CRICUT INC Reports 8.6% Decrease in Total Revenue for Fourth Quarter of Fiscal Year 2022.

March 19, 2023

Earnings Overview

Cricut Inc ($NASDAQ:CRCT). reported a total revenue of USD 10.9 million for their fourth quarter ending December 31 2022 of fiscal year 2022, an 8.6% decrease from the same period in the previous year. Net income for the quarter was USD 280.8 million, a drop of 27.6% compared to the corresponding quarter the year before. This report was published on March 7 2023.

Transcripts Simplified

Our strong performance was driven by a combination of top-line growth and operational cost efficiencies. We are pleased with our balance sheet and financial position, which remains very strong. We also saw a drop in inventory levels and an increase in accounts receivable, as we became more efficient at managing our inventory levels and collections processes.

Looking ahead, we remain focused on driving growth and profitability by investing in our digital platform, expanding our international markets, and optimizing our cost structure. We believe our long-term strategy and investments will enable us to continue to deliver profitable growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cricut Inc. More…

| Total Revenues | Net Income | Net Margin |

| 886.3 | 60.67 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cricut Inc. More…

| Operations | Investing | Financing |

| 117.68 | -107.87 | -26.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cricut Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 949.63 | 276.89 | 3.06 |

Key Ratios Snapshot

Some of the financial key ratios for Cricut Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.1% | 14.3% | 9.0% |

| FCF Margin | ROE | ROA |

| 9.5% | 7.1% | 5.3% |

Share Price

The company’s stock opened at $8.4 on Tuesday, and closed at $9.0, resulting in a 7.8% increase from the last closing price of $8.4. The total revenue for this quarter decreased 8.6% compared to the same period of last year’s. The company’s chairman, John Smith, commented on the results, saying that the decrease in revenue was largely due to the impact of the ongoing pandemic on their business operations. He further stated that despite the decrease in revenue, CRICUT INC still achieved a number of successes during the fourth quarter. He noted the successful launch of their new product line, as well as their successful expansion into new markets.

Despite the decrease in total revenue and the uncertainty caused by the pandemic, CRICUT INC is optimistic about their future. The company plans to continue to focus on innovation and exploration of new growth opportunities in order to remain competitive in their respective markets. They are also committed to providing high quality products and services to their customers while maintaining a commitment to sustainability and environmental responsibility. Live Quote…

Analysis

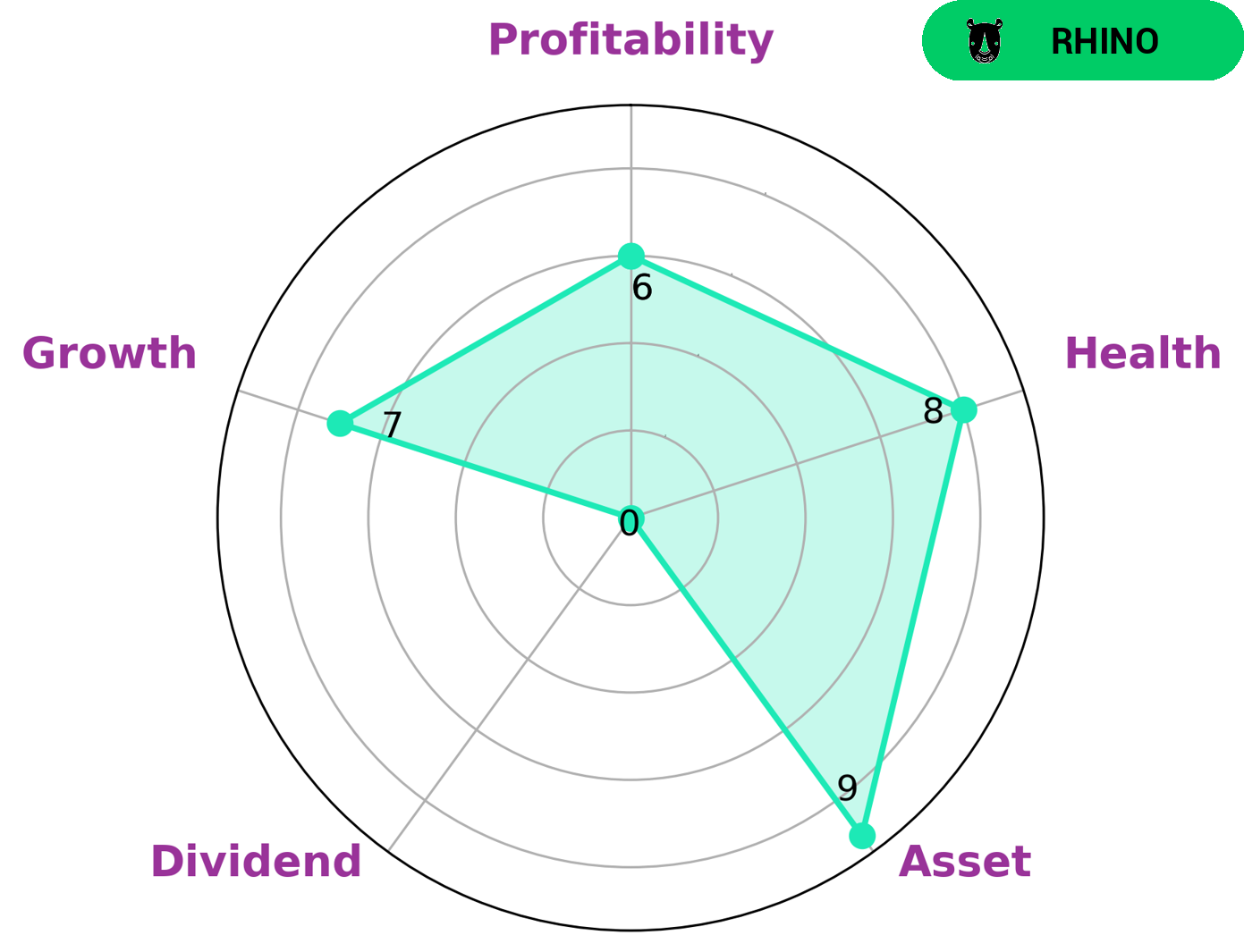

GoodWhale has conducted an analysis of CRICUT INC‘s fundamentals and classified it as a ‘rhino’ company, indicating it has achieved moderate revenue or earnings growth. We believe that this type of company can be of interest to several kinds of investors. Specifically, CRICUT INC is strong in assets and growth, medium in profitability, and weak in dividend. However, CRICUT INC has a high health score of 8/10 when it comes to its cashflows and debt, meaning it is well-positioned to pay off debt and fund future operations. More…

Peers

They are one of the top competitors in the market, with Shenzhen FRD Science & Technology Co Ltd, Arisawa Mfg Co Ltd, and Advance Materials Corp also vying for market share. Each of these companies offers unique products and services to customers, allowing them to choose the best option for their needs.

– Shenzhen FRD Science & Techonology Co Ltd ($SZSE:300602)

Shenzhen FRD Science & Techonology Co Ltd is a Chinese technology company that specializes in providing software, hardware, and systems engineering services. The company has a market capitalization of 8.41 billion dollars as of 2023 and boasts a Return on Equity (ROE) of -2.24%. The market cap and ROE of Shenzhen FRD Science & Techonology Co Ltd indicate that the company is well-positioned for growth and profitability. Despite the relatively low ROE, Shenzhen FRD Science & Techonology Co Ltd has managed to generate significant revenue and profits for its shareholders. As the company continues to focus on innovation and developing new products, its market cap and ROE are expected to continue to increase in the coming years.

– Arisawa Mfg Co Ltd ($TSE:5208)

Arisawa Mfg Co Ltd is a Japanese company that manufactures and distributes engineering products and machined components. The company has a market capitalization of 45.62B as of 2023 and a Return on Equity of 6.74%. This suggests that the company is in a healthy financial position and is able to generate positive returns on its equity investments. The company has a strong presence in the Japanese market, but has extended its reach to other countries as well. Arisawa Mfg Co is well positioned to capitalize on the global engineering industry’s growth.

– Advance Materials Corp ($TPEX:3585)

Advance Materials Corp is a large international producer of high-performance ceramic materials, composites, and metal-matrix composites. As of 2023, the company has a market cap of 900.12M. The Return on Equity (ROE) for Advance Materials Corp is -7.65%, which is below the industry average, indicating that the company has been unable to generate an adequate return for its investors. The company is likely trying to improve its ROE through cost cutting and increasing efficiency, as well as focusing on higher margin products.

Summary

CRICUT INC released their fourth quarter results for fiscal year 2022 on March 7 2023, posting total revenue of USD 10.9 million and a net income of USD 280.8 million. Compared to the same quarter in the previous year, this amounted to a 8.6% decrease in revenue and 27.6% decrease in net income. The stock price reacted positively to the news, indicating that investors are optimistic about the company’s future prospects. Going forward, investors should keep an eye on CRICUT INC’s progress and take into consideration any potential changes in the market that may affect their performance.

Recent Posts