Corsair Gaming Intrinsic Value Calculator – Corsair Gaming’s Turnaround Remains On Track Amidst Market Share Gains

May 26, 2023

Trending News ☀️

Corsair Gaming ($NASDAQ:CRSR) is continuing to experience a successful turnaround, as its market share gains remain on track. The company, which specializes in producing computer gaming components such as memory, PC cases, and cooling solutions, has seen its market share grow steadily over the past few years. This growth comes in spite of the competitive nature of the gaming hardware market, as other competitors have also seen their market shares rise. The company’s market share increase has been driven by a number of factors, including its focus on high-quality products and customer service. Corsair Gaming has also invested heavily in research and development, launching a range of innovative products that have been well-received by gamers. This has been further bolstered by its marketing campaigns, which have successfully positioned the brand as a major player in the gaming hardware industry.

In addition, Corsair Gaming has also placed an emphasis on community building, launching initiatives such as the Corsair Academy and Corsair Connect in an effort to strengthen relationships with its customers. With its strategic efforts to stay ahead of the competition, Corsair Gaming’s turnaround remains on track.

Share Price

On Thursday, CORSAIR GAMING stock opened at $19.4 and ended the day closing at the same price, representing a 0.8% gain from its previous closing price of 19.2. This minimal gain is indicative of the company’s turn-around, as its market share gains has allowed it to remain on track. CORSAIR GAMING has seen increased revenue growth and profit with its recent surge in gaming hardware markets. Its success has been marked by consistent gains in stock value, indicating continued confidence in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Corsair Gaming. More…

| Total Revenues | Net Income | Net Margin |

| 1.35k | -50.31 | -4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Corsair Gaming. More…

| Operations | Investing | Financing |

| 114.32 | -27.81 | 64.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Corsair Gaming. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.3k | 633.02 | 6.21 |

Key Ratios Snapshot

Some of the financial key ratios for Corsair Gaming are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | 85.0% | -3.6% |

| FCF Margin | ROE | ROA |

| 6.5% | -4.9% | -2.4% |

Analysis – Corsair Gaming Intrinsic Value Calculator

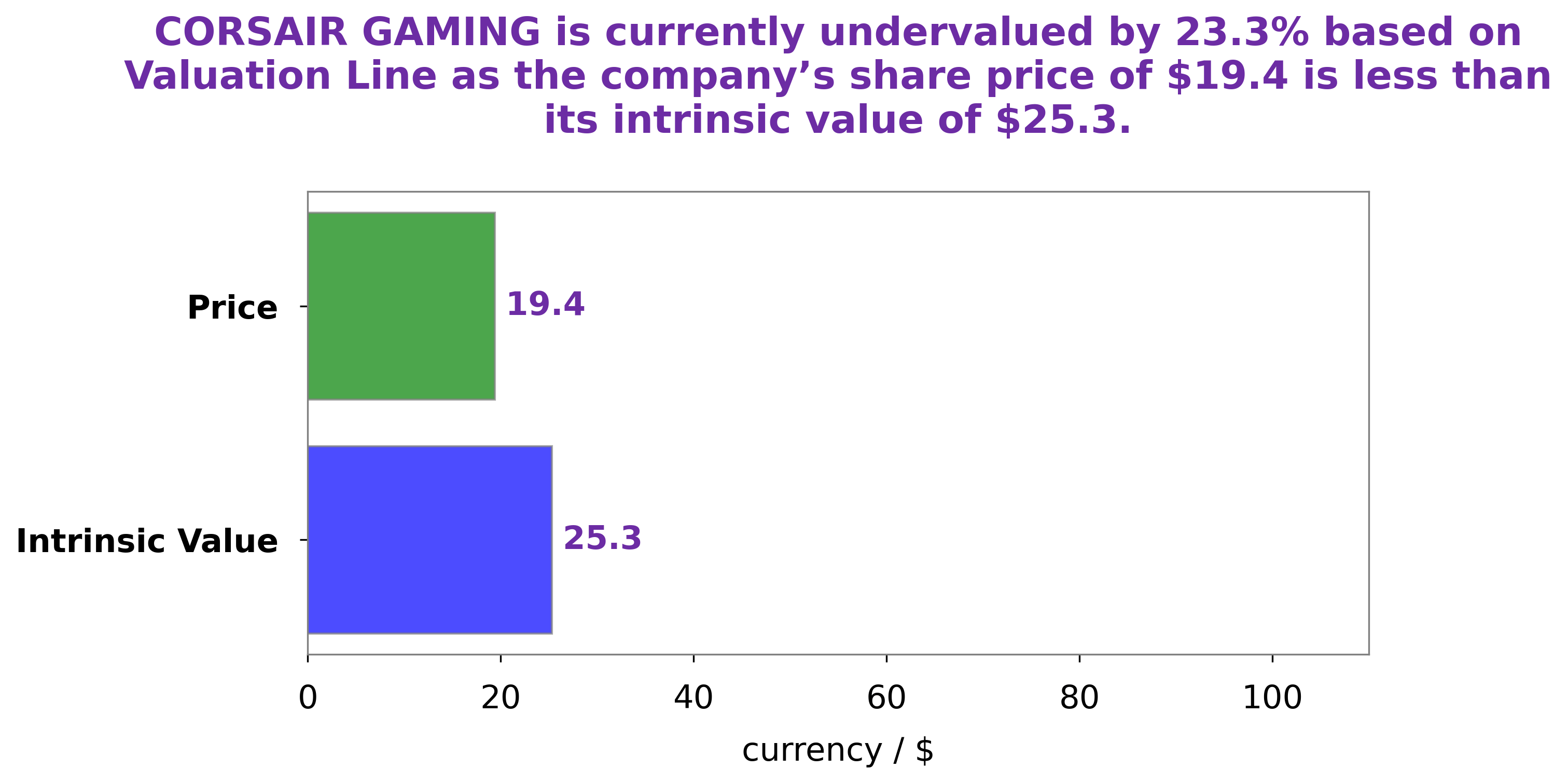

At GoodWhale, we recently conducted an analysis of CORSAIR GAMING‘s fundamentals. After careful consideration, we have determined a fair value of CORSAIR GAMING’s share to be around $25.3, calculated by our proprietary Valuation Line. Currently, the stock is trading at $19.4 – undervalued by 23.3%. We believe that there are attractive opportunities for investors who are willing to take on the risks and hold the stock for the long-term. More…

Peers

Their main competitors are Quixant PLC, Turtle Beach Corp, and Asetek A/S.

– Quixant PLC ($LSE:QXT)

Quixant PLC is a technology company that designs, manufactures and sells advanced monitoring, control and timing systems. The company has a market cap of 114.63M as of 2022 and a ROE of 6.78%. Quixant’s products are used in a variety of industries, including gaming, automotive, aerospace and defense. The company’s products are designed to provide customers with reliable, high-performance solutions.

– Turtle Beach Corp ($NASDAQ:HEAR)

Turtle Beach Corporation is a holding company that operates through its subsidiaries. The company is engaged in the design, manufacture and marketing of audio gaming headsets for video game consoles and personal computers. The company’s products are designed to enhance the gaming experience by providing audio clarity and customization. Turtle Beach’s headsets are sold through major retailers and distributors in North America, Europe, Australia and Asia. The company was founded in 1975 and is headquartered in Valhalla, New York.

– Asetek A/S ($LTS:0QDT)

Asetek A/S is a Denmark-based company engaged in the design and manufacturing of cooling solutions for computers, servers and consumer electronics. The Company’s product portfolio includes all-in-one (AIO) liquid coolers, server liquid cooling solutions, desktop and laptop external cooling solutions, and chipset and power semiconductor cooling solutions. It sells its products to original equipment manufacturers (OEMs) and original design manufacturers (ODMs) in the gaming, personal computer (PC), workstation, server, appliance, and mobile device markets worldwide.

Summary

Corsair Gaming has seen substantial growth in market share due to their successful turnaround, making it an attractive investment option. The company has built on its gaming product portfolio, expanding into the gaming accessories space, providing more comprehensive experiences for their customers. They have also established strategic partnerships with major publishers and developers, increasing their visibility in the gaming industry.

Recent performance has been strong, with sales of gaming products rising substantially year over year, and hardware revenue growing faster than expected. Looking forward, it is likely that Corsair Gaming will continue to benefit from market share gains, making it an attractive option for investors.

Recent Posts