Mondelez International Stock Fair Value Calculator – UBS Group Raises Target Price for Mondelez International to $78.00

May 2, 2023

Trending News 🌥️

Mondelez International ($NASDAQ:MDLZ) Inc. (NASDAQ: MDLZ) is an American multinational confectionery, food, and beverage company based in Illinois. Mondelez International’s portfolio includes several billion-dollar brands such as Oreo, belVita, Cadbury Dairy Milk, Milka, Nabisco and Trident. Recently, UBS Group raised their target price for Mondelez International from $72.00 to $78.00 in a research report. This increase in the target price reflects UBS Group’s confidence in the company’s growth potential and strong performance in recent quarters. UBS Group analysts are bullish on the stock and believe that Mondelez International has a bright future ahead with its global portfolio of well-known brands.

UBS Group analysts also noted that strong growth in developing markets such as India and China could further improve the stock’s prospects, especially if the company continues to invest in the expansion of its product offerings in these markets. It is important to note that stock prices are heavily influenced by fundamental and technical factors, and UBS Group’s upgrade of the target price for Mondelez International is not a guarantee that stock prices will actually reach that level. Nevertheless, the upgrade does provide investors with a more optimistic outlook for Mondelez International’s stock and gives them a better basis for making their own investment decisions.

Share Price

This lead to a significant jump in stock price for the company, which opened at $76.5 and closed at $77.2, up by 0.7% from the prior closing price of 76.7. This increase in target price is indicative of the company’s strong financial performance and potential growth opportunities in the near future. It also reflects investor confidence in the company’s strategies and long-term business objectives. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mondelez International. More…

| Total Revenues | Net Income | Net Margin |

| 32.9k | 3.94k | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mondelez International. More…

| Operations | Investing | Financing |

| 3.9k | -2.81k | -933 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mondelez International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 72.79k | 44.51k | 20.71 |

Key Ratios Snapshot

Some of the financial key ratios for Mondelez International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.1% | 2.1% | 15.1% |

| FCF Margin | ROE | ROA |

| 8.9% | 11.3% | 4.3% |

Analysis – Mondelez International Stock Fair Value Calculator

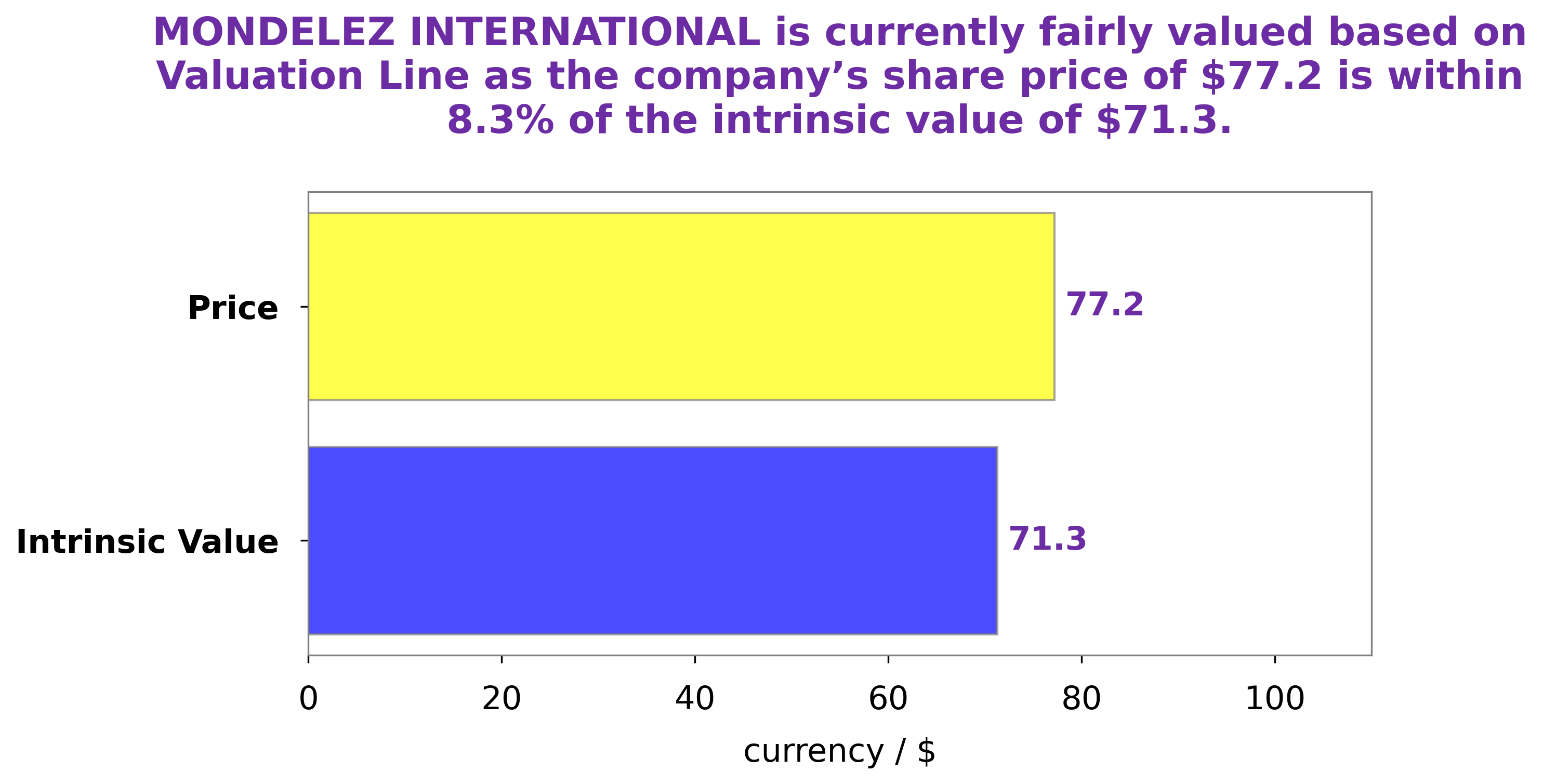

At GoodWhale, we have conducted a thorough analysis of MONDELEZ INTERNATIONAL‘s financials to determine its intrinsic value. Our proprietary Valuation Line has calculated the intrinsic value of a MONDELEZ INTERNATIONAL share to be around $71.3. Currently, MONDELEZ INTERNATIONAL stock is traded at $77.2, which is a fair price, although slightly overvalued by 8.3%. We recommend investors to carefully consider the stock and the potential risks associated before investing. More…

Peers

The company’s competitors include The Kraft Heinz Co, Kimberly-Clark Corp, Nestle SA, and other companies.

– The Kraft Heinz Co ($NASDAQ:KHC)

The Kraft Heinz Co is an American food company with a market cap of 46.76B as of 2022. The company has a Return on Equity of 3.49%. Kraft Heinz produces and markets food and beverage products, including condiments and sauces, cheese and dairy, meals, meats, refreshment beverages, coffee and other grocery products.

– Kimberly-Clark Corp ($NYSE:KMB)

Kimberly-Clark Corp is a consumer goods company with a market cap of 41.96B as of 2022. The company has a return on equity of 295.51% and is involved in the manufacturing and marketing of a range of products including but not limited to diapers, tissues, and paper towels. Kimberly-Clark has a strong presence in both developed and emerging markets and has a well-established distribution network. The company has a long history of dividend payments and has increased its dividend payout for 44 consecutive years.

– Nestle SA ($LTS:0RR6)

Nestle SA is a Swiss food and drink company. It is the largest food company in the world, measured by revenue and other metrics, since 2014. It has more than 2000 brands across all stages of the consumer journey, with a focus on nutrition, health, and wellness. The company’s products include baby food, bottled water, cereals, coffee, and dairy products. It also sells pet food, frozen food, and snacks.

Summary

UBS Group recently upgraded its target price for Mondelez International from $72.00 to $78.00. This is a positive sign for investors, as it implies that the stock could potentially be worth more than previously expected. The research report cited increased demand and the potential of Mondelez’s portfolio to drive higher returns as reasons for the upgrade.

This upgrade could be seen as a signal of confidence in the stock, and investors should look to capitalize on the potential upside. Other factors to consider when investing in Mondelez International include the company’s financial performance, its competitive position, and the outlook of the overall industry.

Recent Posts