MML Investors Services LLC Invests Over $1 Million in Zebra Technologies Co.

March 7, 2023

Trending News ☀️

Over the years, they have continued to grow and innovate their product line to include a wide range of solutions for a variety of industries. The solutions offered by Zebra range from industrial-grade labeling and tagging supplies to barcode printers and scanners, RFID tags and readers, mobile computers, and more. The investment from MML Investor Services LLC is an indication of their faith in the strength of Zebra Technologies ($NASDAQ:ZBRA) Co.’s products and services. Not only that, but it shows the company’s willingness to continue investing in the innovative technology that makes them stand out in the industry.

Given their cutting edge solutions and the injection of capital into their coffers, it is clear that Zebra Technologies Co. has potential to continue being a leader in their industry for years to come. With such a strong foundation of financial backing, it is likely that the company will be able to sustain their growth trajectory and remain a leading provider of barcode labeling products and consumables for many years to come.

Price History

On Thursday, MML Investors Services LLC announced that they have invested over $1 million in Zebra Technologies Co. Media sentiment surrounding this news has been mostly positive, with the stock opening at $299.8 and closing at $306.1, up 1.2% from the last closing price of 302.3. This news comes as Zebra Technologies Co. continues to gain momentum, having made significant strides in the information technology industry since its conception. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zebra Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 5.78k | 463 | 14.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zebra Technologies. More…

| Operations | Investing | Financing |

| 488 | -968 | 253 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zebra Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.53k | 4.8k | 53.12 |

Key Ratios Snapshot

Some of the financial key ratios for Zebra Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 8.9% | 16.2% |

| FCF Margin | ROE | ROA |

| 7.1% | 21.7% | 7.8% |

Analysis

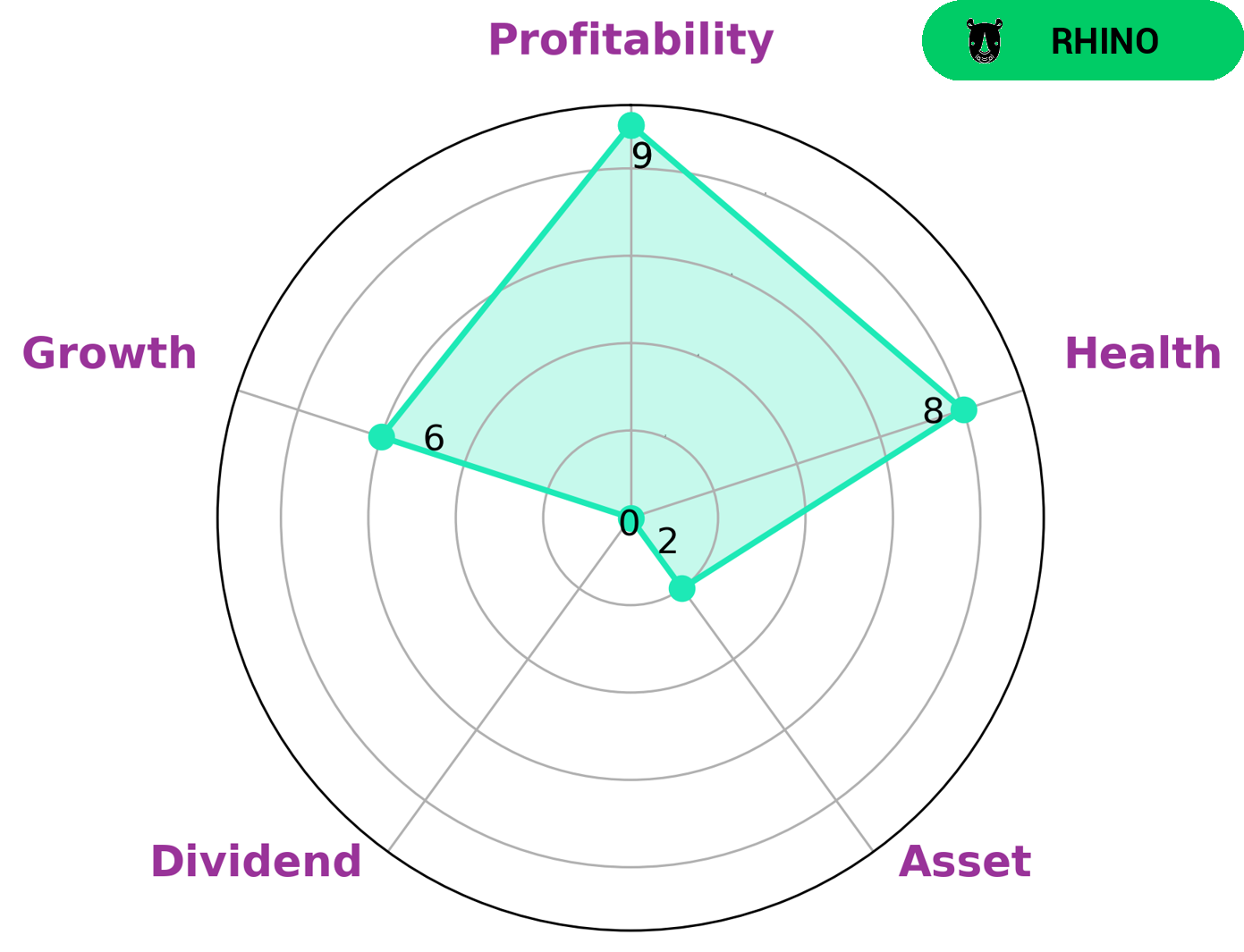

GoodWhale has conducted an analysis of ZEBRA TECHNOLOGIES‘ wellbeing. According to our Star Chart, ZEBRA TECHNOLOGIES is classified as ‘rhino’, representing a company that has achieved moderate revenue or earnings growth. Investors who are looking for more slow and steady growth may be interested in companies like ZEBRA TECHNOLOGIES. When it comes to financial health, ZEBRA TECHNOLOGIES scores a 8/10. This high rating reflects their ability to manage their cashflows and debt well and shows their capacity to sustain future operations in the face of potential crisis. We can further break down the health of ZEBRA TECHNOLOGIES into profitability, growth, and assets & dividends. In terms of profitability, they are strong, while they are rated medium in growth and weak in assets & dividends. Nevertheless, they have been able to perform well even with these deficits. More…

Peers

Its main competitors are TSC Auto ID Technology Corp, Maxar Technologies Inc, and Urovo Technology Co Ltd.

– TSC Auto ID Technology Corp ($TPEX:3611)

TSC Auto ID Technology Corp is a Taiwanese company that manufactures auto-identification products, including barcode printers, barcode scanners, and labels. The company has a market cap of 7.77B as of 2022 and a Return on Equity of 17.53%. TSC Auto ID Technology Corp’s products are used in a variety of industries, including retail, healthcare, manufacturing, logistics, and transportation.

– Maxar Technologies Inc ($NYSE:MAXR)

Maxar Technologies Inc is a leading technology and innovation company that provides advanced solutions for government and commercial customers worldwide. The company has a market capitalization of 1.5 billion as of 2022 and a return on equity of 6.04%. Maxar Technologies Inc is involved in the design, manufacture, and operation of satellites and related products and services for government and commercial customers. The company’s products and services include satellite payloads and platforms, ground infrastructure, and space-based services. Maxar Technologies Inc is headquartered in Westminster, Colorado.

– Urovo Technology Co Ltd ($SZSE:300531)

Urovo Technology Co Ltd is a Chinese company that specializes in the development and manufacture of mobile data terminals and other related products. The company has a market cap of 4.32 billion as of 2022 and a return on equity of 5.52%. Urovo Technology Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

Summary

Zebra Technologies has recently received a significant investment of more than $1 million from MML Investors Services LLC. At the time of writing, the media sentiment towards the move has been overwhelmingly positive, with investors taking the opportunity to purchase shares in the company. A detailed analysis of the investment and its potential impact on Zebra Technologies’ stock price show that there is potential for a significant increase in the value of Zebra Technologies’ shares.

Investors may find it beneficial to research the company’s financials, competitive landscape, and potential catalysts to determine if they should add Zebra Technologies to their portfolios. With its strong market presence, experienced management team and innovative products, Zebra Technologies could prove to be an attractive option for long-term investors.

Recent Posts