Plover Bay Technologies dividend – Plover Bay Technologies Increases Interim Dividend After 2022 Profit Rise.

March 5, 2023

Trending News ☀️

Plover Bay Technologies dividend – Plover Bay Technologies ($SEHK:01523), a leading provider of innovative solutions for the global technology industry, has reported a substantial rise in 2022 profits. This significant increase in profitability has enabled the company to increase its interim dividend, rewarding both shareholders and investors alike. The success of Plover Bay Technologies is largely due to its ability to stay at the forefront of the ever-changing technology industry. By continually innovating and creating new products and solutions, the company has managed to grow its customer base significantly over the past year. This has translated into greater revenues, which in turn has led to the increased dividend for shareholders.

The increased interim dividend is an indication of the confidence that Plover Bay Technologies has in its future growth prospects. The increased dividend also serves as a clear signal of Plover Bay Technology’s commitment to its investors, as it is confident that it will continue to grow and expand in the years to come. The sky is the limit for Plover Bay Technologies, as it strives to be at the forefront of the technology industry. With the increase in its interim dividend, it has shown that it is committed to rewarding shareholders and investors while continuing to pursue new opportunities in the global technology market.

Dividends – Plover Bay Technologies dividend

PLOVER BAY TECHNOLOGIES recently announced a rise in their 2022 profits and are looking to increase their interim dividend. Over the last three years, PLOVER BAY TECHNOLOGIES has issued an annual dividend per share of 0.02, 0.01 and 0.01 USD respectively. This has led to dividend yields of 4.87%, 7.33% and 7.33% from 2020 to 2022, with an average dividend yield of 6.51%.

Investors who are interested in dividend stocks may want to consider PLOVER BAY TECHNOLOGIES as an option. With this increase in profits and the planned interim dividend, it may be a good time to invest in the company.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plover Bay Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 81.49 | 22.22 | 27.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plover Bay Technologies. More…

| Operations | Investing | Financing |

| 16.12 | -1.05 | -12.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plover Bay Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 74.45 | 36.01 | 0.04 |

Key Ratios Snapshot

Some of the financial key ratios for Plover Bay Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | 26.4% | 32.0% |

| FCF Margin | ROE | ROA |

| 17.2% | 41.5% | 21.9% |

Price History

Plover Bay Technologies has achieved notable success in the past year, leading to an increased interim dividend after the company posted a profit rise in 2022. The news has been well-received by the market, with media coverage so far mostly positive. However, on Monday the company’s stock opened at HK$2.8 and closed at HK$2.7, down by 1.5% from the prior closing price of 2.8. This could be a sign of investors taking a more cautious approach to PLOVER BAY TECHNOLOGIES after realizing its impressive growth could be unsustainable in the long-term. Live Quote…

Analysis

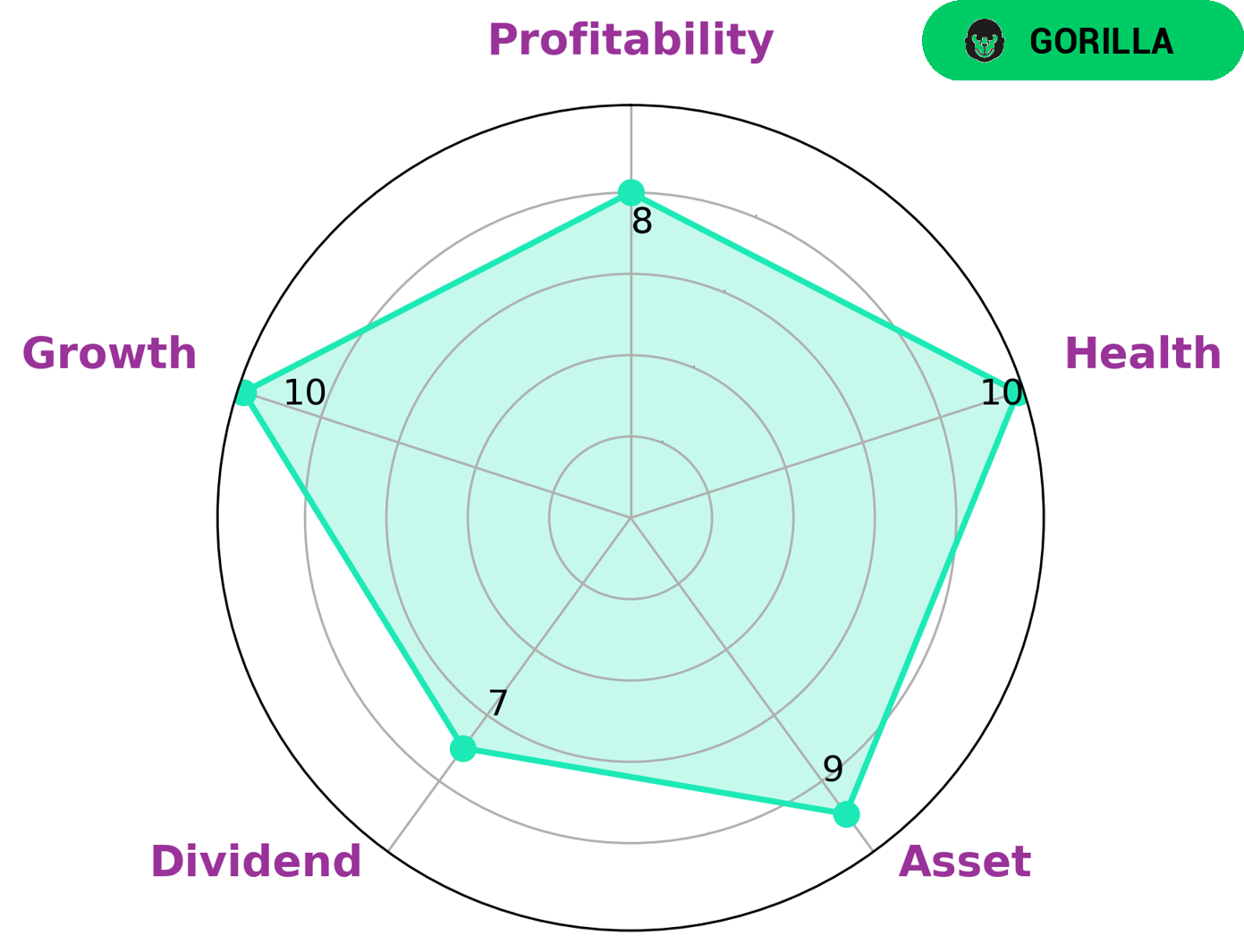

GoodWhale is excited to analyze the fundamentals of PLOVER BAY TECHNOLOGIES. Our Star Chart report shows that PLOVER BAY TECHNOLOGIES is a strong company in terms of its asset, dividend, growth and profitability. Its health score is 10/10, indicating that its cashflows and debt are strong and the company is capable to pay off debt and fund future operations. PLOVER BAY TECHNOLOGIES is classified as a ‘gorilla’, a type of company that has maintained stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for stable and long-term investments may be interested in such company. Besides, investors with a focus on growth opportunities will be attracted by the potential of PLOVER BAY TECHNOLOGIES. The ‘gorilla’ status indicates that it has a strong competitive edge and is well-positioned to continue its impressive performance in the future. More…

Peers

The competition between Plover Bay Technologies Ltd and its competitors, Addvalue Technologies Ltd, Ciena Corp, and Genasys Inc, is fierce. All four companies are striving to make the most innovative products in order to gain a competitive edge in the industry. Each company has its own unique strategies for succeeding in the market, and it is up to each one to prove their worth and gain the trust of customers.

– Addvalue Technologies Ltd ($SGX:A31)

Addvalue Technologies Ltd is a Singapore-based provider of satellite communications solutions for commercial, government and military applications. The company has a market capitalization of 38.9M as of 2022. The negative Return on Equity (ROE) of -79.08% suggests that the company has been unable to generate sufficient profits to cover its equity financing costs. This could be due to the high costs associated with the company’s operations in the highly competitive satellite communications industry.

– Ciena Corp ($NYSE:CIEN)

Ciena Corp is a global telecommunications and networking equipment provider, providing software and hardware solutions to organizations around the world. As of 2022, the company has an impressive market capitalization of 7.21B, indicating that investors have confidence in the company’s ability to generate returns. Additionally, Ciena Corp’s return on equity (ROE) of 5.33% indicates that the company is able to generate returns from its investments. This is largely due to their strong portfolio of products and services that have helped them to remain an industry leader.

– Genasys Inc ($NASDAQ:GNSS)

Genasys Inc is an American technology company that provides mission-critical communications for public safety, homeland security, and commercial and industrial customers. As of 2022, Genasys Inc has a market capitalization of 101.3M. This figure is indicative of the company’s size, representing the total value of its outstanding shares. Moreover, the company has a Return on Equity (ROE) of -2.32%, indicating that the company is not generating enough profits to cover its shareholders’ equity. This could be due to a variety of factors, including a lack of diversified revenue sources or an inability to effectively manage costs.

Summary

Plover Bay Technologies has reported a rise in profits for 2022, leading the company to increase its interim dividend. This rise in profits has been well-received by the market and so far, has been met with mostly positive media coverage. Investors should consider Plover Bay Technologies as an attractive investing opportunity due to its recent gains and its future prospects. Plover Bay’s dividend payout is an indication of the company’s long-term commitment to shareholders and demonstrates the company’s ability to generate returns.

Analyzing financial statements, operational performance, and industry trends would offer investors a better understanding of the company’s current value. This analysis should allow investors to make a more informed decision when determining whether or not Plover Bay Technologies is a viable investment.

Recent Posts