Why a Takeover of Stratasys Limited SSYS Could be Highly Rewarding

April 29, 2023

Trending News ☀️

Stratasys ($NASDAQ:SSYS) Limited (SSYS) is a recognized leader in the 3D printing and additive manufacturing industry. It offers its customers a wide range of products and services to enable them to create complex 3D parts and products with precision and accuracy. This has made the company an attractive acquisition target as a result of its expertise in the 3D printing market and its strong brand recognition. The company recently received an all-cash takeover bid in early March, making it the focus of much attention. The bid from Stratasys’ private equity partner was an indication of the confidence investors have in the company and its technology. Stratasys has the potential to become a major player in the 3D printing industry due to its strong financial position and its innovative product offerings. The company is well-positioned to benefit from the increasing demand for digital manufacturing technology, as well as its strong customer base. Moreover, Stratasys has also been investing heavily in its research and development initiatives, enabling it to remain ahead of its competitors. This has allowed it to maintain its competitive edge in the 3D printing market, while also providing customers with high-quality products and services.

Additionally, Stratasys has also established partnerships with some of the world’s leading companies to help them take advantage of its advanced 3D printing technology. For these reasons, a takeover of Stratasys Limited could be highly rewarding for investors. The company’s strong financial position, innovation and customer base make it an attractive acquisition target for any potential investors. What’s more, Stratasys continues to invest heavily in research and development, which ensures that it can continue to provide customers with the highest quality 3D printing technology. With all this in mind, investors may find that taking a stake in Stratasys could be highly lucrative.

Market Price

On Monday, STRATASYS LTD stock opened at $14.8 and closed at $14.9, up by 0.4% from prior closing price of 14.9. This increase in stock price could be an indication that investors are beginning to recognize the potential reward of a takeover of STRATASYS LTD. The company is a leader in the 3D printing industry, with a wide range of products and services that cater to a variety of industries. As a result, a takeover of the company could potentially yield high returns for investors, given the company’s presence in a growing industry. STRATASYS LTD also has several strategic partnerships that have enabled it to expand its reach and extend its product range. These partnerships provide additional opportunities for growth and could be leveraged to drive even greater reward from a takeover.

Additionally, the company’s strong financial position provides potential leverage to investors looking to capitalize on a takeover. With access to ready capital and an established customer base, STRATASYS LTD is in prime position to generate significant returns through a takeover. The company’s presence in a burgeoning industry, its range of products, strategic partnerships, and strong financial position all contribute to the potential for large returns on investment for a successful takeover. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stratasys Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 651.48 | -28.97 | -8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stratasys Ltd. More…

| Operations | Investing | Financing |

| -75.41 | -7.21 | -2.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stratasys Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.26k | 300.36 | 14.3 |

Key Ratios Snapshot

Some of the financial key ratios for Stratasys Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.8% | – | -8.8% |

| FCF Margin | ROE | ROA |

| -14.6% | -3.7% | -2.8% |

Analysis

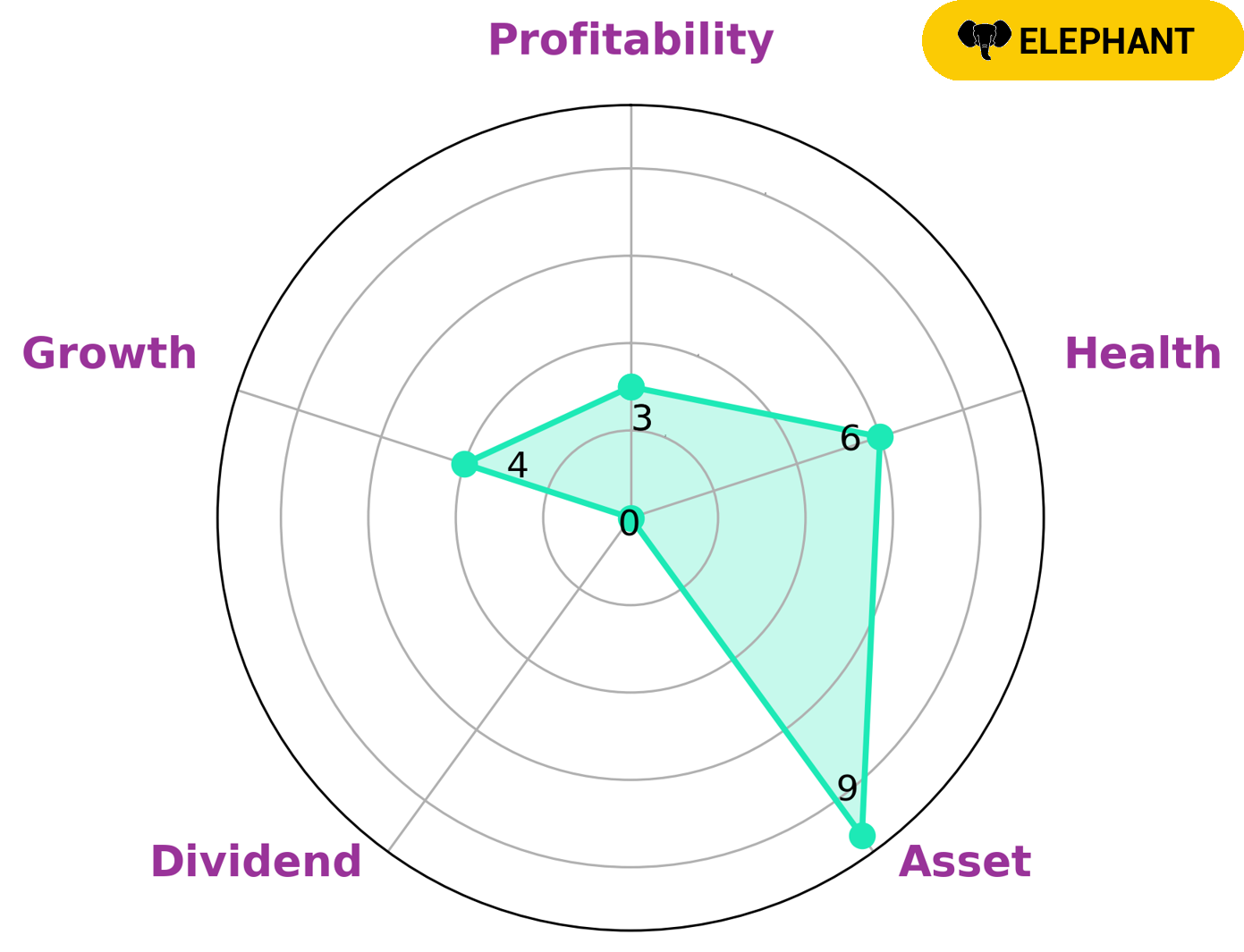

GoodWhale has conducted an analysis of STRATASYS LTD‘s wellbeing. According to the Star Chart, STRATASYS LTD is strong in assets, medium in growth and weak in dividend and profitability. With an intermediate health score of 6/10 with regard to its cashflows and debt, STRATASYS LTD might be able to safely ride out any crisis without the risk of bankruptcy. Further, STRATASYS LTD is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Investors looking to diversify their portfolio and have a relatively low-risk investment might be interested in this type of company. Those with a higher risk appetite may be more interested in investing in companies that are more profitable and have higher growth potential. Those with a patient approach may find value in investing in STRATASYS LTD as they have solid assets and may be able to ride out any crisis. More…

Peers

The company’s products are used in a variety of industries, including aerospace, automotive, healthcare, and consumer products. Stratasys Ltd has a wide range of competitors, including WEP Solutions Ltd, MGI Digital Graphic Technology SA, and HiTi Digital Inc.

– WEP Solutions Ltd ($BSE:532373)

WEP Solutions Ltd is an information technology company that provides a range of services, including software development, enterprise resource planning, and cloud computing. The company has a market cap of 839.61M as of 2022 and a Return on Equity of 6.32%.

– MGI Digital Graphic Technology SA ($OTCPK:FRIIF)

MGI Digital Graphic Technology SA is a Swiss manufacturer of digital printing and finishing solutions for the graphic arts industry. The company has a market capitalization of 184.68 million as of 2022 and a return on equity of 4.79%. MGI Digital Graphic Technology SA designs, manufactures, and markets a range of digital printing and finishing solutions, including printers, print heads, inks, and software. The company’s products are used in a variety of applications, such as signage, packaging, labels, and commercial printing.

– HiTi Digital Inc ($TWSE:3494)

HiTi Digital Inc is a publicly traded company with a market cap of 1B as of 2022. The company has a Return on Equity of -23.92%. HiTi Digital Inc is engaged in the business of digital textile printing, photo printing, and ID card printing.

Summary

StrataSys LTD is a 3-D printing and rapid prototyping solutions provider that has been a lucrative takeover target recently due to its attractive financials. With a strong balance sheet and low debt levels, the company has plenty of financial flexibility to pursue future growth opportunities. Stratasys’ diverse and high-margin products give it a competitive edge in the 3-D printing field and make it attractive as an acquisition target, while its focus on R&D ensures that the company can stay ahead of its peers in terms of innovation. Furthermore, Stratasys has a strong customer base, with many repeat customers and long-term contracts.

Stratasys has also performed well in terms of cash flow generation and dividend payments, making it an attractive investment for investors. All these factors make Stratasys an attractive takeover target for investors looking for a reliable and financially sound company.

Recent Posts