SUPER MICRO COMPUTER Announces Plans to Go Public with Common Stock Offering

December 2, 2023

☀️Trending News

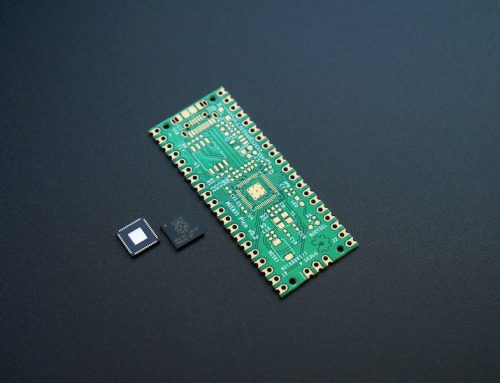

Super Micro Computer ($NASDAQ:SMCI), a leading provider of high-performance server solutions, has announced its intention to make a public offering of its common stock. This move marks the company’s first foray into the public arena, and represents an exciting opportunity for investors to purchase stock in one of the tech industry’s most innovative companies. The company provides reliable, energy-efficient servers and components for enterprise, cloud, data center, and embedded applications. Super Micro’s product portfolio also includes workstations, storage solutions, and networking equipment.

With a proven track record of product innovation and industry-leading performance, Super Micro Computer is well-positioned to capture a larger share of the public market. The company has continued to expand its presence in the tech industry and is now looking to give investors the opportunity to benefit from its success. The initial public offering will provide an excellent opportunity for investors to gain exposure to Super Micro’s future growth prospects.

Share Price

On Thursday, SUPER MICRO COMPUTER, an established computer technology company, announced plans to go public with a common stock offering. As a result of this announcement, the stock opened at $289.9 and closed at $273.5, representing a 4.9% decrease from its prior closing price of $287.6. This offering is aimed at providing the public with an opportunity to invest in the company, which has seen steady growth over the last several years in the computer hardware market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMCI. More…

| Total Revenues | Net Income | Net Margin |

| 7.39k | 612.58 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMCI. More…

| Operations | Investing | Financing |

| 620.46 | -36.37 | -277.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMCI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.1k | 1.93k | 40.93 |

Key Ratios Snapshot

Some of the financial key ratios for SMCI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.8% | 104.7% | 9.7% |

| FCF Margin | ROE | ROA |

| 8.0% | 21.6% | 10.9% |

Analysis

As GoodWhale conducted an analysis of SUPER MICRO COMPUTER’s wellbeing, we observed that the company was strong in asset, growth, and profitability, and weak in dividend according to its Star Chart. Based on this assessment, we classified SUPER MICRO COMPUTER as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. As such, investors interested in long-term, stable investments may be attracted to this type of company. Further, SUPER MICRO COMPUTER has a high health score of 8/10 with regard to its cash flows and debt. This indicates that the company is able to sustain its future operations in times of crisis. More…

Peers

In the computer technology industry, there is intense competition between Super Micro Computer Inc and its competitors NetApp Inc, Quantum Corp, and Peraso Inc. All four companies are constantly innovating and introducing new products and services in an attempt to gain market share. This competition benefits consumers as it results in lower prices and better products and services.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American computer storage and data management company headquartered in Sunnyvale, California. It was founded in 1992 by Dave Hitz, Michael Malcolm, and James Lau. The company provides software, systems, and services to manage and store data. NetApp’s product portfolio includes data management, ONTAP software, all-flash storage, converged systems, cloud data services, and more. As of 2022, NetApp has a market cap of 13.54B and a ROE of 100.42%.

– Quantum Corp ($NASDAQ:QMCO)

Quantum Corporation is a data storage company that provides solutions for capturing, storing, managing, and protecting digital information. The company has a market cap of 119.09M as of 2022 and a return on equity of 16.28%. Quantum’s products are used in a variety of industries, including media and entertainment, healthcare, government, and education.

– Peraso Inc ($NASDAQ:PRSO)

Peraso Inc is a Canadian technology company that develops and manufactures advanced wireless products using 60 GHz millimeter wave technology. The company has a market cap of 32.31M as of 2022 and a Return on Equity of -24.88%. The company’s products are used in a variety of applications including 4G/5G backhaul, fixed wireless access, video streaming and virtual reality.

Summary

Super Micro Computer recently announced its proposed public offering of common stock. This move has caused the stock price to dip slightly, and investors are now wondering if it is a good opportunity to invest in the company. Analysts are taking a closer look at the financials of Super Micro Computer to assess the potential upside and downside of such an investment.

They are looking closely at the company’s recent financial performance, its current balance sheet, debt levels, and future outlook in order to determine if and when to invest. Ultimately, it is up to individual investors to decide whether Super Micro Computer’s stock is a good buy.

Recent Posts