SMCI Intrinsic Value Calculator – Super Micro Computer: AI-Friendly Computing at an Affordable Price

June 12, 2023

☀️Trending News

Super Micro Computer ($NASDAQ:SMCI) is an AI-enabled and cost-effective option for those looking to take advantage of the power of modern computing. The company provides cutting-edge solutions for businesses and individuals looking to get the most out of their computing experience. With Super Micro Computer, users can experience the power of Artificial Intelligence (AI) with a range of servers, motherboards, and other hardware to choose from. Each component is built for maximum efficiency and performance and is priced to provide optimum value for customers. Based in San Jose, California, they offer a wide range of products and services to meet the needs of consumers, businesses, and government organizations. Their products are designed to be reliable and high-performance, offering top-notch quality and a variety of options.

With an extensive line of servers, motherboards, storage, networking, and other hardware, Super Micro Computer has something for everyone. In addition to their hardware offerings, Super Micro Computer also provides a wide range of services, including AI-enabled consulting services and custom solutions for specialized applications. They understand that each customer has unique needs, so they offer tailored solutions that are designed to help customers get the most out of their computing experience. With affordable pricing and top-notch customer service, Super Micro Computer makes it easy for anyone to take advantage of the powerful capabilities of modern computing.

Market Price

Super Micro Computer (SUPER MICRO COMPUTER) has been making waves in the computing world with its cutting-edge technology and AI-friendly computing platform. On Tuesday, its stock opened at $221.0 and closed at $233.2, an increase of 4.2% from its prior closing price of 223.7. This surge in stock prices is a testament to the trust that investors have in Super Micro Computer to deliver on its promise of delivering an affordable computing solution that is tailored specifically for artificial intelligence applications. Super Micro Computer’s products are designed to meet the ever-evolving needs of the AI sector, with its high performance and low power consumption.

This makes it a great choice for companies looking to maximize their computing power while minimizing costs. Furthermore, Super Micro Computer also offers comprehensive customer service and technical support to ensure that customers are able to get the most out of their investment. In short, Super Micro Computer is delivering on its promise of providing an affordable, AI-friendly computing platform that is tailored specifically for the ever-evolving needs of the AI industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMCI. More…

| Total Revenues | Net Income | Net Margin |

| 6.57k | 587.25 | 8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMCI. More…

| Operations | Investing | Financing |

| 647.78 | -39.64 | -490.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMCI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.19k | 1.42k | 33.53 |

Key Ratios Snapshot

Some of the financial key ratios for SMCI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.9% | 87.4% | 10.7% |

| FCF Margin | ROE | ROA |

| 9.7% | 24.6% | 13.8% |

Analysis – SMCI Intrinsic Value Calculator

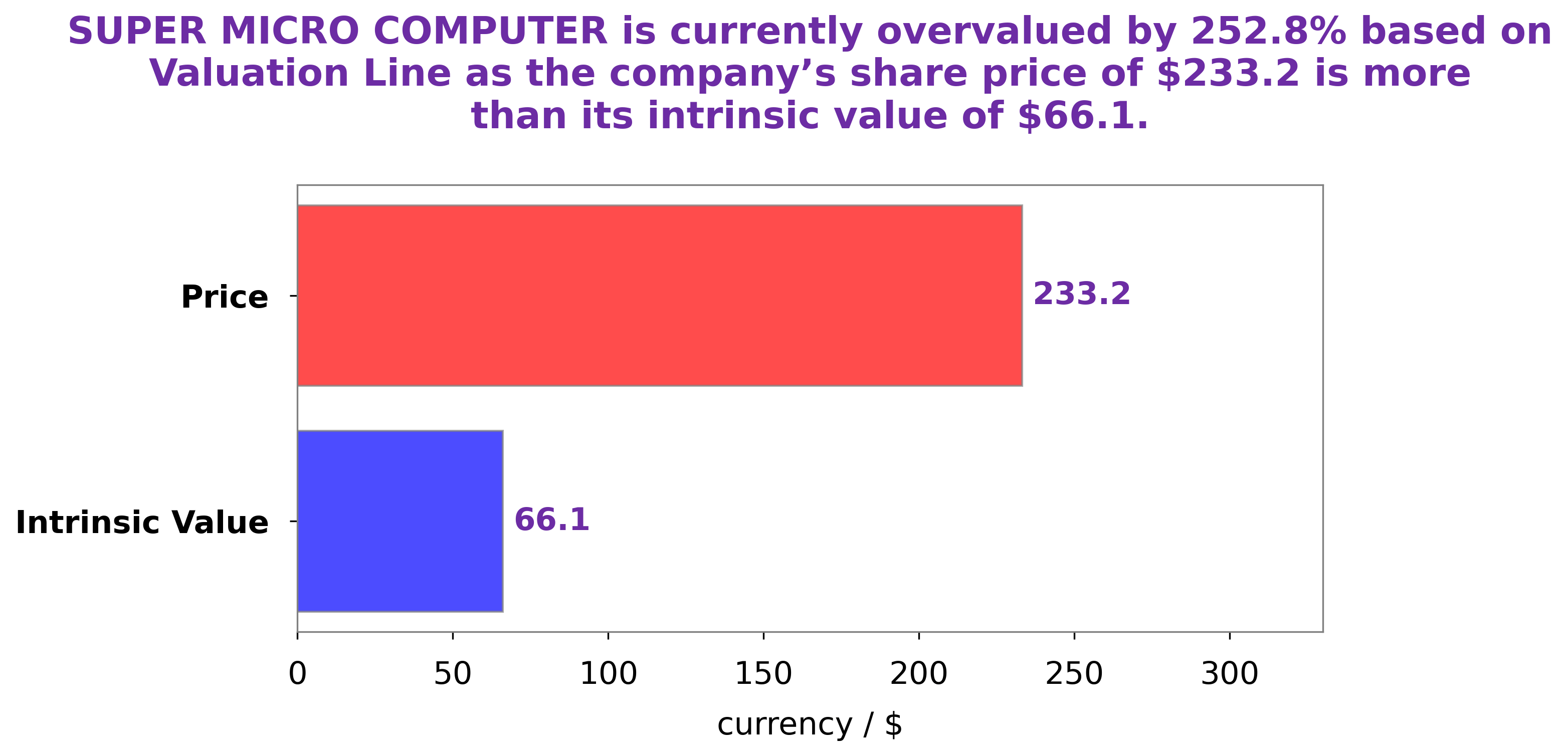

At GoodWhale, we have evaluated the financials of SUPER MICRO COMPUTER and come to the conclusion that the fair value of its share is around $66.1. This was calculated using our proprietary Valuation Line, which takes into account factors such as projected future cash flows, present value of future earnings and other quantitative and qualitative assessment. As of today, SUPER MICRO COMPUTER stock is trading at $233.2, which is overvalued by 252.8%. While this is a good thing for investors who already own the stock, it also indicates that there may be potential downside risk in the short term. In the long term, however, if our Valuation Line proves to be accurate, then this could provide good opportunities for potential investors. More…

Peers

In the computer technology industry, there is intense competition between Super Micro Computer Inc and its competitors NetApp Inc, Quantum Corp, and Peraso Inc. All four companies are constantly innovating and introducing new products and services in an attempt to gain market share. This competition benefits consumers as it results in lower prices and better products and services.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American computer storage and data management company headquartered in Sunnyvale, California. It was founded in 1992 by Dave Hitz, Michael Malcolm, and James Lau. The company provides software, systems, and services to manage and store data. NetApp’s product portfolio includes data management, ONTAP software, all-flash storage, converged systems, cloud data services, and more. As of 2022, NetApp has a market cap of 13.54B and a ROE of 100.42%.

– Quantum Corp ($NASDAQ:QMCO)

Quantum Corporation is a data storage company that provides solutions for capturing, storing, managing, and protecting digital information. The company has a market cap of 119.09M as of 2022 and a return on equity of 16.28%. Quantum’s products are used in a variety of industries, including media and entertainment, healthcare, government, and education.

– Peraso Inc ($NASDAQ:PRSO)

Peraso Inc is a Canadian technology company that develops and manufactures advanced wireless products using 60 GHz millimeter wave technology. The company has a market cap of 32.31M as of 2022 and a Return on Equity of -24.88%. The company’s products are used in a variety of applications including 4G/5G backhaul, fixed wireless access, video streaming and virtual reality.

Summary

Super Micro Computer (SMC) has recently seen its stock price spike upward as investors have taken notice of its AI-optimized products. SMC’s focus on AI technologies has allowed it to offer solutions that are tailored to customer needs, while still being priced competitively. This combination of quality and value has made SMC an attractive investment opportunity.

Analyses from different sources suggest that SMC’s AI innovations have created new interest in the company and its stock, making it an appealing option for those looking to invest in the tech sector. With its strong performance and attractive price point, it is likely that SMC will continue to draw in more investors in the future.

Recent Posts