IMPINJ Reports Q4 Earnings for FY2022 on December 31, 2022.

April 7, 2023

Earnings Overview

IMPINJ ($NASDAQ:PI) reported total revenue of USD -0.1 million and net income of USD 76.6 million for the fourth quarter of its FY2022 ending December 31, 2022, compared to a year-over-year increase of 99.4% and 45.7%, respectively.

Transcripts Simplified

Impinj had a great year in 2022, with record-breaking revenue, adjusted EBITDA margin, and backlog. Their fourth quarter was especially strong, with revenue, adjusted EBITDA, and EPS all up compared to the previous quarter and up year-over-year. Despite wafer and component shortages, the team was able to capitalize on demand and grow their revenue sequentially every quarter.

Gross margin for the fourth quarter was 53.8%, compared to 56.9% in the third quarter and 58.2% in the fourth quarter of 2021. Operating expenses for the fourth quarter were $29.5 million, up from $29 million in the third quarter and $25.3 million in the fourth quarter of 2021.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Impinj. More…

| Total Revenues | Net Income | Net Margin |

| 257.8 | -24.3 | -9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Impinj. More…

| Operations | Investing | Financing |

| 0.64 | -102.8 | -2.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Impinj. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 349.74 | 334.15 | 0.6 |

Key Ratios Snapshot

Some of the financial key ratios for Impinj are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | – | -8.1% |

| FCF Margin | ROE | ROA |

| -4.4% | -147.3% | -3.7% |

Price History

On Wednesday, December 31, 2022, IMPINJ reported its earnings for the fourth quarter of FY2022. At the start of the trading day, IMPINJ’s stock opened at $128.7 and closed at $125.1, representing a 3.0% drop from the previous day’s closing price of $129.0. While investors were initially disappointed in the earnings report, the company’s strong performance overall is likely to bode well for future quarters.

The company recently announced plans to expand its product offerings and services in the near future, and its stock has been steadily climbing since its initial dip on Wednesday. Overall, analysts are optimistic about IMPINJ’s future prospects and believe that it is well positioned for continued success as it enters into its next quarter. Live Quote…

Analysis

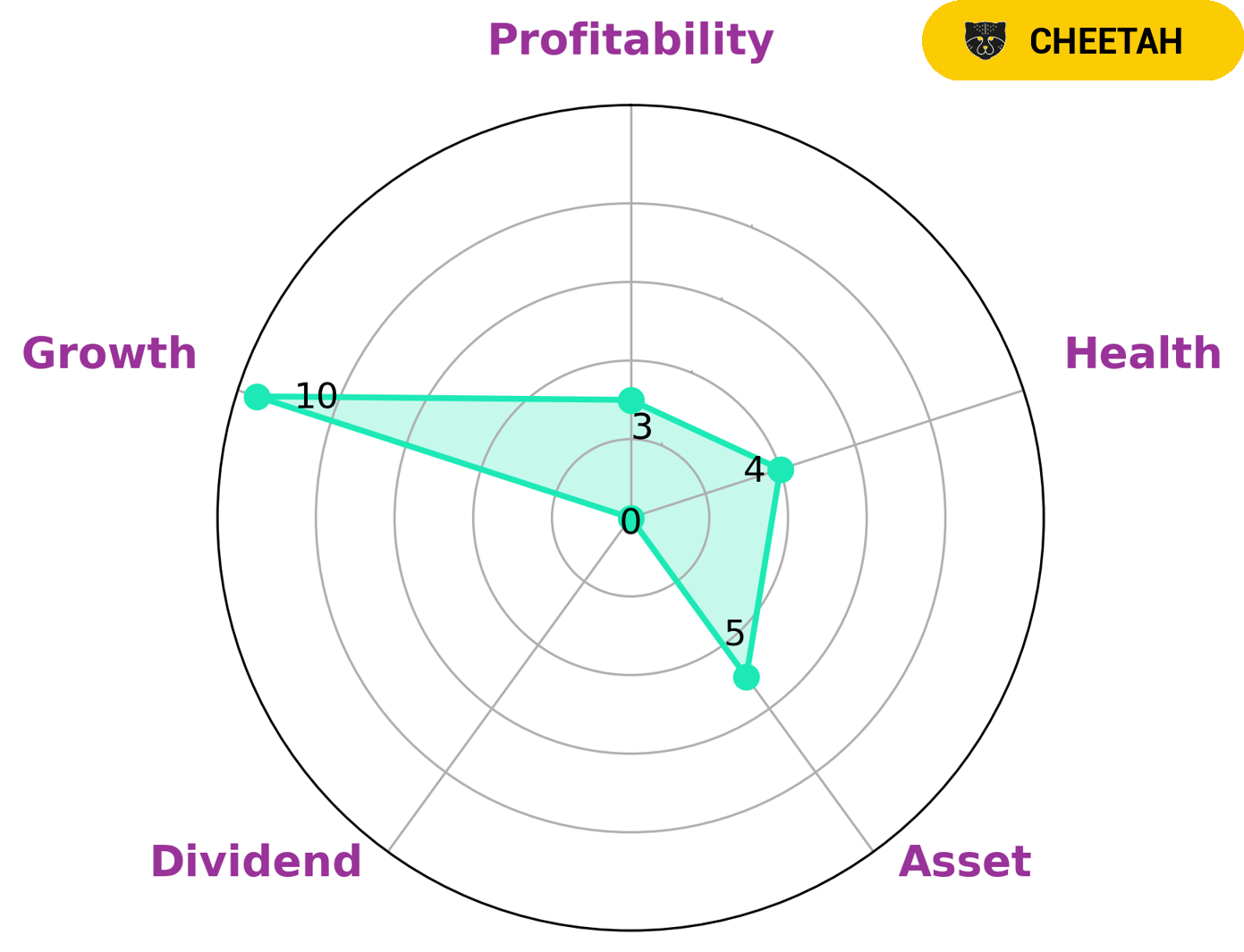

GoodWhale has conducted an analysis of IMPINJ‘s wellbeing. After examining the Star Chart, we have determined that IMPINJ is strong in growth, medium in asset and weak in dividend and profitability. Based on our findings, we can conclude that IMPINJ is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. The type of investors who may be interested in such a company are those who are looking for a high growth investment with a relatively short investment horizon. IMPINJ has an intermediate health score of 4/10 with regard to its cashflows and debt. This indicates that the company might be able to pay off debt and fund future operations. More…

Peers

Its product portfolio includes RFID readers, antennas, tags, and other related hardware and software products. The company’s solutions are used in a wide variety of applications, including inventory management, supply chain management, asset tracking, and access control. Impinj also offers a wide range of services, including consulting, support, and education. The company’s products compete against those offered by Ceragon Networks Ltd, u-Blox Holding AG, and Redline Communications Group Inc.

– Ceragon Networks Ltd ($NASDAQ:CRNT)

Ceragon Networks Ltd is a global provider of high-capacity broadband wireless solutions. Its solutions enable mobile operators, fixed-line service providers, private network operators and enterprises to deliver voice, data and multimedia services. Ceragon Networks Ltd has a market cap of 158.42M as of 2022 and a Return on Equity of -0.74%. The company’s solutions are based on its proprietary Ultra High Capacity technology, which delivers high-capacity, high-availability and low-latency connectivity.

– u-Blox Holding AG ($LTS:0QNI)

u-Blox Holding AG is a Swiss technology company that specializes in positioning and wireless communication technologies for the automotive, industrial, and consumer markets. The company has a market capitalization of 781.27 million as of 2022 and a return on equity of 13.55%. u-Blox Holding AG develops and markets global navigation satellite system (GNSS) positioning products and services for automotive, industrial, and consumer applications. The company’s products include GNSS chips and modules, GNSS software, GNSS reference receivers, GNSS antenna solutions, GNSS evaluation kits, and GNSS simulators. u-Blox Holding AG also provides cellular communication products, such as cellular modules, cellular gateways, and cellular IoT products.

Summary

IMPINJ, a leading provider of item-level information and data, reported strong fourth quarter FY2022 financial results, with total revenue of -0.1 million USD and net income of 76.6 million USD, representing respective increases of 99.4% and 45.7% year-over-year. Despite the positive results, investors reacted negatively to the news, with its stock price declining on the day the earnings were announced. Long-term investors may look to IMPINJ as a potential investment opportunity due to its impressive financial performance and track record of growth. However, short-term investors should be cautious as the stock may remain volatile in the coming days as the market reacts to these financial results.

Recent Posts