Hershey Company Stock Fair Value Calculation – $HSY Price Talks: Hershey Company Captures Attention

June 12, 2023

🌥️Trending News

The Hershey Company ($NYSE:HSY), commonly known as Hershey’s, is an American manufacturer of confectionery, chocolate, and other snacks. When the Hershey Company’s stock price is discussed, people pay attention. The Hershey Company is a consistent performer, with strong sales and earnings growth for the past few years. This has made it an attractive stock to investors looking for a long-term investment. The Hershey Company has a history of innovation, with new products and lines being released regularly.

Recently, their products have been expanding to include organic and vegan alternatives, as well as products with reduced sugar and artificial sweeteners. This has enabled them to remain competitive in the ever-changing food industry. The Hershey Company continues to capture attention in the markets, as their stock price continues to rise. With their history of innovation and strong financial performance, it is no surprise that investors are looking to capitalize on the potential of this company.

Price History

Monday proved to be an interesting day for Hershey Company as the stock opened at $260.8 and closed at $259.5, a 0.5% decrease from the prior closing price of $260.9. Many investors and traders alike are paying attention to the stock performance of HERSHEY COMPANY, as it continues to be one of the most popular companies in the food and beverage industry. Analysts are keeping a close eye on the stock, as it will be important to watch to see where it goes next. Investors will need to determine if the stock will continue to decline or if it will recover from the 0.5% drop. Hershey Company is well-known for its various products ranging from chocolate bars to trail mix and many more.

With its long history and continued popularity, it is no surprise that the stock of HERSHEY COMPANY has been making waves in the market. It will be interesting to see where the stock goes from here and if the company can continue to grow despite its recent decline. Investors will be sure to keep a close eye on HERSHEY COMPANY in the coming weeks to see if the stock will make a comeback or continue to fall. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hershey Company. More…

| Total Revenues | Net Income | Net Margin |

| 10.74k | 1.7k | 17.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hershey Company. More…

| Operations | Investing | Financing |

| 2.43k | -811.73 | -1.5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hershey Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.11k | 7.65k | 16.93 |

Key Ratios Snapshot

Some of the financial key ratios for Hershey Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 12.0% | 20.0% |

| FCF Margin | ROE | ROA |

| 17.4% | 39.7% | 12.1% |

Analysis – Hershey Company Stock Fair Value Calculation

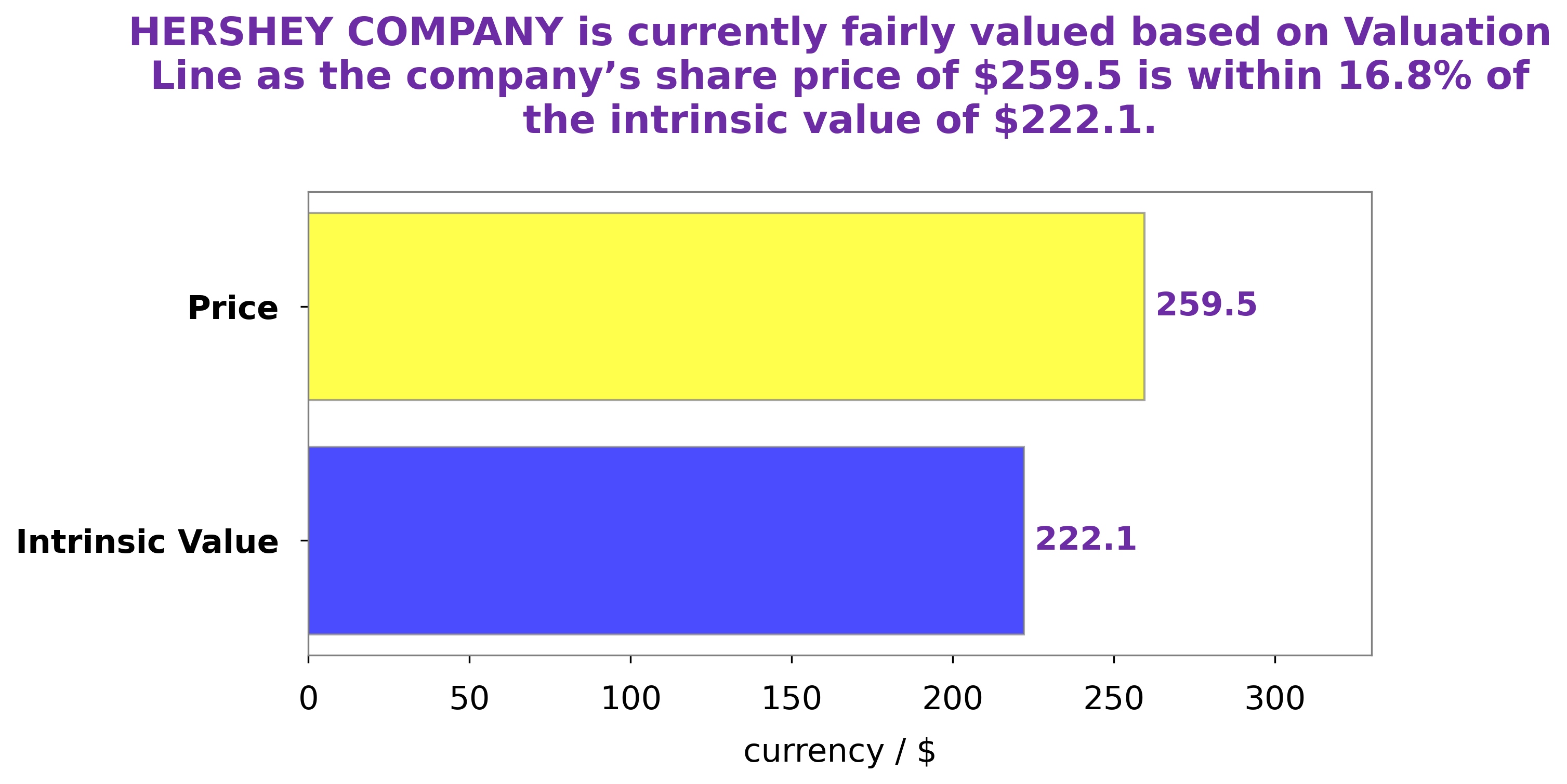

At GoodWhale, we have conducted an analysis of the wellbeing of HERSHEY COMPANY to provide an accurate assessment of its current state. Our proprietary Valuation Line has determined that the fair value of HERSHEY COMPANY share is around $222.1. However, currently the stock is being traded at $259.5, indicating that it is being fair price overvalued by 16.8%. This implies that investors have an optimistic opinion of the company and its performance in the market. More…

Peers

The Hershey Co. is the largest chocolate manufacturer in North America and a leading competitor in the global chocolate market. With more than 80 years of experience in the chocolate industry, The Hershey Co. has a strong reputation for quality and innovation. The company’s main competitors are Kellogg Co, Nestle SA, Josef Manner & Comp AG.

– Kellogg Co ($NYSE:K)

Kellogg Co is a multinational food manufacturing company headquartered in Battle Creek, Michigan, United States. Kellogg’s produces cereal and convenience foods, including cookies, crackers, toaster pastries, cereal bars, fruit-flavored snacks, frozen waffles, and veggie foods. The company’s products are marketed in over 180 countries.

– Nestle SA ($OTCPK:NSRGY)

Nestle is a Swiss food and beverage company with a market cap of 294.41 billion as of 2022. The company has a return on equity of 14.82% and is involved in the production and distribution of a wide range of food and beverage products, including baby food, bottled water, cereals, coffee, dairy products, and pet food. Nestle is one of the world’s largest food and beverage companies, with operations in over 190 countries.

– Josef Manner & Comp AG ($LTS:0F6A)

Joseph Manner & Company AG is a family-owned Austrian confectionery company headquartered in Vienna. It is one of the oldest companies in Austria, founded in 1860. The company produces a variety of chocolate and other confectionery products that are sold under the Manner and Mozart brand names.

Summary

Hershey Company (HSY) has a long history as a leading manufacturer and distributor of confectionery products. The company is highly profitable and regularly pays dividends to shareholders. Analysts anticipate continued growth for HSY, as the company has recently initiated investments in new product lines and international operations.

Its stock is known for being relatively stable, with minimal volatility, making it an attractive option for investors looking for a stable, long-term return. For those interested in investing in HSY, it is advised to keep up to date on earnings news and stock prices, as well as overall company performance.

Recent Posts