Motorola Solutions Stock Drops Monday, Underperforming Market

November 15, 2023

☀️Trending News

Monday was a difficult day for Motorola Solutions ($NYSE:MSI) Inc., as the company’s stock underperformed the market, resulting in a decrease in its value. Motorola Solutions Inc., formerly Motorola Inc., is a global leader in mission-critical communications and enterprise mobility solutions. It provides public safety agencies, businesses and governments with the technology and services they need to keep people safe and connected. With its rich history of innovation, Motorola Solutions has been at the forefront of technological advancement, creating groundbreaking products and services that are designed to help customers create safer communities and workplaces. Its market leading portfolio of communication, software, and services solutions span from public safety two-way radio to video surveillance to enterprise-grade data analytics.

As the market continues to face uncertainty, investors are keeping a close eye on Motorola Solutions stock. The company continues to remain committed to providing customers with the most reliable, secure and innovative communications and software solutions on the market. With Motorola Solutions’ industry-leading portfolio and commitment to innovation, investors continue to have confidence in the company’s long-term success.

Stock Price

Monday was a rough day for MOTOROLA SOLUTIONS Inc. stock, as it fell 0.4% from its prior close. The stock opened at $311.0 and closed at $309.6, underperforming the broader market significantly. This drop in stock price is a sign of investor concern about the company’s future performance in the near term, as they may be expecting lower returns from the company compared to other businesses in the technology sector. It will be interesting to monitor MOTOROLA SOLUTIONS stock over the next few days to see if Monday’s drop in price was the start of a downward trend or just a temporary blip. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Motorola Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 9.84k | 1.7k | 17.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Motorola Solutions. More…

| Operations | Investing | Financing |

| 2.07k | -824 | -1.25k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Motorola Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.44k | 12.06k | 2.18 |

Key Ratios Snapshot

Some of the financial key ratios for Motorola Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | 15.6% | 23.7% |

| FCF Margin | ROE | ROA |

| 18.6% | 417.4% | 11.7% |

Analysis

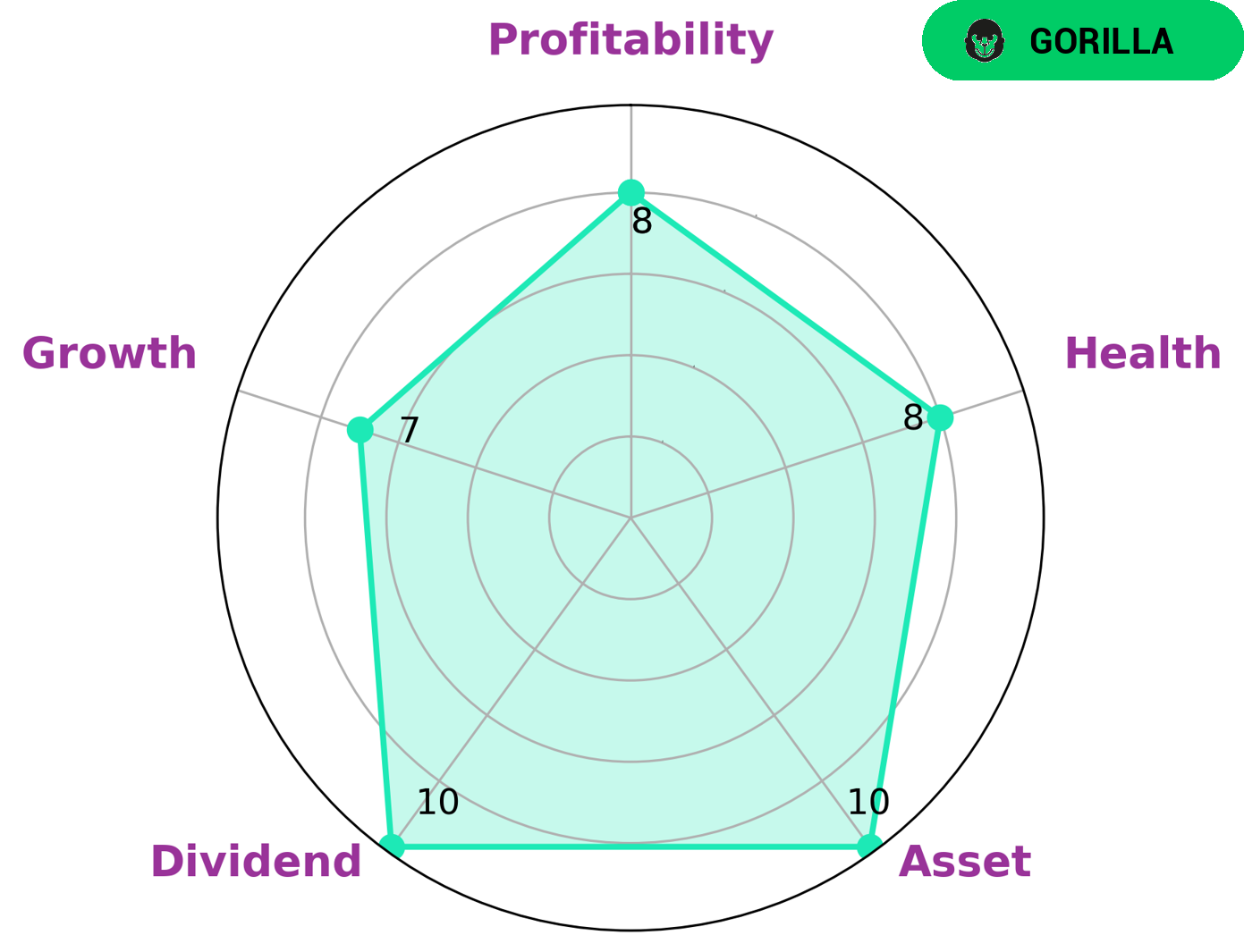

GoodWhale has performed an analysis of MOTOROLA SOLUTIONS‘ fundamentals and according to our Star Chart, this company is strong in dividend, profitability, and medium in asset and growth. Our health score for MOTOROLA SOLUTIONS is 8/10, indicating the company is capable of paying off its debt and funding future operations. Furthermore, we classify MOTOROLA SOLUTIONS as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors with a long-term outlook, who are looking for a stable, reliable return, would be interested in a company like MOTOROLA SOLUTIONS. Such investors may be willing to pay a premium for the quality of the company. These investors may also be interested in taking advantage of the company’s dividend, which provides a steady stream of income. Finally, those investors looking for capital appreciation may be drawn to MOTOROLA SOLUTIONS’ strong profitability and growth potential. More…

Peers

The company’s products and solutions include two-way radios, push-to-talk phones, public safety radios, network infrastructure, and software and services. Motorola Solutions also offers a wide range of professional services, including consulting, systems integration, project management, and managed services. The company’s primary competitors are Aviat Networks Inc, Ondas Holdings Inc, Telefonaktiebolaget L M Ericsson.

– Aviat Networks Inc ($NASDAQ:AVNW)

Aviat Networks, Inc. provides wireless backhaul solutions that enable the transport of data, voice, and video traffic over a wireless network. The company’s solutions include microwave radio systems, routers, switches, and software products that are designed to work together to support end-to-end wireless broadband applications. It serves carriers, service providers, government, and enterprise customers in more than 150 countries. The company was founded in 2006 and is headquartered in Santa Clara, California.

Aviat Networks has a market capitalization of $336.77 million as of 2022 and a return on equity of 8.53%. The company provides wireless backhaul solutions that enable the transport of data, voice, and video traffic over a wireless network. Its solutions include microwave radio systems, routers, switches, and software products that are designed to work together to support end-to-end wireless broadband applications. It serves carriers, service providers, government, and enterprise customers in more than 150 countries.

– Ondas Holdings Inc ($NASDAQ:ONDS)

Ondas Holdings Inc is a publicly traded holding company with a focus on technology investments. The company’s shares are traded on the Nasdaq Stock Market under the ticker symbol “ONDS”. As of 2022, the company had a market capitalization of $224.48 million and a return on equity of -19.92%. The company’s primary businesses include investments in software and technology companies, as well as real estate holdings.

– Telefonaktiebolaget L M Ericsson ($BER:ERCG)

Telefonaktiebolaget L M Ericsson is a Swedish multinational networking and telecommunications company headquartered in Stockholm. The company offers products and services in over 180 countries. The company’s main customers are mobile network operators, followed by cable TV operators, fixed-line operators, and other telecom service providers. The company’s product portfolio includes networks, digital services, cloud, and IoT.

Summary

Analysts have suggested that the fall may be attributed to the current market climate, as concerns surrounding economic conditions have weighed on investor sentiment in recent weeks. Additionally, the company’s recent announcement of the closure of its manufacturing facility in Vietnam may have contributed to the stock’s decline. Going forward, investors should consider the macroeconomic environment and the potential impact on MSI stock before making their investment decisions.

Recent Posts