Extreme Networks’ Undervaluation Suggested By FCF & EBITDA

June 12, 2023

🌥️Trending News

Extreme Networks ($NASDAQ:EXTR) Inc. (NASDAQ: EXTR) is a leading provider of enterprise networking solutions that help customers build and secure their digital infrastructure. Based on the company’s performance, it appears that Extreme Networks is currently undervalued. This can be seen by analyzing the company’s free cash flow (FCF) and earnings before interest, taxes, depreciation and amortization (EBITDA). FCF is a measure of the amount of money a company generates after accounting for capital expenditures. This indicates that the company is generating more cash than it is spending, which is a good sign of financial health.

EBITDA is another measure of a company’s performance. This suggests that the company is continuing to generate profits, despite the challenging economic environment. When taken together, these figures suggest that Extreme Networks is undervalued compared to its peers. Investors should consider this stock as a potential addition to their portfolio as it is well-positioned to benefit from the current digital transformation taking place across the globe.

Stock Price

Extreme Networks‘ stock has been on an uptrend since Tuesday, when it opened at $21.3 and closed at $21.9, up by 2.6% from the previous closing price of 21.4. This price increase suggests that Extreme Networks may be undervalued by the market. This can be further evidenced by the company’s fundamental analysis in terms of its Free Cash Flow (FCF) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). The FCF of Extreme Networks is computed as its operating activities minus its investing activities.

The combination of a steadily increasing FCF and EBITDA provides reason to believe that Extreme Networks may be undervalued by the market. Therefore, Extreme Networks shareholders should continue to monitor the stock performance and news of the company closely. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Extreme Networks. More…

| Total Revenues | Net Income | Net Margin |

| 1.23k | 58.06 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Extreme Networks. More…

| Operations | Investing | Financing |

| 232.64 | -12.94 | -182.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Extreme Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.07k | 965.21 | 0.65 |

Key Ratios Snapshot

Some of the financial key ratios for Extreme Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 17.8% | 6.8% |

| FCF Margin | ROE | ROA |

| 17.9% | 55.4% | 4.9% |

Analysis

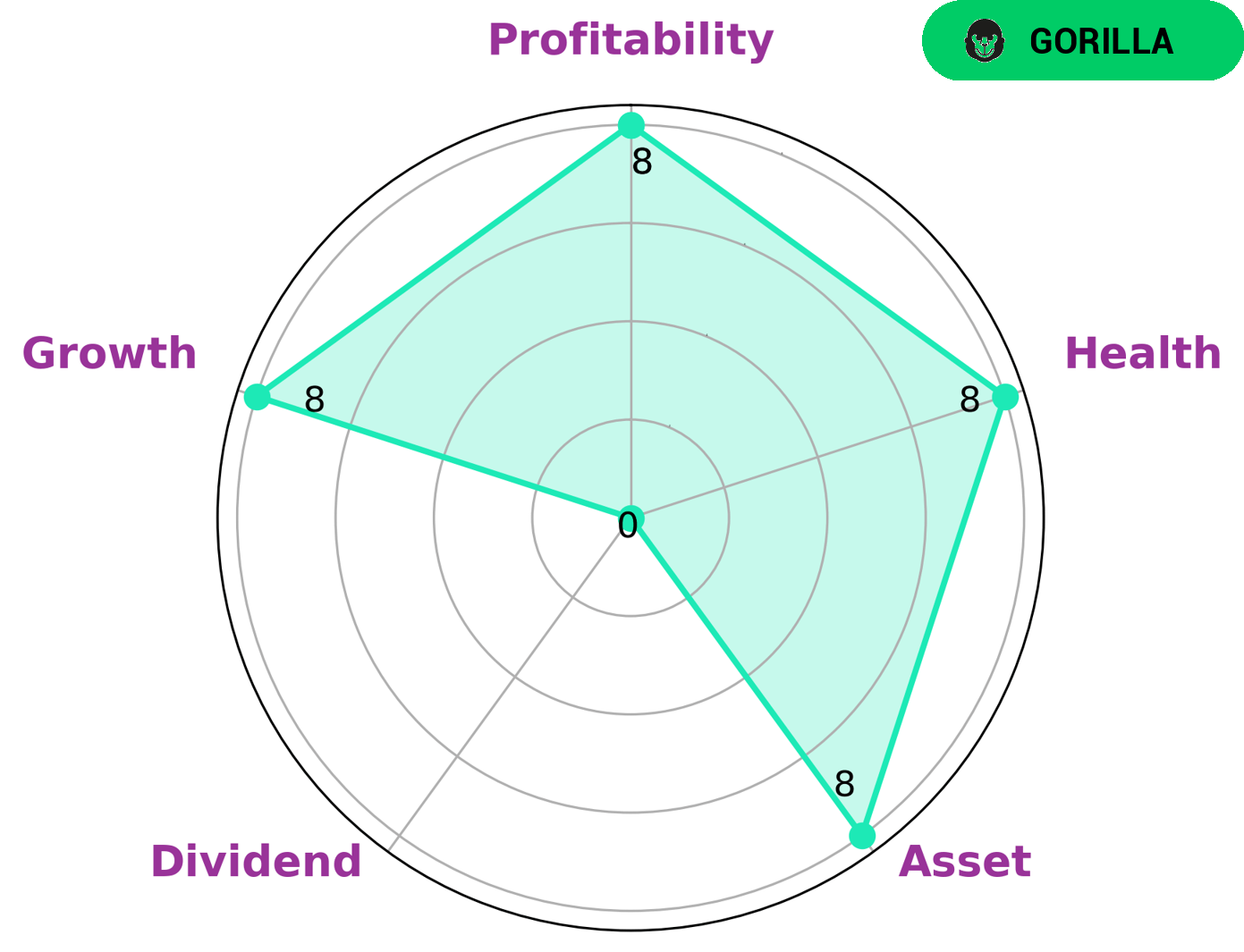

At GoodWhale, we conducted an analysis of EXTREME NETWORKS‘s fundamentals. Our Star Chart shows that EXTREME NETWORKS has a high health score of 8/10 considering its cashflows and debt, which indicates its capability to sustain future operations in times of crisis. We classified EXTREME NETWORKS as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. In terms of what type of investors may be interested in such a company, we believe EXTREME NETWORKS is strong in terms of assets, growth, and profitability, but weak in terms of dividends. As such, investors who are looking for high growth and are comfortable with low dividends may consider this company as an attractive investment option. More…

Peers

The company’s products are designed to meet the most demanding networking challenges. Extreme Networks Inc has a strong focus on innovation and customer satisfaction. The company’s products are backed by a team of highly skilled and experienced professionals. Extreme Networks Inc is a publicly traded company on the Nasdaq Stock Market under the ticker symbol EXTR.

– DZS Inc ($NASDAQ:DZSI)

DZS Inc is a communications equipment company with a market cap of 398.33M as of 2022. The company has a Return on Equity of -9.45%. DZS Inc provides broadband products and solutions to service providers, enterprises, and governments worldwide. The company’s products and solutions include access network products, core network products, and cloud and managed services.

– ADVA Optical Networking SE ($LTS:0NOL)

ADVA Optical Networking SE has a market cap of 1.05B as of 2022, a Return on Equity of 6.63%. The company is a leading provider of fiber optic solutions that enable fast, reliable and cost-effective communications. Its products are used in a variety of applications, including data center networking, metro and long-haul transport, mobile backhaul and data center interconnect.

Summary

Extreme Networks is a technology company that provides a wide range of networking solutions and services for enterprise customers. Investment analysis of Extreme Networks indicates that the company is currently undervalued based on its Free Cash Flow (FCF) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). By comparing its stock price to those of its competitors, Extreme Networks appears to be trading at a discount.

Analysts have also noted that the company has strong management, a diverse product portfolio, and a large customer base, all of which could potentially lead to increased value in the future. Furthermore, Extreme Networks has recently announced plans to expand its operations to new markets, which could also contribute to a stronger market position.

Recent Posts