1847 Holdings Scores Major Contract with Florida Supermarket Chain

April 15, 2023

Trending News 🌥️

1847 Holdings ($NYSEAM:EFSH), a leading provider of food and beverage services in North America, has recently scored a major contract with a major supermarket chain based in Florida. The contract is worth $260K and is expected to provide a major boost to the company’s revenue. This is a significant milestone for 1847 Holdings, as it continues to grow and expand its operations across the United States. The company was founded in 1847 and since then has grown to become one of the most recognized and respected brands in the industry. 1847 Holdings provides a wide range of products, including beverages, snacks, cereals, and frozen foods, as well as catering services and grocery items.

The company is committed to providing customers with quality products and services that meet their specific needs. This new contract with a major supermarket chain in Florida is expected to be a major success for 1847 Holdings. Not only will it provide a substantial boost in revenue for the company, but it also demonstrates its commitment to customer satisfaction and product quality. With this contract, 1847 Holdings will continue to establish itself as a leader in the food and beverage industry.

Share Price

On Friday, 1847 Holdings‘ stock experienced a significant increase in value when it opened at $0.8 and closed at $0.7, a 5.9% rise from its previous closing price of 0.6. The contract will involve the complete overhaul of their IT systems, which includes replacing their current hardware and software solutions with more advanced solutions provided by 1847 Holdings. This is a major coup for the company and is expected to bring significant revenue and future business opportunities. With this new contract, 1847 Holdings is poised to expand its presence in the retail industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 1847 Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 48.93 | -20.07 | -17.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 1847 Holdings. More…

| Operations | Investing | Financing |

| -4.13 | -0.16 | 3.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 1847 Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.48 | 42.59 | 0.64 |

Key Ratios Snapshot

Some of the financial key ratios for 1847 Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | – | -16.1% |

| FCF Margin | ROE | ROA |

| -9.0% | -94.1% | -10.8% |

Analysis

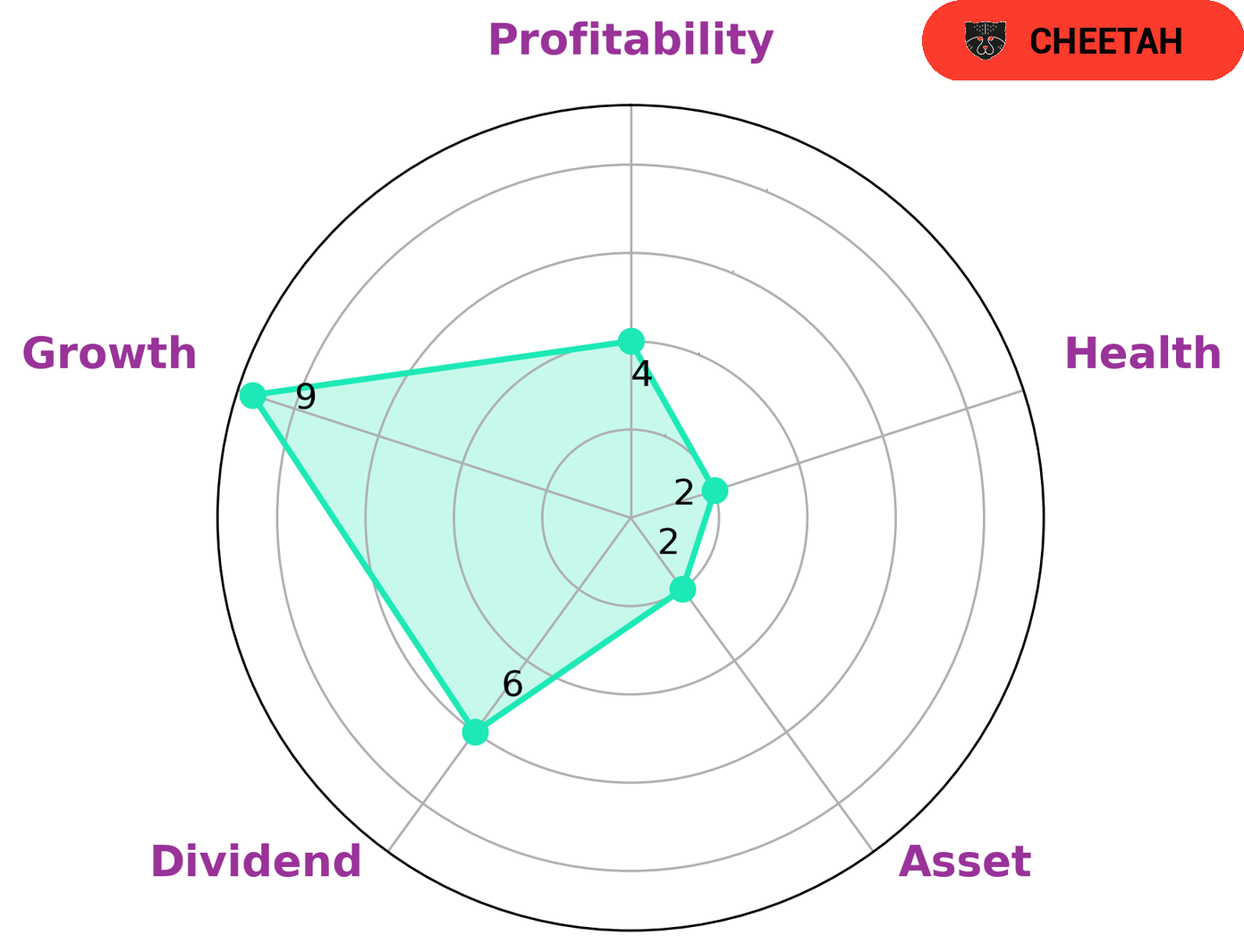

GoodWhale recently conducted an analysis of 1847 HOLDINGS‘s wellbeing. According to our Star Chart, 1847 HOLDINGS is classified as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are willing to take on the risks for potentially higher returns. However, 1847 HOLDINGS has a low health score of 2/10 considering its cashflows and debt, making it less likely to safely ride out any crisis without the risk of bankruptcy. We have identified that 1847 HOLDINGS is strong in growth and medium in dividend, profitability and weak in asset. Thus, it is important for investors to pay attention to key metrics such as cash flows and debt when considering investing in 1847 HOLDINGS. More…

Summary

1847 Holdings Inc. has recently secured an order worth $260K from a super market chain in Florida. This news has had a positive effect on the company’s stock price, which saw an increase on the same day. This is seen as a positive sign for investors, as it suggests that the company is doing well in its operations, and is likely to continue to perform steadily in the near term.

Additionally, 1847 Holdings has a diverse portfolio of offerings, and its commitment to meeting customer demands is clearly evident. As such, investors should consider 1847 Holdings as a viable long-term investment opportunity.

Recent Posts