Juniper Networks and IBM Partner to Democratize Radio Networks and Optimize Mobile User Experiences.

February 25, 2023

Trending News ☀️

JUNIPER ($NYSE:JNPR): Richard E. Perlman, the director of Montrose Environmental Group, Inc., recently sold 400 shares of his stock in the company. This news has sparked a lot of interest in the environmental sector, as Montrose Environmental Group has become a leader in providing environmental services and innovative solutions. They specialize in air quality monitoring, energy and sustainability consulting, methane detection and quantification, and more. Perlman has been instrumental in the success of Montrose Environmental Group, helping to build it into the global leader it is today.

Though Perlman has sold off 400 shares of stock, he remains committed to the company and will continue to help shape its future. He has expressed his ongoing commitment to Montrose Environmental Group’s mission of providing top quality environmental services. The recent news of Perlman’s sale of 400 shares of stock has many observers questioning what this could mean for the future of the company.

Share Price

On Wednesday, the news broke that Richard E. Perlman, director of Montrose Environmental Group, Inc., had sold 400 shares of his stock. Despite this, at the time of writing market sentiment remains mostly positive. The stock opened on Wednesday at $51.0 and closed at $51.2, representing a 0.2% increase from the previous closing price of $51.2. This could indicate that investors remain confident in the company and that the sale of stock by Mr. Perlman should not be seen as a bearish indicator. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Juniper Networks. More…

| Total Revenues | Net Income | Net Margin |

| 5.3k | 471 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Juniper Networks. More…

| Operations | Investing | Financing |

| 97.6 | 407.5 | -528.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Juniper Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.33k | 4.85k | 13.86 |

Key Ratios Snapshot

Some of the financial key ratios for Juniper Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | 4.1% | 11.2% |

| FCF Margin | ROE | ROA |

| -0.1% | 8.4% | 4.0% |

Analysis

At GoodWhale, we recently conducted an analysis of MONTROSE ENVIRONMENTAL’s wellbeing in terms of financial and business risk. Our Risk Rating placed MONTROSE ENVIRONMENTAL as a high risk investment, which means potential investors should proceed with caution. We have also detected 2 risk warnings in the company’s balance sheet and cashflow statement. These warnings further emphasize the need for investors to research the company further before committing to any financial involvement. To gain a better understanding of the risks associated with investing in MONTROSE ENVIRONMENTAL, interested parties can register on goodwhale.com for free to access our detailed overview of the risks and potential investments. More…

Summary

Richard Perlman, the Director of Montrose Environmental Group, Inc., recently sold 400 shares of the company’s stock. This has prompted investors to analyze their position in Montrose Environmental. This positive news has increased the stock’s performance on the market, proving beneficial for investors. Despite the relatively low trading volume that this stock has, Montrose Environmental is gaining attention as more money pours into the company.

Analysts suggest that Montrose Environmental should continue to climb as investors remain confident in the company’s future prospects. The recent selling of shares by Richard Perlman should not be seen as a negative but rather as a testament to his confidence in the company’s future success. Investors should take this into consideration when determining their position in Montrose Environmental.

Trending News ☀️

TG Therapeutics is a biopharmaceutical company that is devoted to developing and commercializing treatments for autoimmune diseases and B-cell malignancies. Its lead product is ublituximab, a monoclonal antibody, which has been approved by the FDA and holds potential for treating relapsing-remitting multiple sclerosis and more. Ublituximab has demonstrated positive results in clinical trials with adult patients suffering from clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease. Moreover, ublituximab is believed to have an effect on T cells, causing them to produce anti-inflammatory cytokines that reduce inflammation and lower the risk of relapses. TG Therapeutics is confident that ublituximab has the potential to significantly benefit those with MS by reducing symptoms and improving quality of life. With its capability of targeting B cells, ublituximab could be key in reducing inflammation and improving the outcomes associated with MS.

Additionally, if studies show that it is able to prevent relapses, ublituximab may serve as a revolutionary breakthrough in treating MS in adults.

Market Price

TG Therapeutics is a biopharmaceutical company that has developed innovative treatments for B-cell malignancies and autoimmune diseases. Their lead product is Ublituximab, an immunotherapy for B-cell malignancies. At the time of writing, news has been mostly negative for TG Therapeutics.

On Thursday, their stock opened at $17.0 and closed at $16.4, down 2.7% from their previous closing price at $16.9. This has led to some concerns over the company’s ability to deliver on its promise and to generate profits in the near future. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of TG THERAPEUTICS’s wellbeing, and based on our Risk Rating, TG THERAPEUTICS is a medium risk investment in terms of financial and business aspects. We detected three risk warning signs in their income sheets, balance sheets and cashflow statement. If you want to explore the details of these risks further, please register on our website at goodwhale.com and check it out. We are committed to providing users with all the necessary insights they need to make informed investment decisions. More…

Summary

TG Therapeutics is a biopharmaceutical company focused on developing treatments for various types of B-cell malignancies and autoimmune diseases. Their lead product, Ublituximab, has recently been the subject of much news and investment analysis. At the time of writing, analysts are divided on the stock, with some citing potential for high returns and others seeing it as too risky. Overall, it seems that investors can expect varying returns depending on their risk tolerance and the company’s progress.

Trending News ☀️

Shenzhen Fenda Technology recently announced that it will be investing 180 million yuan into their smart home subsidiary. This investment is part of the company’s plan to expand into the smart home market and further develop their technologies. With this new funding, the subsidiary will be able to create innovative products and services that can help people to better manage their home, making life more connected and convenient. The company has already released several smart home products, such as home automation systems and intelligent door locks. These products have been well-received by consumers, indicating strong potential for the technology.

Furthermore, the investment in the subsidiary will enable the company to further expand their product portfolio and make them more accessible to consumers. Shenzhen Fenda Technology plans to continue investing in their smart home subsidiary, creating a strong base for their business in this growing industry. With their innovative products and services, they hope to take a leading role in this sector and become a major player in the smart home market. This investment reflects the company’s commitment to continue pushing boundaries and creating innovative technologies that can improve people’s lives.

Market Price

On Wednesday, news about Shenzhen Fenda Technology investing 180 million yuan into a smart home subsidiary spread quickly. This announcement has been met with largely positive sentiment from investors, as evidenced by the stock opening and closing at CNY4.2 with an additional 1.9% increase in the company’s share price. This investment will help ensure that Shenzhen Fenda Technology remains competitive in the smart home market. Live Quote…

Analysis

GoodWhale has conducted an analysis of SHENZHEN FENDA TECHNOLOGY’s wellbeing and has classified the company as an ‘elephant’, which is a type of company that is rich in assets after deducting off liabilities. After our assessment, SHENZHEN FENDA TECHNOLOGY has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Our analysis also showed that SHENZHEN FENDA TECHNOLOGY is strong in asset, medium in growth, profitability and weak in dividend. Given these results, we believe that SHENZHEN FENDA TECHNOLOGY is an attractive investment opportunity for long-term investors who are looking for a stable company with good cash flows. The company’s solid asset base provides a strong underpinning to their future growth, while its overall health score indicates that it is able to pay off its debts and fund future operations. Additionally, its low dividend potential makes it less attractive for short-term investors looking for quick returns. More…

Summary

Shenzhen Fenda Technology recently announced they were making a large investment in their Smart Home Subsidiary with the amount of 180 million yuan. This move is met with positive sentiment from investors, as they see the potentials of growth and success in the Smart Home industry. This capital injection will allow the subsidiary to expand their operations, allowing them to further develop and innovate their products.

Additionally, this investment will increase the company’s portfolio within the Smart Home industry which opens up more opportunities for revenue and profit. Investors are confident of Shenzhen Fenda Technology’s ability to reap the rewards of this investment.

Trending News ☀️

Since 2007, PCTEL has been facing a significant challenge as it has seen its revenues remain stagnant in the face of the Wi-Fi and mobile internet revolution. Despite investing heavily in research and development, the company has not seen much of a return on this investment in terms of revenue growth. It has become increasingly difficult for PCTEL to see the R&D expenditure as a profitable venture rather than simply a cost of doing business. Operating in the highly competitive field of design and manufacturing of antenna components and radio frequency testing equipment for a range of electronic products, PCTEL have been unable to keep up with the continual advancements and technological developments occurring in the market. As a result, the company has been unable to capitalize on the emerging trends in the industry and thus take advantage of the growing market opportunities.

In order to overcome this challenge, PCTEL must focus on increasing their market share by developing innovative products and services that meet customer demands. They must also look to increase their customer base in order to offset their R&D expenditure and promote long-term revenue growth. Only then can PCTEL overcome its current struggles and realize their full potential in the mobile internet and Wi-Fi revolution.

Share Price

On Thursday, PCTEL stock opened at $4.6 and closed at the same price, despite positive news coverage for the Wi-Fi and Mobile Internet Revolution. PCTEL has failed to turn their high Research & Development expenditure into growth in their revenues. This struggle is further compounded by the growing competition in the Wi-Fi and Mobile Internet space. As a result of their lack of revenue growth, despite their high R&D expenditure, investors are unsure of PCTEL’s capability to capitalize on this revolution. Live Quote…

Analysis

At GoodWhale, we recently conducted a financial analysis of PCTEL’s stock. After comparing their market price to our proprietary Valuation Line tool, we concluded that the intrinsic value of PCTEL’s share is around $6.6. Currently, PCTEL is trading at $4.6 per share, which implies that the stock is undervalued by 29.8%. Therefore, we consider this an opportunity to invest in PCTEL at a discounted price. More…

Summary

PCTEL has been investing heavily in research and development (R&D) in recent years in an effort to remain competitive in an everchanging Wi-Fi and mobile internet market. Despite these higher R&D expenditures, the company’s revenue growth has been slow. Current news coverage of the company is mostly positive. Investors should carefully consider the risks versus rewards when investing in PCTEL; a well-thought-out strategy and diversification are essential.

It is important to monitor the company’s business developments and understand the competitive landscape, including new competitors that may emerge at any time. Being aware of the company’s financial situation will also be advantageous when making investment decisions.

Trending News ☀️

MIRAIT ONE CORPORATION, a Japanese corporation listed on the Tokyo Stock Exchange (1417), has announced that it will be cancelling 5 million of its shares. This decision is part of their effort to optimize their financial position and reduce their outstanding share capital by reducing the total amount of shares. The primary purpose of the cancellation is to make MIRAIT ONE CORPORATION more attractive to potential investors. By decreasing the shares available, the company is expecting to see an increased demand for current shares and as a result, a rise in their share price.

Additionally, decreasing their outstanding shares will also help the company further minimize its financial risk by reducing its exposure to excess debt. At this time, shareholders of the company will have their shares reduced accordingly while any remaining shareholders will have their holdings augmented. MIRAIT ONE CORPORATION has stated that they are committed to providing shareholders with maximum value and looking towards a successful future.

Market Price

On Friday, MIRAIT ONE Corporation (1417) made an announcement to cancel 5 million of its own shares. Despite this news, investors mostly remain positive on the stock as it opened at JP¥1486.0 and closed at JP¥1489.0, up by 0.3% from prior closing price of 1485.0. This indicates that investors are still confident in MIRAIT ONE. The company will continue to monitor the performance of its stock and take necessary measures to ensure value of the share. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis on MIRAIT ONE’s wellbeing. According to our Risk Rating, MIRAIT ONE is a medium risk investment in terms of financial and business aspects. We have identified two risk warnings in the income sheet and the cashflow statement. If you would like to know more about these risk warnings, we would be more than happy to provide you with further information. All you need to do is register with us and our team can help you gain a better understanding. More…

Summary

Investing in MIRAIT ONE CORPORATION (1417) may be a good option for investors despite their recent decision to cancel five million shares. Analysts mostly agree that their long-term outlook is positive due to their highly diversified portfolio and growing revenue base. The company has a wide range of products, with an increasing global presence, and a focus on sustainable growth. With an expanding customer base and an established market presence, MIRAIT ONE CORPORATION looks likely to be a reliable long-term investment for shareholders.

Furthermore, the company has an experienced management team and sound financials, providing investors with peace of mind that their money is safe. As such, investors should seriously consider investing in MIRAIT ONE CORPORATION as a sound option for their portfolio.

Trending News ☀️

Juniper Networks and IBM have announced a partnership to enable the democratization of radio access networks and to optimize mobile user experiences. By integrating IBM’s network automation capabilities with Juniper’s RAN optimization and Open RAN technology, both organizations are taking the necessary steps to manage the influx of connected devices. This integration allows for vendor diversity and ensures that users are not locked into any one specific supplier. In addition to making be radio networks more accessible, this new collaboration will also facilitate better mobile experience for users. The goal is to use the combination of IBM’s network automation and Juniper’s end-to-end portfolio to create solutions that will optimize mobile user experiences.

This includes developing initiatives that will provide improved services and better levels of connectivity. By making these networks more accessible, it allows for greater usability, improved service, and better user experiences. This collaboration will ultimately lead to a better connected world.

Market Price

This news was met with a positive reaction from media, as JUNIPER NETWORKS stock opened at $31.5 and closed at $31.5, up by 0.6% from its previous closing price of 31.3. The move signifies the two companies’ commitment to making wireless data access and transmission more accessible and efficient for large-scale applications. With this partnership, JUNIPER NETWORKS and IBM will be able to enhance the mobile user experience and explore new opportunities in the telecom industry. Live Quote…

Analysis

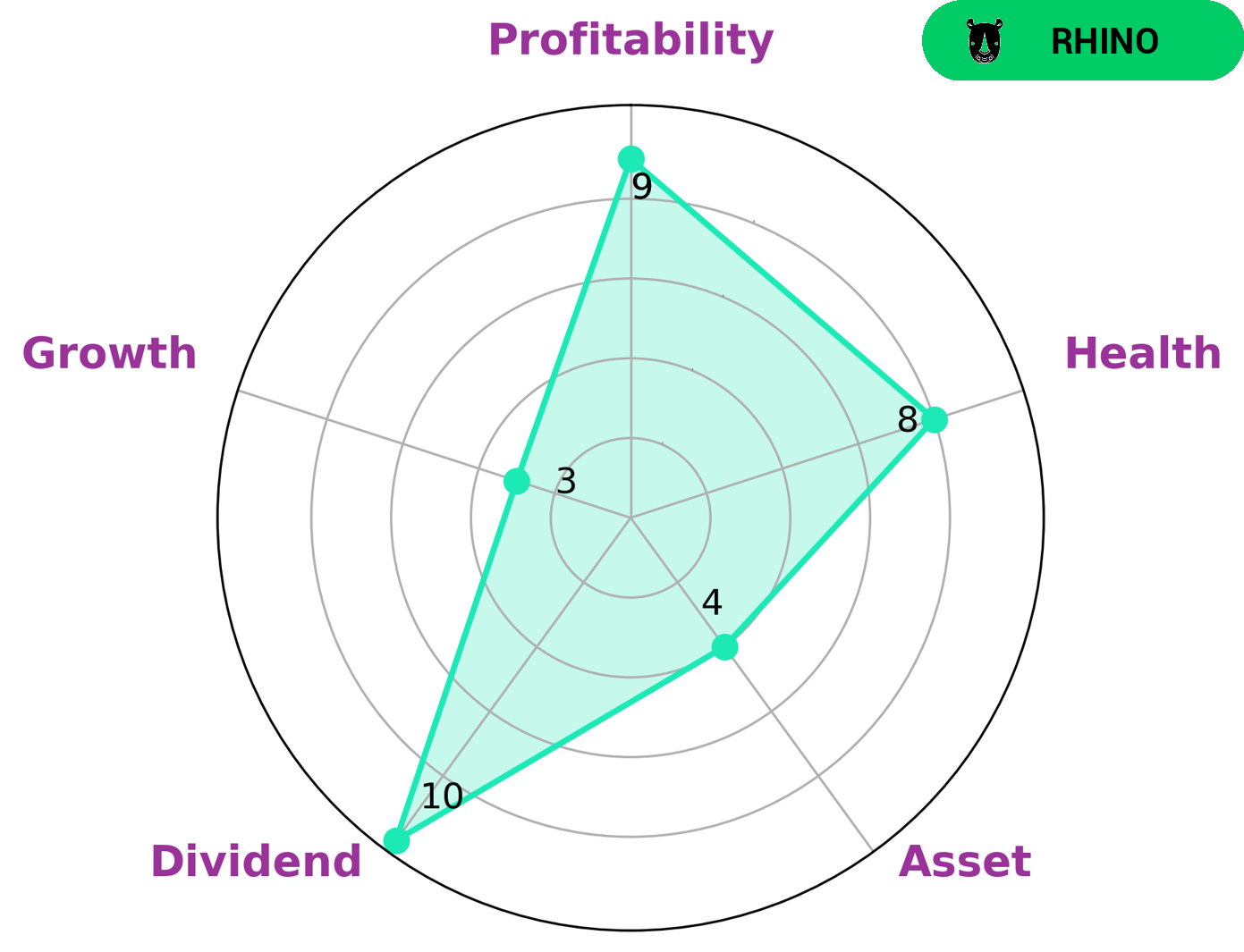

I examined the financials of JUNIPER NETWORKS and classified it as a “rhino”, which is a type of company that has achieved moderate revenue or earnings growth. This can be seen from the Star Chart which provides an in-depth analysis of the company. With a high health score of 8/10 with regard to its cashflows and debt, it is evident that JUNIPER NETWORKS is a stable company capable to sustain future operations in times of crisis. Additionally, it is also strong in dividend and profitability, and medium when it comes to asset and weak in growth. Corporate investors and dividend seekers would be interested in such a company due to its stable income stream, while value investors may be less interested as they tend to look for companies with higher growth potential. More…

Peers

It’s main competitors are TPT Global Tech Inc, Unizyx Holdings, and Sangfor Technologies Inc. All three companies offer networking products and services, but Juniper Networks Inc is the clear leader in the industry. It has the most market share and the most innovative products.

– TPT Global Tech Inc ($OTCPK:TPTW)

TPT Global Tech Inc is a publicly traded company with a market capitalization of $1.75 million as of 2022. The company has a Return on Equity of 6.63%. TPT Global Tech Inc is a provider of global telecommunications solutions and services. The company offers a range of services, including voice, data, and video, to residential and business customers in the United States and internationally.

– Unizyx Holdings ($TWSE:3704)

Unizyx Holdings is a publicly traded company with a market capitalization of 12.59 billion as of 2022. The company has a return on equity of 12.15%. Unizyx Holdings is a holding company that operates businesses in the financial services, insurance, and investment industries. The company’s subsidiaries include Union Bank of Taiwan, Taiwan Insurance, and Uni-Investment.

– Sangfor Technologies Inc ($SZSE:300454)

Sangfor Technologies Inc is a global provider of information technology solutions. Its products and services include network security, cloud computing, and big data. The company has a market cap of 50.71B as of 2022 and a return on equity of -1.21%. It has operations in China, North America, Europe, Asia Pacific, and the Middle East.

Summary

Juniper Networks, a leading provider of routing, security, and automation solutions for the connected world, recently announced a strategic partnership with IBM to democratize radio networks and optimize mobile user experiences. The collaboration provides networks with the flexibility and scalability to support mobile and enterprise applications as well as more effectively manage costs. Analysts believe that this agreement will have a positive impact on Juniper Networks’ share prices, as it promises to improve their existing radio network solutions offering.

Additionally, IBM’s extensive technological capabilities and industry knowledge are expected to help Juniper Networks further enhance their ability to deliver comprehensive and cost-effective solutions. Juniper Networks is expected to generate increased profits through better service offerings and reduced operating costs, while IBM stands to capitalize on its strategic alliance with the network provider.

Recent Posts