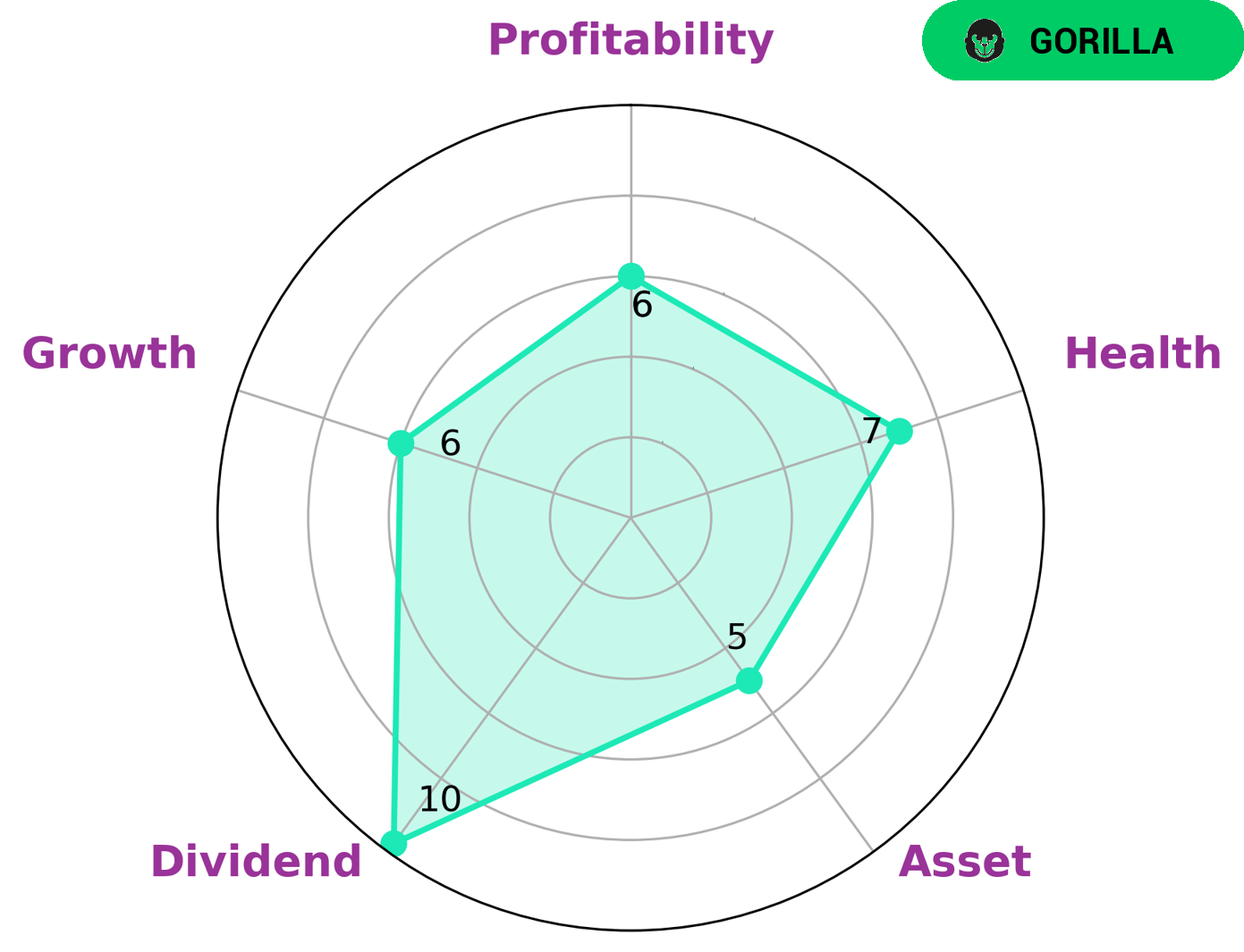

GoodWhale has conducted an analysis of the fundamentals of BONHEUR ASA, which we classify as a ‘gorilla’ type of company. This is due to its strong competitive advantage that has enabled it to achieve stable and high revenue or earning growth. As such, investors who are interested in dividend yield and/or asset growth may find the company attractive. Furthermore, the company is also moderately productive and profitable, furthering its appeal. Finally, with a health score of 7/10, the company is considered capable of paying off debt and funding future operations through its cashflows and debt. This strong financial situation makes it an attractive choice for potential investors. More…

Peers

It has several major competitors, such as KST Beteiligungs AG, Eastern Technical Engineering PCL, and Sembcorp Industries Ltd. Each of these companies offer similar products and services in the same industries, providing an intense competitive landscape.

– KST Beteiligungs AG ($BER:KSW)

KST Beteiligungs AG is a publicly traded company based in Germany that specializes in venture capital and private equity investments. The company’s market capitalization as of 2023 stands at 5.66 million euros, reflecting the current value of its shares trading on the stock market. KST Beteiligungs AG has also demonstrated a solid Return on Equity (ROE) of 0.78%, indicating a positive performance in terms of generating profits for shareholders. The company invests across a variety of industries, with particular focus on technology, telecommunications, media, and financial services businesses.

– Eastern Technical Engineering PCL ($SET:ETE)

Eastern Technical Engineering PCL is an engineering, procurement, and construction company operating mainly in Southeast Asia. The company provides technological and engineering services to engineering and construction projects in the region. As of 2023, the company has a market cap of 532M, which suggests that it is gaining traction in the market. Furthermore, its Return on Equity stands at 4.78%, indicating that it is making efficient use of its equity to generate profits. This is a positive sign for investors as it is an indication of the company’s success and ability to generate good returns for its shareholders.

– Sembcorp Industries Ltd ($SGX:U96)

Sembcorp Industries Ltd is a leading energy, water and marine group based in Singapore. With a market capitalization of 8.75 billion SGD as of 2023, the company is well-positioned to capitalize on the growth opportunities in the global energy sector. Their Return on Equity (ROE) stands at 17.64%, which indicates that the company is efficiently using its equity to generate profits. The company’s diversified portfolio of energy, water and marine businesses enables it to generate strong returns and expand operations across Southeast Asia and India.

Summary

Investing in BONHEUR ASA can be a great choice for investors looking for a regular dividend income stream. Its strong fundamentals include healthy cash flows, low debt levels, and a solid dividend payout ratio.

Additionally, BONHEUR ASA has experienced steady growth over the past few years and is expected to continue to deliver strong performance in the near future. Analysts have a positive outlook on the company’s stock price, citing its strong balance sheet and long-term prospects. Investors should also note that the stock has significant upside potential, making it an attractive option for long-term investors.

Recent Posts