Cisco Systems, – The Overlooked Youngest Sibling in Intel-Microsoft Family.

February 1, 2023

Trending News 🌥️

Cisco Systems ($NASDAQ:CSCO), Inc. has been overshadowed by its two older siblings in the Intel-Microsoft family – Intel Corporation and Microsoft Corporation. Investors of Cisco Systems, Inc. may feel like the neglected youngest child, as all the attention is focused on Intel and Microsoft. Cisco Systems, Inc. is a multinational technology conglomerate specializing in networking hardware, software, and services. Cisco’s products enable customers to connect to their internal networks, access the internet, and collaborate with customers, vendors, and partners.

Cisco has also been steadily increasing its dividend, indicating its commitment to providing shareholders with a return on their investment. Despite its lack of visibility, Cisco Systems, Inc. has been quietly and consistently growing its business for more than three decades. Its products are used by businesses around the world to connect, collaborate, and innovate.

Market Price

Despite being a key player in the tech industry, it has not made many headlines lately.

However, on Tuesday, CISCO SYSTEMS’ stock opened at $48.1 and closed at $48.7, up by 0.9% from last closing price of 48.2. This signals a small but steady upward trend for the company, despite being overshadowed by its older siblings. CISCO SYSTEMS is primarily known for its networking products and services, which are used by a variety of customers from government to major corporations. It is also a leader in the Internet of Things (IoT) space, providing customers with secure, reliable and cost-effective solutions for their IoT needs. Despite its relative lack of news coverage, CISCO SYSTEMS remains an important player in the tech industry. Its products and services are vital to many businesses, and its commitment to innovation and customer satisfaction is second to none.

In addition, its stock price has been steadily increasing, suggesting that investors still see value in the company’s products and services. Its products and services are vital to many businesses, and its commitment to innovation and customer satisfaction is second to none. It has also seen a steady increase in its stock price over the last few days, making it an attractive option for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cisco Systems. More…

| Total Revenues | Net Income | Net Margin |

| 52.29k | 11.5k | 21.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cisco Systems. More…

| Operations | Investing | Financing |

| 13.76k | 1.77k | -14.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cisco Systems. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 93.05k | 52.78k | 9.69 |

Key Ratios Snapshot

Some of the financial key ratios for Cisco Systems are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.2% | -0.8% | 28.0% |

| FCF Margin | ROE | ROA |

| 25.3% | 23.0% | 9.9% |

VI Analysis

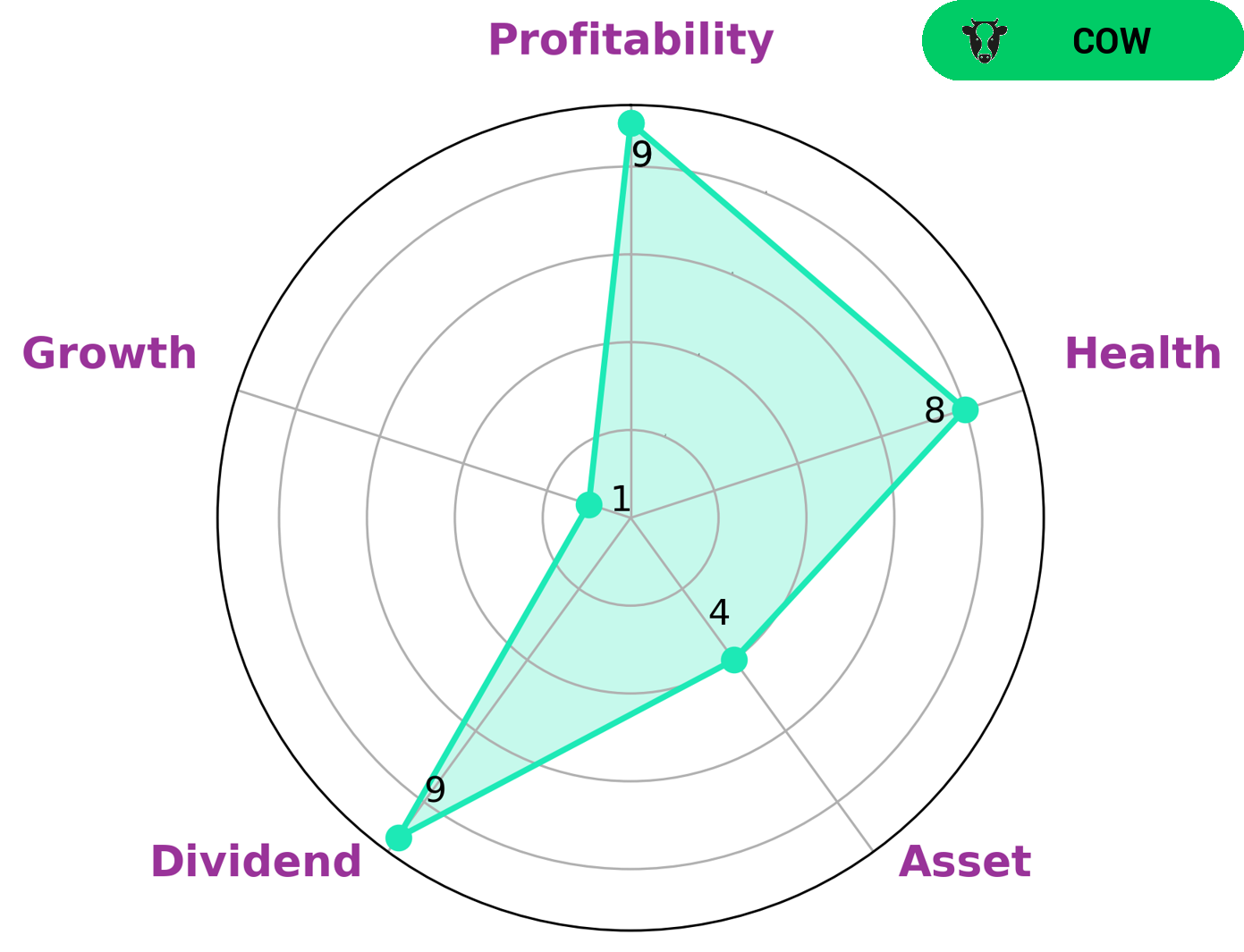

VI app simplifies the analysis of CISCO SYSTEMS‘ long term potential by providing insight into the company’s fundamentals. According to the VI Star Chart, the company is strong in dividend, profitability, and medium in asset while weak in growth. Moreover, CISCO SYSTEMS has a high health score of 8/10, indicating its capability to sustain future operations during times of crisis due to its cashflows and debt. CISCO SYSTEMS is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. This makes it an attractive investment prospect for investors that prioritize safety and stability, such as retirees and those with low risk tolerance. Those looking for high returns may be disappointed as the company’s growth is below average. Overall, CISCO SYSTEMS is a safe and reliable investment option with a good track record of dividend payments. Investors looking for a secure and reliable source of income may find it an attractive option. However, those seeking high returns may want to look elsewhere as the company’s growth is below average. More…

VI Peers

Its main competitors are Cognex Corp, Sercomm Corp, and Netgem SA. Cisco has a strong market share in the networking and communications equipment market, and is a well-known and respected brand.

– Cognex Corp ($NASDAQ:CGNX)

Cognex Corp is a technology company that specializes in the development and manufacture of machine vision products, software, and systems. The company’s products are used in a variety of industries, including automotive, consumer electronics, food and beverage, life sciences, logistics, and semiconductor. Cognex Corp has a market cap of 7.94B as of 2022, a Return on Equity of 11.66%. The company’s products are used in a variety of industries, including automotive, consumer electronics, food and beverage, life sciences, logistics, and semiconductor.

– Sercomm Corp ($TWSE:5388)

Sercomm Corporation is a world-leading communication device manufacturer. The company designs, develops, and manufactures a wide range of products for the telecommunications, enterprise networking, and security industries. Sercomm’s products are used in a variety of applications, including VoIP phone systems, video surveillance systems, and wireless networking.

Sercomm has a market capitalization of 19.35 billion as of 2022 and a return on equity of 12.06%. The company’s products are used in a variety of applications, including VoIP phone systems, video surveillance systems, and wireless networking. Sercomm is a world-leading communication device manufacturer.

– Netgem SA ($LTS:0N9W)

Netgem SA is a French company that provides broadband internet, digital television, and fixed-line telephone services to residential and business customers. The company has a market cap of 28.11M as of 2022 and a Return on Equity of -8.09%. Netgem SA offers a variety of services that allow customers to connect to the internet, watch digital television, and make phone calls. The company’s products and services are available in France, Spain, Belgium, Switzerland, and the United Kingdom.

Summary

As the youngest of the Intel-Microsoft family, Cisco Systems has been gaining attention and recognition for its advanced and secure networking solutions, offering investors an opportunity to tap into a growing and profitable market. With its focus on innovation, cost-efficiency, and customer satisfaction, investors should keep an eye on Cisco Systems for potential growth opportunities and solid returns.

Recent Posts