Roland Dg dividend yield – Roland DG Corp Declares 55.0 Cash Dividend

June 10, 2023

🌥️Dividends Yield

On June 1 2023, Roland DG Corp declared a cash dividend of 55.0 JPY per share. This marks the fourth consecutive year that ROLAND DG ($TSE:6789) has distributed an annual dividend, with the three previous years being 130.0, 130.0 and 100.0 JPY respectively. This results in dividend yields of 5.03%, 5.03% and 5.73% for 2021, 2022 and 2023 respectively, resulting in an average dividend yield of 5.26%. For those interested in dividend stocks, ROLAND DG could be a viable option to consider, with an ex-dividend date of June 29 2023.

This cash dividend payout is seen as a sign of confidence in the company from management, and a move to please investors who are looking for reliable dividend payments. As such, ROLAND DG should be considered by any investor who is looking to add a potential dividend paying stock to their portfolio.

Price History

On Thursday, ROLAND DG Corporation announced it would be declaring a cash dividend of 55.0. The company’s stock opened at JP¥3270.0 and closed at JP¥3225.0, representing a decrease of 1.1% from the previous closing price of 3260.0. The dividend comes at a time when ROLAND DG’s finances are sound, with the company continuing to perform well in the marketplace. The company has seen strong growth over recent years, and this dividend is a signal that it expects to remain profitable in the future as well.

By issuing a dividend, ROLAND DG is further demonstrating its commitment to return value to its shareholders. This payment reinforces the company’s commitment to continuously return profits to investors and should serve as a reminder of the trust placed in ROLAND DG’s management. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Roland Dg. More…

| Total Revenues | Net Income | Net Margin |

| 51.83k | 4.34k | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Roland Dg. More…

| Operations | Investing | Financing |

| 2.68k | -2.72k | -2.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Roland Dg. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 46.72k | 14.77k | 2.69k |

Key Ratios Snapshot

Some of the financial key ratios for Roland Dg are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 38.3% | 11.6% |

| FCF Margin | ROE | ROA |

| -0.3% | 11.7% | 8.1% |

Analysis

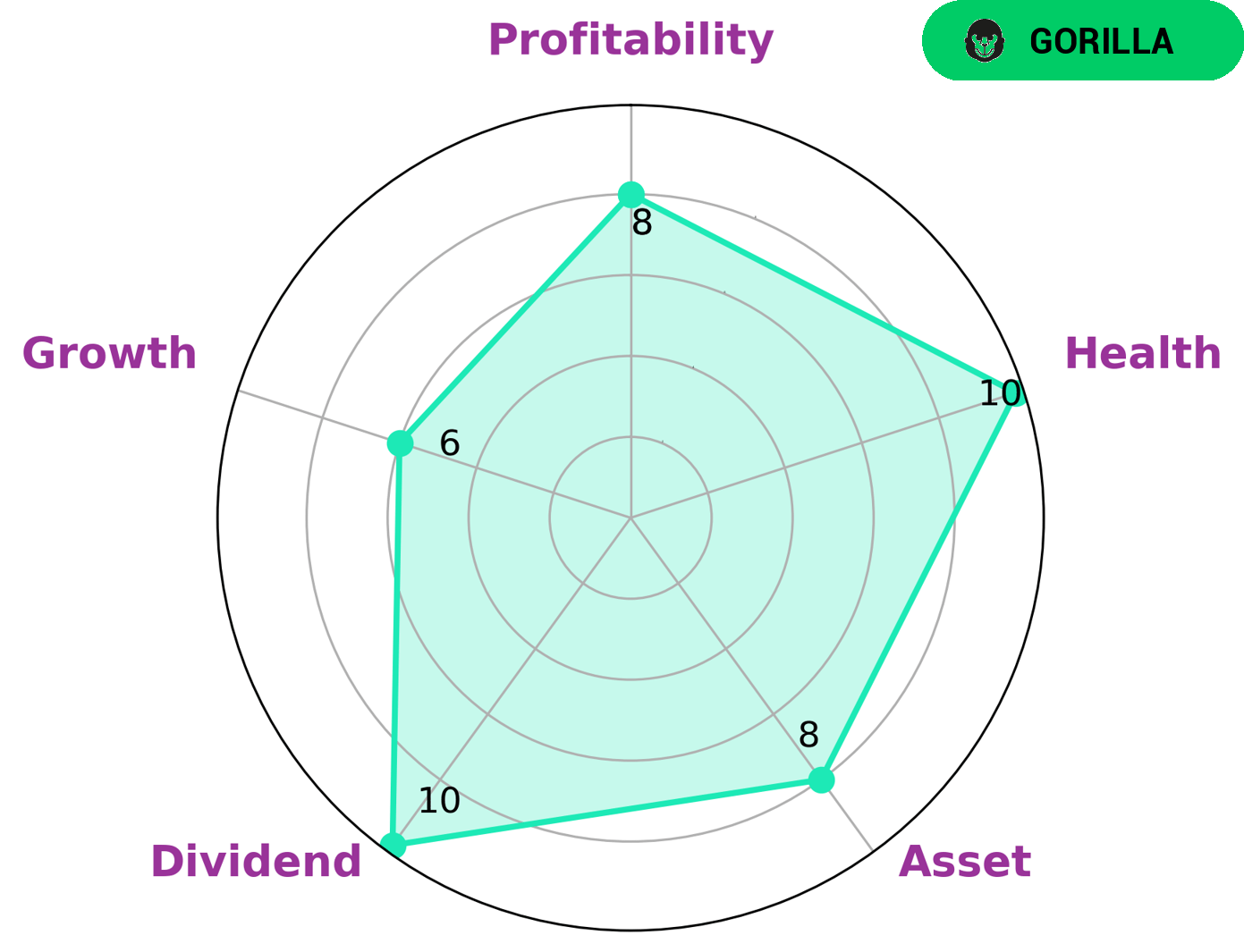

At GoodWhale, we conducted an analysis of ROLAND DG‘s fundamentals. We used our Star Chart to assess the company. The results indicated that ROLAND DG is strong in assets, dividends, and profitability, and medium in growth. Moreover, ROLAND DG had a high health score of 10/10 according to our cashflows and debt analysis. This means that the company is capable of safely riding out any economic crisis without the risk of bankruptcy. Furthermore, our analysis concluded that ROLAND DG is a ‘gorilla’ type of company, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. We believe that ROLAND DG would be attractive to investors who are looking for sound, long-term investments. The combination of its strong fundamentals and competitive advantage makes it an ideal target for those looking to invest in a high-quality company. More…

Peers

Its competitors include HiTi Digital Inc, MGI Digital Graphic Technology SA, and Elecom Co Ltd, all of which offer their own unique printing and production solutions. Together, these companies are at the forefront of innovation in the industry.

– HiTi Digital Inc ($TWSE:3494)

HiTi Digital Inc is a Taiwan-based company that designs, manufactures, and markets digital imaging products. The company’s products include digital cameras, inkjet photo printers, and other photo accessories. As of 2023, HiTi Digital Inc had a market capitalization of 975.88 million USD. Return on Equity (ROE), a measure of profitability, was -35.52%, indicating that the company was not able to generate a return for its shareholders from its equity investments. Despite these unfavorable numbers, HiTi Digital Inc is still well-recognized and respected in the industry as a provider of quality products and services.

– MGI Digital Graphic Technology SA ($BER:2EI)

MGI Digital Graphic Technology SA is a French digital printing and imaging technology company that designs, manufactures, and distributes digital presses and other graphic printing solutions. The company has a market cap of 144.92M as of 2023, which indicates the market’s belief in its sound financials and potential for growth. Moreover, MGI Digital Graphic Technology SA has a Return on Equity (ROE) of 4.63%, which is a measure of profitability that shows how well the company is able to generate returns on its shareholders’ investments. This high profitability indicates that the company is able to generate positive returns for its shareholders.

– Elecom Co Ltd ($TSE:6750)

Elecom Co Ltd is a Japanese manufacturer and marketer of consumer electronics. The company produces a wide variety of products such as office automation equipment, electronic dictionaries, digital cameras, mobile phones, computer peripherals, and home appliances. As of 2023, Elecom Co Ltd has a market cap of 118.09B, making it the largest consumer electronics company in Asia. Additionally, its Return on Equity (ROE) of 9.49% indicates that the company has been successfully generating returns on its invested equity capital.

Summary

Investing in ROLAND DG can be attractive due to its consistent dividends. Over the past three years, the company has distributed an annual dividend per share of 130.0, 130.0 and 100.0 JPY, respectively. This translates into dividend yields of 5.03%, 5.03% and 5.73% for 2021, 2022 and 2023 respectively, with an average dividend yield of 5.26%. Such a high yield in comparison to other available investments makes ROLAND DG an attractive option for investors looking for steady returns.

Recent Posts