Knowles Corporation Stock Fair Value – KNOWLES CORPORATION Forecasts Q2 Revenue Between $165M and $180M

May 5, 2023

Trending News 🌥️

KNOWLES CORPORATION ($NYSE:KN) is a leading global provider of advanced micro-acoustic, audio processing and precision device solutions. The company’s products are used in a range of applications, from consumer electronics to medical and industrial equipment. This forecast demonstrates the company’s continued focus on delivering high-quality products, services and solutions to its customers.

In addition, this announcement reflects the company’s ability to quickly adjust its strategy in response to changing market dynamics and customer demands. The company’s strong performance over the past year has been driven by its commitment to innovation, as well as its ongoing focus on meeting customers’ needs. As KNOWLES CORPORATION looks to the future, it remains committed to delivering high-quality products and services that will enable customers to make the most of their technological investments.

Earnings

In its earning report for the first quarter of FY2023, KNOWLES CORPORATION reported total revenue of 144.3M USD, a 28.4% decrease from the same period last year, and a net income loss of 5.2M USD, a 128.7% decrease from the same period last year. In light of the current financial performance, KNOWLES CORPORATION has forecasted Q2 revenue between 165M USD and 180M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Knowles Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 707.6 | -453.4 | -23.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Knowles Corporation. More…

| Operations | Investing | Financing |

| 107.4 | -29.8 | -75.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Knowles Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.2k | 208.1 | 10.81 |

Key Ratios Snapshot

Some of the financial key ratios for Knowles Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.5% | -19.9% | -62.0% |

| FCF Margin | ROE | ROA |

| 11.1% | -27.7% | -23.0% |

Stock Price

Following the announcement, KNOWLES CORPORATION stock opened at $16.4 and closed down 1.1% from its prior closing price of $16.4, settling at $16.2. The company is yet to release the actual revenue figures for the second quarter of the year, but investors are already keeping a close eye on the results. Live Quote…

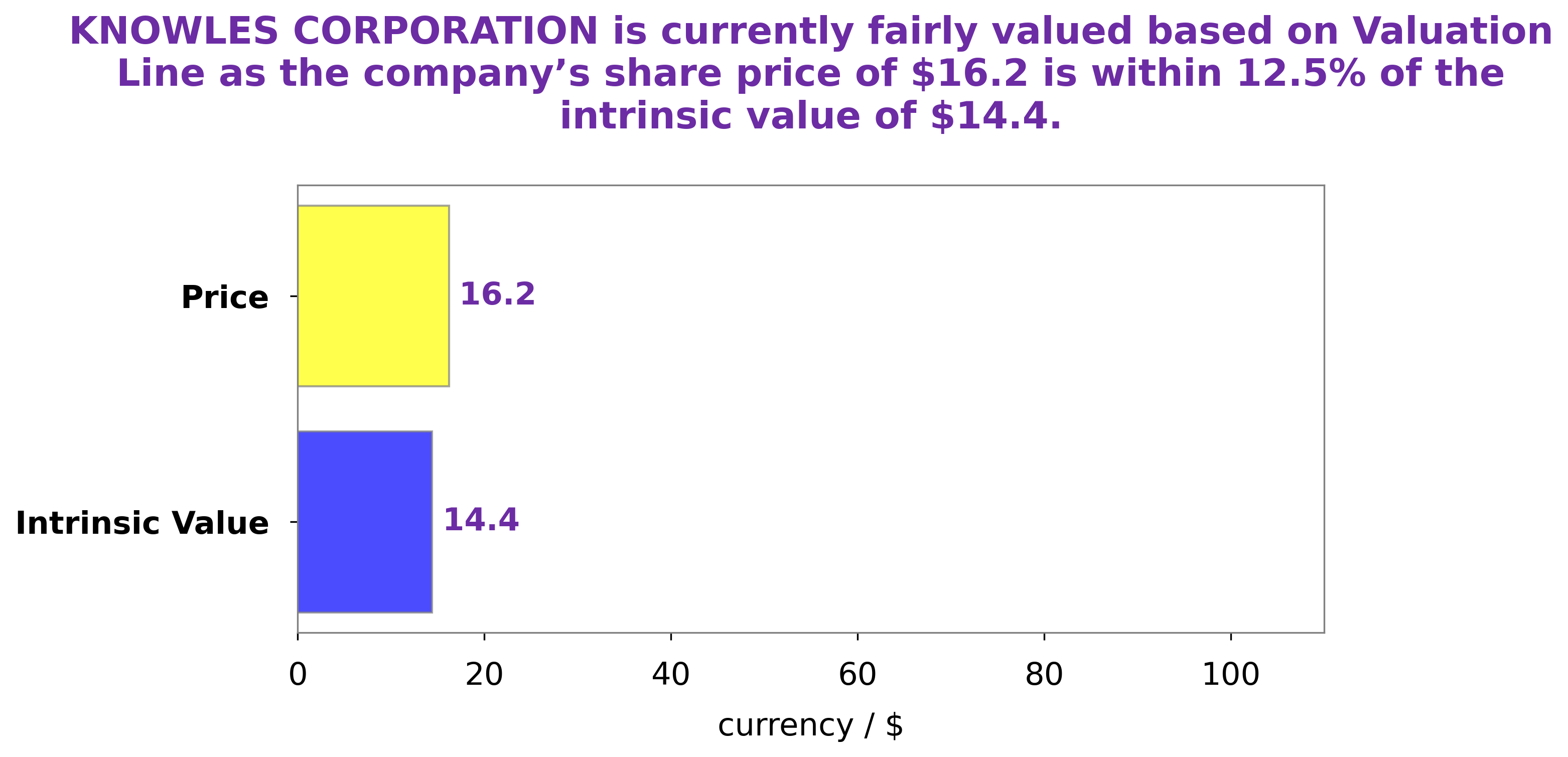

Analysis – Knowles Corporation Stock Fair Value

At GoodWhale, we recently conducted an analysis of KNOWLES CORPORATION‘s financials. After considering various metrics, our proprietary Valuation Line determined that the fair value of a KNOWLES CORPORATION share should be around $14.4. However, the stock is currently trading at a price of $16.2, which is a fair price that is overvalued by 12.7%. More…

Peers

In the mobile phone industry, there is intense competition between Knowles Corp and its competitors AdvanceTC Ltd, Shenzhen CDL Precision Technology Co Ltd, and Sonim Technologies Inc. All four companies are vying for market share in the smartphone market.

– AdvanceTC Ltd ($OTCPK:ATCLF)

AdvanceTC Ltd is a company that provides telecommunications and IT services. It has a market cap of 12.16M as of 2022 and a return on equity of 271.78%. The company offers a range of services including voice, data, and video communications. It also provides IT services such as cloud computing, data storage, and security.

– Shenzhen CDL Precision Technology Co Ltd ($SZSE:300686)

Shenzhen CDL Precision Technology Co Ltd is a precision technology company that specializes in the design and manufacture of high precision components and assemblies for the automotive, aerospace, and other industries. The company has a market cap of 3.26B as of 2022 and a return on equity of 0.17%.

– Sonim Technologies Inc ($NASDAQ:SONM)

Sonim Technologies Inc is a provider of ultra-rugged mobile phones and services designed for use in hazardous environments. The company has a market cap of 16.64M as of 2022 and a return on equity of -234.74%. Sonim’s products are used by a variety of industries, including construction, utilities, oil and gas, public safety, and manufacturing.

Summary

Knowles Corporation is an American producer of micro-acoustic, audio processing, and specialty component solutions. Investors should consider this news in light of the company’s current performance, including its revenue growth over the past several quarters and its strong gross margins. In addition, investors should review the company’s financial statements, customer base, and market position. Analysts are optimistic about the company’s potential in the market, with some forecasting that the company could exceed its revenue guidance for the quarter.

Recent Posts