Cisco Systems Intrinsic Value Calculation – Cisco Systems Sees Significant Stock Drop Amid High Trading Volume

April 21, 2023

Trending News 🌧️

Cisco Systems ($NASDAQ:CSCO), a multinational technology giant based in California, has seen a significant drop in their stock prices recently. On Wednesday, Cisco’s stock plummeted by 4% during high trading volume. This sudden drop has raised questions amongst investors and analysts alike as to what is causing this sudden dip in Cisco’s stock prices. A variety of factors could be at play including decreased demand for Cisco products or services due to the pandemic and competition from other tech giants like Microsoft, Amazon, and Google.

It is also possible that investors are taking profits from Cisco’s stock after its long run of success. Despite this recent downturn, Cisco Systems remains a major technology player in the market and has a strong financial stability. With the company focusing on cloud computing, data analytics, and the Internet of Things, Cisco is well-positioned to continue to grow and succeed in the tech industry.

Market Price

On Wednesday, CISCO SYSTEMS experienced a significant stock drop of 4.5% to close at $48.0, having opened at $49.2. This was a drop from its previous closing price of $50.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cisco Systems. More…

| Total Revenues | Net Income | Net Margin |

| 53.16k | 11.3k | 21.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cisco Systems. More…

| Operations | Investing | Financing |

| 16.04k | 229 | -13.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cisco Systems. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 95.84k | 54.37k | 10.13 |

Key Ratios Snapshot

Some of the financial key ratios for Cisco Systems are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.0% | -0.8% | 27.3% |

| FCF Margin | ROE | ROA |

| 29.1% | 22.2% | 9.5% |

Analysis – Cisco Systems Intrinsic Value Calculation

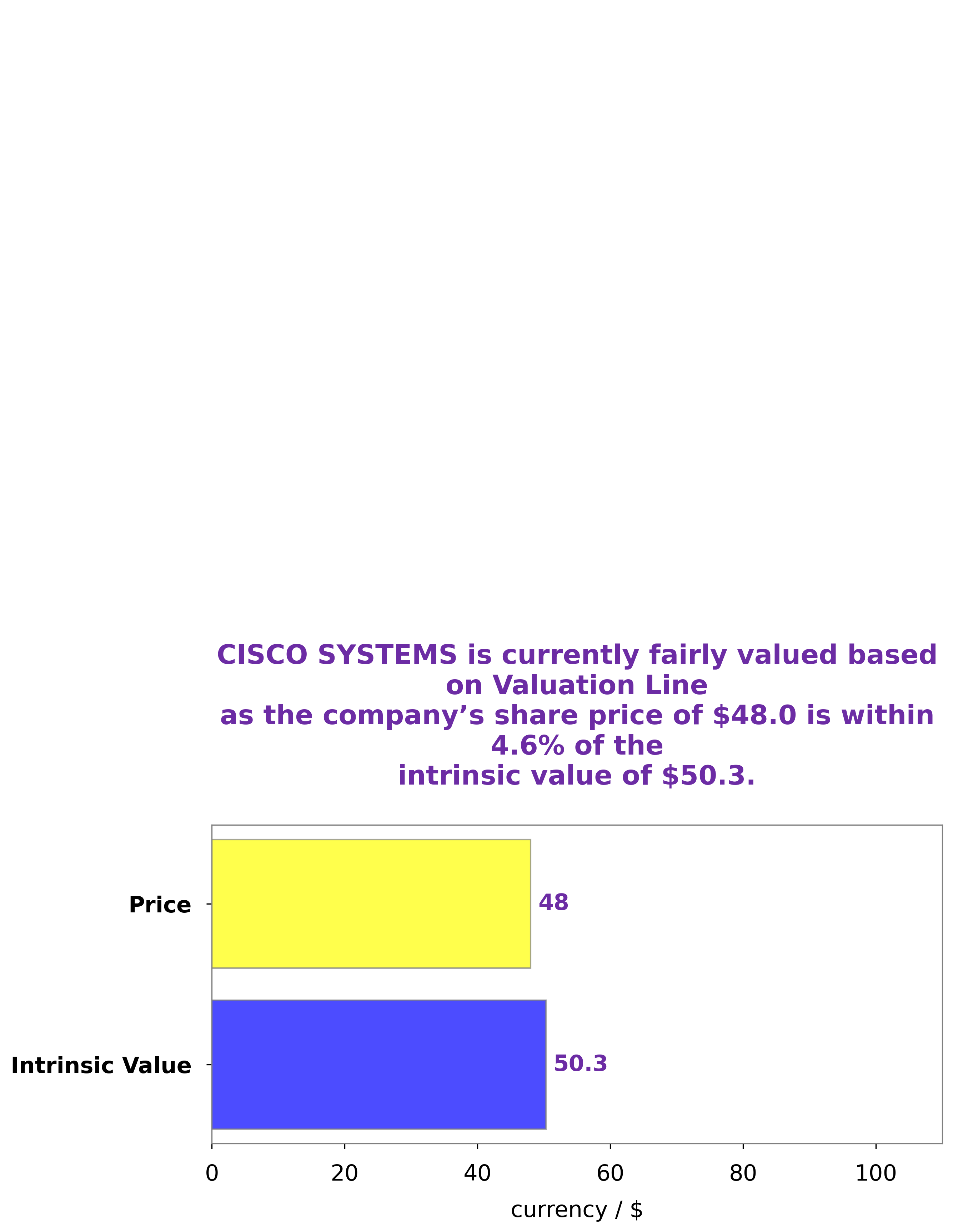

GoodWhale has recently analyzed the wellbeing of CISCO SYSTEMS, and found that the fair value of CISCO SYSTEMS share is around $50.3. This calculation was done using our proprietary Valuation Line, which takes into account the company’s fundamentals, such as its financial performance, market trends, and industry outlook. At present, CISCO SYSTEMS stock is traded at $48.0, which is a fair price but slightly undervalued by 4.6%. We believe that this could be a great opportunity for investors to pick up a potential bargain. More…

Peers

Its main competitors are Cognex Corp, Sercomm Corp, and Netgem SA. Cisco has a strong market share in the networking and communications equipment market, and is a well-known and respected brand.

– Cognex Corp ($NASDAQ:CGNX)

Cognex Corp is a technology company that specializes in the development and manufacture of machine vision products, software, and systems. The company’s products are used in a variety of industries, including automotive, consumer electronics, food and beverage, life sciences, logistics, and semiconductor. Cognex Corp has a market cap of 7.94B as of 2022, a Return on Equity of 11.66%. The company’s products are used in a variety of industries, including automotive, consumer electronics, food and beverage, life sciences, logistics, and semiconductor.

– Sercomm Corp ($TWSE:5388)

Sercomm Corporation is a world-leading communication device manufacturer. The company designs, develops, and manufactures a wide range of products for the telecommunications, enterprise networking, and security industries. Sercomm’s products are used in a variety of applications, including VoIP phone systems, video surveillance systems, and wireless networking.

Sercomm has a market capitalization of 19.35 billion as of 2022 and a return on equity of 12.06%. The company’s products are used in a variety of applications, including VoIP phone systems, video surveillance systems, and wireless networking. Sercomm is a world-leading communication device manufacturer.

– Netgem SA ($LTS:0N9W)

Netgem SA is a French company that provides broadband internet, digital television, and fixed-line telephone services to residential and business customers. The company has a market cap of 28.11M as of 2022 and a Return on Equity of -8.09%. Netgem SA offers a variety of services that allow customers to connect to the internet, watch digital television, and make phone calls. The company’s products and services are available in France, Spain, Belgium, Switzerland, and the United Kingdom.

Summary

Cisco Systems, Inc. is one of the largest technology companies in the world and its stock has been closely watched by investors. Recently, its stock price experienced a 4% decrease due to high trading activity. This could signal a shift in investor sentiment or it may be an indicator of further volatility in the near future. To analyze the short-term and long-term prospects of investing in this company, investors should consider the company’s fundamentals such as earnings, cash flow, and revenue growth.

Other factors such as the competitive landscape, technological changes, government regulations and global economic conditions should also be taken into account. The performance of Cisco Systems’ products and services, current financial statements, and future projections should also be taken into consideration when investing in this company. By carefully studying these factors, investors can make informed decisions and maximize their return on investment.

Recent Posts