Comtech Telecommunications Intrinsic Value Calculator – COMTECH TELECOMMUNICATIONS Reports Q3 Earnings Results for Fiscal Year 2023

June 10, 2023

🌥️Earnings Overview

On June 8 2023, COMTECH TELECOMMUNICATIONS ($NASDAQ:CMTL) announced its financials for the third quarter of their fiscal year 2023, ending April 30 2023. Total revenue increased by 11.6% year-over-year to USD 136.3 million, while net income decreased to USD -7.5 million from the previous year’s figure of -0.0 million.

Price History

On Thursday, COMTECH TELECOMMUNICATIONS reported their third quarter earnings results for the fiscal year 2023. The company opened at $11.7 and closed at $11.3, down by 2.4% from its prior closing price of 11.6. This is the second consecutive quarter in which the company has seen its stock slide. Despite the lackluster performance, the company was able to maintain a healthy balance sheet. Though the company reported a decline in earnings, they were able to make improvements in other areas.

This allowed the company to invest more in customer service and product innovation, which could improve their performance in future quarters. Overall, COMTECH TELECOMMUNICATIONS has had a difficult third quarter, but the company is confident that their efforts will pay off in the long run. With their strong balance sheet and improved cost structure, they remain well-positioned to capitalize on future growth opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Comtech Telecommunications. More…

| Total Revenues | Net Income | Net Margin |

| 528.16 | -35.42 | -3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Comtech Telecommunications. More…

| Operations | Investing | Financing |

| -6.6 | -20.07 | 15.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Comtech Telecommunications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 989.86 | 438.59 | 19.77 |

Key Ratios Snapshot

Some of the financial key ratios for Comtech Telecommunications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.4% | -3.0% | -3.3% |

| FCF Margin | ROE | ROA |

| -5.1% | -2.0% | -1.1% |

Analysis – Comtech Telecommunications Intrinsic Value Calculator

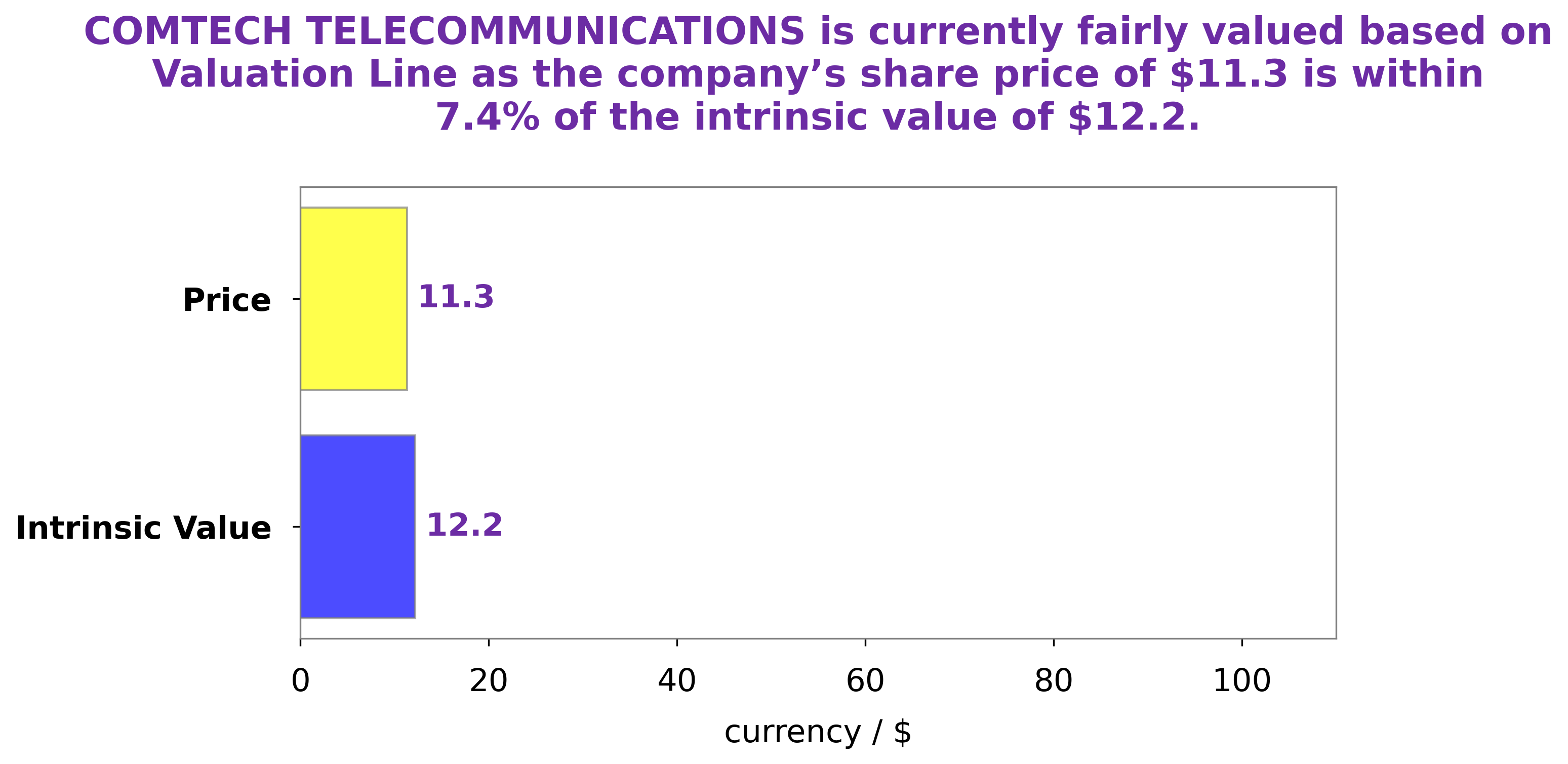

At GoodWhale, we have been analyzing COMTECH TELECOMMUNICATIONS‘s financials and we believe that the fair value of COMTECH TELECOMMUNICATIONS share is around $12.2. This value has been calculated using our proprietary Valuation Line, which takes into account a range of factors including the company’s current financials, industry trends, market sentiment and other relevant data. This presents an opportunity to investors who are looking for a bargain and may want to buy COMTECH TELECOMMUNICATIONS shares at a discounted price. More…

Peers

The company has a strong product portfolio and a wide range of customers. Comtech’s main competitors are PC Connection Inc, Surge Technologies Inc, and TKH Group NV.

– PC Connection Inc ($NASDAQ:CNXN)

In 2022, the market cap for S&P Connection Inc was 1.34 billion with a return on equity of 10.74%. The company briefly intro’d as followed: S&P Connection Inc is a provider of products and services that enable the connection of people, businesses and ideas. The company offers a range of products and services that include: broadband and Internet services, VoIP telephone services, data center services, and managed IT services.

– Surge Technologies Inc ($OTCPK:STCI)

With a market capitalization of 1.63 billion euros as of 2022 and a return on equity of 15.12 percent, TKH Group NV is a leading international provider of industrial solutions. The company offers a wide range of products and services in the areas of communication, security, safety, and industrial automation. TKH Group NV is headquartered in the Netherlands and has operations in more than 30 countries worldwide.

Summary

COMTECH TELECOMMUNICATIONS reported strong financial results for the third quarter of FY2023, with total revenue of USD 136.3 million, an 11.6% increase year-over-year. Net income was negative at USD -7.5 million; however, this is a significant improvement over the preceding year’s -0.0 million. This performance shows the company’s potential for future growth and profitability, making it an attractive investment opportunity. Investors should continue to monitor COMTECH TELECOMMUNICATIONS’ financial performance and progress towards achieving its business goals.

Recent Posts