VIAVI SOLUTIONS Announces Second Quarter FY2023 Earnings Results for Period Ending December 31, 2022.

February 11, 2023

Earnings report

VIAVI SOLUTIONS ($NASDAQ:VIAV), a global leader in providing network and service enablement solutions, recently announced its second quarter FY2023 earnings results for the period ending December 31, 2022. VIAVI Solutions provides customers with integrated test and monitoring solutions for the design, deployment, and management of networks and services. The company reported total revenue for the quarter of USD 8.4 million, a decrease of 75.7% compared to the same period from the previous year. Net income reported was USD 284.5 million, a decrease of 9.6% year over year. VIAVI Solutions is dedicated to creating innovative and valuable solutions for their customers to maximize network performance, reduce operational costs and ensure successful network deployments. The company also remains committed to furthering the business opportunities that their solutions create.

Despite the difficult economic conditions created by the pandemic, VIAVI Solutions was able to increase their net income margins by 10% over the same period from the previous year. This improvement was largely driven by improved revenue management and cost savings initiatives. VIAVI Solutions is continuing to focus on their core strengths as they strive to deliver reliable and innovative solutions to customers worldwide. The company is confident that their investments in research and development will continue to drive growth in the coming quarters and years. VIAVI Solutions looks forward to continued success in FY2023 and beyond.

Stock Price

The stock opened at $11.6 and closed at $11.5, a 0.6% increase from the prior closing price of $11.4. The stock saw a modest gain from beginning to end of the trading day as investors reacted to the news of the quarterly earnings results. Overall, VIAVI SOLUTIONS‘ second quarter FY2023 financial results were in-line with investors’ expectations and showed continued growth for the company. The company’s performance in the quarter was bolstered by their ongoing investments in research and development and capital expenditures which led to higher revenues, higher operating income and higher net income.

The company is also focusing on expanding its presence in new markets, as well as leveraging its existing customer base to drive further growth. Given its strong performance in the quarter, VIAVI SOLUTIONS is well positioned to continue its growth trajectory in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Viavi Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 1.25k | 76.7 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Viavi Solutions. More…

| Operations | Investing | Financing |

| 151.3 | -71 | -210.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Viavi Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.83k | 1.14k | 2.86 |

Key Ratios Snapshot

Some of the financial key ratios for Viavi Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 16.9% | 12.5% |

| FCF Margin | ROE | ROA |

| 6.4% | 15.0% | 5.3% |

Analysis

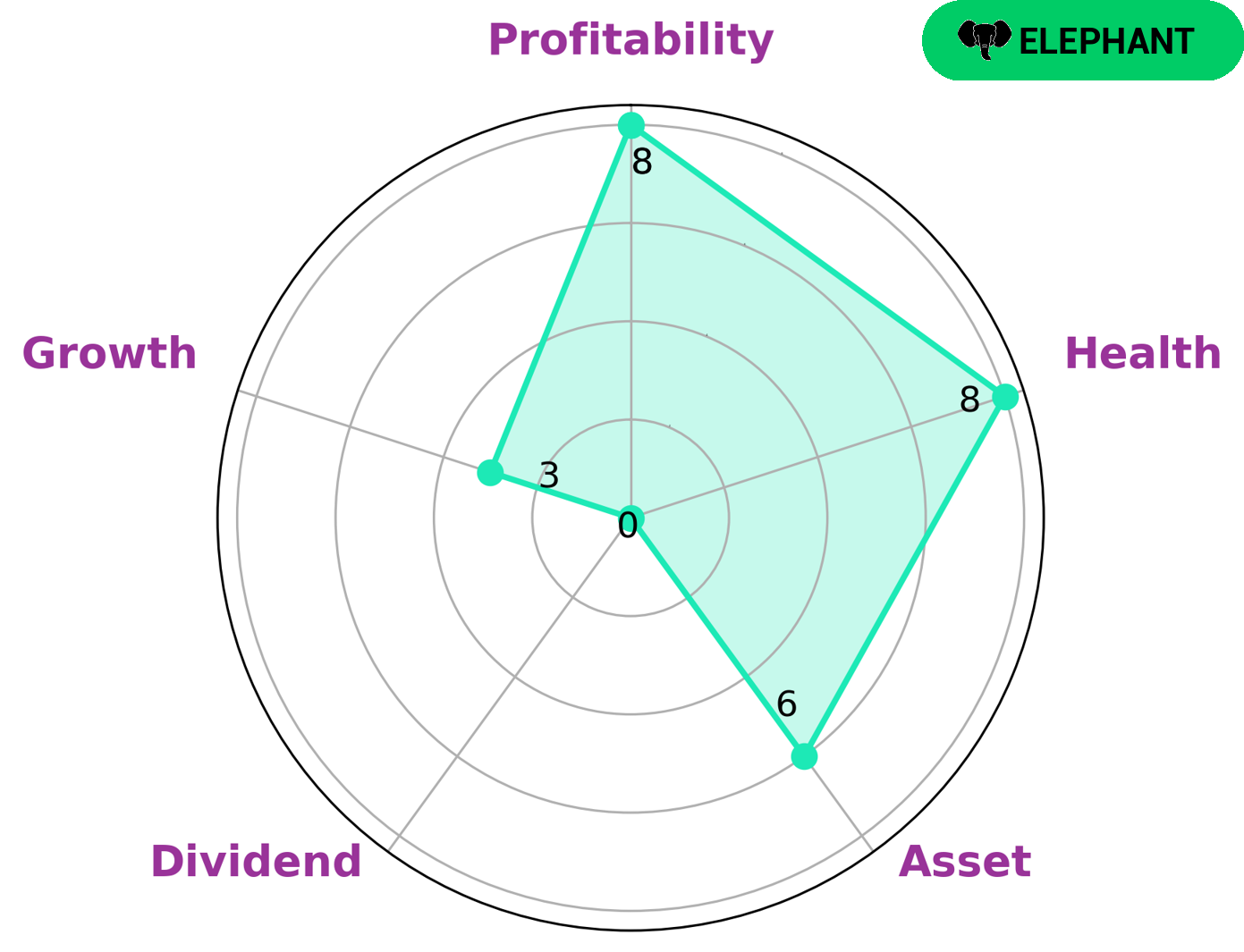

GoodWhale’s Star Chart analysis of VIAVI SOLUTIONS gives it a health score of 8/10, indicating that its financials are well-positioned for future crises or difficult economic environments. This strong score is due in part to the company’s strong cash flows and debt capabilities. VIAVI SOLUTIONS is classified as an ‘elephant’ which indicates that it holds a large amount of assets while having fewer liabilities. The company is strong in terms of profitability and medium in terms of asset. However, investors should be aware that VIAVI SOLUTIONS may not provide much in terms of dividend or growth. Investors looking to get a return on their investment through dividends would likely be disappointed with VIAVI SOLUTIONS. Those looking for a company with strong asset and good returns on investments may find this company attractive. In conclusion, VIAVI SOLUTIONS has a good health score and is a strong asset-rich company, albeit with low dividend and growth values. Investors looking for strong returns on investments and asset-rich companies may find VIAVI SOLUTIONS to be a good option. More…

Peers

The company offers a portfolio of solutions that enable its customers to optimize and assure the performance of their networks and applications. Its competitors include Raisecom Technology Co Ltd, TPT Global Tech Inc, Calnex Solutions PLC.

– Raisecom Technology Co Ltd ($SHSE:603803)

Raisecom Technology Co Ltd is a Chinese company that manufactures and sells telecommunications equipment. The company has a market capitalization of $3.12 billion as of 2022 and a return on equity of -0.43%. Raisecom Technology Co Ltd’s products include routers, switches, and network interface cards. The company also provides software and services for voice and data communications.

– TPT Global Tech Inc ($OTCPK:TPTW)

TPT Global Tech Inc is a publicly traded company with a market capitalization of $3.14 million as of 2022. The company has a return on equity of 6.63%. TPT Global Tech Inc is a provider of telecommunications and technology solutions. The company offers a range of services, including voice, data, and video communications; broadband and wireless Internet; and managed network and security solutions.

– Calnex Solutions PLC ($LSE:CLX)

Calnex Solutions is a leading provider of network test and measurement solutions. The company’s products are used by network operators and equipment manufacturers worldwide to ensure the quality and performance of their networks. Calnex’s products are used in all phases of the network lifecycle, from design and development to deployment and operations. The company’s products are backed by a team of expert engineers who are dedicated to providing the highest quality products and support.

Summary

VIAVI SOLUTIONS reported dismal second quarter results for FY2023, with total revenues decreasing by 75.7% year-on-year and net income decreasing by 9.6%. Despite the company’s poor performance, investors may still be interested in VIAVI SOLUTIONS as a long-term investment opportunity. The company’s strong balance sheet and low debt-to-equity ratio could make it an attractive investment, provided that its near-term prospects improve.

Additionally, VIAVI SOLUTIONS has a diversified portfolio of products and services, which should help to minimize the risk associated with investing. Furthermore, the company has a history of consistently increasing its dividend, which can provide investors with consistent income. In order to make an educated decision, investors should carefully consider VIAVI SOLUTIONS’ financials and its outlook before investing.

Recent Posts