Wesbanco Bank Invests in Knowles Corporation (NYSE:KN)

April 2, 2023

Trending News 🌥️

Knowles Corporation ($NYSE:KN) (NYSE:KN) has had new investment from Wesbanco Bank Inc. The company is a global leader in the design, manufacture and sale of advanced micro-acoustic, audio processing, and specialty component solutions for the mobile, hearing, industrial and healthcare markets. Knowles Corporation is well known for its innovation and commitment to providing the best products to its customers. The company has developed a comprehensive portfolio of products to meet the increasing demands of the global mobile and consumer electronics space, including audio components and sensors, MEMS microphones, and wireless connectivity solutions.

In addition, they are also a leader in the industrial space, providing solutions for vocal recognition systems, hearing aids, medical devices, automotive applications and other industrial applications. Knowles Corporation has a long history of providing superior quality products and services to its customers, and with Wesbanco Bank Inc.’s investment they are well positioned to continue doing so. This latest move gives Knowles even more resources to focus on innovation and product development in order to stay ahead of the competition.

Stock Price

On Tuesday, Wesbanco Bank Inc. announced that it had invested in Knowles Corporation (NYSE:KN), a leading global provider of advanced micro-acoustic, audio processing, and specialty component solutions. This investment comes on the heels of the stock’s opening of $16.3 per share and subsequent closing at $16.5 per share, a 0.7% increase from the previous day’s close. The steady incline of the stock price has been attributed to the company’s reliable and innovative products that are being utilized in today’s ever-evolving technology and audio industries. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Knowles Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 764.7 | -430.1 | -18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Knowles Corporation. More…

| Operations | Investing | Financing |

| 86.3 | -32.7 | -73.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Knowles Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.18k | 191 | 10.9 |

Key Ratios Snapshot

Some of the financial key ratios for Knowles Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | -8.4% | -54.1% |

| FCF Margin | ROE | ROA |

| 7.1% | -23.8% | -21.9% |

Analysis

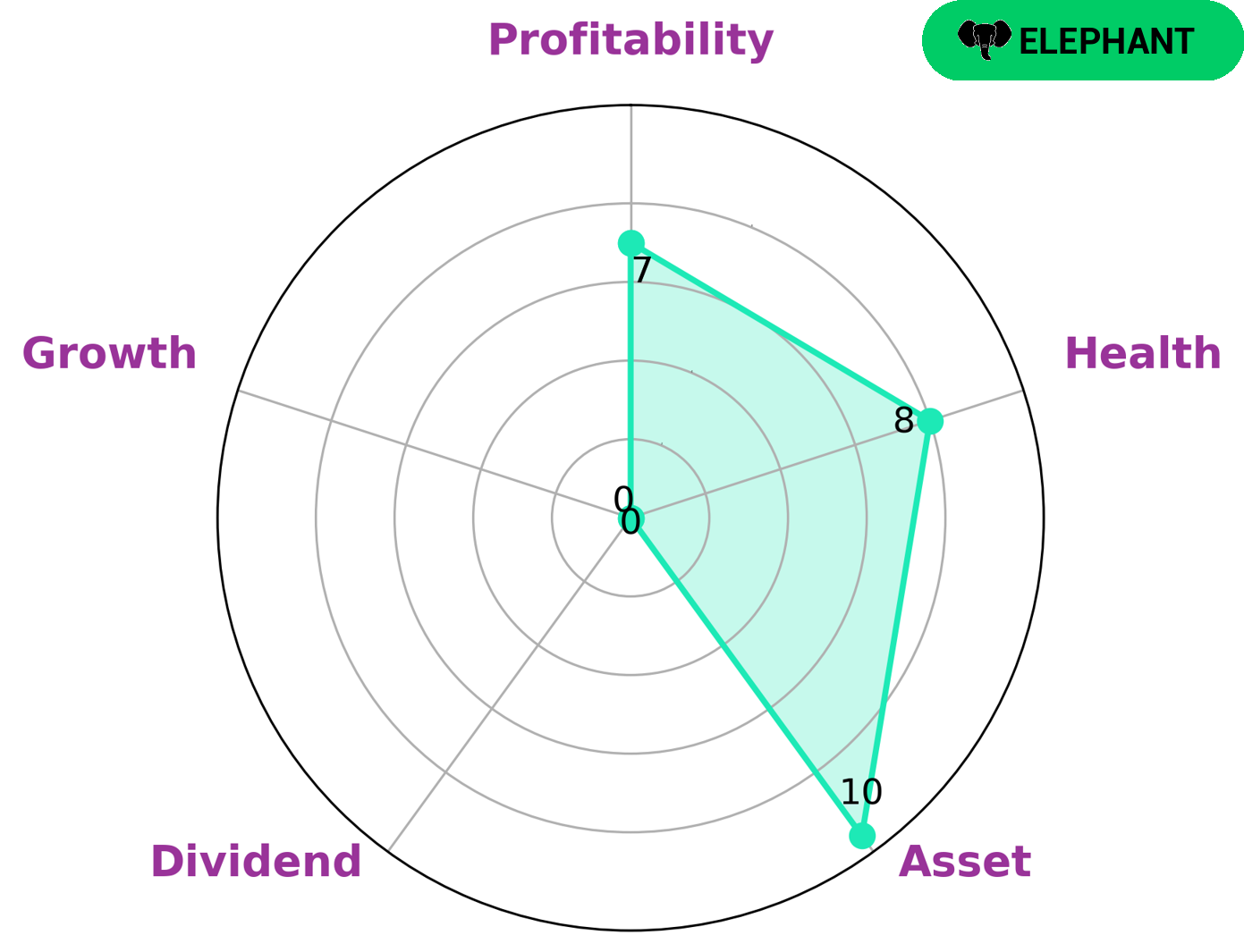

As part of our analysis of KNOWLES CORPORATION‘s fundamentals, GoodWhale conducted a Star Chart assessment to determine the company’s classification. We concluded that KNOWLES CORPORATION is an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This may be attractive to a number of investors including value investors and those with an eye on long-term sustainability. We also found KNOWLES CORPORATION to have a high health score of 8/10 considering its cashflows and debt. This indicates that the company is well positioned to sustain future operations even in times of crisis. In terms of other metrics, KNOWLES CORPORATION is strong in asset and profitability, but weak in dividend and growth. More…

Peers

In the mobile phone industry, there is intense competition between Knowles Corp and its competitors AdvanceTC Ltd, Shenzhen CDL Precision Technology Co Ltd, and Sonim Technologies Inc. All four companies are vying for market share in the smartphone market.

– AdvanceTC Ltd ($OTCPK:ATCLF)

AdvanceTC Ltd is a company that provides telecommunications and IT services. It has a market cap of 12.16M as of 2022 and a return on equity of 271.78%. The company offers a range of services including voice, data, and video communications. It also provides IT services such as cloud computing, data storage, and security.

– Shenzhen CDL Precision Technology Co Ltd ($SZSE:300686)

Shenzhen CDL Precision Technology Co Ltd is a precision technology company that specializes in the design and manufacture of high precision components and assemblies for the automotive, aerospace, and other industries. The company has a market cap of 3.26B as of 2022 and a return on equity of 0.17%.

– Sonim Technologies Inc ($NASDAQ:SONM)

Sonim Technologies Inc is a provider of ultra-rugged mobile phones and services designed for use in hazardous environments. The company has a market cap of 16.64M as of 2022 and a return on equity of -234.74%. Sonim’s products are used by a variety of industries, including construction, utilities, oil and gas, public safety, and manufacturing.

Summary

Investors in Knowles Corporation (NYSE:KN) have reason to be bullish following the recent news that Wesbanco Bank Inc. has taken a new position in the company. This could be seen as a vote of confidence in Knowles’ financial prospects and future performance. With these positive indicators, investors may want to seriously consider adding Knowles to their portfolio.

Recent Posts