Plover Bay Technologies dividend calculator – Plover Bay Technologies Ltd Announces Cash Dividend of 0.0869

March 18, 2023

Dividends Yield

Plover Bay Technologies ($SEHK:01523) Ltd Announces Cash Dividend of 0.0869 on March 1st 2023. This is a significant increase from the past three years, when the company issued an annual dividend per share of 0.02, 0.01 and 0.01 USD respectively. This resulted in respective dividend yields from 2020 to 2022 of 4.87%, 7.33% and 7.33%, with an average dividend yield of 6.51%.

If you are looking for a dividend stock, PLOVER BAY TECHNOLOGIES could be the perfect choice for you. The ex-dividend date for the company is March 8th 2023, so make sure you purchase the stock before then to be eligible to receive the dividend.

Price History

This announcement was made after the stock opened at HK$2.7 and closed at the same price, 0.7% below its prior closing price of 2.8. The company is confident in its financial position and looks forward to delivering long-term value to shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plover Bay Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 81.49 | 22.22 | 27.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plover Bay Technologies. More…

| Operations | Investing | Financing |

| 16.12 | -1.05 | -12.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plover Bay Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 74.45 | 36.01 | 0.04 |

Key Ratios Snapshot

Some of the financial key ratios for Plover Bay Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | 26.4% | 32.0% |

| FCF Margin | ROE | ROA |

| 17.2% | 41.5% | 21.9% |

Analysis

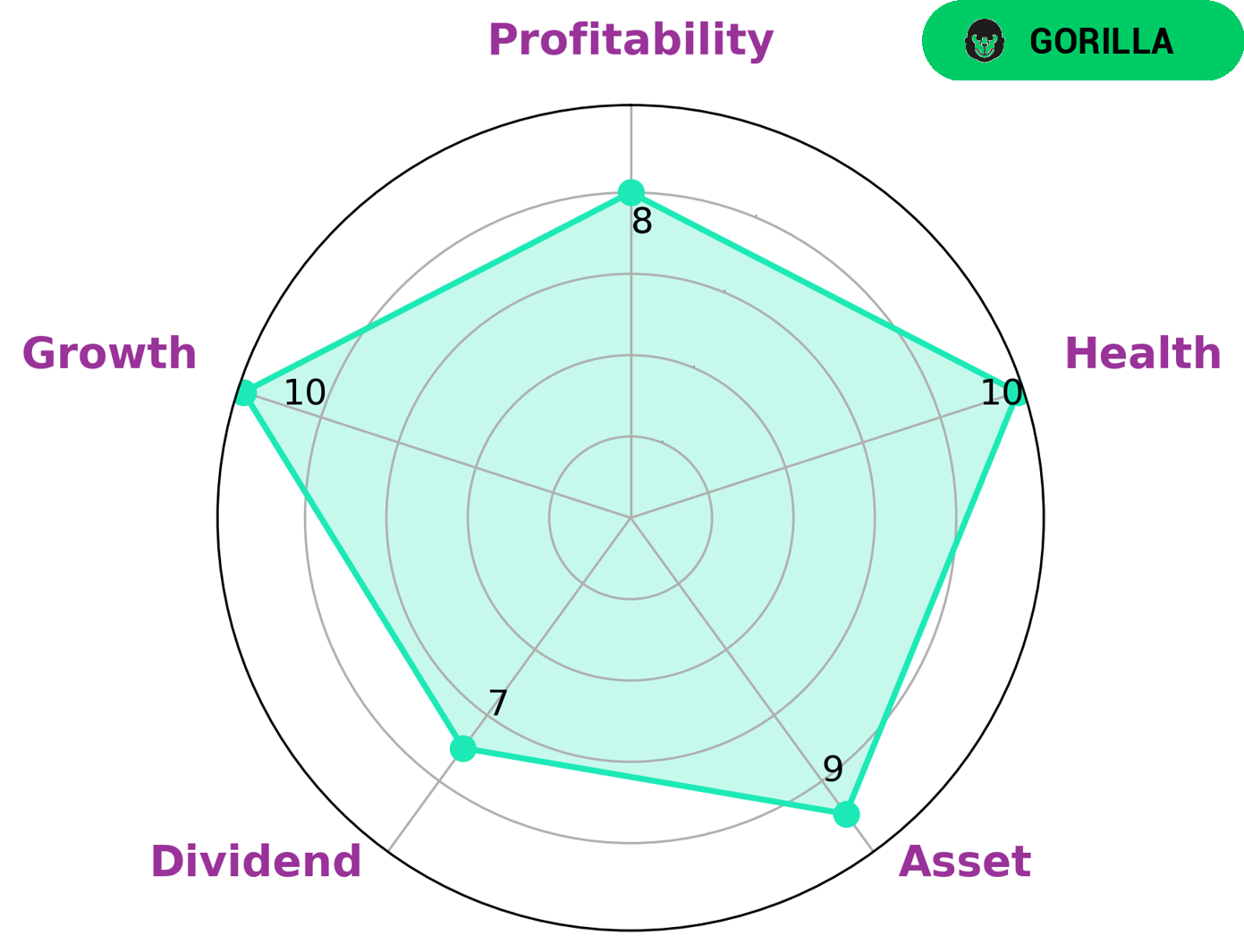

At GoodWhale, we have performed an analysis of PLOVER BAY TECHNOLOGIES’ financials. Based on our Star Chart, PLOVER BAY TECHNOLOGIES is strong in asset, dividend, growth, and profitability. With a high health score of 10/10 considering its cashflows and debt, the company is well-prepared to sustain future operations in times of crisis. We classify this company as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors of all types may be interested in such a company. Whether you are a value investor looking for a strong dividend or a growth investor eager to capitalize on the company’s high profitability, PLOVER BAY TECHNOLOGIES could be the perfect choice for you. With its solid financials and reliable performance, this company is sure to remain a strong choice for investors for a long time. More…

Peers

The competition between Plover Bay Technologies Ltd and its competitors, Addvalue Technologies Ltd, Ciena Corp, and Genasys Inc, is fierce. All four companies are striving to make the most innovative products in order to gain a competitive edge in the industry. Each company has its own unique strategies for succeeding in the market, and it is up to each one to prove their worth and gain the trust of customers.

– Addvalue Technologies Ltd ($SGX:A31)

Addvalue Technologies Ltd is a Singapore-based provider of satellite communications solutions for commercial, government and military applications. The company has a market capitalization of 38.9M as of 2022. The negative Return on Equity (ROE) of -79.08% suggests that the company has been unable to generate sufficient profits to cover its equity financing costs. This could be due to the high costs associated with the company’s operations in the highly competitive satellite communications industry.

– Ciena Corp ($NYSE:CIEN)

Ciena Corp is a global telecommunications and networking equipment provider, providing software and hardware solutions to organizations around the world. As of 2022, the company has an impressive market capitalization of 7.21B, indicating that investors have confidence in the company’s ability to generate returns. Additionally, Ciena Corp’s return on equity (ROE) of 5.33% indicates that the company is able to generate returns from its investments. This is largely due to their strong portfolio of products and services that have helped them to remain an industry leader.

– Genasys Inc ($NASDAQ:GNSS)

Genasys Inc is an American technology company that provides mission-critical communications for public safety, homeland security, and commercial and industrial customers. As of 2022, Genasys Inc has a market capitalization of 101.3M. This figure is indicative of the company’s size, representing the total value of its outstanding shares. Moreover, the company has a Return on Equity (ROE) of -2.32%, indicating that the company is not generating enough profits to cover its shareholders’ equity. This could be due to a variety of factors, including a lack of diversified revenue sources or an inability to effectively manage costs.

Summary

Investing in Plover Bay Technologies could be a wise decision for those looking for a dividend stock. In the last three years, the company has issued an annual dividend per share of 0.02, 0.01 and 0.01 USD respectively, with respective dividend yields of 4.87%, 7.33% and 7.33%. This averages to a dividend yield of 6.51%, indicating that Plover Bay Technologies offers a lucrative dividend return. With its solid track record, it could be a viable option for those seeking reliable returns on their investments.

Recent Posts