Super Micro Computer Reports Record Q2 Non-GAAP EPS, Beating Estimates by $0.23

February 1, 2023

Trending News ☀️

Super Micro Computer ($NASDAQ:SMCI), Inc. (SMCI) reported its Q2 Non-GAAP EPS of $3.26, surpassing analysts’ estimates by $0.23. The company is a global leader in high-performance, high-efficiency server, storage technology and green computing. It provides end-to-end green computing solutions to data center, cloud computing, enterprise IT, big data, high performance computing, and embedded markets. It reported robust demand across all of its product categories, including server boards and chassis, storage systems and server systems. This strong cash position will help the company invest in research and development to better serve its customers.

In addition, the company’s cost reduction initiatives are continuing to yield results. The company is also continuing to expand its presence in emerging markets such as India, China and Southeast Asia. Overall, Super Micro Computer Inc. reported strong results in its second quarter and is well-positioned to continue its growth trajectory in the coming quarters. Investors should remain bullish on the stock as the company has strong fundamentals and is well-positioned to benefit from the growing demand for high-performance, high-efficiency server technology and green computing solutions.

Market Price

This news has been met with positive sentiment, as the stock opened at $72.6 and closed at $72.3, up by 0.3% from the previous closing price of $72.1. The strong earnings report is mostly due to Super Micro Computer Co’s effective cost controls and higher sales of their products. This was mostly due to the increased demand for their products, which has allowed them to charge higher prices for their goods and services. Super Micro Computer Co.’s strong performance in the second quarter was also helped by a relatively stable global economy and strong demand for their products. The company also noted that they have seen a steady rise in their customer base and an increase in their financial performance over the past few quarters.

In addition, Super Micro Computer Co.’s CEO said that they are confident that they can maintain their current levels of growth in the future and that they are planning to invest further in research and development to ensure that their products remain at the cutting edge of technology. Overall, Super Micro Computer Co’s strong financial performance in the second quarter is an encouraging sign for the company’s future prospects. With continued demand for their products, investments into research and development, and cost controls in place, the company should continue to experience strong financial performance in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMCI. More…

| Total Revenues | Net Income | Net Margin |

| 6.02k | 444.14 | 7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMCI. More…

| Operations | Investing | Financing |

| 7.36 | -45.13 | 7.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMCI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.3k | 1.68k | 27.25 |

Key Ratios Snapshot

Some of the financial key ratios for SMCI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.8% | 73.0% | 9.0% |

| FCF Margin | ROE | ROA |

| -0.4% | 22.2% | 10.3% |

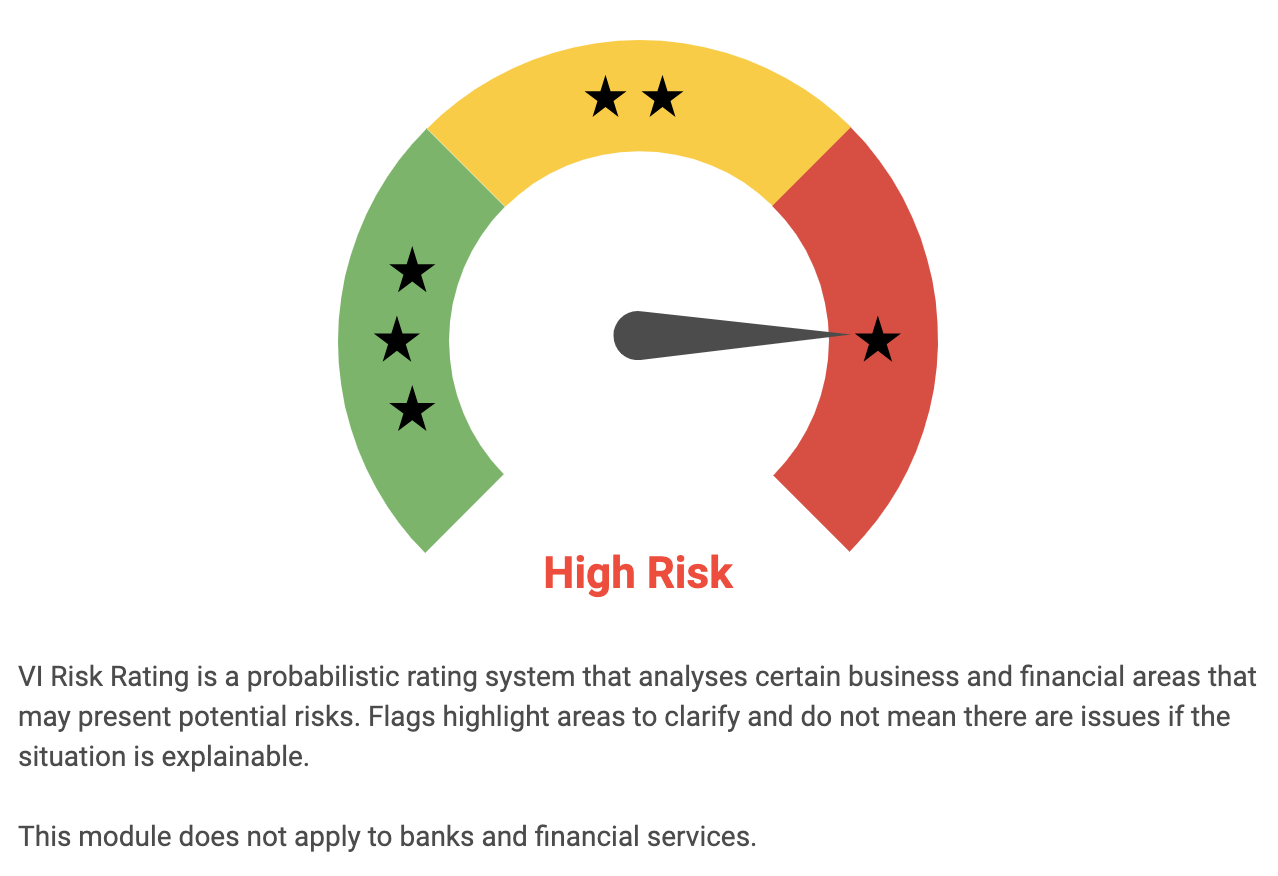

VI Analysis

For investors looking to analyse the long term potential of SUPER MICRO COMPUTER, the VI App has made the task much easier. By assessing the company’s fundamentals, the app gives the company a VI Risk Rating of ‘High’. This indicates that while the company has strong potential, it is also a high risk investment in terms of financial and business aspects. The app has also detected two risk warnings in non-financial and financial journals. These warnings highlight certain issues concerning the company, such as its reliance on suppliers and its debt level. Such insights can be invaluable for investors when making decisions about the company. Investors can access all this information and more by registering on vi.app. It is an essential tool for those looking to get an accurate picture of SUPER MICRO COMPUTER’s future prospects. With its help, investors can make well informed decisions about whether or not to invest in the company. More…

VI Peers

In the computer technology industry, there is intense competition between Super Micro Computer Inc and its competitors NetApp Inc, Quantum Corp, and Peraso Inc. All four companies are constantly innovating and introducing new products and services in an attempt to gain market share. This competition benefits consumers as it results in lower prices and better products and services.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American computer storage and data management company headquartered in Sunnyvale, California. It was founded in 1992 by Dave Hitz, Michael Malcolm, and James Lau. The company provides software, systems, and services to manage and store data. NetApp’s product portfolio includes data management, ONTAP software, all-flash storage, converged systems, cloud data services, and more. As of 2022, NetApp has a market cap of 13.54B and a ROE of 100.42%.

– Quantum Corp ($NASDAQ:QMCO)

Quantum Corporation is a data storage company that provides solutions for capturing, storing, managing, and protecting digital information. The company has a market cap of 119.09M as of 2022 and a return on equity of 16.28%. Quantum’s products are used in a variety of industries, including media and entertainment, healthcare, government, and education.

– Peraso Inc ($NASDAQ:PRSO)

Peraso Inc is a Canadian technology company that develops and manufactures advanced wireless products using 60 GHz millimeter wave technology. The company has a market cap of 32.31M as of 2022 and a Return on Equity of -24.88%. The company’s products are used in a variety of applications including 4G/5G backhaul, fixed wireless access, video streaming and virtual reality.

Summary

Super Micro Computer has reported record second quarter non-GAAP earnings per share (EPS), beating analyst estimates by $0.23. This is a positive sign for investors, as it shows that the company is successfully executing its business strategies. Additionally, the positive news sentiment surrounding the company should help to further boost investor confidence. As such, investors should consider adding Super Micro Computer to their portfolio as it appears to be a good opportunity for potential growth.

Recent Posts