Impinj Stock Fair Value – IMPINJ Reports Better-Than-Expected Revenue Despite Lower-Than-Anticipated Earnings

April 28, 2023

Trending News 🌥️

Impinj ($NASDAQ:PI)’s non-GAAP earnings per share (EPS) of $0.30 fell short of expectations by $0.03, while revenue of $85.9 million exceeded estimates by $2.31 million. Impinj Inc. is a publicly traded company that designs, manufactures, and sells RAIN RFID solutions to provide businesses with automated item-level inventory management and customer engagement solutions. RFID technology enables organizations to more accurately and cost-effectively track their customers’ products and items throughout the entire supply chain. The company’s better-than-expected revenue was driven by strong sales of its RAIN RFID endpoints and tags, which reflected an increase in customer demand for its products and solutions.

Additionally, Impinj was able to capitalize on new opportunities in the retail and healthcare sectors, as well as broader adoption of RAIN technology across its customer base. Despite these positive results, the company’s earnings fell short of expectations due to increased costs related to R&D, sales, and marketing expenses. Additionally, the company noted that foreign exchange headwinds impacted their bottom line. The company is also focused on expanding its presence in new and existing markets, as well as developing new products and solutions to meet customer needs.

Market Price

On Wednesday, IMPINJ stock opened at $135.4 and closed at $135.3, down by 0.5% from its previous closing price of 136.0. Despite the stock’s slight dip, the company reported better-than-expected revenue for the quarter, even though the earnings were lower than anticipated. This suggests that investors have confidence in IMPINJ’s ability to generate growth in the future.

It also highlights their commitment to meeting the needs of their customers through their innovative products and services. Despite the lower-than-anticipated earnings, IMPINJ still managed to turn in a positive performance, which is indicative of the company’s strong fundamentals and resilience in the face of difficult market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Impinj. More…

| Total Revenues | Net Income | Net Margin |

| 257.8 | -24.3 | -9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Impinj. More…

| Operations | Investing | Financing |

| 0.64 | -102.8 | -2.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Impinj. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 349.74 | 334.15 | 0.6 |

Key Ratios Snapshot

Some of the financial key ratios for Impinj are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | – | -8.1% |

| FCF Margin | ROE | ROA |

| -4.4% | -147.3% | -3.7% |

Analysis – Impinj Stock Fair Value

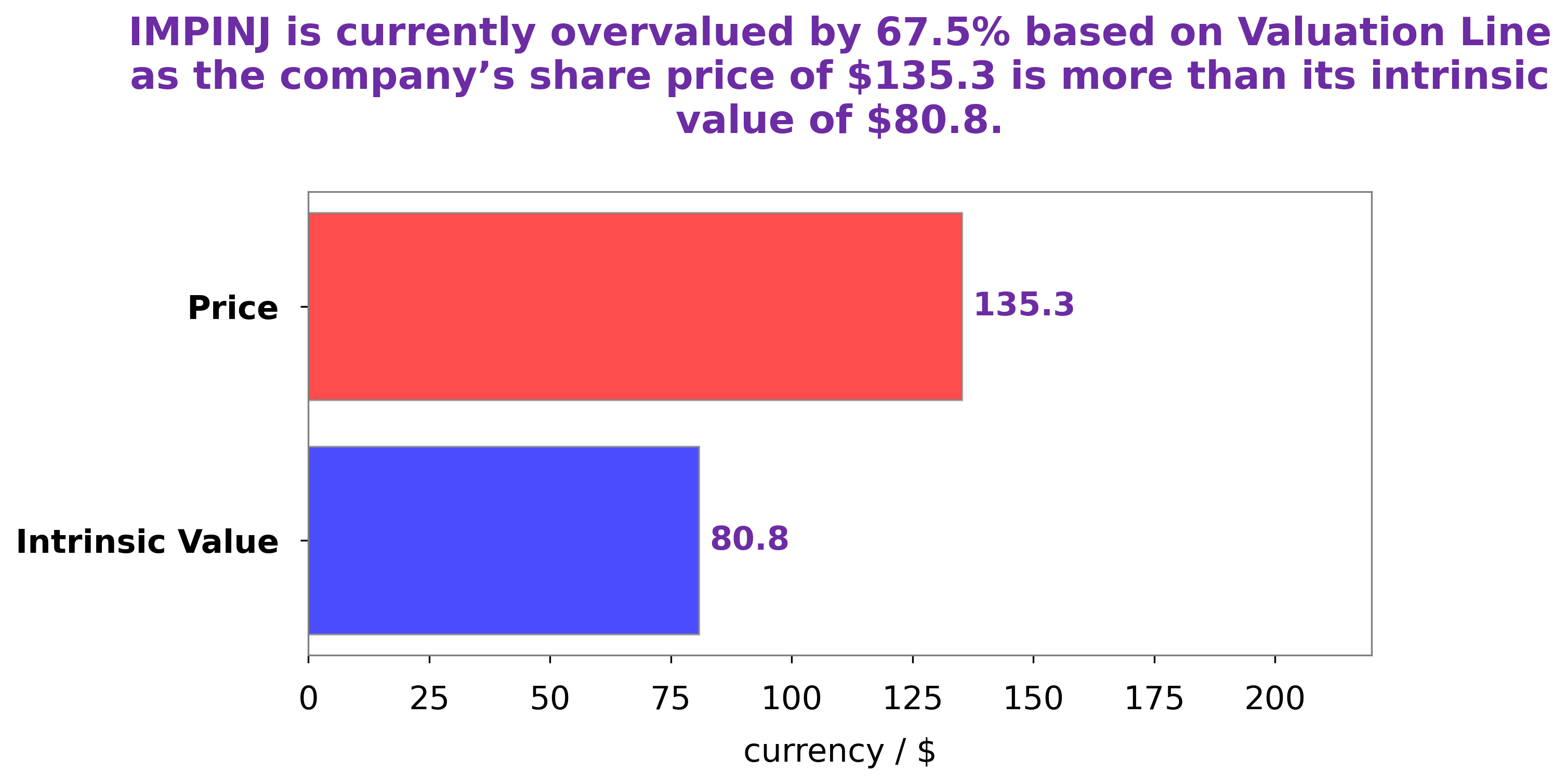

At GoodWhale, we conducted an in-depth analysis of Impinj‘s financials, and have concluded that the intrinsic value of their share is approximately $80.8. This value was calculated using our proprietary Valuation Line. However, Impinj’s current stock price is $135.3, meaning that it is overvalued by 67.5%. This may be due to the market’s enthusiasm for Impinj’s prospects, but investors should be aware of the discrepancy between the stock’s true value and its current trading price. More…

Peers

Its product portfolio includes RFID readers, antennas, tags, and other related hardware and software products. The company’s solutions are used in a wide variety of applications, including inventory management, supply chain management, asset tracking, and access control. Impinj also offers a wide range of services, including consulting, support, and education. The company’s products compete against those offered by Ceragon Networks Ltd, u-Blox Holding AG, and Redline Communications Group Inc.

– Ceragon Networks Ltd ($NASDAQ:CRNT)

Ceragon Networks Ltd is a global provider of high-capacity broadband wireless solutions. Its solutions enable mobile operators, fixed-line service providers, private network operators and enterprises to deliver voice, data and multimedia services. Ceragon Networks Ltd has a market cap of 158.42M as of 2022 and a Return on Equity of -0.74%. The company’s solutions are based on its proprietary Ultra High Capacity technology, which delivers high-capacity, high-availability and low-latency connectivity.

– u-Blox Holding AG ($LTS:0QNI)

u-Blox Holding AG is a Swiss technology company that specializes in positioning and wireless communication technologies for the automotive, industrial, and consumer markets. The company has a market capitalization of 781.27 million as of 2022 and a return on equity of 13.55%. u-Blox Holding AG develops and markets global navigation satellite system (GNSS) positioning products and services for automotive, industrial, and consumer applications. The company’s products include GNSS chips and modules, GNSS software, GNSS reference receivers, GNSS antenna solutions, GNSS evaluation kits, and GNSS simulators. u-Blox Holding AG also provides cellular communication products, such as cellular modules, cellular gateways, and cellular IoT products.

Summary

The company reported Non-GAAP earnings per share of $0.30, which missed the consensus analyst estimate by $0.03. Investors should consider these results when making their investing decisions and keep an eye out for any changes in the company’s performance.

Recent Posts