Dell Technologies Stock Intrinsic Value – Adviser Investments LLC Raises Stake in Dell Technologies

December 24, 2023

🌥️Trending News

Adviser Investments LLC has recently upped its stake in Dell Technologies ($NYSE:DELL) Inc., a leading, publicly traded technology company. Dell Technologies specializes in offering an extensive range of technology products and services, including storage, networking, software, servers, security, and mobility solutions. The company’s portfolio of products and services encompasses both the consumer and business segments. Dell Technologies also provides cloud computing services and end-to-end IT infrastructure solutions for businesses. Dell Technologies has been a leader in the technology industry for many years, consistently providing innovative solutions for customers.

The company is one of the most trusted and respected names in the industry, thanks to its superior customer service, market-leading products, and reliable after-sales support. As such, it has become a popular choice among businesses and consumers alike. With Adviser Investments LLC increasing its stake in Dell Technologies Inc., there is no doubt that the company will continue to be a major force in the technology sector for years to come.

Share Price

Adviser Investments LLC recently raised its stake in Dell Technologies Inc. In the latest stock market update, on Friday, DELL TECHNOLOGIES stock opened at $75.7 and closed at the same price, up by 0.5% from last closing price of 75.3. This marks a significant move towards investing in Dell Technologies Inc, signifying Adviser Investments LLC’s confidence in the company’s performance in the stock market. The increase of its stake in DELL TECHNOLOGIES is an indication that the company is still seen as a lucrative investment by many investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dell Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 91.15k | 2.67k | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dell Technologies. More…

| Operations | Investing | Financing |

| 9.86k | -2.91k | -3.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dell Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 83.26k | 85.83k | -3.74 |

Key Ratios Snapshot

Some of the financial key ratios for Dell Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.4% | 10.0% | 5.5% |

| FCF Margin | ROE | ROA |

| 7.8% | -115.8% | 3.8% |

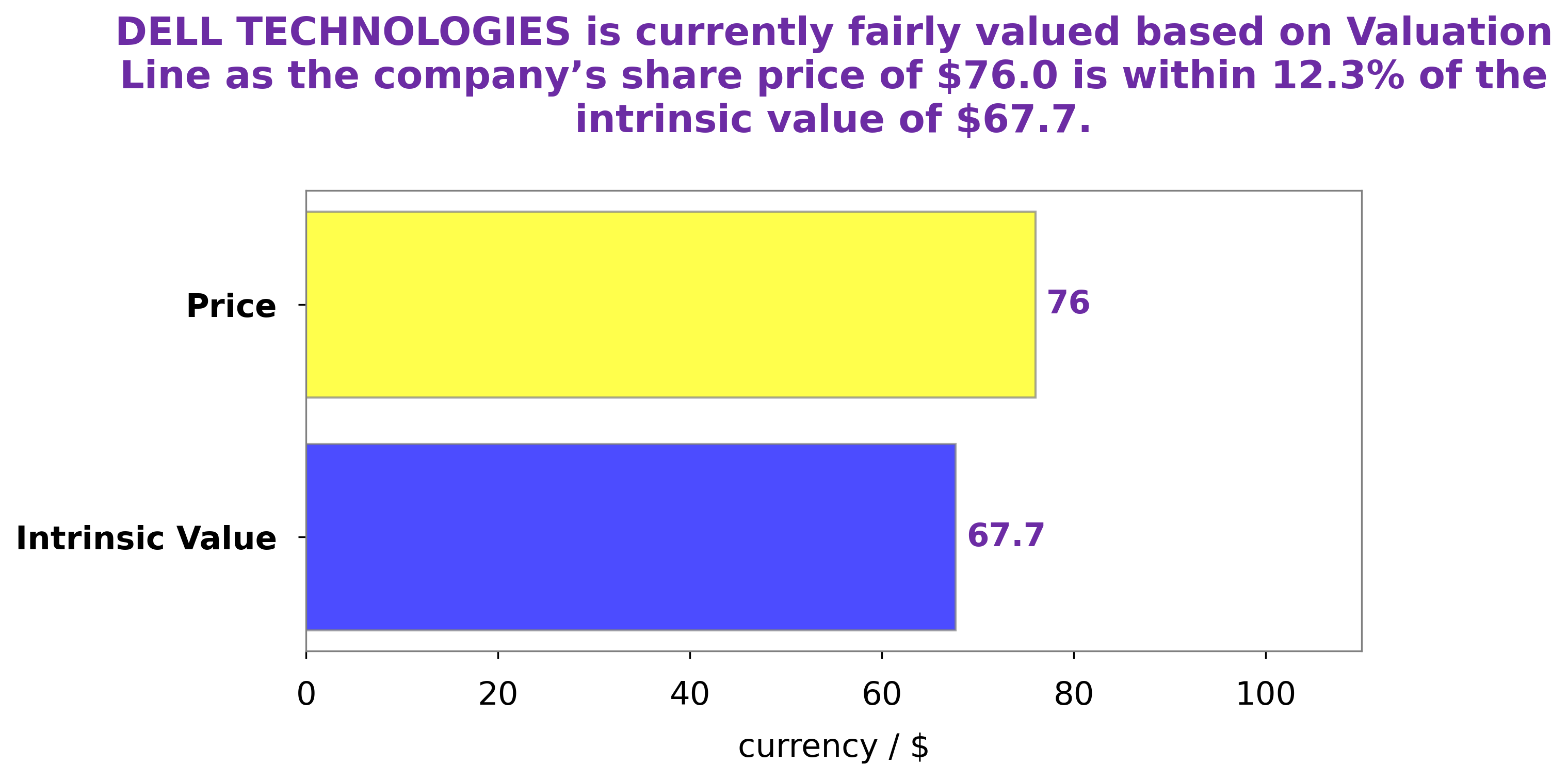

Analysis – Dell Technologies Stock Intrinsic Value

GoodWhale has conducted an analysis of DELL TECHNOLOGIES‘ wellbeing. Our proprietary Valuation Line showed us that the fair value of DELL TECHNOLOGIES’ share is around $67.5. However, when we looked at the stock’s current price, we noticed that it is traded at $75.7, which is a fair price that is overvalued by 12.1%. More…

Peers

In the technology industry, competition is fierce. Companies are constantly trying to one-up each other with new products and features. This is especially true for Dell Technologies Inc and its competitors: VMware Inc, NetApp Inc, and HP Inc. These companies are constantly trying to outdo each other, and it makes for an exciting and ever-changing landscape.

– VMware Inc ($NYSE:VMW)

VMWare Inc. is a publicly traded software company headquartered in Palo Alto, California. It was founded in 1998 and provides virtualization software for x86-64 computers. VMWare’s primary product is its hypervisor, which creates virtual machines on which other operating systems can be installed. VMWare also offers cloud computing, networking, and security products.

VMWare has a market capitalization of $45.57 billion as of 2022. The company’s return on equity is -1025.37%. VMWare provides virtualization software for x86-64 computers. The company’s primary product is its hypervisor, which creates virtual machines on which other operating systems can be installed. VMWare also offers cloud computing, networking, and security products.

– NetApp Inc ($NASDAQ:NTAP)

NetApp, Inc. is a leading data management, cloud storage, and data backup company. It has a market cap of 13.54B as of 2022 and a ROE of 100.42%. The company’s products and services are used by major corporations and governments around the world.

– HP Inc ($NYSE:HPQ)

HP Inc is a technology company that provides personal computing and other services. The company has a market cap of $25.64 billion and a return on equity of -225.66%. HP Inc is a leading provider of personal computing and other technology services. The company offers a wide range of products and services, including PCs, printers, scanners, and more. HP Inc is a publicly traded company listed on the New York Stock Exchange.

Summary

Adviser Investments LLC recently lifted their holdings of Dell Technologies Inc. This investment firm has increased its position in the leading global technology infrastructure and services provider. The move shows a confidence in Dell’s potential to generate high returns and growth potential. Dell’s stock has been performing strongly in recent months due to its increasing presence in cloud computing, storage, and other data-driven markets. This investment also shows the firm’s confidence in Dell’s ability to use its vast resources to expand into new markets and enhance its current offerings.

Additionally, Dell has continued to make strategic acquisitions, allowing them to further benefit from market trends. As such, Adviser Investments LLC continues to express optimism for Dell Technologies future returns.

Recent Posts